Analyzing Palantir Stock Before May 5th: Is It A Good Investment?

Table of Contents

Palantir's Recent Financial Performance and Future Projections

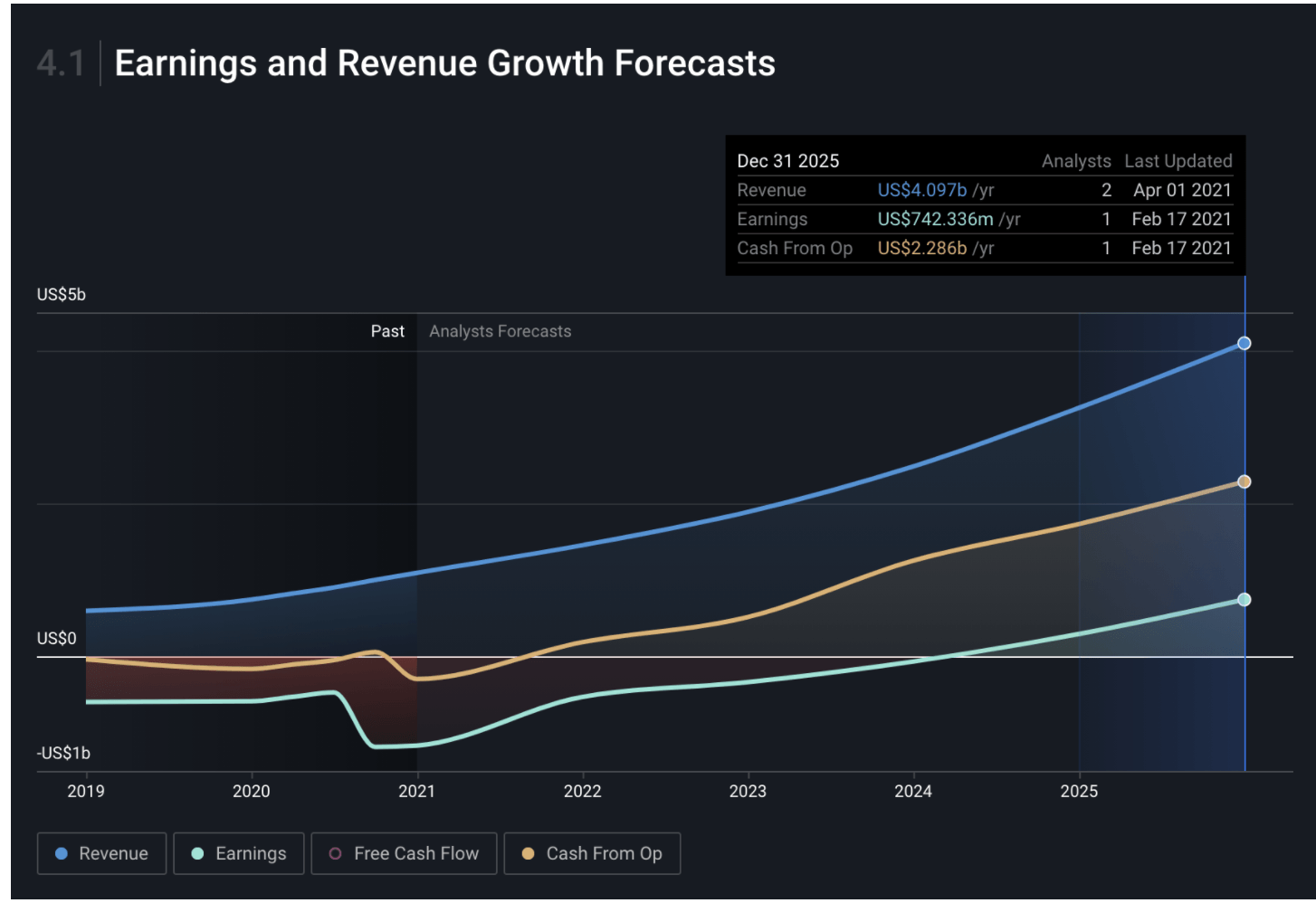

Understanding Palantir's financial health is crucial for any investment decision. Analyzing recent quarterly earnings reports reveals key trends impacting Palantir stock. Let's examine some vital financial metrics:

-

Revenue Growth: Examine the revenue growth rate compared to previous quarters and industry benchmarks. Consistent, strong revenue growth indicates a healthy and expanding business. Look for trends – is the growth accelerating, decelerating, or stagnating? This is a key indicator of future Palantir earnings.

-

Profitability Margins: Analyze profitability margins (gross, operating, and net) and their trajectory. Improving margins suggest increasing efficiency and profitability, which is positive for Palantir stock valuation. Declining margins, however, might signal underlying challenges.

-

Cash Flow and Debt Levels: A strong cash flow is essential for sustainable growth and financial stability. High levels of debt can increase risk. Examining Palantir's cash flow statement and debt levels provides insights into its financial strength and its ability to weather economic downturns. This is particularly relevant when considering Palantir earnings and stock valuation.

