Apple Stock Suffers Setback Amidst $900 Million Tariff Projection

Table of Contents

The $900 Million Tariff Projection: A Deep Dive

The source of the $900 million tariff projection stems from [Insert Source Here – e.g., a specific government announcement, a reputable financial news outlet]. This projection targets various Apple products, potentially impacting the company's bottom line significantly. The specific products affected include:

- iPhones: A large portion of iPhone production occurs overseas, making them particularly vulnerable to tariffs.

- Macs: Similar to iPhones, many Mac components are sourced internationally, leading to increased costs.

- iPads: The iPad production chain also faces potential tariff increases, adding to the overall financial strain.

- Apple Watches & AirPods: These smaller, yet significant, product lines are also subject to tariff increases, further impacting profitability.

These tariffs primarily affect imports into [Insert Specific Regions – e.g., the United States, European Union]. The projected financial impact is substantial, with estimates suggesting a potential [Insert Percentage]% decrease in projected profits for the [Insert relevant timeframe – e.g., next quarter, fiscal year]. This translates to a significant loss of revenue for Apple and directly impacts its stock price.

Market Reaction and Investor Sentiment

The immediate market reaction to the tariff news was a noticeable drop in Apple's stock price. Trading volume increased significantly as investors reacted to the uncertainty created by the potential tariffs. Analyst reports have varied, with some predicting a short-term recovery and others expressing concerns about the long-term impact on Apple's growth.

- Sharp Decline: Apple stock experienced a [Insert Percentage]% drop in value following the tariff announcement.

- Increased Volatility: Trading volume spiked as investors bought and sold shares based on their individual risk tolerance and predictions.

- Negative Sentiment: Many analysts expressed concerns about the potential impact on consumer demand and Apple's future profitability.

- Uncertainty: Investor uncertainty is high due to the unclear long-term effects of the tariffs and Apple's response strategy.

[Insert Chart/Graph Depicting Stock Price Fluctuations Here]

Apple's Potential Strategic Responses

To mitigate the impact of these tariffs, Apple may employ several strategies:

- Shifting Production: Relocating manufacturing to countries with more favorable trade agreements could reduce tariff costs. However, this requires substantial investment and time.

- Price Adjustments: Apple could absorb some of the tariff costs, but this might impact profit margins and potentially reduce consumer demand. Alternatively, they could pass the increased costs onto consumers, leading to higher prices.

- Lobbying Efforts: Apple may engage in lobbying efforts to influence trade policy and potentially reduce or eliminate the tariffs. The success of such efforts is uncertain.

- Product Diversification: Investing in research and development of new product lines that are less affected by tariffs could also be a viable long-term solution.

Each strategy carries its own risks and challenges. Shifting production, for instance, can disrupt supply chains and increase operational costs. Price adjustments could alienate consumers or significantly reduce profits. The effectiveness of lobbying efforts is also uncertain.

Long-Term Implications for Apple and Investors

The long-term impact of these tariffs on Apple's profitability and growth remains uncertain. However, the potential effects are considerable:

- Reduced Profitability: Higher production costs could significantly impact Apple's profit margins.

- Impact on Market Share: Increased prices could make Apple products less competitive, potentially affecting its market share.

- Investor Concerns: The uncertainty surrounding the tariff situation will continue to be a concern for investors, affecting their confidence in the stock's future performance.

The overall outlook for Apple stock in the face of these tariffs is mixed. While the company's strong brand and innovative products offer some resilience, the financial impact of the tariffs is a significant challenge. Long-term investors need to carefully consider the risks and opportunities before making investment decisions.

Conclusion

The $900 million tariff projection represents a significant challenge to Apple and its investors. The immediate impact has been a decline in Apple stock, driven by concerns about reduced profitability and market share. Apple's strategic responses will be crucial in determining the long-term consequences. Understanding the potential effects of these tariffs on Apple Stock is essential for informed investment decisions.

