Should Investors Worry About Current Stock Market Valuations? BofA Weighs In.

Table of Contents

BofA's Key Concerns Regarding Current Stock Market Valuations

Bank of America has expressed several concerns regarding current stock market valuations, citing potentially unsustainable levels in certain sectors. Their analysis points towards a number of key risk factors:

-

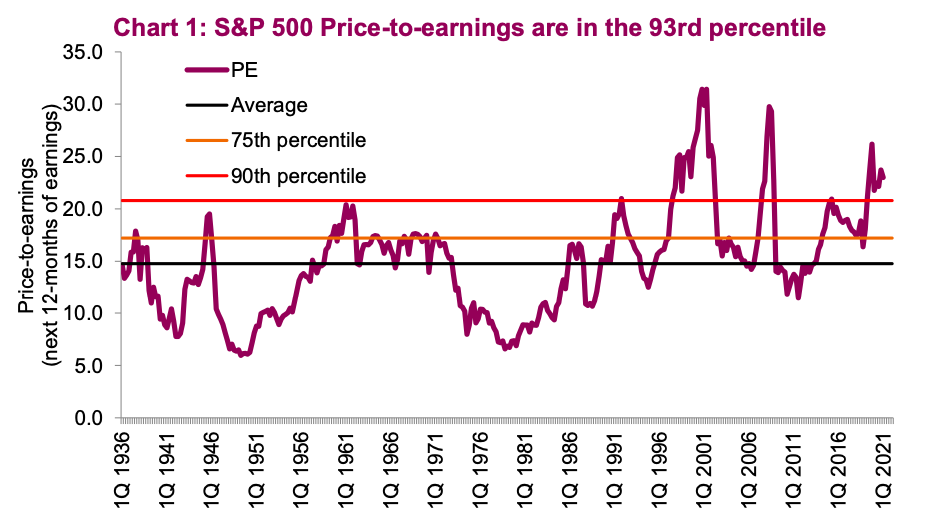

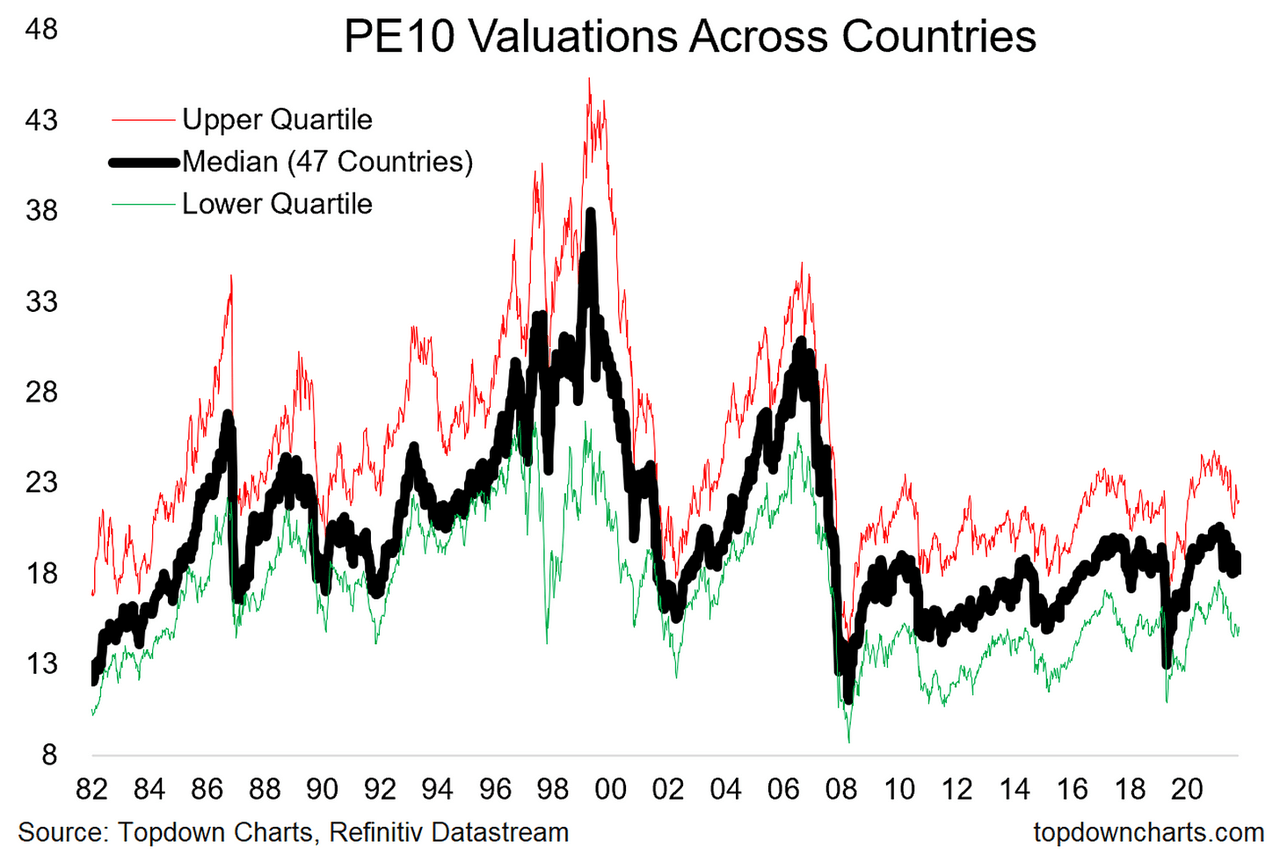

High Price-to-Earnings (P/E) ratios in specific sectors: BofA's reports highlight significantly elevated P/E ratios in certain sectors compared to historical averages. This suggests that investors are paying a premium for earnings, potentially indicating overvaluation. For example, certain technology and growth stocks may show P/E ratios far exceeding their historical norms or those of comparable companies.

