Analyzing Japan's Bond Market: The Impact Of A Steep Yield Curve

Table of Contents

Understanding Japan's Yield Curve

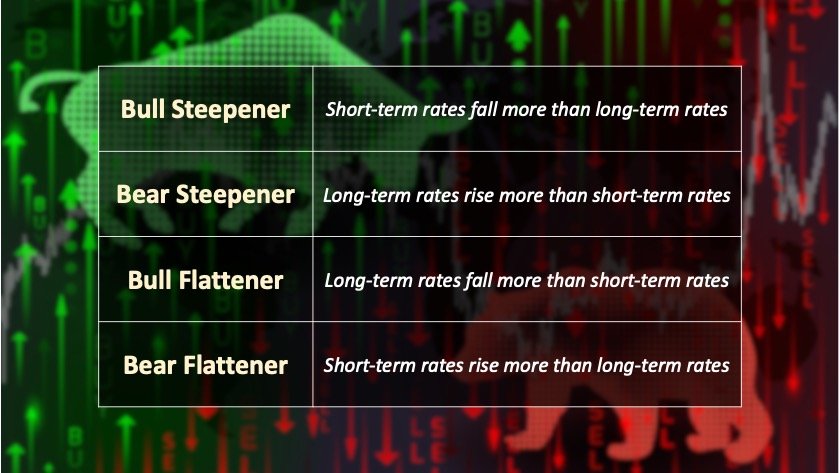

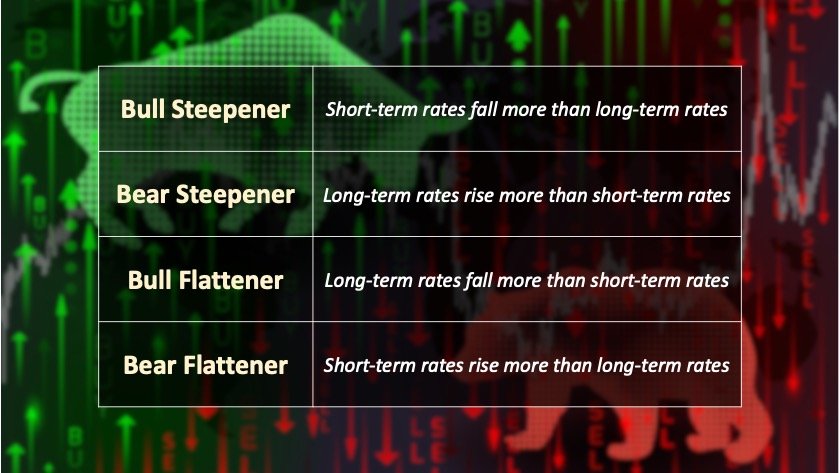

The yield curve graphically represents the relationship between the interest rates (or yields) offered by bonds with different maturities. It's a vital indicator of economic health, reflecting market expectations about future interest rates and economic growth. A normal yield curve slopes upward, with longer-term bonds offering higher yields than short-term bonds. An inverted yield curve, where short-term yields exceed long-term yields, is often seen as a recessionary warning sign.

Currently, Japan's yield curve is exhibiting a steepening trend, a deviation from its historically flatter profile maintained through the Bank of Japan's (BOJ) yield curve control (YCC) policy. This steepening signifies a notable shift in market sentiment and expectations.

- Definition of yield curve: The relationship between bond yields and their time to maturity.

- Normal vs. inverted yield curves: Normal curves slope upward; inverted curves slope downward.

- Current yield curve shape in Japan: Significantly steeper than in recent years, reflecting rising long-term yields.

- Historical comparison: The current steepening contrasts sharply with the prolonged period of near-zero interest rates and a flat yield curve under the BOJ's YCC policy. This historical context highlights the magnitude of the current shift.

This steepening primarily affects Japanese government bonds (JGBs), the benchmark for the Japanese fixed-income market, impacting bond yields across various maturities.

Factors Contributing to the Steepening Yield Curve

Several factors are contributing to the steepening yield curve in Japan's bond market:

The Bank of Japan's (BOJ) recent adjustments to its monetary policy, specifically its gradual shift away from strict yield curve control (YCC), have played a significant role. This has allowed long-term JGB yields to rise more freely. Furthermore, the global rise in inflation and interest rates, spurred by factors such as supply chain disruptions and geopolitical instability, has increased the attractiveness of higher-yielding assets globally, indirectly impacting demand for JGBs.

- BOJ's shift away from YCC: This policy change has unleashed upward pressure on JGB yields, contributing significantly to the steeper curve.

- Impact of rising global inflation: Higher global inflation increases the appeal of assets offering inflation hedges, potentially reducing demand for Japanese government bonds.

- Changes in investor confidence and risk appetite: A shift towards riskier assets can diminish the demand for relatively safe haven assets like JGBs, influencing their yields.

