Analyzing The Fiscal Impact Of Election Promises: Deficit Projections And Economic Risks

Table of Contents

Evaluating the Credibility of Election Promises

Analyzing the Costing Methodology

Accurately assessing the costs of complex policy proposals presents significant challenges. The fiscal impact of election promises is often obscured by:

- Lack of Transparency: Many promises lack detailed costing breakdowns, making independent verification difficult. Vague statements about "increased investment" without specific figures hinder proper evaluation.

- Incomplete Data: Reliable data on the potential impact of certain policies might be unavailable or insufficient, especially for novel initiatives. This lack of comprehensive information leads to imprecise cost estimations.

- Unforeseen Consequences: Policy implementation often reveals unintended consequences, leading to cost overruns and budget strain. Complex interactions between different policies can produce unexpected outcomes that are initially overlooked.

- Differing Economic Models: Economists use various models with differing assumptions, resulting in widely varying cost projections for the same policy. This variance makes it challenging to determine a reliable estimate of the fiscal impact.

Independent fiscal analyses from reputable organizations, such as government budget offices or non-partisan think tanks, are crucial for providing more objective assessments of the fiscal impact of election promises. These analyses provide a valuable counterpoint to the often-rosy projections presented by political parties.

Identifying Unfunded Mandates

Promises without clear funding mechanisms represent a significant risk to fiscal stability. Unfunded mandates lead to accumulating debt and jeopardize the government's ability to meet its financial obligations. Examples include:

- Large-scale infrastructure projects: Ambitious infrastructure plans often require substantial funding beyond existing budgetary allocations. The failure to secure funding for these projects creates significant long-term fiscal liabilities.

- Tax cuts without offsetting revenue increases: Reducing taxes without identifying corresponding spending cuts or revenue-generating measures will invariably widen the budget deficit. This can destabilize the economy in the long term.

The dangers of accumulating unfunded liabilities are substantial. They constrain future budgets, limiting the government's ability to respond to unforeseen crises or invest in other essential areas. A comprehensive analysis of the fiscal impact of election promises, therefore, must rigorously identify and assess the implications of any unfunded commitments.

Projecting Budget Deficits and National Debt

The Impact of Tax Policies

Proposed tax changes significantly affect government revenue and, subsequently, the national debt. The fiscal impact of election promises concerning taxation depends heavily on the underlying economic theory.

- Supply-side economics: This theory argues that lower taxes stimulate economic growth, leading to increased revenue in the long run (the Laffer Curve illustrates this concept). However, this effect isn't always guaranteed and may be slow to materialize.

- Demand-side economics: This approach emphasizes the importance of government spending to boost aggregate demand and economic activity. Tax cuts under this model may not be prioritized unless they are targeted at stimulating consumption.

Historical examples demonstrate how tax policy changes have impacted national debt. Significant tax cuts without corresponding spending reductions have often resulted in increased deficits. Conversely, tax increases or efficient tax reforms can help reduce the deficit.

The Impact of Spending Proposals

Increased government spending in various sectors (healthcare, education, infrastructure) has a profound impact on the budget. The fiscal impact of election promises concerning spending should consider:

- The multiplier effect: Government spending can stimulate economic activity, leading to a ripple effect of increased income and employment. However, the magnitude of this effect is debated amongst economists.

- Potential inefficiencies and cost overruns: Large-scale government projects are often plagued by delays, cost overruns, and inefficiencies, potentially exceeding initial budget estimates significantly.

Examining real-world examples of large government projects, such as infrastructure initiatives or healthcare reforms, can illustrate the budgetary impact. Analyzing the actual costs versus the initial projections provides valuable insight into potential cost overruns.

Assessing the Economic Risks

Inflationary Pressures

Increased government spending and borrowing can fuel inflation. The fiscal impact of election promises that involve significant increases in government spending must account for potential inflationary pressures:

- The Phillips Curve: This illustrates the inverse relationship between inflation and unemployment; however, this relationship isn't always stable or predictable.

- Stagflation: A combination of high inflation and high unemployment represents a particularly challenging economic scenario.

High inflation erodes purchasing power, impacting economic stability and potentially leading to social unrest. Therefore, understanding the potential inflationary consequences is vital when analyzing the fiscal impact of election promises.

