China's Economy Under Pressure: Special Bonds To Counter Trump's Tariffs

Table of Contents

The Impact of Trump's Tariffs on the Chinese Economy

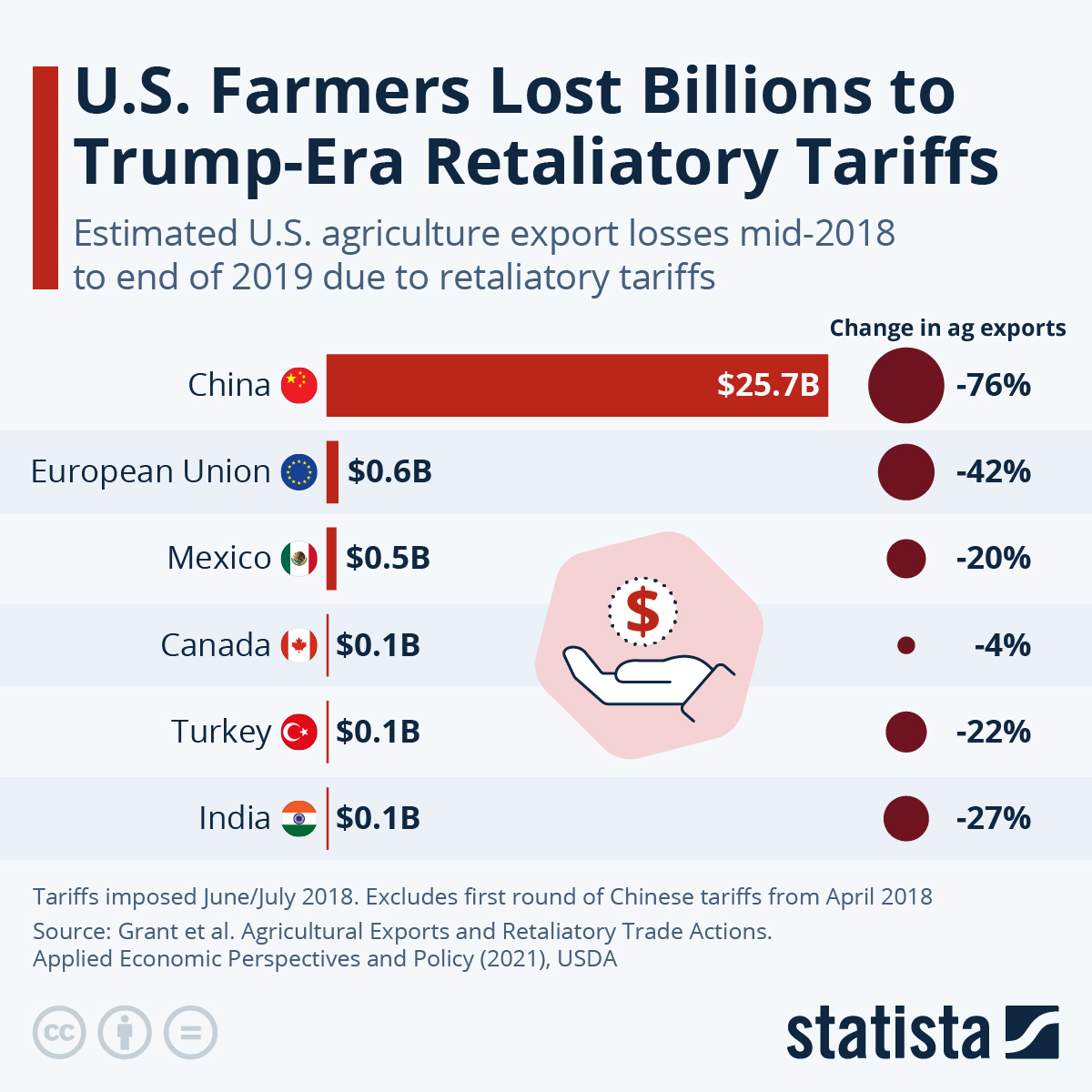

Trump's tariffs, implemented in a series of escalating rounds, significantly impacted the Chinese economy. The increased costs on Chinese goods exported to the US, coupled with retaliatory tariffs from China, created a challenging environment for businesses and investors.

Declining Exports and Foreign Investment

The tariffs directly impacted Chinese exports, leading to a decline in key sectors.

- Manufacturing: Industries like steel, aluminum, and consumer electronics faced significant export reductions. Data from the Chinese Customs Administration showed a [insert percentage]% decrease in exports to the US in [insert year].

- Technology: The tech sector, a key driver of Chinese economic growth, also suffered, with reduced sales of smartphones, computers, and other electronic goods to the US market.

- Foreign Direct Investment (FDI): The trade uncertainty created by the tariffs discouraged foreign investment. Companies hesitated to commit capital to China, fearing further escalation of the trade war and disruptions to their supply chains. FDI inflows decreased by [insert percentage]% in [insert year], according to the Ministry of Commerce.

Domestic Economic Slowdown

The decline in exports and FDI had a ripple effect on China's domestic economy.

- Reduced Consumer Spending: Lower exports led to job losses in manufacturing and related industries, impacting consumer confidence and spending.

- Employment Challenges: Businesses, facing reduced demand and increased costs, were forced to cut jobs or postpone expansion plans, contributing to a rise in unemployment.

- GDP Growth: China's GDP growth rate slowed down during this period, reflecting the overall economic impact of the trade war. The GDP growth rate fell from [insert previous year's percentage]% to [insert year's percentage]% in [insert year], according to the National Bureau of Statistics of China.

China's Response: The Role of Special Bonds

In response to the economic challenges posed by the trade war, the Chinese government implemented a range of measures, with the issuance of special bonds being a key component.

