High Stock Market Valuations: BofA's Analysis And Why Investors Shouldn't Panic

Table of Contents

BofA's Key Findings on High Stock Market Valuations

BofA's recent report on stock market valuations provides a nuanced perspective on current market conditions. The report analyzed various valuation metrics to gauge the overall health and potential risks within the market. While acknowledging the elevated levels of some metrics, BofA refrained from issuing a blanket warning of an imminent crash.

-

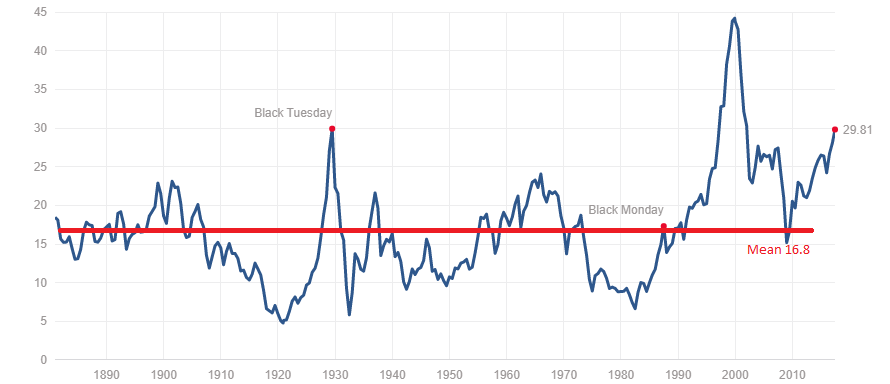

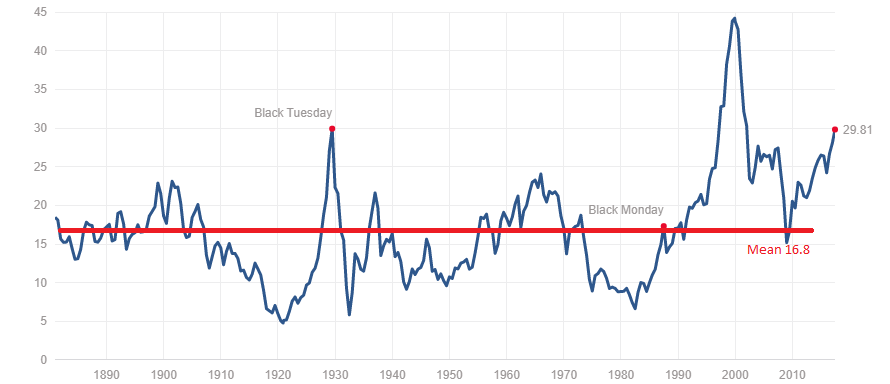

Specific valuation metrics and their current levels according to BofA: The report likely cited metrics such as the Price-to-Earnings ratio (P/E ratio), both trailing and forward-looking, and the cyclically adjusted price-to-earnings ratio (Shiller PE). Specific numerical data would need to be referenced directly from BofA's report for accuracy. For example, BofA might have noted a high Shiller PE ratio, suggesting valuations are historically elevated compared to average earnings over a longer period.

-

BofA's interpretation of these metrics: BofA's interpretation of these high stock valuations likely considered factors beyond simple historical comparisons. They may have pointed out that historically high P/E ratios don't automatically predict a market crash. Factors like low interest rates, strong corporate earnings growth, and continued technological innovation can justify higher valuations, at least to some extent.

-

Specific sectors or asset classes highlighted in the report: BofA's analysis may have highlighted specific sectors experiencing higher valuations than others. Technology stocks, for instance, often command higher P/E ratios due to anticipated growth, while more cyclical sectors might display more moderate valuations. Understanding these sectoral variations is critical for strategic investment decisions. The report might also have addressed asset classes beyond equities, considering the relative valuation of bonds and other fixed-income instruments.

Understanding the Factors Driving High Valuations

Several interconnected economic and market forces contribute to the current high stock market valuations. It's crucial to understand these drivers to form a balanced perspective.

-

Low interest rates and their impact on discounted cash flow valuations: Low interest rates reduce the discount rate used in discounted cash flow (DCF) valuations. This lowers the present value of future cash flows, making companies appear more valuable. This is a significant factor in explaining the relatively high valuations seen in many sectors.

-

Strong corporate earnings growth (or expectations of growth): Robust corporate earnings, or the anticipation of strong future earnings, can support higher valuations. Investors are willing to pay a premium for companies demonstrating consistent growth and profitability.

-

Technological innovation and its effect on market leaders' valuations: The rapid pace of technological innovation drives growth in certain sectors, fueling investor optimism and justifying higher valuations for leading companies in these fields.

-

Increased investor confidence (or speculation): High investor confidence, sometimes bordering on speculation, can push valuations upward. This enthusiasm can lead to a "fear of missing out" (FOMO) effect, driving prices higher even in the face of potential risks.

