Analyzing CoreWeave Inc. (CRWV) Stock's Fall On Thursday

Table of Contents

Market Sentiment and Investor Reactions to CRWV's Performance

The CRWV stock price drop on Thursday didn't occur in a vacuum. Several factors related to both the broader market and CoreWeave's specific circumstances contributed to the negative investor sentiment. While the overall market experienced some volatility that day, the severity of CRWV's decline suggests company-specific issues played a significant role.

-

Negative News and Announcements: Prior to the fall, there were no major negative press releases directly impacting CoreWeave. However, the absence of positive news, coupled with other factors, may have contributed to selling pressure. The lack of bullish catalysts could have influenced investor behavior.

-

Analyst Ratings and Revisions: A close examination of analyst ratings and potential downgrades around the time of the drop is crucial. Any changes in analyst sentiment, even subtle ones, can significantly influence trading activity and the overall perception of a stock like CRWV.

-

Trading Volume Spikes: A sharp increase in trading volume often accompanies significant price movements. Analyzing the volume data around Thursday's CRWV stock decline can reveal whether the sell-off was driven by a large number of investors or a smaller group of significant players.

-

Social Media Sentiment: Social media platforms are increasingly used to gauge public opinion on stocks. Monitoring social media discussions about CRWV around the time of the drop could offer insights into the prevalent sentiment among retail investors. Negative buzz or a sudden shift in sentiment could have amplified the downward pressure.

Analyzing CoreWeave's (CRWV) Financial Performance and Future Outlook

Understanding CoreWeave's financial health is vital to comprehending the CRWV stock decline. A detailed review of recent financial reports, focusing on key performance indicators (KPIs), is necessary.

-

Key Financial Figures: Analyzing metrics such as revenue growth, profit margins, and earnings per share (EPS) in the periods leading up to and following the price drop is crucial. A significant deviation from expectations could have triggered the sell-off. Comparing CRWV's performance against competitors in the cloud computing and AI infrastructure sectors provides valuable context.

-

Debt Levels and Liquidity: High levels of debt or concerns about the company's ability to meet its financial obligations can negatively impact investor confidence. Analyzing CRWV's debt-to-equity ratio and its cash flow position can offer insights into its financial stability and resilience.

-

Long-Term Growth Prospects: Investors also consider a company's future prospects. Any concerns about CRWV's long-term growth strategy, market competition, or potential technological disruptions could have fueled the stock's decline. Assessing the company's competitive advantage and potential for future innovation is vital.

-

Potential Risks: Evaluating the overall risk profile of CRWV is essential. Factors such as dependence on specific customers, regulatory changes, or technological advancements could pose significant risks.

Technical Analysis of CRWV Stock Chart Patterns

Technical analysis offers another perspective on the CRWV stock fall. Studying the stock chart for specific patterns can provide insights into the price movement.

-

Support and Resistance Levels: A breach of crucial support levels can trigger further downward pressure. Analyzing where the CRWV stock price had found support before the drop and observing how easily it broke through these levels is insightful.

-

Moving Averages: The relationship between CRWV's stock price and its moving averages (e.g., 50-day, 200-day) can indicate potential trends. A crossover of moving averages can often signal a change in momentum.

-

Candlestick Patterns: Specific candlestick patterns can foreshadow price movements. Identifying any bearish patterns (e.g., hanging man, shooting star) before or during the decline can shed light on the technical aspects of the price drop.

-

Volume Analysis: Analyzing volume alongside price changes is crucial. High volume during the decline suggests significant selling pressure, while low volume may suggest a more controlled or less impactful sell-off.

Conclusion: Understanding and Responding to the CoreWeave Inc. (CRWV) Stock Fall

The CRWV stock fall on Thursday was likely a result of a confluence of factors, including broader market sentiment, concerns about CoreWeave's financial performance, and negative technical indicators. While the short-term outlook may seem uncertain, understanding these contributing factors is crucial for informed decision-making. Investors should carefully assess both the potential risks and opportunities associated with CRWV before making any investment decisions. Remember to conduct thorough research, stay updated on market developments, and consider consulting a financial advisor before investing in any stock, especially following significant price fluctuations. For further insights and updates on CRWV stock, consider subscribing to our newsletter for continued analysis. Stay informed about CoreWeave Inc. (CRWV) stock and make well-informed choices regarding your investment strategy.

Featured Posts

-

Trinidad Concert Minister Debates Age Limits And Song Bans For Kartel Performance

May 22, 2025

Trinidad Concert Minister Debates Age Limits And Song Bans For Kartel Performance

