Analysis: Gold Market Responds To Trump's Less Aggressive Stance

Table of Contents

Trump's Shifting Rhetoric and its Impact on Market Sentiment

Trump's previous presidency was marked by an aggressive stance on trade, leading to significant market uncertainty. His trade wars and unpredictable policies fueled demand for gold, driving prices upwards as investors sought refuge from geopolitical risks. This heightened uncertainty was a major factor in gold's price surge during that period. However, a noticeable shift in his rhetoric following his departure from office resulted in a ripple effect on the gold market. For example, his less confrontational statements regarding international trade and reduced emphasis on protectionist policies created a sense of increased market stability.

- Increased market stability: Reduced anxieties surrounding trade wars led to a decreased demand for safe-haven assets.

- Decreased demand for gold: As investor confidence grew, the appeal of gold as a hedge against uncertainty lessened.

- Impact on investor confidence and risk appetite: A more predictable political landscape encouraged investors to shift their portfolios towards higher-risk, higher-reward assets.

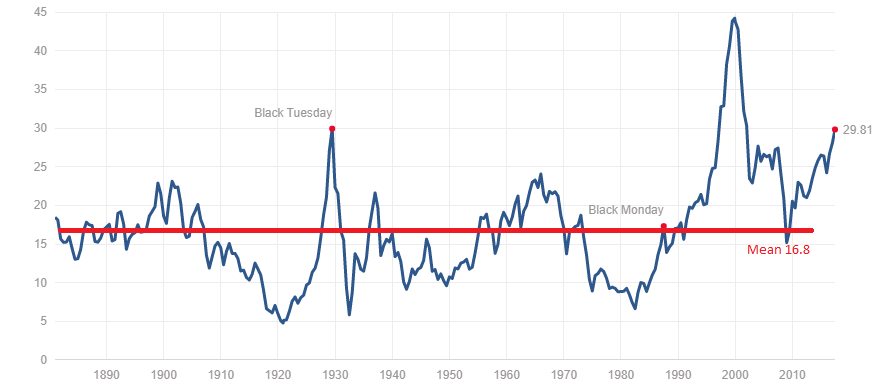

- Specific gold price movements: A clear correlation can be observed between the shift in Trump's stance and a subsequent dip in gold prices. (Include a relevant chart or graph here showing gold price fluctuations during this period)

Geopolitical Factors Influencing Gold Prices Beyond Trump's Stance

While Trump's altered rhetoric played a significant role, it's crucial to consider other geopolitical factors influencing gold prices. A holistic analysis requires accounting for these broader market forces.

- Global inflation rates: Rising inflation typically boosts gold prices as investors seek to protect their purchasing power.

- US dollar strength/weakness: A weaker US dollar generally strengthens gold's value, as gold is priced in US dollars.

- Central bank policies: Central banks' actions, such as interest rate adjustments and quantitative easing, can significantly impact gold demand. Expansionary monetary policies often lead to increased gold investment.

- Other significant global events: Geopolitical tensions, such as conflicts or political instability in other regions, can also increase demand for safe-haven assets like gold.

Analyzing the Gold Market's Reaction: Price Fluctuations and Trading Volume

Following the perceived shift in Trump's stance, the gold market experienced a noticeable price correction. The price of gold declined, reflecting a reduced demand for this safe-haven asset. This price movement is further substantiated by changes in trading volume.

- Charts and graphs: (Include charts and graphs comparing gold price fluctuations before and after the shift in Trump's stance). These visuals clearly illustrate the price correction.

- Trading volume comparison: The decrease in trading volume suggests a reduction in investor interest in the gold market during this period, corroborating the impact of reduced uncertainty.

- Key support and resistance levels: Analysis of technical charts can reveal key support and resistance levels that influenced price movements within the gold market.

- Trading strategies: Investors likely adjusted their trading strategies in response to these shifts, moving away from gold and towards other assets perceived to offer better returns in a less volatile environment.