Call to Action: Stay informed about the evolving situation surrounding Apple stock and its response to potential tariffs. Follow reputable financial news sources for the latest updates on Apple's performance and the overall impact of trade policies on the tech sector. Continue to monitor the Apple Stock situation closely to make well-informed investment choices.

Featured Posts

-

Apple Stock Dip Key Levels Breached Before Q2 Earnings

May 24, 2025

Apple Stock Dip Key Levels Breached Before Q2 Earnings

May 24, 2025 -

M6 Traffic Chaos Van Crash Causes Hours Of Delays

May 24, 2025

M6 Traffic Chaos Van Crash Causes Hours Of Delays

May 24, 2025 -

Rethinking Middle Management Their Importance In Modern Organizations

May 24, 2025

Rethinking Middle Management Their Importance In Modern Organizations

May 24, 2025 -

The Post Roe Reality The Significance Of Over The Counter Birth Control

May 24, 2025

The Post Roe Reality The Significance Of Over The Counter Birth Control

May 24, 2025 -

Mia Farrows Warning Trump Congress And The Future Of American Democracy

May 24, 2025

Mia Farrows Warning Trump Congress And The Future Of American Democracy

May 24, 2025

Latest Posts

-

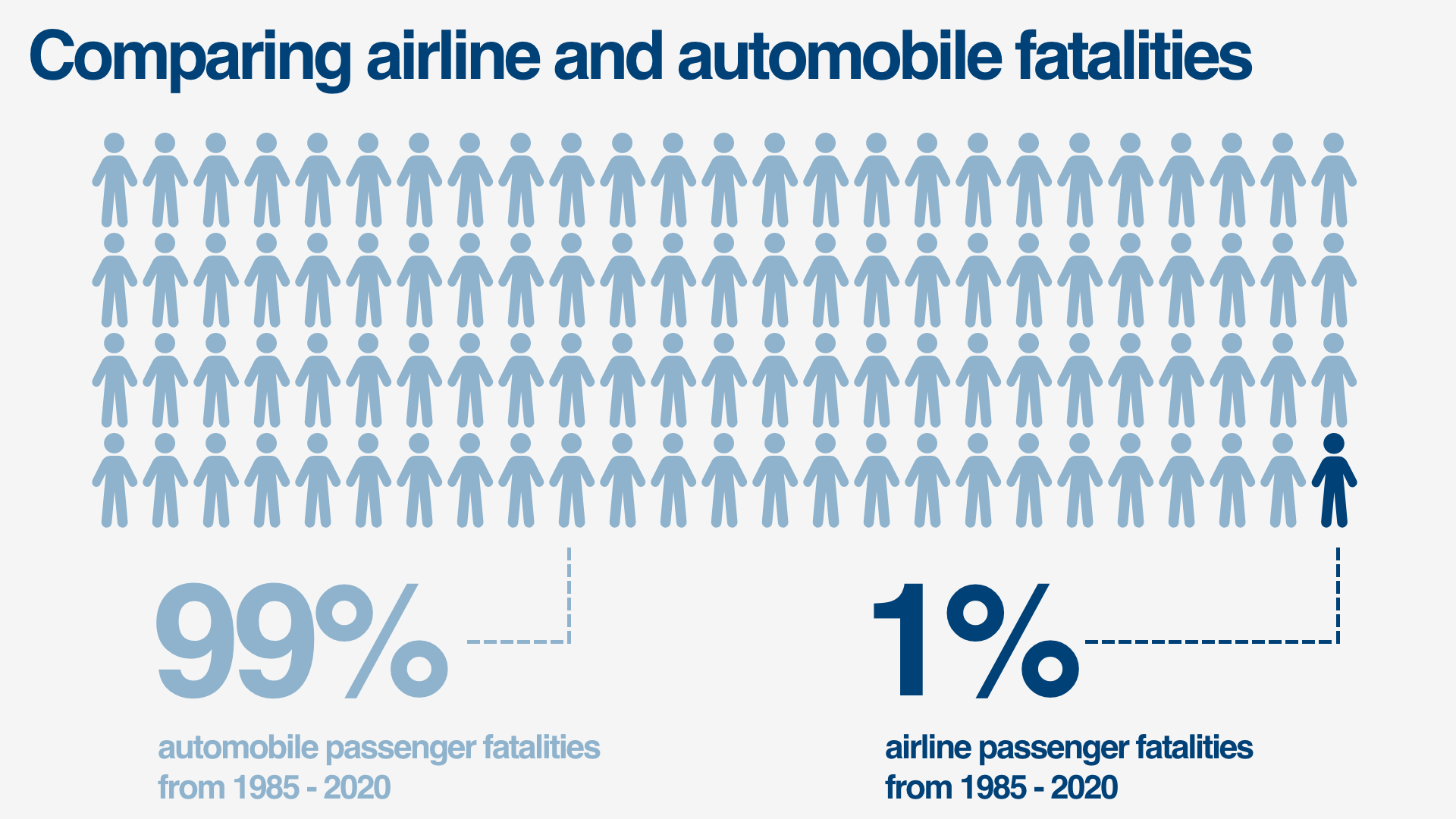

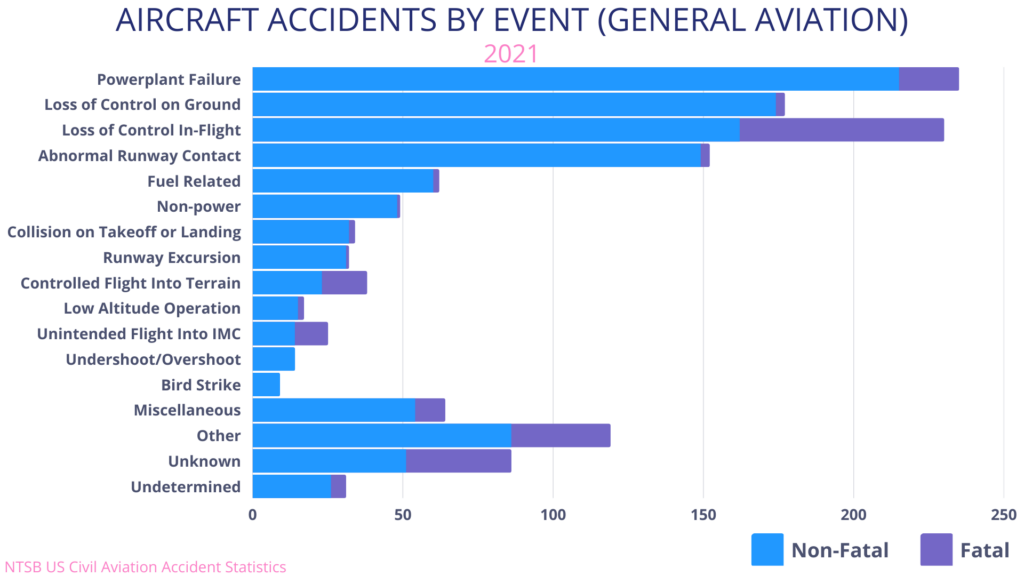

Are Airplane Crashes Common A Visual Analysis Of Flight Safety Data

May 24, 2025

Are Airplane Crashes Common A Visual Analysis Of Flight Safety Data

May 24, 2025 -

Accessibility In Games A Casualties Of Industry Downturns

May 24, 2025

Accessibility In Games A Casualties Of Industry Downturns

May 24, 2025 -

Airplane Safety Understanding The Statistics Of Close Calls And Crashes

May 24, 2025

Airplane Safety Understanding The Statistics Of Close Calls And Crashes

May 24, 2025 -

Ramaphosas White House Encounter Exploring Other Possible Responses

May 24, 2025

Ramaphosas White House Encounter Exploring Other Possible Responses

May 24, 2025 -

Live Stock Market Updates Bond Sell Off Dow Futures Reaction Bitcoin Rally

May 24, 2025

Live Stock Market Updates Bond Sell Off Dow Futures Reaction Bitcoin Rally

May 24, 2025