May 22, 2025 -

La Petite Italie De L Ouest Une Exploration De Son Architecture Toscane

May 22, 2025

La Petite Italie De L Ouest Une Exploration De Son Architecture Toscane

May 22, 2025 -

Did Taylor Swift And Blake Livelys Friendship End Due To Legal Battles

May 22, 2025

Did Taylor Swift And Blake Livelys Friendship End Due To Legal Battles

May 22, 2025 -

Abn Amro Rentedaling En De Gevolgen Voor De Huizenmarkt

May 22, 2025

Abn Amro Rentedaling En De Gevolgen Voor De Huizenmarkt

May 22, 2025 -

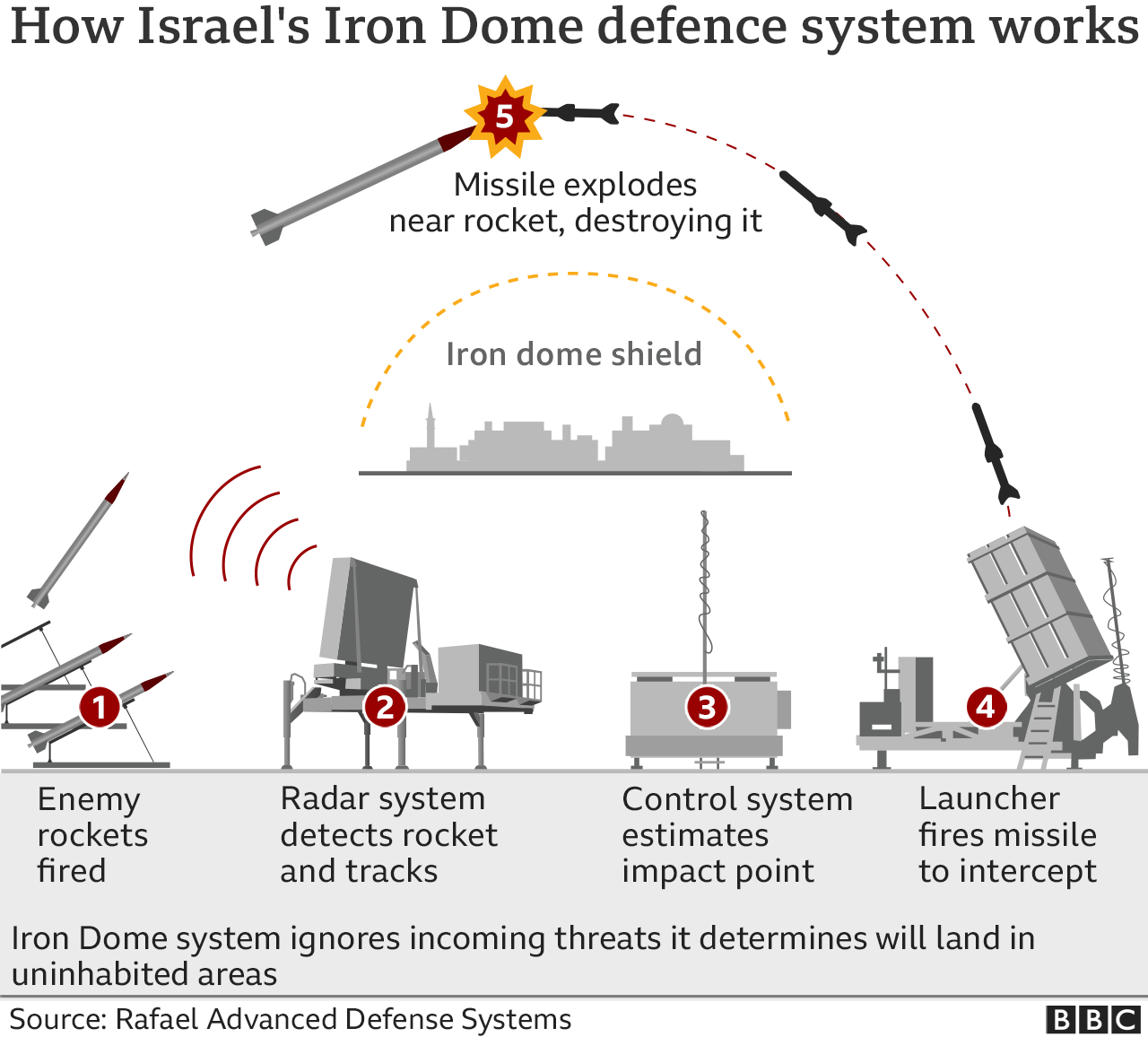

Golden Dome Missile Shield Trumps Plan And Its Feasibility

May 22, 2025

Golden Dome Missile Shield Trumps Plan And Its Feasibility

May 22, 2025

Latest Posts

-

Wordle Game 1370 March 20th Tips Clues And Answer

May 22, 2025

Wordle Game 1370 March 20th Tips Clues And Answer

May 22, 2025 -

March 20th Wordle Answer 1370 Clues To Help You Solve

May 22, 2025

March 20th Wordle Answer 1370 Clues To Help You Solve

May 22, 2025 -

Unraveling Todays Nyt Wordle March 26 The Answer Revealed

May 22, 2025

Unraveling Todays Nyt Wordle March 26 The Answer Revealed

May 22, 2025 -

Wordle 1370 Hints And Answer For March 20th

May 22, 2025

Wordle 1370 Hints And Answer For March 20th

May 22, 2025 -

April 26 2025 Wordle Tips Clues And The Answer To Puzzle 1407

May 22, 2025

April 26 2025 Wordle Tips Clues And The Answer To Puzzle 1407

May 22, 2025