The Role of Speculation and Investor Behavior

Speculation and investor sentiment played a significant role in shaping gold prices. News articles and investor commentary reveal a shift in market sentiment from a risk-averse stance to a more risk-tolerant one.

- News articles and investor commentary: Media reports and expert opinions reflected the changing perceptions of market risk and the subsequent impact on investor behavior.

- Short-term vs. long-term strategies: Investors may have shifted from long-term gold holdings to shorter-term investments in other asset classes.

- Impact of algorithmic trading: Algorithmic trading likely amplified price volatility during this transition period, adding complexity to market dynamics.

Conclusion

The gold market's response to Trump's less aggressive stance demonstrates the significant influence of political landscapes on precious metal prices. The shift towards less uncertainty led to a decrease in demand for gold, resulting in price corrections and reduced trading volume. However, it's vital to remember that this is just one factor among many influencing gold prices. Geopolitical events, inflation rates, US dollar movements, and central bank policies all contribute to the complex dynamics of the gold market.

Call to action: Stay informed about the ongoing developments in the gold market and how shifts in political landscapes, such as changes in Trump's stance, or other significant global events, can influence gold prices. Continue to monitor the interplay between geopolitical events and precious metal investment opportunities. Learn more about managing risk in the gold market to make informed investment decisions.

Featured Posts

-

High Stock Market Valuations Bof As Analysis And Why Investors Shouldnt Panic

Apr 25, 2025

High Stock Market Valuations Bof As Analysis And Why Investors Shouldnt Panic

Apr 25, 2025 -

India Trip Transforms Usha Vance Into A Celebrity

Apr 25, 2025

India Trip Transforms Usha Vance Into A Celebrity

Apr 25, 2025 -

Sadie Sinks Broadway Break A Visit To The Stranger Things Cast

Apr 25, 2025

Sadie Sinks Broadway Break A Visit To The Stranger Things Cast

Apr 25, 2025 -

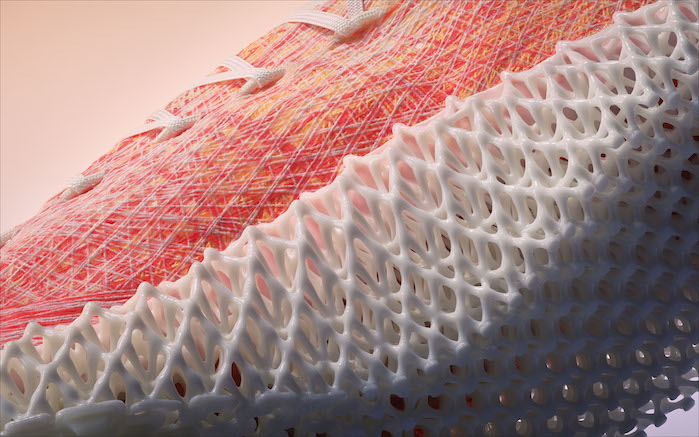

Puma And The Future Of Hyrox Footwear Innovation In Performance

Apr 25, 2025

Puma And The Future Of Hyrox Footwear Innovation In Performance

Apr 25, 2025 -

Canadians Rethink Condo Investments A Market In Transition

Apr 25, 2025

Canadians Rethink Condo Investments A Market In Transition

Apr 25, 2025

Latest Posts

-

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 26, 2025

Los Angeles Palisades Fire A List Of Celebrities Whose Homes Were Damaged Or Destroyed

Apr 26, 2025 -

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Bmw Porsche And Other Auto Brands

Apr 26, 2025 -

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025

The Growing Problem Of Betting On Natural Disasters Focus On Los Angeles

Apr 26, 2025 -

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025

Los Angeles Wildfires A Case Study In Disaster Speculation

Apr 26, 2025 -

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025

How Middle Management Drives Company Growth And Employee Development

Apr 26, 2025