Analysis Of Nestlé (NESN) Sales Performance: The Role Of Coffee And Cocoa Pricing

Table of Contents

The Impact of Coffee Pricing on Nestlé's Sales

Fluctuations in Arabica and Robusta Coffee Prices

Nestlé's extensive coffee portfolio, including iconic brands like Nescafé, is heavily reliant on the price of Arabica and Robusta beans. These two varieties represent the bulk of global coffee production, and fluctuations in their prices directly impact Nestlé's production costs and profit margins. A sharp increase in coffee bean prices necessitates either absorbing the increased cost (reducing profit margins) or passing it on to consumers (potentially impacting sales volume). Historical data reveals a clear correlation: periods of significant coffee price spikes often coincide with slower growth in Nestlé's coffee sales figures.

- Impact on consumer purchasing behavior: Price increases can lead to decreased consumer demand, particularly in price-sensitive markets. Consumers may switch to cheaper alternatives or reduce their overall coffee consumption.

- Nestlé's strategies for mitigating price increases: Nestlé employs various strategies to mitigate the impact of price volatility, including hedging strategies in the futures market to lock in prices and diversification of sourcing to secure beans from various regions.

Nestlé's Coffee Brands and Market Share

Nestlé's coffee segment comprises a diverse range of brands catering to various consumer preferences and price points. The performance of these brands is directly tied to coffee pricing and overall market trends. Analyzing market share data reveals the relative strength of each brand in different segments (instant, ground, specialty coffee). Innovation, particularly in the premium coffee segment, plays a crucial role in mitigating price sensitivity. Premium offerings command higher prices and often demonstrate less price elasticity of demand.

- Market share trends: Tracking Nestlé's market share in key regions provides insights into the effectiveness of its pricing and marketing strategies in the face of fluctuating coffee prices.

- Brand performance data: Analyzing the performance of individual brands (Nescafé Gold, Nescafé Dolce Gusto, etc.) highlights areas of strength and weakness within Nestlé's portfolio.

- Strategies for premiumization: The development and marketing of premium coffee products allow Nestlé to capture higher profit margins and reduce reliance on price competition in the more price-sensitive segments.

The Influence of Cocoa Pricing on Nestlé's Sales

Cocoa Bean Price Volatility and its Effect on Chocolate Sales

Cocoa bean prices are another key factor influencing Nestlé's sales performance. The cost of cocoa significantly impacts the final price of chocolate products, influencing consumer demand. Price volatility in the cocoa market presents a considerable challenge, as it makes it difficult for Nestlé to accurately forecast production costs and pricing strategies. Sustainable sourcing initiatives and hedging strategies play a crucial role in mitigating risks associated with price fluctuations.

- Price elasticity of demand for chocolate: Chocolate, while a staple, still exhibits some price sensitivity. Significant price increases can lead to reduced consumption, especially in budget-conscious markets.

- Sourcing strategies (sustainable cocoa initiatives): Nestlé's investment in sustainable cocoa farming practices not only benefits the environment but also enhances its supply chain resilience and potentially reduces price risks in the long term.

Nestlé's Chocolate Brands and Market Positioning

Nestlé's chocolate portfolio boasts iconic brands like KitKat and others. The success of these brands is inextricably linked to both pricing and marketing strategies. Maintaining brand equity and strong market positioning is crucial during periods of price volatility. Marketing campaigns emphasizing quality, heritage, and unique product features help mitigate the impact of price increases.

- Brand performance analysis: Analyzing the sales and profitability of individual chocolate brands provides valuable insights into consumer preferences and the effectiveness of Nestlé's marketing strategies.

- Marketing strategies during periods of price volatility: Effective marketing strategies can highlight value propositions and emphasize product quality to offset price sensitivity.

Overall Sales Performance and Financial Analysis

Analyzing Nestlé's Financial Reports

A thorough analysis of Nestlé's financial reports (quarterly and annual) reveals the correlation between commodity price fluctuations and the company's overall financial performance, specifically revenue, profit margins, and return on investment. Examining key financial ratios and metrics allows for a comprehensive understanding of how effective Nestlé's hedging and risk management strategies are in mitigating the impact of coffee and cocoa price volatility.

