Analyzing The April 8th Treasury Market Events: What Investors Should Know

Table of Contents

Yield Curve Inversion and its Implications

Yield curve inversion, a phenomenon where short-term Treasury yields exceed long-term yields, is often viewed as a harbinger of economic recession. Historically, an inverted yield curve has preceded economic downturns, making it a significant indicator for investors.

-

Specific Inversion on April 8th: On April 8th, the yield curve inverted further, with the 2-year Treasury yield surpassing the 10-year yield by a notable margin. This specific inversion signaled heightened concerns among market participants about the economy's future trajectory. You can find detailed yield data on the US Treasury Department website.

-

Potential Economic Signals: This inversion suggests that investors anticipate future interest rate cuts by the Federal Reserve, potentially in response to slowing economic growth or even a recession. This expectation drives down long-term yields, as investors seek safety in longer-term bonds, anticipating lower rates in the future.

-

Differing Interpretations: While many economists view yield curve inversion as a recessionary warning sign, others argue that different factors might be at play, including unusual market conditions or central bank policies. Analyzing multiple perspectives is crucial for a comprehensive understanding.

-

Impact on Treasury Yields: The inversion significantly impacted both short-term and long-term Treasury yields. Short-term yields rose reflecting expectations of near-term Fed actions, while long-term yields remained relatively low due to the flight to safety.

-

Relevant Data: For detailed charts and data on Treasury yields, refer to the Federal Reserve Economic Data (FRED) website and the US Treasury Department's website. Analyzing this data is critical for understanding the nuances of Treasury market behavior.

Impact of Inflation Data on Treasury Prices

The release of inflation data around April 8th played a significant role in influencing Treasury prices. Investors closely monitor inflation indicators like the Consumer Price Index (CPI) and the Producer Price Index (PPI) to gauge the Federal Reserve's likely response regarding interest rate hikes.

-

Specific Inflation Figures: The CPI and PPI releases around April 8th (specific figures would need to be inserted here based on actual data from that time) provided insights into the persistence of inflationary pressures. These figures are essential for understanding the broader macroeconomic picture.

-

Influence on Interest Rate Expectations: Higher-than-expected inflation figures typically increase investor expectations of further interest rate hikes by the Federal Reserve to combat inflation. This expectation impacts Treasury bond yields.

-

Inflation and Treasury Yields: Rising inflation expectations generally lead to higher Treasury bond yields, as investors demand higher returns to compensate for the erosion of purchasing power. Conversely, lower-than-expected inflation figures can push yields down.

-

Impact on Different Maturities: The impact of inflation data varies across different Treasury maturities. Short-term Treasury securities are generally more sensitive to near-term inflation expectations, while long-term securities are more influenced by longer-term inflation forecasts and overall economic outlook.

The Role of Geopolitical Events

Geopolitical events significantly influence investor sentiment and risk appetite, directly impacting Treasury market activity. On April 8th, (insert specific geopolitical event if applicable from April 8th), had a considerable effect on the market.

-

Specific Geopolitical Events: (Insert specific events and explain their relevance to the Treasury market). Events like these create uncertainty in the global economy, pushing investors towards safer assets, such as Treasury bonds.

-

Investor Sentiment and Risk Appetite: Geopolitical uncertainty often leads to a decrease in risk appetite, causing investors to shift from riskier assets to safer havens like US Treasury bonds. This "flight to safety" increases demand for Treasuries.

-

Flight-to-Safety Phenomenon: The flight-to-safety phenomenon pushes Treasury prices up and yields down, as investors seek the safety and stability of US government debt. This effect is especially prominent during times of global uncertainty.

-

Geopolitical Uncertainty and Treasury Yields: Increased geopolitical uncertainty tends to suppress Treasury yields, as the demand for safe-haven assets increases.

The Impact on Specific Treasury Securities

The impact of the April 8th events varied across different Treasury securities. For example, (Insert specific yield changes for 10-year notes and 30-year bonds on April 8th, citing a reliable source). Longer-term securities generally exhibited greater price volatility due to their sensitivity to long-term interest rate expectations and economic forecasts.

Conclusion

The April 8th Treasury market events highlighted the interconnectedness of economic indicators, inflation expectations, and geopolitical factors. Understanding yield curve inversions, inflation data releases, and the impact of geopolitical events is crucial for successful Treasury investment strategies. The volatility witnessed underscores the importance of careful analysis and a well-diversified portfolio.

Call to Action: Stay informed about future Treasury market movements by regularly reviewing market analysis and economic data. Understanding the nuances of Treasury market events, such as those seen on April 8th, is crucial for making informed investment decisions. Continue your learning about analyzing Treasury market events to optimize your investment portfolio.

Featured Posts

-

Over The Counter Birth Control Examining The Post Roe Landscape

Apr 29, 2025

Over The Counter Birth Control Examining The Post Roe Landscape

Apr 29, 2025 -

Hollywood At A Standstill The Combined Writers And Actors Strike

Apr 29, 2025

Hollywood At A Standstill The Combined Writers And Actors Strike

Apr 29, 2025 -

Chicagos Zombie Office Buildings A Real Estate Crisis

Apr 29, 2025

Chicagos Zombie Office Buildings A Real Estate Crisis

Apr 29, 2025 -

5 Dos And Don Ts Succeeding In The Private Credit Job Market

Apr 29, 2025

5 Dos And Don Ts Succeeding In The Private Credit Job Market

Apr 29, 2025 -

Open Ais 2024 Event Easier Voice Assistant Creation Unveiled

Apr 29, 2025

Open Ais 2024 Event Easier Voice Assistant Creation Unveiled

Apr 29, 2025

Latest Posts

-

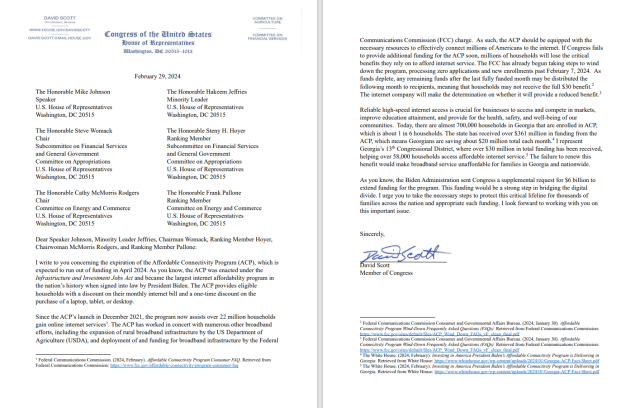

Louisville Representative Challenges Usps On Mail Delivery Transparency

Apr 29, 2025

Louisville Representative Challenges Usps On Mail Delivery Transparency

Apr 29, 2025 -

Usps Mail Delays Louisville Congressman Demands Transparency

Apr 29, 2025

Usps Mail Delays Louisville Congressman Demands Transparency

Apr 29, 2025 -

Remembering The Fallen Fort Belvoirs Vigil For Army Helicopter Crash Victims

Apr 29, 2025

Remembering The Fallen Fort Belvoirs Vigil For Army Helicopter Crash Victims

Apr 29, 2025 -

Louisville Congressman Accuses Usps Of Lack Of Transparency On Mail Delays

Apr 29, 2025

Louisville Congressman Accuses Usps Of Lack Of Transparency On Mail Delays

Apr 29, 2025 -

Candlelight Vigil Honors Fallen Soldiers Fort Belvoir Mourns Helicopter Crash Victims

Apr 29, 2025

Candlelight Vigil Honors Fallen Soldiers Fort Belvoir Mourns Helicopter Crash Victims

Apr 29, 2025