Analyst forecasts for Palantir's future financial performance offer additional perspective. While individual forecasts may vary, the consensus view provides a valuable indication of market sentiment towards Palantir stock. Consider these forecasts in conjunction with your own analysis of Palantir earnings and revenue growth.

Key Growth Drivers and Market Opportunities for Palantir

Palantir's growth hinges on several key factors. The company operates in two primary segments: government contracts and commercial clients.

-

Government Contracts: Palantir's significant government contracts provide a stable revenue stream. However, dependence on government spending can also present risks. The long-term growth potential within this segment depends on continued government investment in data analytics and national security.

-

Commercial Clients: Expansion into the commercial sector presents considerable growth potential for Palantir. This segment offers broader market opportunities but also increased competition. Success here will depend on Palantir's ability to secure and retain commercial clients, compete effectively against established players, and demonstrate a strong return on investment for its clients.

Further growth drivers for Palantir include:

-

Expansion into new markets and verticals: Diversification across industries reduces dependence on any single sector and expands potential revenue streams.

-

Strategic partnerships and acquisitions: Collaborations with other companies and strategic acquisitions can enhance Palantir's technology and market reach, driving growth in both government and commercial sectors.

-

Technological innovation and product development: Continual innovation and investment in product development are vital for maintaining a competitive advantage. Palantir needs to stay ahead of the curve to secure its position in the evolving data analytics landscape.

Risk Factors and Potential Downsides of Investing in Palantir Stock

While Palantir offers significant growth potential, several risk factors need careful consideration. A thorough risk assessment is crucial before investing in Palantir stock:

-

Dependence on Government Contracts: Heavy reliance on government contracts exposes Palantir to budgetary constraints and shifts in government priorities. This constitutes a significant risk factor for investors.

-

Competition from Established Tech Giants: Palantir faces competition from established tech giants with substantial resources and market presence. This intense competition can pressure margins and hinder growth.

-

High Valuation Relative to Earnings: A high valuation relative to earnings might indicate that Palantir stock is overvalued, increasing the risk of a price correction.

-

Potential Regulatory Hurdles: The nature of Palantir's business may expose it to increased regulatory scrutiny, potentially impacting operations and growth. This is a key aspect of the risk assessment process.

Market volatility and general economic conditions also influence Palantir's stock price. A downturn in the overall market can negatively impact even the strongest performing stocks.

Technical Analysis of Palantir Stock Before May 5th

Technical analysis provides another perspective on Palantir stock before May 5th. Analyzing chart patterns, support and resistance levels, trading volume, and recent price movements offers insights into potential short-term price movements. (Note: This section would ideally include relevant charts and graphs). Consider the following:

-

Chart patterns: Identify any discernible chart patterns (e.g., head and shoulders, triangles) that might suggest future price direction.

-

Support and Resistance Levels: Pinpoint key support and resistance levels that might influence price movements.

-

Trading Volume: High trading volume often accompanies significant price changes. Analyzing trading volume can help identify periods of increased market activity and potential volatility.

Upcoming events, such as earnings announcements or product launches, can also influence Palantir stock price before May 5th. Be aware of these events and their potential impact.

Conclusion: Is Palantir Stock a Good Investment Before May 5th?

Ultimately, whether Palantir stock is a good investment for you before May 5th depends on your individual risk tolerance and investment strategy. Our analysis reveals both significant growth potential and notable risk factors. Palantir's strong growth in certain segments, coupled with its innovative technology, are positive indicators. However, the dependence on government contracts and the high valuation relative to earnings present considerable risks.

Conduct your own thorough research and consider consulting with a financial advisor before making any decisions regarding Palantir stock. Remember to carefully weigh the potential benefits and risks before investing. Remember to analyze Palantir earnings and revenue growth for a better understanding of its performance before making your investment decision. A well-informed decision, factoring in both fundamental and technical analysis, is crucial for successful investment in Palantir stock or any other stock.

Featured Posts

-

Racist Stabbing Woman Charged In Unprovoked Killing Of Man

May 10, 2025

Racist Stabbing Woman Charged In Unprovoked Killing Of Man

May 10, 2025 -

Ryujinx Shuts Down The Nintendo Factor In Emulator Development

May 10, 2025

Ryujinx Shuts Down The Nintendo Factor In Emulator Development

May 10, 2025 -

Oboronnoe Soglashenie Makrona I Tuska Klyuchevye Punkty I Vliyanie Na Ukrainu

May 10, 2025

Oboronnoe Soglashenie Makrona I Tuska Klyuchevye Punkty I Vliyanie Na Ukrainu

May 10, 2025 -

Chief Justice Roberts Recounts Being Mistaken For Former House Republican Leader

May 10, 2025

Chief Justice Roberts Recounts Being Mistaken For Former House Republican Leader

May 10, 2025 -

Is Palantir Stock A Good Investment Risks And Rewards

May 10, 2025

Is Palantir Stock A Good Investment Risks And Rewards

May 10, 2025