- Key financial ratios and metrics: Analyzing data points like gross profit margin, operating profit margin, and return on equity provides a quantifiable measure of the impact of commodity price changes.

- Impact of commodity prices on profitability: Careful observation reveals whether Nestlé successfully mitigates price risks or suffers profit margin compression during price spikes.

Future Outlook and Predictions

Predicting future trends in coffee and cocoa pricing requires considering various factors, including climate change, geopolitical instability, supply chain disruptions, and evolving consumer preferences. These predictions are crucial for forecasting Nestlé's future sales performance and overall financial health. Understanding potential risks and opportunities will allow for informed decision-making.

- Long-term price projections: Analyzing forecasts from commodity market experts helps assess the potential impact on Nestlé's future profitability.

- Potential risks and opportunities for Nestlé: Identifying potential supply chain disruptions, consumer behavior changes, and the need for innovation will determine Nestlé's long-term strategic planning and resilience.

Conclusion: Understanding Nestlé (NESN) Sales and Commodity Market Dynamics

This analysis underscores the significant influence of coffee and cocoa pricing on Nestlé's (NESN) sales performance. The company's success hinges on its ability to effectively manage these price risks through diversification, hedging, and strategic brand management. Understanding commodity market dynamics is paramount for investors and stakeholders seeking to accurately assess Nestlé's financial outlook. By carefully monitoring Nestlé (NESN)'s sales performance and the fluctuations in coffee and cocoa pricing, investors can make more informed decisions. Continue your research into Nestlé's financial reports and the broader commodities market to fully understand the complexities of its business model and future prospects.

Featured Posts

-

Thornabys Blackbush Walk Csi On Scene Area Secured

Apr 25, 2025

Thornabys Blackbush Walk Csi On Scene Area Secured

Apr 25, 2025 -

Trumps Attack On Currency Manipulation Impact On The Krw Usd Exchange Rate

Apr 25, 2025

Trumps Attack On Currency Manipulation Impact On The Krw Usd Exchange Rate

Apr 25, 2025 -

Analysis Gold Market Responds To Trumps Less Aggressive Stance

Apr 25, 2025

Analysis Gold Market Responds To Trumps Less Aggressive Stance

Apr 25, 2025 -

Eurovision 2025 Who Are The Frontrunners

Apr 25, 2025

Eurovision 2025 Who Are The Frontrunners

Apr 25, 2025 -

The End Of Ryujinx Nintendo Contact Forces Development Halt

Apr 25, 2025

The End Of Ryujinx Nintendo Contact Forces Development Halt

Apr 25, 2025

Latest Posts

-

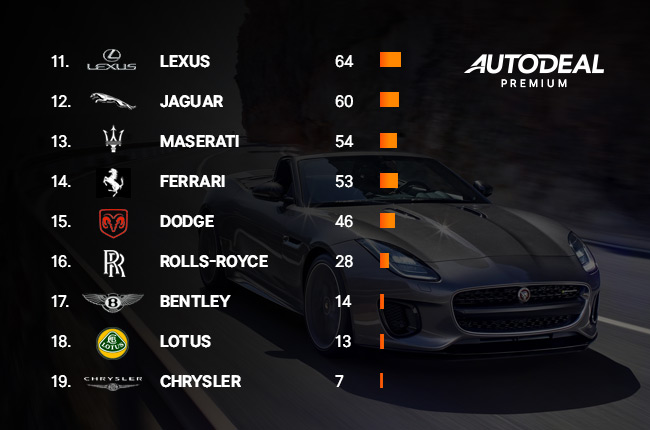

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025 -

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025 -

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025

Navigating The Chinese Market The Struggles Of Bmw Porsche And Other Auto Brands

Apr 26, 2025 -

The Growing Market Of Betting On Natural Disasters A Case Study Of The La Wildfires

Apr 26, 2025

The Growing Market Of Betting On Natural Disasters A Case Study Of The La Wildfires

Apr 26, 2025 -

The La Wildfires And The Gambling Industry A Concerning Connection

Apr 26, 2025

The La Wildfires And The Gambling Industry A Concerning Connection

Apr 26, 2025