Import Tariffs: A Major Hurdle For A Montreal-Based Guitar Company

Table of Contents

The Impact of Import Tariffs on Raw Materials

Import tariffs, also known as import duties or customs duties, directly increase the cost of imported goods. For Maple Leaf Guitars, this translates to substantially higher expenses for essential raw materials. The impact is felt across their entire supply chain:

-

Increased cost of imported tonewoods: The exquisite tonewoods crucial for high-quality guitars, such as rosewood and mahogany, are often sourced internationally. Import tariffs significantly inflate the price of these materials, directly impacting the final cost of production. The price increase isn't just on the wood itself; it includes the added tariff burden on the shipping and handling.

-

Higher prices for electronic components: Many guitar components, from pickups to electronics, are sourced from Asian manufacturers. Import tariffs on these electronic components add another layer of expense, further squeezing profit margins. This includes everything from the tiny capacitors and resistors to more complex circuits. Even seemingly insignificant components are impacted.

-

Rising shipping costs exacerbated by tariffs: Shipping costs are already substantial for international trade. Import tariffs add yet another cost burden to an already complex logistical process. This can significantly affect smaller businesses with tighter budgets.

-

Reduced profit margins due to increased input costs: The cumulative effect of higher costs for raw materials, components, and shipping, all inflated by import tariffs, drastically reduces the profit margins for Maple Leaf Guitars, making it increasingly difficult to remain competitive. This affects their ability to invest in research, development, and marketing.

Competition and Market Share in the Face of Tariffs

The increased production costs stemming from import tariffs create a significant disadvantage for Maple Leaf Guitars in the competitive guitar market. They face pressure from several angles:

-

Loss of price competitiveness against international competitors: Companies in countries with lower import duties or those producing domestically enjoy a substantial cost advantage. Maple Leaf Guitars must either absorb the increased costs, reducing profit, or raise prices, potentially losing market share.

-

Difficulty in penetrating new export markets due to higher prices: The higher prices resulting from import tariffs make it more challenging for Maple Leaf Guitars to compete in international markets, limiting their growth potential and global reach. The increased costs make their products less attractive to buyers in other countries.

-

Potential market share erosion to cheaper, imported guitars: Consumers are often more sensitive to price, particularly in a competitive market like musical instruments. The higher prices of Maple Leaf Guitars due to tariffs make them vulnerable to competition from cheaper imports.

-

Need for strategic pricing adjustments to maintain sales: To maintain sales and market share, Maple Leaf Guitars must carefully analyze market dynamics and consider strategic pricing adjustments. This could involve making tough decisions about pricing versus maintaining profit margins.

Exploring Mitigation Strategies for Import Tariff Challenges

Maple Leaf Guitars, like many other businesses facing similar challenges, needs to explore various mitigation strategies to lessen the negative impacts of import tariffs. Several options are available:

-

Sourcing raw materials from domestic suppliers: If feasible and cost-effective, shifting to domestic suppliers for tonewoods and other components could alleviate some of the tariff burden. However, domestic sourcing may not always be possible or economically viable.

-

Negotiating better deals with existing suppliers: Stronger relationships with international suppliers might lead to better pricing and potentially shared cost burdens, mitigating the impact of the tariffs. This requires strong negotiating skills and long-term relationships.

-

Exploring government assistance programs for businesses impacted by tariffs: Many governments offer programs designed to support businesses affected by import tariffs. Researching and applying for these programs can provide financial relief. This often requires detailed paperwork and adherence to strict guidelines.

-

Investing in automation to increase efficiency and reduce production costs: Automating aspects of production can improve efficiency, reduce labor costs, and ultimately help offset some of the increased expenses due to tariffs. This is a long-term strategy requiring significant capital investment.

-

Diversifying product lines to offer higher-margin, less import-dependent products: Expanding into product lines that rely less on imported materials can reduce the overall impact of tariffs on the company's profitability. This requires market research and careful planning.

The Role of Government Policy and Trade Agreements

Government trade policies and international agreements play a crucial role in shaping the landscape of import tariffs. For Maple Leaf Guitars, understanding these dynamics is crucial:

-

Influence of CUSMA (USMCA) on import duties: The Canada-United States-Mexico Agreement (CUSMA) influences the import duties between Canada, the US, and Mexico. Understanding its implications for specific materials is vital.

-

Potential for future trade negotiations to impact tariffs: Future trade negotiations and agreements can significantly alter tariff rates. Staying informed about these developments is essential for strategic planning.

-

Lobbying efforts for tariff reductions or exemptions: Businesses can engage in lobbying efforts to advocate for tariff reductions or exemptions for specific products, potentially reducing the impact on their operations.

Conclusion

Import tariffs present significant challenges to businesses like Maple Leaf Guitars, impacting raw material costs, competitiveness, and ultimately, profitability. The increased cost of imported tonewoods, electronic components, and shipping, directly linked to tariffs, significantly reduces profit margins and hinders growth. However, by exploring mitigation strategies like sourcing domestic materials, negotiating better supplier deals, seeking government assistance, investing in automation, and diversifying product lines, Maple Leaf Guitars can navigate these challenges. Don't let import tariffs silence your business; explore effective strategies today! Understanding the impact of import tariffs and proactively planning your next move is crucial for survival and success in today’s global market.

