Is Palantir Stock A Good Investment? Risks And Rewards

Table of Contents

Understanding Palantir's Business Model and Potential

Palantir's business model is multifaceted, offering significant potential but also inherent risks. A thorough understanding of its operations is crucial for any Palantir investment.

Government Contracts and their Impact

A considerable portion of Palantir's revenue stems from government contracts, particularly within the defense and intelligence sectors. This provides a degree of stability, as government contracts often span multiple years. However, reliance on these contracts also exposes Palantir to geopolitical risks and potential budget cuts.

- Examples of key government contracts: Contracts with the CIA, Department of Defense, and various other national security agencies contribute significantly to revenue.

- Potential future contract wins: Palantir actively pursues new government contracts both domestically and internationally, presenting opportunities for future revenue growth.

- Geopolitical risks affecting contracts: Changes in government policy or international relations could impact the renewal or acquisition of future contracts, presenting a substantial risk to Palantir stock.

Commercial Growth and Market Opportunities

Palantir is aggressively expanding its commercial operations, primarily through its Foundry platform. Foundry is a data integration and analytics platform designed to help large enterprises improve operational efficiency and make better data-driven decisions.

- Key features of Foundry: Data integration, AI-powered analytics, and customizable workflows are some key differentiators.

- Examples of successful commercial partnerships: Partnerships with Fortune 500 companies across various industries showcase the platform's growing acceptance and market penetration.

- Competitive landscape analysis: Palantir faces competition from established players like Databricks and Snowflake, necessitating continuous innovation and strategic partnerships.

Technological Innovation and Future Outlook

Palantir's commitment to R&D is a key factor in its long-term prospects. Continuous innovation in areas like AI, machine learning, and data security are essential for maintaining its competitive edge and attracting new clients.

- Key technologies Palantir uses: Artificial intelligence, machine learning, natural language processing, and advanced data visualization technologies.

- Patents held by the company: A strong patent portfolio protects Palantir's intellectual property and provides a competitive advantage.

- Potential disruptive innovations: Future technological advancements could create new market opportunities and enhance Palantir’s existing offerings.

Assessing the Risks of Investing in Palantir Stock

While Palantir offers significant potential, several risks warrant careful consideration before making a Palantir investment.

High Valuation and Stock Volatility

Palantir's stock has historically demonstrated considerable volatility. Its high price-to-earnings ratio (P/E ratio) compared to industry peers indicates a high valuation, which can make the stock susceptible to market fluctuations.

- Historical stock performance data: Analyzing past performance provides insights into the stock's volatility and potential for significant price swings.

- Comparison to competitors' valuations: Comparing Palantir's valuation to competitors helps assess whether its price reflects its potential.

- Factors contributing to volatility: Market sentiment, news related to government contracts, and the overall performance of the tech sector significantly influence Palantir's stock price.

Dependence on a Few Key Clients

A significant portion of Palantir's revenue is concentrated among a relatively small number of key clients, mainly government agencies. Losing a major client could severely impact the company's financial performance.

- Concentration of revenue from specific clients: Analyzing the revenue breakdown by client highlights the dependence on a few key accounts.

- Strategies to diversify client base: Palantir’s efforts to expand into the commercial sector are crucial for reducing this reliance.

Competition and Market Saturation

The big data analytics market is becoming increasingly competitive. New entrants and established players are vying for market share, potentially leading to market saturation and price pressure.

- Key competitors: Databricks, Snowflake, and other data analytics companies pose significant competition.

- Competitive advantages of Palantir: Palantir's strong government relationships and advanced technology are key differentiators.

- Potential for market disruption: Technological advancements and emerging trends in the industry could disrupt the existing market dynamics.

Evaluating the Rewards of Investing in Palantir Stock

Despite the risks, several factors suggest potential rewards for long-term Palantir investment.

