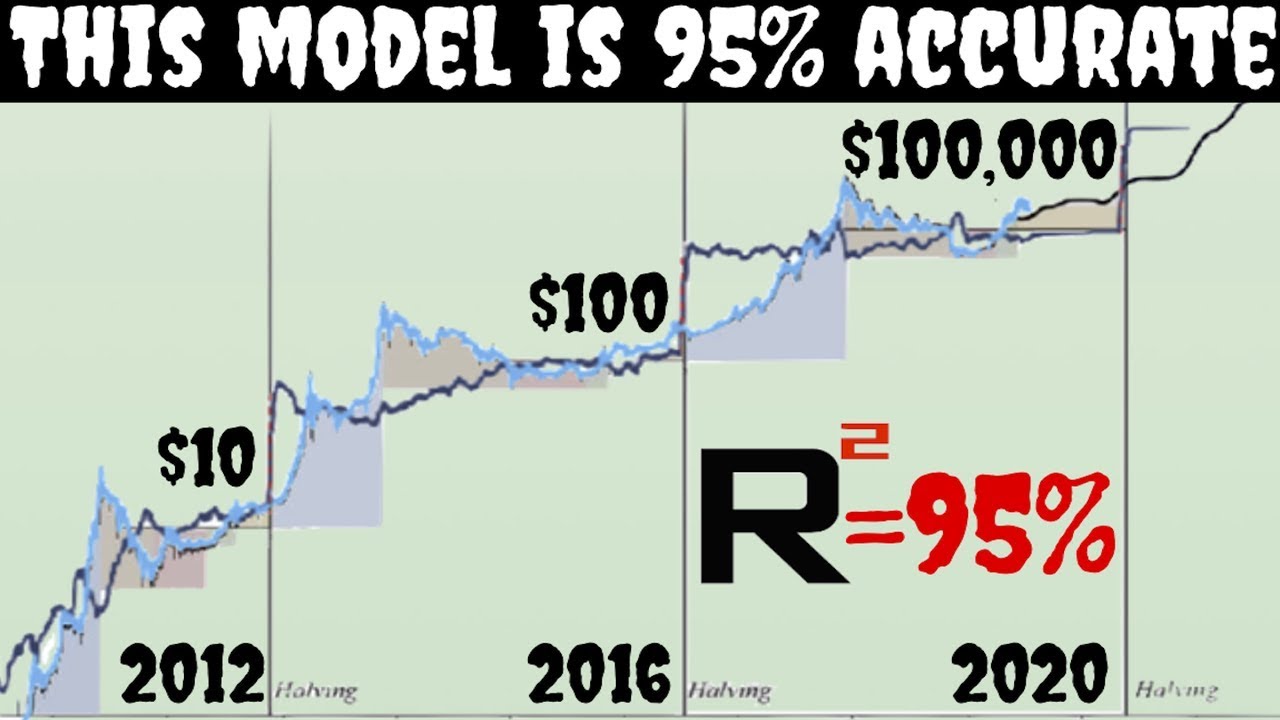

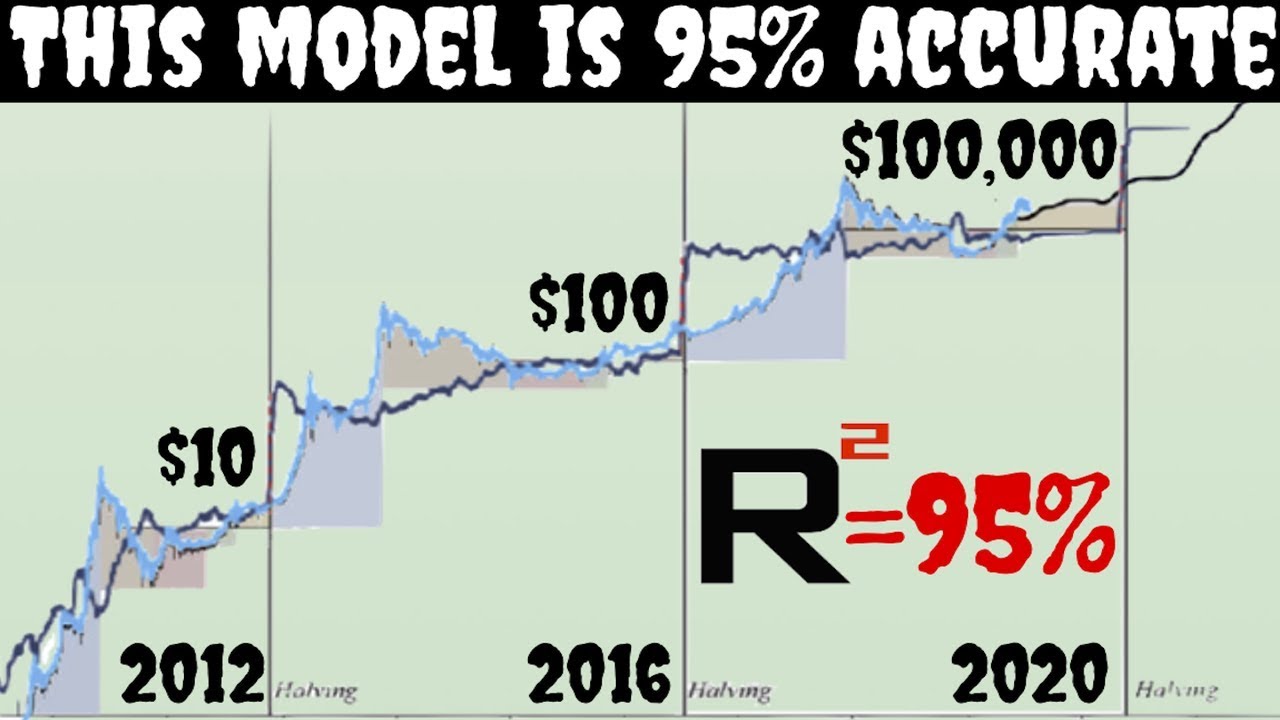

Analyzing The 1,500% Bitcoin Growth Prediction: A Realistic Outlook?

Table of Contents

Factors Potentially Fueling a Bitcoin Price Surge

Several factors could potentially contribute to a significant Bitcoin price increase, although a 1,500% surge represents an exceptionally high growth rate. Let's examine some key potential catalysts:

Increased Institutional Adoption

Growing interest from large financial institutions and corporations is a significant factor influencing Bitcoin's price. These institutions view Bitcoin as a store of value and a hedge against inflation, leading to substantial investments.

- Examples and Impact: Grayscale Bitcoin Trust, a prominent investment vehicle, holds a massive amount of Bitcoin, influencing market sentiment. Similarly, MicroStrategy's significant Bitcoin holdings demonstrate institutional confidence. The potential approval of BlackRock's Bitcoin ETF application could further amplify this trend, potentially injecting billions of dollars into the market.

- Correlation Analysis: Historical data shows a strong correlation between increased institutional investment and Bitcoin price appreciation. As more institutional players enter the market, liquidity increases and price volatility can potentially decrease.

Global Macroeconomic Uncertainty

Global economic instability can drive investors towards Bitcoin as a safe haven asset. Inflation, geopolitical instability, and economic downturns often lead investors to seek alternative stores of value outside traditional markets.

- Macroeconomic Indicators: High inflation rates erode the purchasing power of fiat currencies, making Bitcoin an attractive alternative. Geopolitical tensions and economic uncertainty can further increase the demand for Bitcoin.

- Decoupling Potential: While Bitcoin's price has historically shown some correlation with traditional markets, its potential to decouple from these markets is a significant factor fueling the bullish predictions. As Bitcoin becomes more established as a distinct asset class, this decoupling could become more pronounced.

