Analyzing Palantir Stock: A Buying Decision Before May 5th

Table of Contents

Palantir's Recent Performance and Financial Health

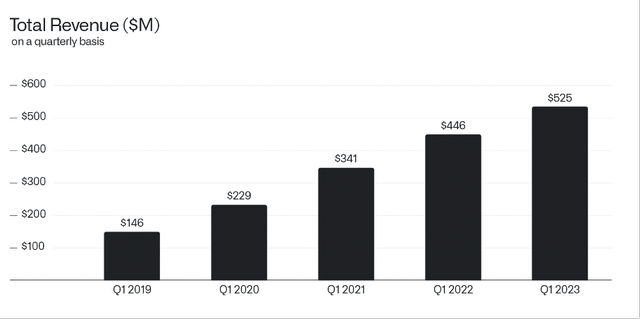

Analyzing Palantir's (PLTR) recent performance requires a close look at its quarterly earnings reports. Let's examine some key financial indicators:

-

Revenue Growth: Palantir's revenue growth has shown [insert data, e.g., a consistent upward trend over the past few quarters, exceeding expectations in Q4 2022 with a [percentage]% increase year-over-year]. This compares favorably to [insert comparison to industry average or competitors]. However, it's crucial to analyze the sources of this growth – is it primarily driven by government contracts or is the commercial sector contributing significantly?

-

Profitability: While Palantir has demonstrated revenue growth, profitability remains a key area of focus for investors. Examining gross margins, operating margins, and net income is crucial. [Insert data on margins and net income for relevant quarters]. A comparison to competitors like [mention competitors, e.g., Snowflake or Databricks] will provide valuable context.

-

Debt and Cash Flow: Understanding Palantir's debt levels and cash flow is vital for assessing its financial health. [Insert data on debt-to-equity ratio and cash flow from operations]. A strong cash position indicates resilience and the ability to invest in future growth initiatives.

-

Significant News and Events: Recent news regarding new contracts, strategic partnerships, or regulatory changes can significantly impact Palantir's stock price. [Mention any relevant news, e.g., a major contract win with a government agency or a successful product launch].

Evaluating Palantir's Growth Potential

Palantir's long-term growth strategy hinges on several key factors:

-

Government vs. Commercial: Palantir operates in both the government and commercial sectors. Analyzing the revenue contribution from each sector reveals its dependence on government contracts and the potential for diversification into the commercial space. [Insert data showcasing the percentage contribution of each sector]. Strong growth in the commercial sector would signal a reduced reliance on government contracts and improve long-term sustainability.

-

Market Trends: The increasing demand for big data analytics and artificial intelligence fuels Palantir's growth potential. However, intense competition and technological advancements are potential threats. [Mention specific market trends and their potential impact on PLTR].

-

Competitive Advantages: Palantir's proprietary technology, strong customer relationships, and expertise in complex data analytics provide significant competitive advantages. However, maintaining this edge requires constant innovation and adaptation.

-

Threats to Growth: Potential threats include increased competition from established players and emerging startups, economic slowdowns affecting government spending, and the potential for disruptive technologies.

Key Metrics to Consider for Palantir Stock

Investors should closely monitor several key metrics:

-

Price-to-Earnings Ratio (P/E): [Insert current P/E ratio and comparison to industry average]. A high P/E ratio might indicate high growth expectations but also higher risk.

-

Price-to-Sales Ratio (P/S): [Insert current P/S ratio and comparison to industry average]. This ratio provides insights into the company's valuation relative to its revenue.

-

Revenue Growth Rate: [Insert recent revenue growth rates]. A consistently high growth rate is a positive indicator of future potential.

-

Customer Acquisition Cost (CAC) and Customer Churn Rate: These metrics reveal the efficiency of Palantir's sales and retention strategies. Lower CAC and lower churn are favorable.

Assessing the Risks of Investing in Palantir Stock

Investing in Palantir involves several risks:

-

High Valuation: Palantir's stock valuation compared to its earnings and revenue might be considered high by some investors, making it susceptible to market corrections.

-

Government Contract Dependence: A significant portion of Palantir's revenue comes from government contracts. Changes in government spending or policy could negatively impact its financial performance.

-

Competition: The big data analytics market is highly competitive. Palantir faces competition from established players and innovative startups.

-

Regulatory Changes: Regulatory changes related to data privacy and security could affect Palantir's operations.

-

Risk Mitigation: Diversification and using stop-loss orders can mitigate some of these risks.

Palantir Stock Prediction and Trading Strategy Before May 5th

Based on the analysis above, [insert a reasoned prediction about Palantir's stock price movement before May 5th, emphasizing the inherent uncertainties of the market]. Avoid making definitive predictions and focus on potential scenarios.

-

Potential Price Targets: [Mention potential price targets with clear caveats]. These are merely estimations and not guarantees.

-

Suggested Trading Strategies: Depending on your risk tolerance, strategies like buy-and-hold or swing trading might be considered. [Briefly explain the suitability of each strategy].

-

Risk Tolerance: Individual investors should carefully consider their own risk tolerance before making any investment decisions.

Conclusion

Analyzing Palantir stock requires a thorough assessment of its recent performance, growth potential, and inherent risks. While the company exhibits strong revenue growth and possesses technological advantages, its high valuation and reliance on government contracts present significant risks. Before making a buying decision on Palantir stock before May 5th, carefully weigh the analysis presented here against your own investment goals and risk tolerance. Remember, this is not financial advice; conduct thorough due diligence and consult with a financial advisor before investing in Palantir or any other stock. Further research into Palantir stock and market trends is crucial for informed decision-making.

Featured Posts

-

Analyzing The Impact Of Androids New Design On Gen Zs Smartphone Choices

May 09, 2025

Analyzing The Impact Of Androids New Design On Gen Zs Smartphone Choices

May 09, 2025 -

Palantir Stock Buy Sell Or Hold A Detailed Evaluation

May 09, 2025

Palantir Stock Buy Sell Or Hold A Detailed Evaluation

May 09, 2025 -

El Salvador Prison Transfers Jeanine Pirros Stance On Due Process Rights

May 09, 2025

El Salvador Prison Transfers Jeanine Pirros Stance On Due Process Rights

May 09, 2025 -

The La Palisades Wildfires A List Of Celebrities Who Lost Homes

May 09, 2025

The La Palisades Wildfires A List Of Celebrities Who Lost Homes

May 09, 2025 -

Jeanine Pirros Fox News Journey From Judge To Television Personality

May 09, 2025

Jeanine Pirros Fox News Journey From Judge To Television Personality

May 09, 2025