Analyzing Proxy Statements (Form DEF 14A): Best Practices For Investors

Table of Contents

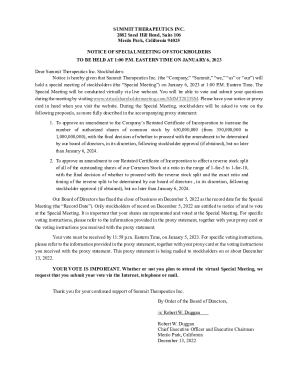

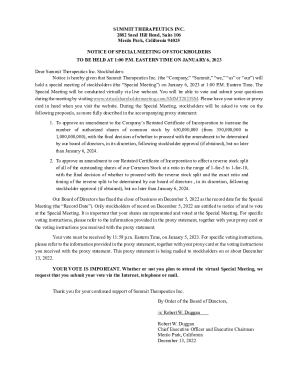

A proxy statement, also known as Form DEF 14A, is a crucial document filed with the Securities and Exchange Commission (SEC) by publicly traded companies. It provides essential information to shareholders before a shareholder meeting, enabling them to make informed voting decisions on critical matters affecting the company's future. Analyzing these statements allows investors to participate actively in corporate governance, potentially influencing strategic decisions and ultimately enhancing returns. This article outlines best practices for analyzing proxy statements (Form DEF 14A) to empower investors in making well-informed decisions.

Understanding the Structure and Key Sections of a DEF 14A

The DEF 14A is more than just a legal document; it's a window into a company's operations, governance, and future plans. Understanding its structure is crucial for effective analysis.

The Corporate Governance Landscape

Corporate governance is the bedrock of a well-run company. The proxy statement details the composition and responsibilities of the board of directors and its key committees. Scrutinize this section carefully.

- Board Independence: Look for a majority of independent directors—those without ties to management—to ensure objective oversight.

- Director Expertise: Analyze the directors' backgrounds and skills to assess whether the board possesses the necessary expertise to guide the company effectively.

- Committee Effectiveness: Evaluate the performance and activities of the audit committee (financial reporting), compensation committee (executive pay), and nominating committee (director selection). Look for evidence of robust oversight and transparency.

- Board Diversity: Assess the board's diversity in terms of gender, race, ethnicity, and professional background. Diversity brings varied perspectives and enhances decision-making.

Keywords: Corporate governance, board of directors, independent directors, audit committee, compensation committee, nominating committee, board diversity, corporate governance best practices.

Executive Compensation

Executive compensation is a highly scrutinized aspect of corporate governance. The proxy statement details the pay packages of top executives, including salaries, bonuses, stock options, and other benefits.

- Alignment with Performance: Scrutinize whether executive compensation is linked to company performance. Excessive pay without performance-based incentives raises concerns.

- Transparency: Look for clear explanations of compensation components and the rationale behind them.

- Golden Parachutes: Be aware of any significant severance packages ("golden parachutes") for executives, as these can impact shareholder value.

Keywords: Executive compensation, CEO pay, stock options, performance-based compensation, golden parachutes, executive pay transparency.

Shareholder Proposals

Shareholder proposals allow investors to propose changes to company policy or practices. The proxy statement outlines these proposals and the company's recommendations.

- ESG Factors: Many proposals focus on Environmental, Social, and Governance (ESG) factors, such as climate change, diversity, and ethical sourcing.

- Impact Assessment: Assess the potential impact of each proposal on the company's long-term strategy and shareholder value.

- Voting Recommendations: Consider the company's recommendations and your own assessment before voting.

Keywords: Shareholder proposals, shareholder activism, ESG, environmental, social, governance, shareholder engagement.

Merger and Acquisition Information

Proxy statements often include information about proposed mergers, acquisitions, or other significant corporate transactions.

- Transaction Details: Understand the rationale, structure, and valuation of the proposed transaction.

- Potential Risks: Evaluate potential risks and synergies associated with the transaction.

- Due Diligence: Consider whether the company has conducted sufficient due diligence to ensure the deal is in the best interests of shareholders.