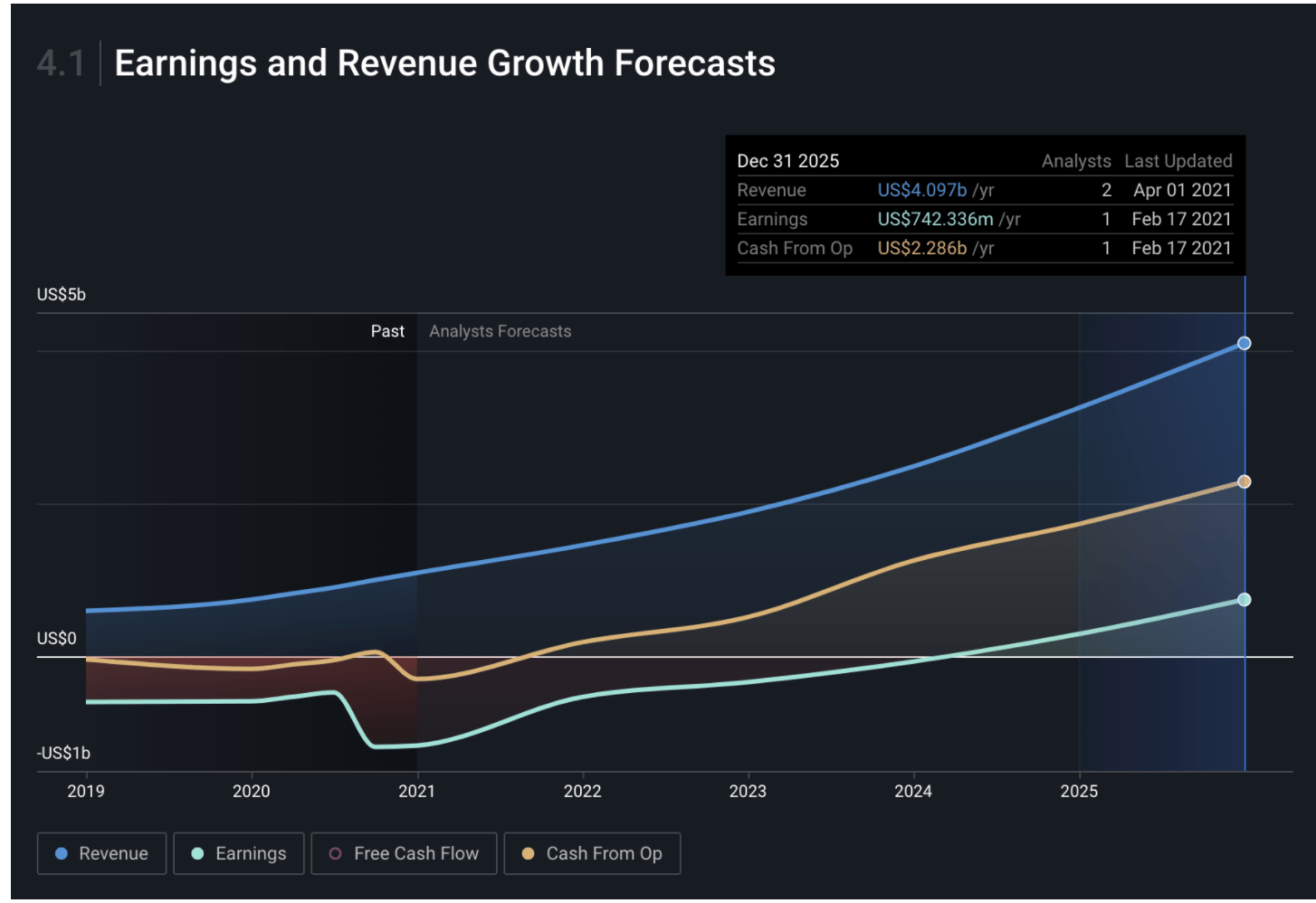

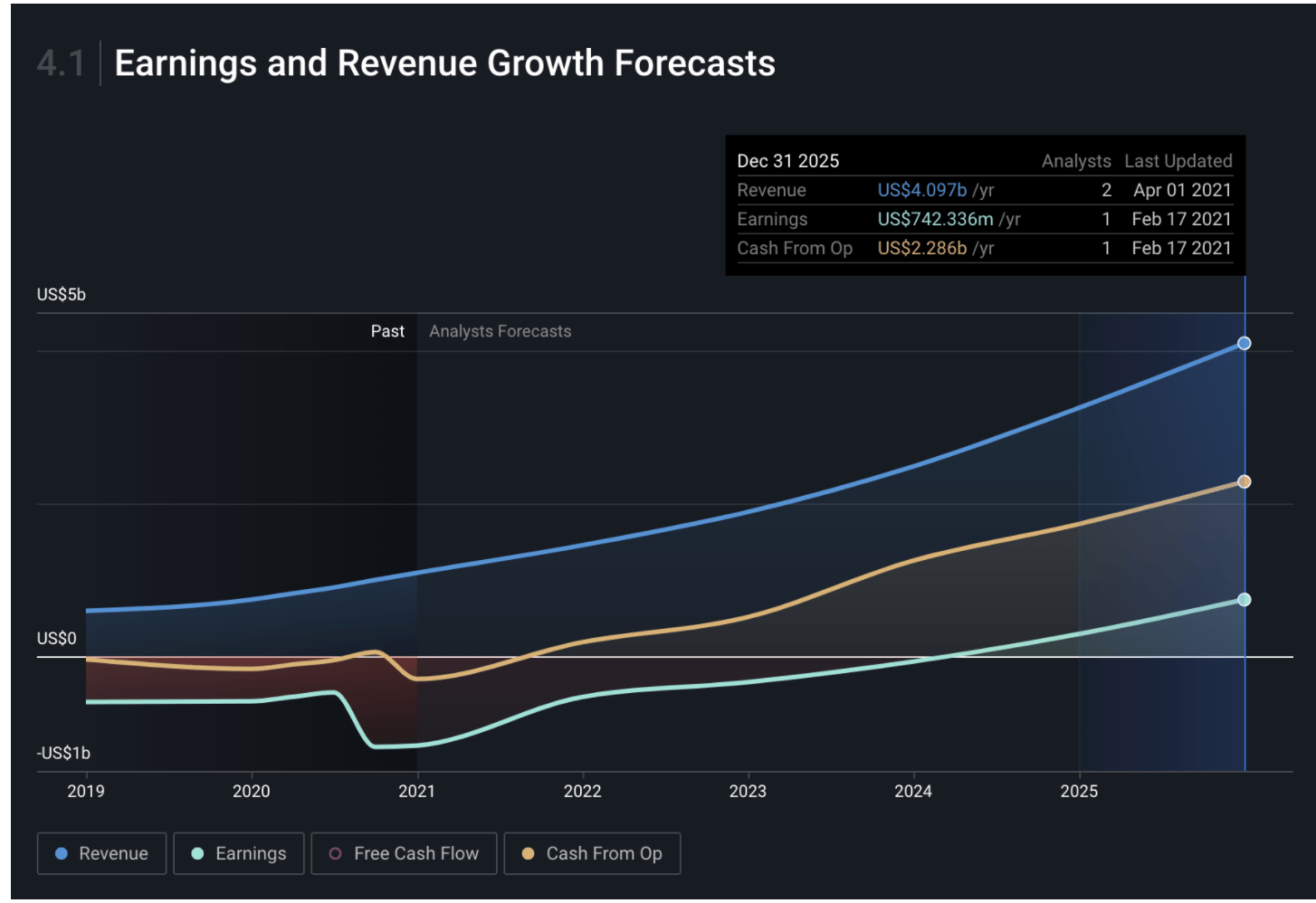

Potential for High Growth

Palantir's revenue growth potential is significant, fueled by both expansion in the commercial sector and continued government contract wins.

- Projected revenue growth figures: Analyzing industry forecasts and Palantir's own projections offers insights into future revenue potential.

- Potential for market share gains: Palantir's technological advantages and strategic partnerships could allow it to gain market share.

First-Mover Advantage

Palantir's early entry into the big data analytics market has established strong brand recognition and a significant head start over many competitors.

- Reasons for Palantir's first-mover advantage: Early adoption of key technologies and strong relationships with government agencies.

- How it translates to competitive advantage: This advantage allows Palantir to attract top talent and secure lucrative contracts.

Long-Term Investment Potential

Considering Palantir's technological capabilities and strong market position, its long-term investment potential is noteworthy.

- Long-term growth projections: Based on ongoing technological advancements and market expansion, long-term growth projections can be assessed.

- Potential for increased profitability: As Palantir scales its operations and enhances operational efficiency, its profitability is expected to increase.

Conclusion: Is Palantir Stock Right for You? A Final Verdict on Palantir Investment

