Amundi MSCI World II UCITS ETF USD Hedged Dist: Understanding Net Asset Value (NAV)

Table of Contents

Net Asset Value (NAV) represents the net value of an ETF's assets minus its liabilities, per share. Think of it as the true underlying value of your investment in the ETF. For the Amundi MSCI World II UCITS ETF USD Hedged Dist, understanding its NAV is particularly important due to its global exposure and USD hedging strategy. This article aims to demystify the NAV calculation and demonstrate its significance for your investment decisions.

How the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist is Calculated

The NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is calculated daily, reflecting the market value of its underlying assets. This process involves several key steps:

-

Market Value of Underlying Assets: The ETF tracks the MSCI World Index, meaning its holdings mirror this benchmark. The market value of each holding within the index is determined at the end of the trading day. This includes the value of stocks from various countries and sectors represented in the index.

-

Conversion to USD: Since the ETF is USD hedged, the value of non-USD denominated assets is converted to US dollars using prevailing exchange rates. This hedging strategy aims to mitigate the impact of currency fluctuations on the investor's returns.

-

Deduction of ETF Expenses: The ETF's operating expenses, including management fees and other costs, are deducted from the total asset value.

-

Final NAV Calculation per Share: The final NAV is calculated by dividing the total net asset value (after expenses) by the total number of outstanding shares. This gives you the NAV per share.

Simplified Example: Let's assume the total value of the underlying assets after currency conversion is $100 million, and the ETF's total expenses are $100,000. If there are 10 million shares outstanding, the NAV per share would be ($100,000,000 - $100,000) / 10,000,000 = $9.99.

Factors Affecting the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Several factors influence the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist:

-

Market Fluctuations: Global market performance is the primary driver of NAV changes. Positive market movements generally increase the NAV, while negative movements decrease it. This reflects the overall performance of the companies within the MSCI World Index.

-

Currency Exchange Rates: Given the USD hedging, fluctuations in exchange rates between the USD and other currencies can still affect the NAV, although the impact is mitigated compared to an unhedged ETF. Changes in these rates during the day will affect the final NAV calculation.

-

Dividends from Underlying Holdings: When underlying companies in the MSCI World Index pay dividends, this increases the NAV of the ETF. This is because the ETF receives these dividends and redistributes them to shareholders (in the case of a distributing ETF like this one) or reinvests them (in accumulating ETFs).

-

ETF Expenses: Management fees and other operating expenses reduce the overall asset value and consequently the NAV.

In short, the key factors impacting the NAV are:

- Global market performance

- USD/other currency exchange rate movements

- Dividend payments from underlying companies

- Management fees and other expenses

Why Understanding NAV is Crucial for Amundi MSCI World II UCITS ETF USD Hedged Dist Investors

Understanding the NAV of the Amundi MSCI World II UCITS ETF USD Hedged Dist is critical for several reasons:

-

Performance Tracking: NAV helps you track the performance of your investment over time, allowing you to assess the effectiveness of your investment strategy. Comparing the changes in NAV over different timeframes gives a clear picture of your return.

-

Informed Buy/Sell Decisions: By monitoring NAV, you can make more informed decisions about when to buy or sell your ETF shares. You can compare the NAV to the market price of the ETF share to identify potential mispricing opportunities.

-

Long-Term Investment Strategy Assessment: Regularly reviewing the NAV and its fluctuations helps to assess the long-term performance of your investment and allows adjustments to your strategy as needed.

-

Understanding Investment Risk: Understanding how factors like market volatility and currency fluctuations affect the NAV allows investors to better assess the risk associated with their investment.

In summary, the key benefits of understanding NAV are:

- Performance Tracking

- Informed Buy/Sell Decisions

- Long-term Investment Strategy Assessment

- Understanding Investment Risk

Where to Find the NAV of Amundi MSCI World II UCITS ETF USD Hedged Dist

Accessing the daily NAV data for the Amundi MSCI World II UCITS ETF USD Hedged Dist is straightforward. You can find this information from several reliable sources:

-

Amundi's Official Website: The ETF provider's website is the primary source for accurate and up-to-date NAV information.

-

Major Financial Data Providers: Reputable financial data providers like Bloomberg and Refinitiv also publish ETF NAV data.

-

Your Brokerage Account Platform: Most brokerage platforms provide real-time or near real-time NAV information for the ETFs you hold in your account.

Note that there might be slight delays in NAV reporting, typically within a few hours of market close.

Conclusion: Mastering Amundi MSCI World II UCITS ETF USD Hedged Dist NAV

Understanding the Net Asset Value (NAV) of the Amundi MSCI World II UCITS ETF USD Hedged Dist is essential for making sound investment decisions. By understanding how the NAV is calculated and the factors that influence it, you can effectively track your investment performance, make informed buy and sell decisions, and assess your long-term investment strategy. Regularly monitoring the NAV is key to managing your investment effectively. Learn more about the Amundi MSCI World II UCITS ETF USD Hedged Dist and its Net Asset Value (NAV) today!

