Your Real Safe Bet: Diversification Strategies For Financial Security

Table of Contents

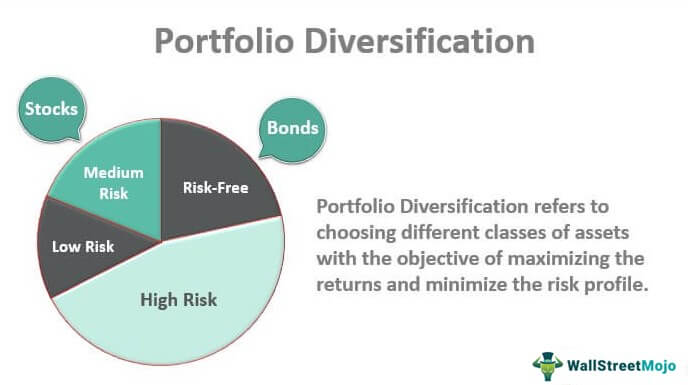

Asset Class Diversification: Spreading Your Investments Across Different Markets

Asset class diversification involves spreading your investments across various asset categories to reduce risk. A well-diversified portfolio typically includes stocks, bonds, real estate, and alternative investments.

Stocks: The Engine of Growth

Stocks represent ownership in a company and offer the potential for high returns. However, they also carry higher risk. Diversifying within stocks themselves is crucial.

- Advantages: Potential for high returns, growth opportunities.

- Disadvantages: Volatility, potential for significant losses.

- Risk Tolerance: Consider your risk tolerance – are you comfortable with potentially higher returns alongside higher risk?

- Investment Options: Index funds (track a specific market index), ETFs (exchange-traded funds offering diversified exposure to various sectors or markets), individual stocks (requiring more research and higher risk). Consider large-cap (established companies), mid-cap (growing companies), small-cap (smaller, higher-growth potential companies), and international stocks for broader diversification.

Bonds: The Stabilizing Force

Bonds represent a loan you make to a government or corporation, offering a fixed income stream and generally lower risk than stocks.

- Reducing Volatility: Bonds help reduce the overall volatility of your portfolio, acting as a buffer during market downturns.

- Risk Levels: Government bonds are generally considered lower risk than corporate bonds, while municipal bonds offer tax advantages.

- Maturity Dates: Consider the maturity date of your bonds – longer-term bonds offer higher yields but are more sensitive to interest rate changes.

Real Estate: A Tangible Asset

Real estate provides a tangible asset class that can act as a hedge against inflation.

- Rental Income: Residential or commercial properties can generate rental income, providing a consistent cash flow.

- Long-Term Appreciation: Real estate values tend to appreciate over time, offering long-term capital gains.

- Risks: Market fluctuations, property maintenance costs, and vacancy periods are potential downsides.

Alternative Investments: High-Risk, High-Reward Opportunities

Alternative investments, such as commodities (gold, oil), precious metals, and private equity, can add further diversification but often come with higher risks.

- Higher Returns, Higher Risk: These investments often offer the potential for significantly higher returns, but they also carry higher risk and lower liquidity.

- Liquidity: Accessing your money quickly can be challenging with certain alternative investments.

- Examples: Gold as a safe haven asset, private equity investments in startups or established businesses.

Geographic Diversification: Reducing Exposure to Single-Market Risks

Geographic diversification involves spreading your investments across different countries and regions. This reduces your exposure to the risks associated with economic downturns or political instability in a single location.

- Benefits: Mitigates risks associated with localized economic events.

- Currency Fluctuations: Be aware of the risks associated with currency fluctuations.

- Strategies: International mutual funds and ETFs offer a convenient way to gain exposure to international markets.

Sector Diversification: Spreading Your Investments Across Different Industries

Sector diversification means avoiding concentration in a single industry. By diversifying across various sectors (technology, healthcare, energy, consumer goods, etc.), you reduce your risk if one sector underperforms.

- Risk Reduction: Diversification across different sectors minimizes losses if one industry experiences a downturn.

- Industry Examples: Spreading investments across technology, healthcare, and energy sectors reduces vulnerability to shocks within a single industry.

- Achieving Diversification: ETFs and mutual funds provide efficient ways to achieve sector diversification.