What are Special Bonds?

Special bonds, in the context of China's fiscal policy, are government bonds issued to finance specific projects, primarily infrastructure development. Unlike general government bonds, their proceeds are earmarked for pre-determined uses, often with a focus on stimulating economic activity. The mechanism involves the central government issuing these bonds, then allocating funds to local governments and state-owned enterprises for designated projects.

Funding Infrastructure Projects and Stimulating Growth

The proceeds from the issuance of China's special bonds were largely directed towards:

- Transportation Infrastructure: High-speed rail projects, highway expansions, and port upgrades received significant funding.

- Energy Infrastructure: Investments in renewable energy projects, power grid modernization, and energy efficiency initiatives were prioritized.

- Technology Infrastructure: Funding was allocated to 5G network development, digital infrastructure upgrades, and research and development in key technological sectors. These investments aimed at boosting job creation and long-term economic competitiveness. For example, [insert example of a specific project].

Addressing Local Government Debt

The issuance of special bonds also played a crucial role in addressing the mounting debt burden faced by many local governments. By providing them with additional funding, the central government aimed to prevent defaults and maintain fiscal stability at the local level. This involved a specific mechanism for distributing funds to local authorities based on their needs and the designated projects.

Assessing the Effectiveness of Special Bonds

The effectiveness of China's special bonds in countering the impact of Trump's tariffs is a complex issue with both positive and negative aspects.

Positive Impacts

- Infrastructure Development: The increased infrastructure spending did lead to a boost in construction activity and related industries, creating jobs and stimulating economic growth.

- Job Creation: Construction projects funded by the special bonds created numerous jobs, helping to mitigate the impact of job losses in export-oriented sectors.

- Improved Economic Indicators: In certain sectors, investments fueled by special bonds led to improvements in productivity and economic efficiency.

Challenges and Limitations

- Increased Government Debt: The issuance of special bonds inevitably increased the overall government debt level, raising concerns about long-term fiscal sustainability. The ratio of government debt to GDP increased from [insert previous percentage]% to [insert current percentage]% between [insert years].

- Potential for Inefficiency: Some critics argued that the allocation of funds wasn't always efficient, with projects chosen based on political considerations rather than purely economic merit.

- Long-term Sustainability: The long-term impact and overall sustainability of this strategy remain to be seen. The effectiveness of special bonds depends heavily on the successful implementation and efficient management of infrastructure projects.

Conclusion

China's issuance of special bonds was a significant response to the economic challenges posed by Trump's tariffs. While these bonds played a role in mitigating the negative impacts and stimulating growth through infrastructure investment, the long-term effectiveness and potential risks associated with increased government debt require further observation. Understanding the intricacies of China's Special Bonds is crucial for comprehending its economic resilience and future strategies. To stay informed on this critical aspect of China's economic policy, continue researching the impact of China's Special Bonds and related fiscal measures.

Featured Posts

-

Your Guide To Big Name Concerts In Okc This March

Apr 25, 2025

Your Guide To Big Name Concerts In Okc This March

Apr 25, 2025 -

Sbs Eurovision Courtney Act And Tony Armstrong Take The Reins

Apr 25, 2025

Sbs Eurovision Courtney Act And Tony Armstrong Take The Reins

Apr 25, 2025 -

Liga Santafesina Todos Los Goles Jugadas Y Resumen Semanal

Apr 25, 2025

Liga Santafesina Todos Los Goles Jugadas Y Resumen Semanal

Apr 25, 2025 -

Jay Barbershops Community Initiative A Haircut Marathon For Suicide Prevention

Apr 25, 2025

Jay Barbershops Community Initiative A Haircut Marathon For Suicide Prevention

Apr 25, 2025 -

Linda Evangelista And Cool Sculpting The High Price Of Cosmetic Procedures

Apr 25, 2025

Linda Evangelista And Cool Sculpting The High Price Of Cosmetic Procedures

Apr 25, 2025

Latest Posts

-

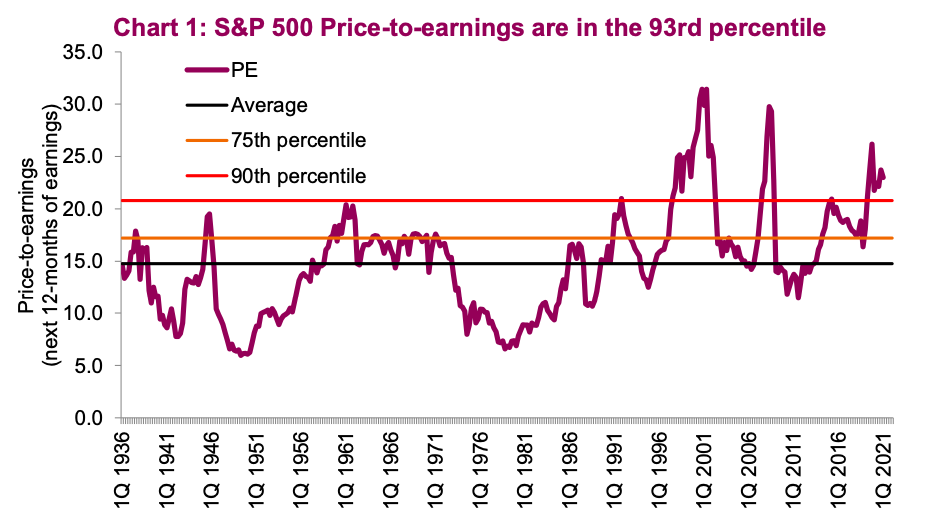

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025 -

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025 -

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025 -

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025