Featured Posts

-

Against All Odds Bochums Incredible Comeback Against Bayern Munich

Apr 25, 2025

Against All Odds Bochums Incredible Comeback Against Bayern Munich

Apr 25, 2025 -

Premios Caonabo De Oro 2025 Lista Completa De Ganadores

Apr 25, 2025

Premios Caonabo De Oro 2025 Lista Completa De Ganadores

Apr 25, 2025 -

St Pauli Vs Bayern Munich Sanes Impact Decides Close Match

Apr 25, 2025

St Pauli Vs Bayern Munich Sanes Impact Decides Close Match

Apr 25, 2025 -

Chinas Economy Under Pressure Special Bonds To Counter Trumps Tariffs

Apr 25, 2025

Chinas Economy Under Pressure Special Bonds To Counter Trumps Tariffs

Apr 25, 2025 -

The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

Apr 25, 2025

The Complexities Of The Chinese Auto Market Case Studies Of Bmw And Porsche

Apr 25, 2025

Latest Posts

-

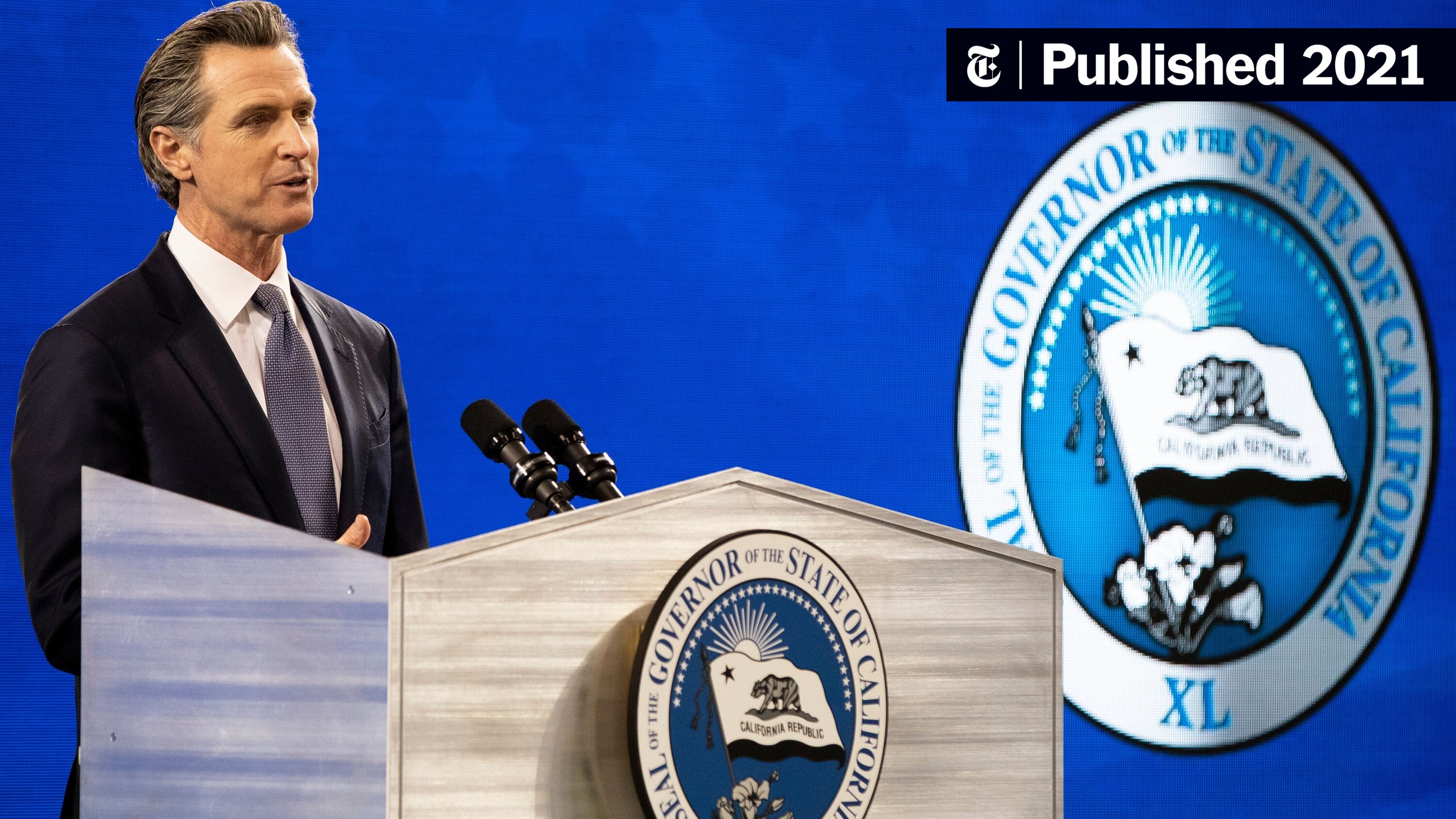

Governor Newsom Targets Judgmental Democrats In Latest Remarks

Apr 26, 2025

Governor Newsom Targets Judgmental Democrats In Latest Remarks

Apr 26, 2025 -

California Governor Calls Out Intra Party Toxicity

Apr 26, 2025

California Governor Calls Out Intra Party Toxicity

Apr 26, 2025 -

Newsoms Sharp Rebuke Of Toxic Democrats

Apr 26, 2025

Newsoms Sharp Rebuke Of Toxic Democrats

Apr 26, 2025 -

Gavin Newsom Criticizes Toxic And Judgmental Democrats

Apr 26, 2025

Gavin Newsom Criticizes Toxic And Judgmental Democrats

Apr 26, 2025 -

Newsom Faces Criticism For Toxic Democrats Comment

Apr 26, 2025

Newsom Faces Criticism For Toxic Democrats Comment

Apr 26, 2025