Keywords: Mergers and acquisitions (M&A), due diligence, transaction details, valuation, corporate transactions.

Utilizing Online Resources and Tools for Efficient Analysis

Analyzing proxy statements efficiently requires leveraging available online resources.

SEC's EDGAR Database

The SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) system () is the primary source for proxy statements and other corporate filings.

Proxy Voting Platforms

Many brokerage firms and online platforms offer tools to simplify proxy voting and analysis. These platforms often provide summaries and analyses of key proposals.

Financial News and Analyst Reports

Supplement your analysis with financial news articles and analyst reports to gain a broader perspective on the company's performance and prospects.

Interpreting Key Financial Metrics and Indicators

The proxy statement often includes summarized financial information.

Financial Statements

Review the summarized financial statements within the proxy statement and cross-reference them with the company's complete financial reports (10-K).

Key Performance Indicators (KPIs)

Pay attention to key performance indicators (KPIs) like revenue growth, profitability margins, debt levels, and return on equity. These metrics help assess the company’s financial health.

Risk Factors

Carefully review the risk factors section to understand potential threats to the company's future performance and stability.

Making Informed Voting Decisions Based on Your Analysis

Your analysis of the proxy statement should guide your voting decisions.

Aligning Your Vote with Your Investment Goals

Use the information gathered to determine how each proposal aligns with your investment goals and risk tolerance.

Engaging with the Company

If you have questions or concerns after reviewing the proxy statement, contact the company’s investor relations department directly.

Conclusion: Mastering Proxy Statement Analysis for Enhanced Investment Returns

Mastering the art of proxy statement analysis (Form DEF 14A) is crucial for becoming a more informed and effective shareholder. By systematically reviewing the key sections, utilizing available online resources, and interpreting financial metrics, you can make well-informed voting decisions and potentially enhance your investment returns. Start analyzing proxy statements today to improve your investment outcomes. Unlock the value hidden in DEF 14A filings and become a more informed shareholder!

Featured Posts

-

Broadcoms Proposed V Mware Price Hike At And T Details A 1 050 Cost Surge

May 17, 2025

Broadcoms Proposed V Mware Price Hike At And T Details A 1 050 Cost Surge

May 17, 2025 -

Severance Ben Stiller Compares Lumon Industries To Apple

May 17, 2025

Severance Ben Stiller Compares Lumon Industries To Apple

May 17, 2025 -

Quiet Luxury Soundproof Apartments Reshape Tokyos Real Estate Landscape

May 17, 2025

Quiet Luxury Soundproof Apartments Reshape Tokyos Real Estate Landscape

May 17, 2025 -

Credit Score Damage The Effects Of Missed Student Loan Payments

May 17, 2025

Credit Score Damage The Effects Of Missed Student Loan Payments

May 17, 2025 -

Dubai Dan Abu Dhabi Dalam Bahaya Ancaman Rudal Dari Houthi Yaman

May 17, 2025

Dubai Dan Abu Dhabi Dalam Bahaya Ancaman Rudal Dari Houthi Yaman

May 17, 2025

Latest Posts

-

6 1 Billion Celtics Sale Uncertainty And The Future Of The Franchise

May 17, 2025

6 1 Billion Celtics Sale Uncertainty And The Future Of The Franchise

May 17, 2025 -

Nba Prediction Celtics At Pistons Who Will Win

May 17, 2025

Nba Prediction Celtics At Pistons Who Will Win

May 17, 2025 -

Donald Trumps Family Tree Exploring The Generations Of The Trump Family

May 17, 2025

Donald Trumps Family Tree Exploring The Generations Of The Trump Family

May 17, 2025 -

Boston Celtics Sold For 6 1 B Fans React To Private Equity Ownership

May 17, 2025

Boston Celtics Sold For 6 1 B Fans React To Private Equity Ownership

May 17, 2025 -

Understanding The Trump Family A Detailed Look At The Presidents Lineage

May 17, 2025

Understanding The Trump Family A Detailed Look At The Presidents Lineage

May 17, 2025