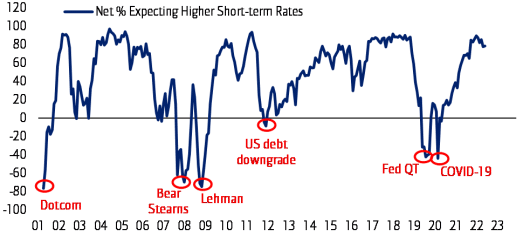

Interest Rate Hikes

Higher government borrowing can lead to increased interest rates. This has several ramifications:

- Increased borrowing costs for businesses and consumers: Higher interest rates make it more expensive for businesses to invest and for consumers to borrow money, slowing economic growth.

- Crowding out private investment: Increased government borrowing can lead to higher interest rates, making it more difficult for private businesses to secure financing. This "crowding out" effect limits private investment and reduces overall economic growth.

Analyzing the potential impact on interest rates is critical when evaluating the long-term economic consequences of the fiscal impact of election promises.

Impact on International Credit Ratings

Unsustainable fiscal policies negatively impact a nation's credit rating, affecting borrowing costs and investor confidence.

- Downgraded credit ratings: A lower credit rating makes it more expensive for the government to borrow money internationally, increasing the cost of servicing the national debt.

- Capital flight and currency devaluation: Investors may lose confidence and withdraw their investments from the country, leading to capital flight and potential currency devaluation.

The fiscal impact of election promises must account for these international implications. Maintaining a strong credit rating is essential for ensuring long-term economic stability and attracting foreign investment.

Conclusion

Critically evaluating the fiscal impact of election promises before casting a vote is paramount. Unrealistic or poorly costed promises carry significant long-term economic risks, including increased budget deficits, national debt, inflation, higher interest rates, and potential downgrades in international credit ratings. Demand transparency and detailed costing from political candidates; research the fiscal implications of your preferred candidates' platforms; and become active participants in promoting fiscally responsible governance by engaging with the fiscal impact of election promises discussion. Further research into specific policy proposals and their potential economic consequences is strongly encouraged.

Featured Posts

-

Canakkale Zaferi Ne Zaman Kazanildi 107 Yilinda Anma

Apr 25, 2025

Canakkale Zaferi Ne Zaman Kazanildi 107 Yilinda Anma

Apr 25, 2025 -

Dwnld Trmp Ka Ywkryn Pr Rwsy Hmle Ke Bare Myn Skht Rdeml

Apr 25, 2025

Dwnld Trmp Ka Ywkryn Pr Rwsy Hmle Ke Bare Myn Skht Rdeml

Apr 25, 2025 -

Marvel Fans Rejoice Ultimate Spider Man 4 Casting Duo Revealed

Apr 25, 2025

Marvel Fans Rejoice Ultimate Spider Man 4 Casting Duo Revealed

Apr 25, 2025 -

Should Investors Worry About Current Stock Market Valuations Bof A Weighs In

Apr 25, 2025

Should Investors Worry About Current Stock Market Valuations Bof A Weighs In

Apr 25, 2025 -

Jets 2025 Draft Strategy Needs Assessment Draft Pick Projections And Potential Players

Apr 25, 2025

Jets 2025 Draft Strategy Needs Assessment Draft Pick Projections And Potential Players

Apr 25, 2025

Latest Posts

-

Le Labo Du 8 Une Exposition Photographique De Pierre Terrasson

Apr 26, 2025

Le Labo Du 8 Une Exposition Photographique De Pierre Terrasson

Apr 26, 2025 -

Milan Design Week 2025 Saint Laurent Showcases The Legacy Of Charlotte Perriand

Apr 26, 2025

Milan Design Week 2025 Saint Laurent Showcases The Legacy Of Charlotte Perriand

Apr 26, 2025 -

Exposition De Photos De Pierre Terrasson A La Galerie Le Labo Du 8

Apr 26, 2025

Exposition De Photos De Pierre Terrasson A La Galerie Le Labo Du 8

Apr 26, 2025 -

Saint Laurent And Charlotte Perriand A Milan Design Week 2025 Collaboration

Apr 26, 2025

Saint Laurent And Charlotte Perriand A Milan Design Week 2025 Collaboration

Apr 26, 2025 -

Dong Duong Hotel Joins Fusion Hotel Collection In Hue

Apr 26, 2025

Dong Duong Hotel Joins Fusion Hotel Collection In Hue

Apr 26, 2025