Technological Advancements and Network Upgrades

Technological advancements within the Bitcoin ecosystem are crucial for enhancing its scalability, security, and overall appeal.

- Scalability Solutions: Layer-2 solutions, like the Lightning Network, significantly improve Bitcoin's transaction speed and efficiency, addressing a key criticism of the network.

- Regulatory Clarity and Technological Development: Regulatory clarity in key jurisdictions and continued development of Bitcoin-related technologies instill investor confidence.

- New Use Cases: The emergence of new use cases and applications for Bitcoin, such as decentralized finance (DeFi) integration, expands its potential appeal and utility, driving demand.

Challenges and Headwinds to a 1,500% Bitcoin Price Increase

While the factors mentioned above could contribute to price growth, several significant challenges stand in the way of a 1,500% increase.

Regulatory Uncertainty and Government Intervention

Varying regulatory landscapes across different countries pose a significant risk to Bitcoin's price. Governments worldwide are grappling with how to regulate cryptocurrencies, and this uncertainty can create volatility.

- Varying Regulatory Approaches: The regulatory approach in the US, EU, and China, among others, differs significantly, creating uncertainty for investors.

- Potential for Stricter Regulations or Bans: Governments could implement stricter regulations or even bans on Bitcoin, potentially impacting its price negatively.

Market Volatility and Price Corrections

Bitcoin's price is inherently volatile, and significant price corrections are a regular occurrence. These corrections can be driven by various factors, including market sentiment, news events, and technical factors.

- Historical Volatility: Bitcoin's price history demonstrates substantial volatility, with periods of significant gains followed by sharp declines.

- Psychological Factors: Investor psychology plays a crucial role, with panic selling potentially exacerbating price drops.

- Technical Analysis: Technical indicators, such as support and resistance levels, can provide insights into potential price reversals.

Competition from Alternative Cryptocurrencies

The cryptocurrency market is not limited to Bitcoin; numerous alternative cryptocurrencies (altcoins) compete for investor attention and market share.

- Competitive Landscape: Ethereum, Solana, and many other altcoins offer different functionalities and potential investment opportunities.

- Market Share Erosion: The emergence of successful altcoins could potentially erode Bitcoin's market share, slowing down its price appreciation.

Conclusion

While a 1,500% Bitcoin price surge is theoretically possible, given the confluence of factors such as institutional adoption and macroeconomic uncertainty, the significant hurdles presented by regulatory uncertainty, inherent market volatility, and competition from other cryptocurrencies cannot be ignored. A realistic outlook requires a balanced perspective, weighing both potential gains and substantial risks. Investors should proceed with caution, conducting thorough due diligence, and diversifying their portfolios. The future of Bitcoin remains uncertain; continuous monitoring and in-depth analysis of the factors influencing its price are crucial. Further analysis of Bitcoin's growth potential is essential to inform your investment decisions.

Featured Posts

-

Inter Milan Contracts 2026 Four Players Facing Uncertain Futures

May 08, 2025

Inter Milan Contracts 2026 Four Players Facing Uncertain Futures

May 08, 2025 -

Denver Nuggets Jokic And Starting Lineup Benched After Demanding Game

May 08, 2025

Denver Nuggets Jokic And Starting Lineup Benched After Demanding Game

May 08, 2025 -

Pro Shares Xrp Etfs Launch No Spot Market But Price Jumps

May 08, 2025

Pro Shares Xrp Etfs Launch No Spot Market But Price Jumps

May 08, 2025 -

Trump On Cusma Positive Remarks But Termination Remains Possible

May 08, 2025

Trump On Cusma Positive Remarks But Termination Remains Possible

May 08, 2025 -

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadle Ka Nwtyfkyshn Jary

May 08, 2025

Pnjab 8 Ays Pyz Awr 21 Dy Ays Pyz Ke Tqrr W Tbadle Ka Nwtyfkyshn Jary

May 08, 2025