Featured Posts

-

Sejarah Porsche 356 Asal Usul Dan Pabrik Zuffenhausen Jerman

May 25, 2025

Sejarah Porsche 356 Asal Usul Dan Pabrik Zuffenhausen Jerman

May 25, 2025 -

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value Nav

May 25, 2025

Amundi Msci World Ii Ucits Etf Usd Hedged Dist A Guide To Net Asset Value Nav

May 25, 2025 -

Fatal Stabbing Leads To Arrest Of Previously Released Teen

May 25, 2025

Fatal Stabbing Leads To Arrest Of Previously Released Teen

May 25, 2025 -

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025 -

Dar Vienas Porsche Elektromobiliu Ikrovimo Centras Europoje Issami Informacija

May 25, 2025

Dar Vienas Porsche Elektromobiliu Ikrovimo Centras Europoje Issami Informacija

May 25, 2025

Latest Posts

-

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025

Get Your Bbc Radio 1 Big Weekend Tickets The Ultimate Guide

May 25, 2025 -

Securing Your Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025

Securing Your Bbc Radio 1 Big Weekend Tickets Tips And Strategies

May 25, 2025 -

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025

Bbc Radio 1 Big Weekend A Ticket Buyers Guide

May 25, 2025 -

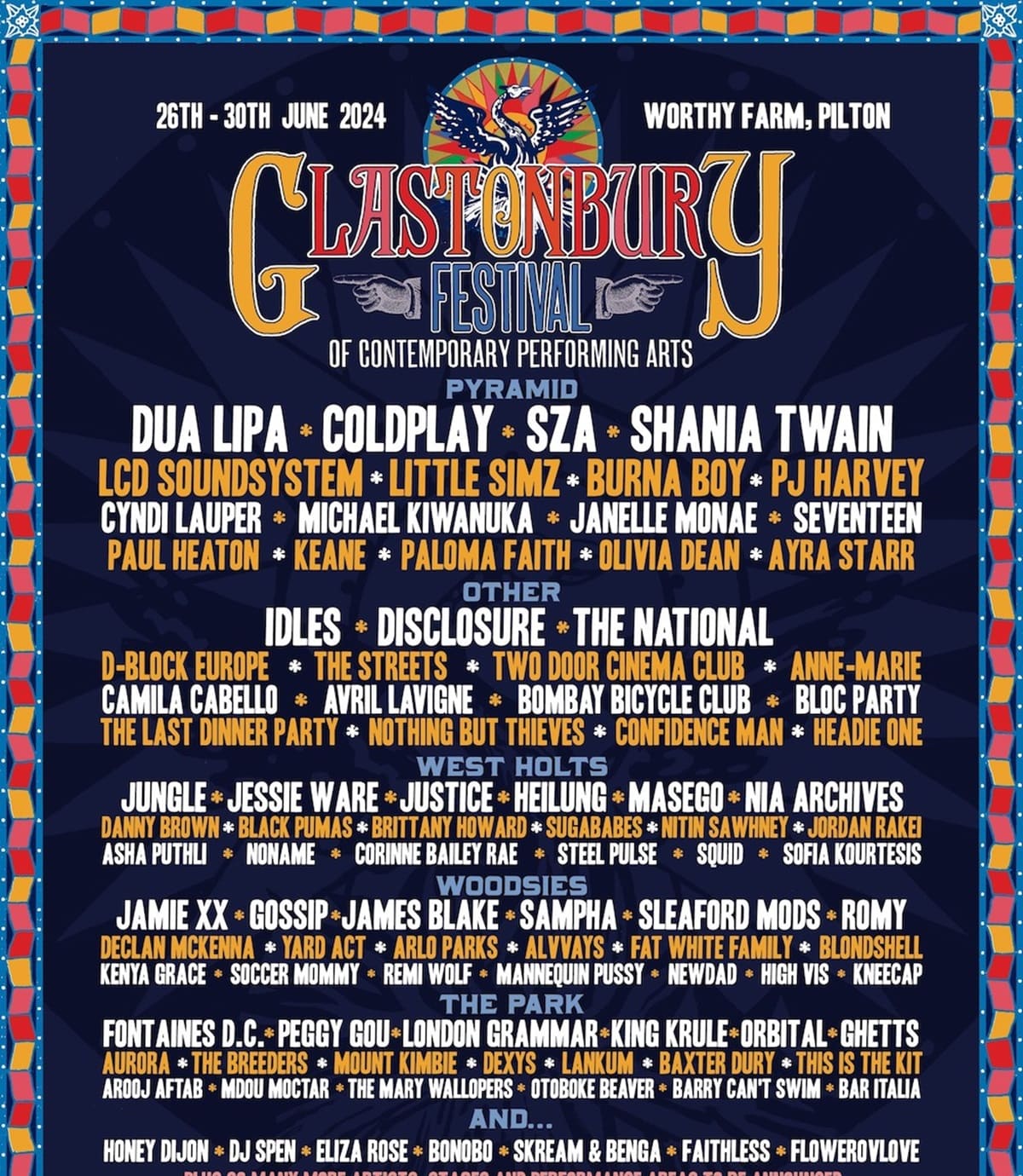

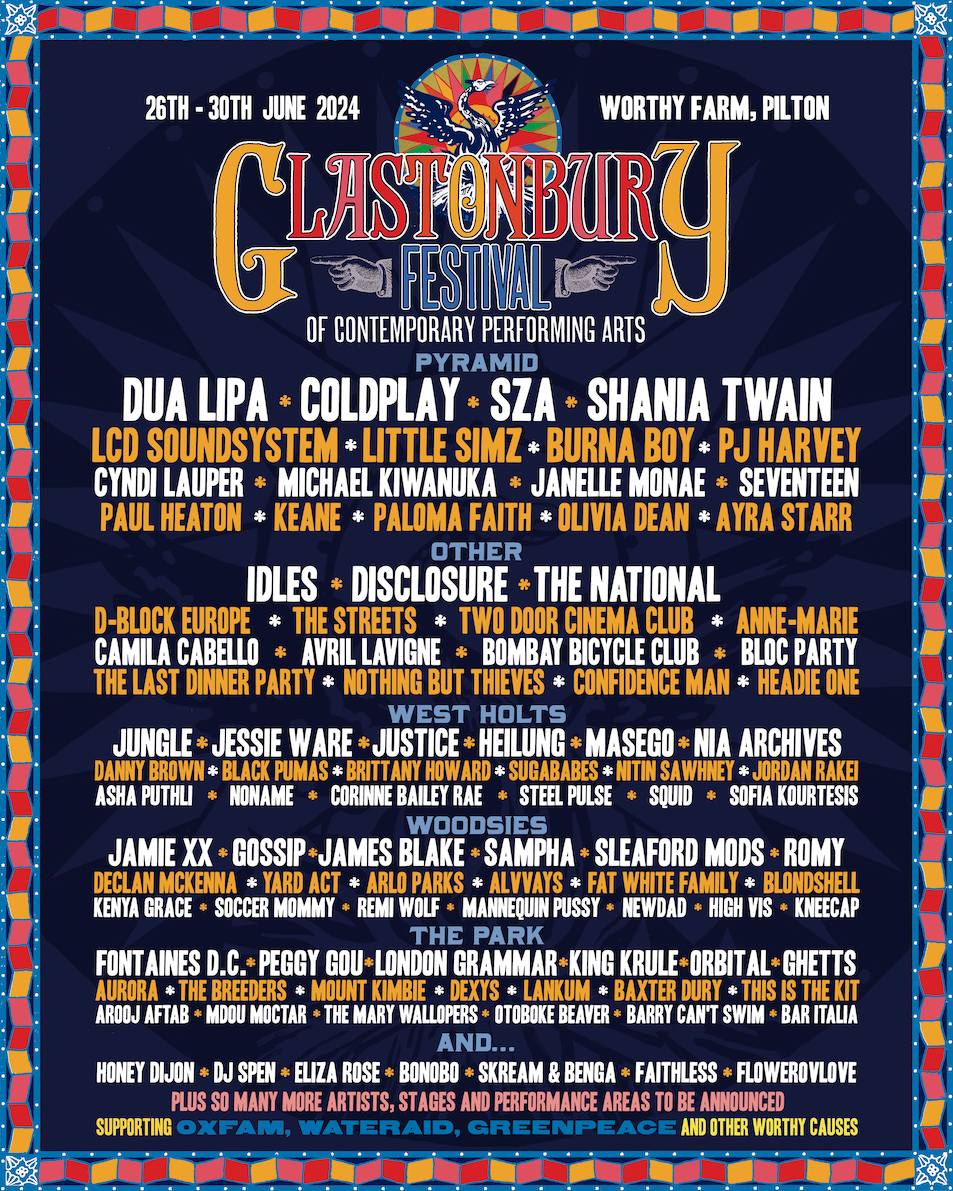

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025

Glastonbury Festival 2025 Complete Lineup And Ticket Purchase Guide Following Leak

May 25, 2025 -

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025

Glastonbury 2025 Full Lineup Revealed Following Leak Get Your Tickets Now

May 25, 2025