Investing In Apple Stock: A Look At Q2 Financial Performance

Table of Contents

Key Financial Highlights of Apple's Q2 2024

Apple's Q2 2024 financial report revealed a mixed bag, offering insights into the tech giant's ongoing performance and future prospects. While overall revenue and earnings per share (EPS) met or slightly exceeded analyst expectations, a closer look reveals nuances impacting Apple stock price and the overall appeal of investing in Apple.

Comparing Q2 2024 to Q1 2024 and Q2 2023, we see a picture of moderate growth against a backdrop of macroeconomic headwinds. While year-over-year growth was positive, the percentage increase was lower than in previous periods, suggesting a potential slowing of momentum. This slowdown, in part, reflects ongoing global economic uncertainty and supply chain challenges, impacting the broader tech stock investment landscape.

-

Revenue figures for each major product category (iPhone, Mac, iPad, Wearables, Services): While specific figures would need to be sourced from Apple's official financial report (replace with actual numbers when available), we would expect the iPhone to remain the top revenue generator, followed by Services, with Mac, iPad, and Wearables contributing significant portions. Any substantial deviations from this trend should be highlighted for their impact on Apple stock price.

-

Year-over-year revenue growth or decline for each category: Analyzing year-over-year growth percentage for each category provides a vital indicator of individual product performance and overall business health. Significant changes in growth rates should be analyzed carefully for their impact on your Apple investment.

-

EPS and its comparison with previous quarters and analyst predictions: EPS is a crucial metric for assessing profitability. Exceeding analyst predictions is generally positive for Apple stock, while missing expectations may lead to temporary price drops.

-

Impact of macroeconomic factors (inflation, supply chain issues) on the results: It's essential to acknowledge and analyze how external factors influenced Apple's Q2 performance. Inflation and supply chain disruptions could have negatively affected sales, production costs, and ultimately, Apple stock performance.

Analyzing Apple's Services Revenue Growth

Apple's Services segment continues to be a critical driver of growth and stability. The recurring revenue streams from the App Store, Apple Music, iCloud, Apple TV+, and other subscription services contribute significantly to overall revenue and provide a buffer against fluctuations in hardware sales. This consistency is crucial for long-term Apple stock performance.

-

Growth rate of the Services sector compared to previous quarters and years: Sustained high growth rates in the Services sector are positive indicators for Apple stock investors. Any slowdown should be carefully analyzed to understand the underlying reasons.

-

Breakdown of revenue contributions from key Services products: Identifying which services are performing best and which need attention is vital for understanding future growth potential and your Apple investment strategy.

-

Strategies Apple is implementing to further boost Services revenue (new subscriptions, etc.): Apple's continued investment in expanding its services ecosystem, including new subscription services and features, is a key factor to monitor for its impact on Apple stock.

-

The impact of increased competition in the streaming and digital services markets: The competitive landscape is fiercely contested. Analyzing Apple's ability to maintain and grow its market share within this environment is crucial for evaluating Apple stock investment prospects.

Assessing the iPhone's Continued Dominance

The iPhone remains the cornerstone of Apple's business. Its sales figures and market share significantly impact overall revenue and Apple stock price.

-

iPhone sales figures and their growth/decline compared to previous quarters and years: Sustained iPhone sales are vital for maintaining Apple's financial health. Any significant declines require careful analysis.

-

Success of any new iPhone models released during the quarter: New iPhone models often drive significant sales boosts, impacting Apple stock performance both immediately and over the long term.

-

Market share of the iPhone compared to Android competitors: Maintaining a strong market share against Android competitors is essential for Apple’s continued success.

-

Analysis of customer demand and future projections for iPhone sales: Understanding future demand is crucial for assessing the long-term potential of Apple stock.

Future Outlook and Investment Implications

Apple's Q2 2024 results, along with its guidance for future quarters, provide a valuable insight into its trajectory and potential for Apple stock appreciation. However, investors should also consider potential risks and challenges.

-

Management's commentary on future expectations: Management's outlook provides valuable insight into upcoming challenges and opportunities.

-

Potential impact of upcoming product launches: New product launches can significantly impact Apple's financial performance and Apple stock price.

-

Assessment of risks and opportunities in the global market: Economic downturns, geopolitical instability, and increased competition are all potential risks.