- Role of currency fluctuations: Fluctuations in the value of the Japanese Yen (JPY) can influence the attractiveness of JGBs to foreign investors, impacting the demand and yields.

These combined factors are creating a more dynamic and less predictable Japanese bond market compared to the recent past.

Economic Implications of a Steep Yield Curve in Japan

A steepening yield curve has multifaceted implications for the Japanese economy:

Increased borrowing costs for businesses and consumers are a direct consequence of higher interest rates. This can dampen economic activity, as businesses may postpone investments and consumers may reduce spending. However, a steeper curve might also signal increased investor confidence in future economic growth, potentially leading to more investment. The impact on the Japanese Yen is complex, with a potentially stronger Yen in the short term due to higher interest rates but potentially negative impacts on exports. The ripple effects extend to the global financial system, affecting global capital flows and investor strategies.

- Increased borrowing costs: Higher interest rates translate to increased costs for businesses and households, potentially slowing economic growth.

- Effects on business investment and consumer spending: Higher borrowing costs could lead to reduced investment and consumption, impacting GDP growth.

- Potential impact on economic growth: The effect on economic growth is potentially mixed – higher rates can curb inflation but also dampen investment and spending.

- Implications for the Japanese Yen: A steeper yield curve might initially strengthen the Yen, but the long-term impact is complex and depends on various factors.

- Ripple effects on the global financial system: Changes in the Japanese bond market can influence global capital flows and have wider global economic consequences.

Investment Strategies in a Steepening Yield Curve Environment

The steepening yield curve presents both risks and opportunities in the Japanese bond market. Investors must carefully assess their risk tolerance and investment objectives:

Strategies range from investing in short-term JGBs to mitigate interest rate risk to exploiting the potential for higher yields in longer-term bonds. However, increased volatility and the possibility of further yield increases necessitate careful risk management strategies, including hedging techniques. Portfolio diversification across different asset classes is crucial to mitigate the specific risks associated with JGBs.

- Investment strategies for different risk tolerances: Conservative investors may opt for short-term JGBs, while those with higher risk tolerance might consider longer-term bonds.

- Opportunities in short-term vs. long-term JGBs: Short-term JGBs offer lower yields but less interest rate risk; long-term JGBs offer higher yields but greater interest rate risk.

- Hedging strategies: Various hedging strategies can help mitigate interest rate risk and currency fluctuations.

- Importance of diversification: Diversifying across asset classes reduces overall portfolio risk and protects against market fluctuations.

Conclusion

The steepening yield curve in Japan's bond market presents both challenges and opportunities. The BOJ's policy adjustments, global inflationary pressures, and shifting investor sentiment are all contributing factors. Understanding these dynamics is crucial for investors and policymakers alike. Further analysis of Japan's bond market and the impact of a steep yield curve is necessary for informed decision-making. To stay informed on this evolving situation and learn more about navigating the intricacies of Japan's bond market, continue researching the impact of a steep yield curve and its effect on Japanese government bonds (JGBs).

Featured Posts

-

Cassie Venturas Cross Examination A Legal Perspective On The Diddy Trial

May 17, 2025

Cassie Venturas Cross Examination A Legal Perspective On The Diddy Trial

May 17, 2025 -

Analyzing Thibodeaus Impact How He Prevented Knicks Collapse

May 17, 2025

Analyzing Thibodeaus Impact How He Prevented Knicks Collapse

May 17, 2025 -

Rfk Jr S Hhs To Halt Routine Covid Vaccine Recommendations For Children And Pregnant Women

May 17, 2025

Rfk Jr S Hhs To Halt Routine Covid Vaccine Recommendations For Children And Pregnant Women

May 17, 2025 -

Track And Field All Conference Honors And Results Roundup

May 17, 2025

Track And Field All Conference Honors And Results Roundup

May 17, 2025 -

Angel Reese Faces Tampering Accusation From Wnba Player

May 17, 2025

Angel Reese Faces Tampering Accusation From Wnba Player

May 17, 2025

Latest Posts

-

Nba Addresses Crucial No Call That Affected Pistons In Game 4

May 17, 2025

Nba Addresses Crucial No Call That Affected Pistons In Game 4

May 17, 2025 -

Nba Game 4 Controversy Pistons React To Costly No Call

May 17, 2025

Nba Game 4 Controversy Pistons React To Costly No Call

May 17, 2025 -

Reduce Your Student Loan Burden A Financial Planners Recommendations

May 17, 2025

Reduce Your Student Loan Burden A Financial Planners Recommendations

May 17, 2025 -

Financial Planning Strategies For Student Loan Borrowers

May 17, 2025

Financial Planning Strategies For Student Loan Borrowers

May 17, 2025 -

Nba Admits Missed Call Cost Pistons Game 4 Examining The Impact

May 17, 2025

Nba Admits Missed Call Cost Pistons Game 4 Examining The Impact

May 17, 2025