Investing in Palantir Technologies involves a careful assessment of both the significant risks and substantial rewards. The high growth potential and first-mover advantage are attractive, but the volatility, dependence on key clients, and competitive landscape require thorough consideration. A Palantir investment is suitable only for those with a high risk tolerance and a long-term investment horizon. Before committing to a Palantir investment, thorough due diligence is essential. Consult with a qualified financial advisor to determine if Palantir stock aligns with your individual financial goals and risk profile. Remember to conduct your own research before making any investment decisions related to Palantir stock. A well-informed Palantir investment strategy is key to navigating the complexities of this unique market opportunity.

Featured Posts

-

Dakota Johnson And Family At Materialist Premiere Photos

May 10, 2025

Dakota Johnson And Family At Materialist Premiere Photos

May 10, 2025 -

5 Hour Stephen King Binge The Best Short Series To Watch Now On Streaming

May 10, 2025

5 Hour Stephen King Binge The Best Short Series To Watch Now On Streaming

May 10, 2025 -

Multiple Car Break Ins Reported At Elizabeth City Apartments

May 10, 2025

Multiple Car Break Ins Reported At Elizabeth City Apartments

May 10, 2025 -

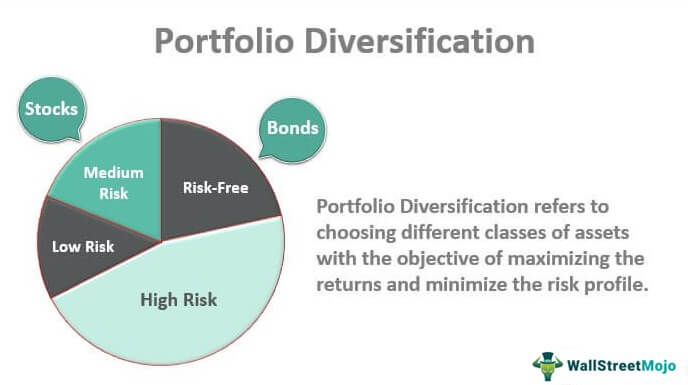

Your Real Safe Bet Diversification Strategies For Financial Security

May 10, 2025

Your Real Safe Bet Diversification Strategies For Financial Security

May 10, 2025 -

Indian Stock Market Sensex Nifty Performance And Top Gainers Losers

May 10, 2025

Indian Stock Market Sensex Nifty Performance And Top Gainers Losers

May 10, 2025