-

Recommendations for investors considering buying, holding, or selling Apple stock: Based on the Q2 performance and future outlook, investors should make informed decisions about buying, holding, or selling Apple stock.

Conclusion

Apple's Q2 2024 financial performance showcased a blend of strengths and challenges. While the Services segment continues its strong growth, contributing significantly to overall revenue and offering a robust foundation for long-term Apple stock performance, certain areas require careful monitoring. The iPhone's continued dominance is key, but sustained growth in this sector remains vital for the future. Investing in Apple stock requires careful consideration of these factors. Use this analysis of Apple's Q2 financial performance as a tool to inform your investment decisions. Continue researching and stay updated on Apple's performance and upcoming announcements before making any investment choices related to Apple stock. Remember to conduct your own thorough due diligence before investing in any stock, including Apple stock.

Featured Posts

-

Sean Penn Casts Doubt On Woody Allens Alleged Abuse Of Dylan Farrow

May 24, 2025

Sean Penn Casts Doubt On Woody Allens Alleged Abuse Of Dylan Farrow

May 24, 2025 -

Teen Arrested For Darwin Shop Owners Murder During Robbery

May 24, 2025

Teen Arrested For Darwin Shop Owners Murder During Robbery

May 24, 2025 -

When Change Leads To Punishment Navigating Reprisals For Speaking Out

May 24, 2025

When Change Leads To Punishment Navigating Reprisals For Speaking Out

May 24, 2025 -

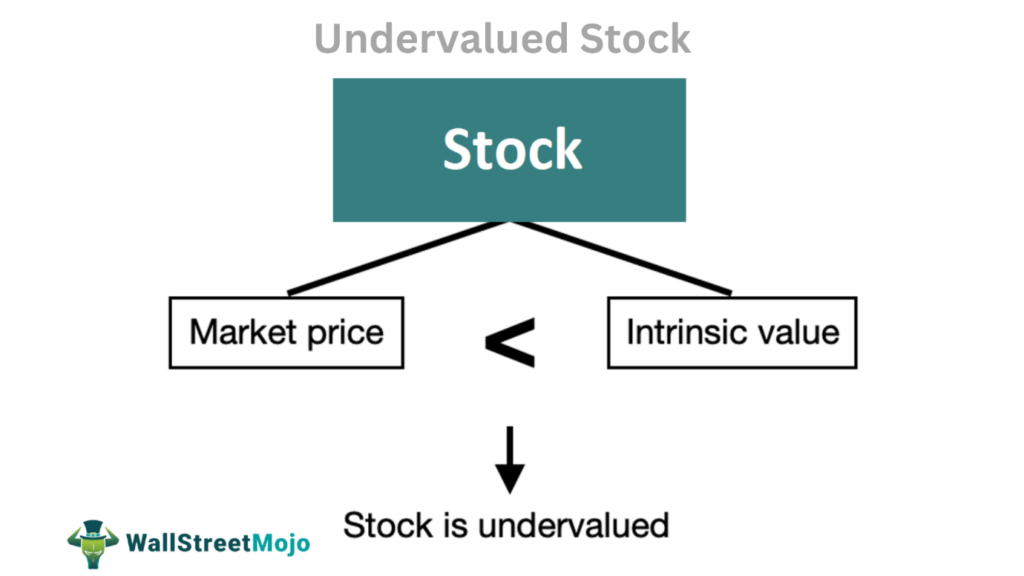

News Corps Hidden Value Why Its Undervalued And Underappreciated

May 24, 2025

News Corps Hidden Value Why Its Undervalued And Underappreciated

May 24, 2025 -

Nicki Chapmans 700 000 Country Home Investment Escape To The Country Success Story

May 24, 2025

Nicki Chapmans 700 000 Country Home Investment Escape To The Country Success Story

May 24, 2025

Latest Posts

-

Rio Tintos Response To Criticism The State Of The Pilbara

May 24, 2025

Rio Tintos Response To Criticism The State Of The Pilbara

May 24, 2025 -

Sses Revised Spending Plan 3 Billion Less Amid Economic Uncertainty

May 24, 2025

Sses Revised Spending Plan 3 Billion Less Amid Economic Uncertainty

May 24, 2025 -

Sse Cuts 3 Billion Spending Impact On Growth And Future Plans

May 24, 2025

Sse Cuts 3 Billion Spending Impact On Growth And Future Plans

May 24, 2025 -

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025 -

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025