Time Diversification: Dollar-Cost Averaging and Long-Term Investing

Time diversification leverages the power of compounding and mitigates short-term market fluctuations.

- Dollar-Cost Averaging: Investing a fixed amount at regular intervals, regardless of market conditions.

- Long-Term Horizon: A long-term investment horizon allows you to ride out market cycles and benefit from the power of compounding.

- Compounding Returns: Reinvesting profits to generate even greater returns over time.

Conclusion

Implementing diversification strategies for financial security is crucial for long-term wealth building and risk mitigation. By spreading your investments across different asset classes, geographic regions, and industry sectors, and employing strategies like dollar-cost averaging, you significantly reduce your exposure to market volatility and improve your chances of achieving your financial goals. Start building a diversified portfolio today! Seek professional financial advice to create a personalized plan that aligns with your risk tolerance and financial objectives. Learn more about investment diversification and financial planning by exploring reputable resources online and consulting with a qualified financial advisor. Secure your financial future by diversifying your investments wisely.

Featured Posts

-

The Reality Of Us Funding In Transgender Animal Research

May 10, 2025

The Reality Of Us Funding In Transgender Animal Research

May 10, 2025 -

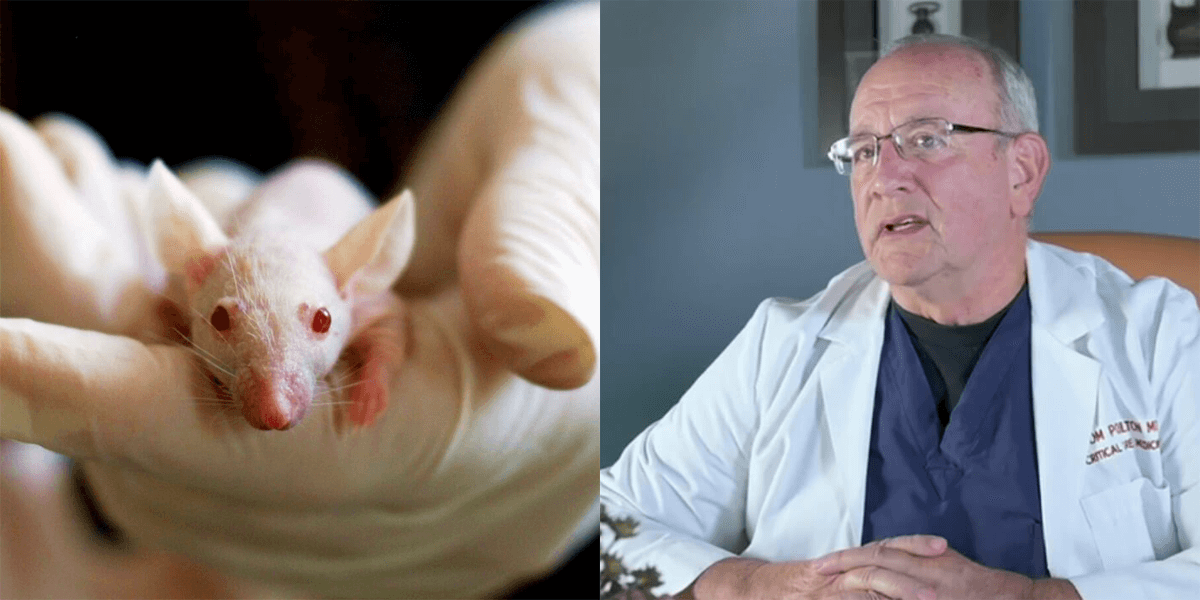

Palantir Stock Before May 5th Wall Streets Prediction And What It Means For Investors

May 10, 2025

Palantir Stock Before May 5th Wall Streets Prediction And What It Means For Investors

May 10, 2025 -

Should You Buy Palantir Technologies Stock In 2024

May 10, 2025

Should You Buy Palantir Technologies Stock In 2024

May 10, 2025 -

Growth Opportunities A Map Of The Countrys Rising Business Hubs

May 10, 2025

Growth Opportunities A Map Of The Countrys Rising Business Hubs

May 10, 2025 -

Prediction 2 Stocks Poised To Outperform Palantir In 3 Years

May 10, 2025

Prediction 2 Stocks Poised To Outperform Palantir In 3 Years

May 10, 2025