-

Geopolitical factors influencing investment flows: Global events, such as trade wars or geopolitical instability, can influence investment flows and market valuations. These events can create uncertainty, affecting investor sentiment and pushing valuations higher or lower depending on the perceived risk.

Why Investors Shouldn't Necessarily Panic

While high stock market valuations warrant attention, they don't necessarily signal an imminent market crash. A long-term perspective is crucial.

-

Long-term perspective: Highlight historical market cycles and recoveries: History shows that markets experience cyclical fluctuations. High valuations have been observed in the past, followed by periods of correction and subsequent growth. Focusing on long-term investment goals, rather than short-term market noise, is key to weathering market volatility.

-

BofA's outlook and suggested investment strategies (if any): BofA's report likely provides an outlook for the market and may suggest specific investment strategies. This might include sector rotation, focusing on value stocks, or emphasizing defensive positions within a diversified portfolio.

-

Focus on diversification and risk management: Diversification across asset classes and sectors is a crucial risk management strategy. This helps to mitigate the impact of any downturn in a particular sector or asset class.

-

Opportunities within specific sectors despite high valuations: Even in a market with high overall valuations, opportunities may exist within specific sectors or individual companies that are undervalued relative to their potential. Thorough research and due diligence are essential to identify such opportunities.

-

Importance of individual investor circumstances and risk tolerance: High stock market valuations affect different investors differently based on their individual financial circumstances, risk tolerance, and investment time horizon. A young investor with a long time horizon might be less concerned about short-term fluctuations than an investor nearing retirement.

The Importance of a Long-Term Investment Horizon

A long-term investment horizon allows investors to ride out market cycles, mitigating the impact of short-term volatility. Dollar-cost averaging, a strategy of investing a fixed amount at regular intervals regardless of market price, can further reduce the influence of high valuations on portfolio performance. Long-term investors can use periods of high valuations as opportunities to gradually acquire assets at different price points.

Assessing Your Personal Risk Tolerance

High stock market valuations shouldn't trigger blanket panic selling. The impact of high valuations depends heavily on individual circumstances and risk tolerance. Investors should carefully assess their financial goals, risk appetite, and investment time horizon before making any significant portfolio adjustments.

Conclusion

BofA's analysis on high stock market valuations provides a balanced view, highlighting elevated metrics but avoiding alarmist predictions. The key takeaway is that while valuations are high, they are not necessarily unsustainable or predictive of an immediate market crash. A long-term perspective, coupled with diversification and effective risk management, are critical strategies for navigating this environment. Understanding the factors contributing to high valuations—low interest rates, strong earnings growth, and technological innovation—allows investors to make more informed decisions.

Don't let high stock market valuations paralyze you. Conduct thorough research, consider BofA's insights, and consult with a financial advisor to develop a well-informed investment strategy that aligns with your individual circumstances and risk tolerance. Remember, navigating high stock market valuations requires careful planning and a long-term outlook.

Featured Posts

-

Luxury Car Sales In China Analyzing The Struggles Of Bmw And Porsche

Apr 25, 2025

Luxury Car Sales In China Analyzing The Struggles Of Bmw And Porsche

Apr 25, 2025 -

Land Your Dream Private Credit Job 5 Key Dos And Don Ts

Apr 25, 2025

Land Your Dream Private Credit Job 5 Key Dos And Don Ts

Apr 25, 2025 -

Japanese Asset Market Booms As Us Investment Slows

Apr 25, 2025

Japanese Asset Market Booms As Us Investment Slows

Apr 25, 2025 -

The Devastating Effect Of Tariffs On A Montreal Guitar Maker

Apr 25, 2025

The Devastating Effect Of Tariffs On A Montreal Guitar Maker

Apr 25, 2025 -

Import Tariffs A Major Hurdle For A Montreal Based Guitar Company

Apr 25, 2025

Import Tariffs A Major Hurdle For A Montreal Based Guitar Company

Apr 25, 2025

Latest Posts

-

Makeup And Skin Health Understanding The Risks And Benefits

Apr 25, 2025

Makeup And Skin Health Understanding The Risks And Benefits

Apr 25, 2025 -

Nhung Buc Anh Voi La Mat Trong Bua Tiec Buffet

Apr 25, 2025

Nhung Buc Anh Voi La Mat Trong Bua Tiec Buffet

Apr 25, 2025 -

Is Makeup Harmful To Your Skin A Dermatologists Perspective

Apr 25, 2025

Is Makeup Harmful To Your Skin A Dermatologists Perspective

Apr 25, 2025 -

Hinh Anh Voi An Tiec Buffet Trang Diem An Tuong

Apr 25, 2025

Hinh Anh Voi An Tiec Buffet Trang Diem An Tuong

Apr 25, 2025 -

Is Makeup Bad For Your Skin The Truth About Cosmetics And Skincare

Apr 25, 2025

Is Makeup Bad For Your Skin The Truth About Cosmetics And Skincare

Apr 25, 2025