-

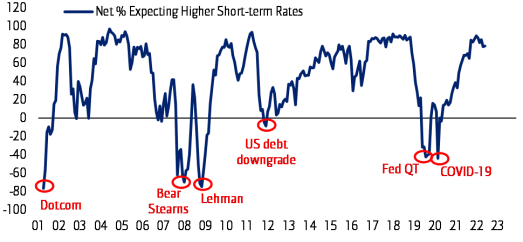

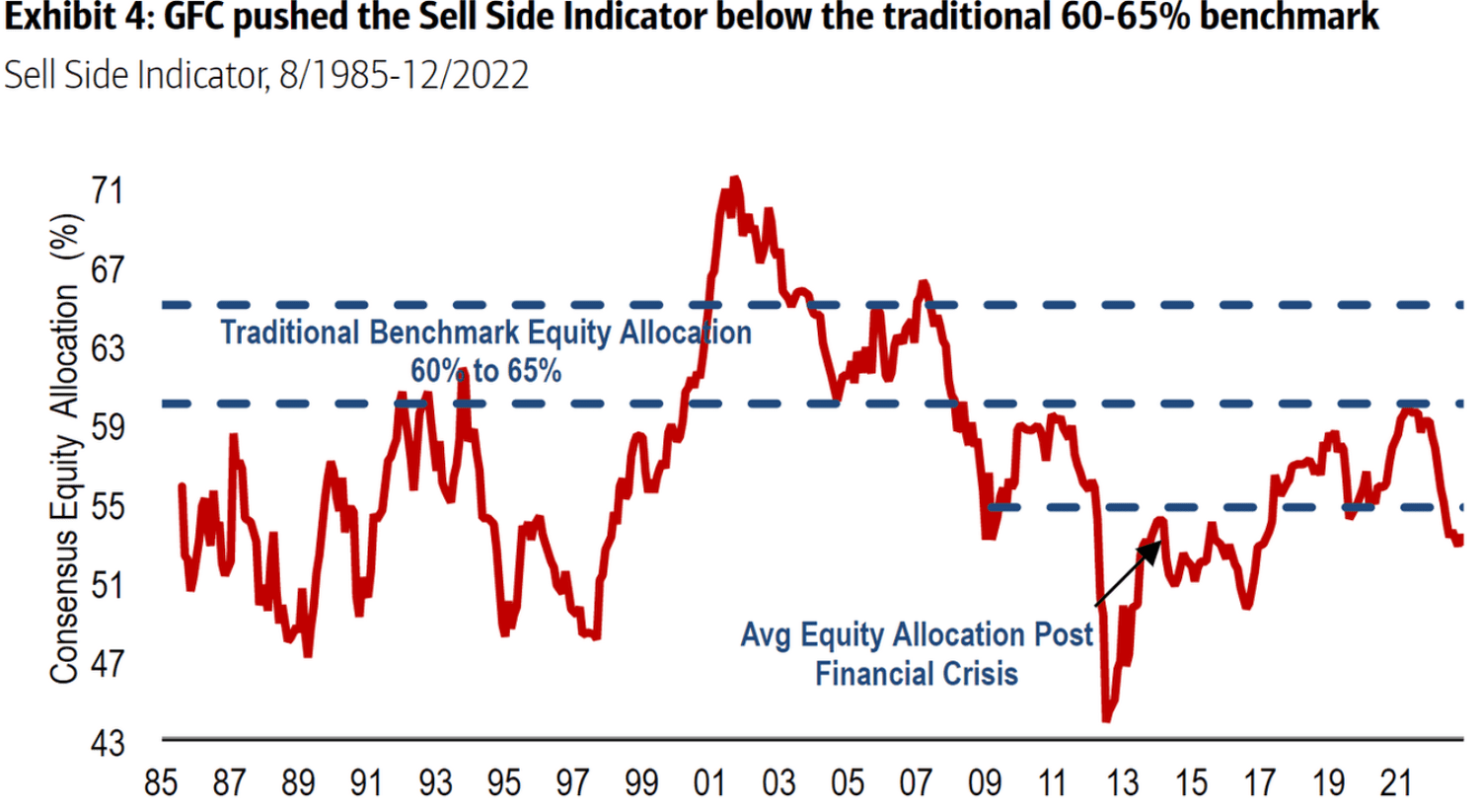

Potential overvaluation relative to historical averages and economic fundamentals: BofA's analysis compares current valuations against historical data and fundamental economic indicators such as GDP growth, inflation, and interest rates. The comparison suggests a potential disconnect between market prices and underlying economic strength, raising concerns about a potential market correction. This discrepancy is a major factor in their overall valuation concerns.

-

Concerns about interest rate hikes and their impact on valuations: The Federal Reserve's monetary policy, particularly interest rate hikes, significantly impacts stock market valuations. BofA's analysis likely considers the potential for higher interest rates to reduce corporate profitability and investor appetite for riskier assets, leading to lower valuations. Higher rates increase the cost of borrowing for companies, impacting earnings growth.

-

Specific examples of overvalued sectors according to BofA's analysis: While BofA's specific sector calls may vary across reports, they likely highlight sectors with high growth expectations but potentially limited future earnings potential. Analyzing these specific sectors, as detailed in BofA's reports, is crucial for investors to understand the areas of greatest concern regarding current market valuations.

Counterarguments and Potential Upsides

While BofA raises valid concerns, it's crucial to consider counterarguments and potential upsides to the current market valuations:

-

Strong corporate earnings growth potential: Despite high valuations, some sectors demonstrate robust earnings growth potential, justifying higher price-to-earnings ratios. This growth could be fueled by technological innovation, expanding markets, or operational efficiencies.

-

Technological advancements driving innovation and future growth: Technological breakthroughs across various sectors could drive future growth and justify current valuations. Artificial intelligence, renewable energy, and biotechnology are examples of sectors with significant long-term growth potential, potentially supporting current valuations.

-

Potential for sustained low interest rates (depending on economic conditions): While interest rate hikes are a concern, the potential for sustained low interest rates in certain economic scenarios could support higher valuations by keeping borrowing costs low for companies and investors. This, however, depends heavily on macroeconomic conditions.

-

Positive economic indicators that might support higher valuations: Strong employment numbers, consumer spending, and overall economic growth can contribute to higher valuations. These positive indicators could offset some of the concerns raised about overvaluation.

BofA's Recommendations for Investors

Navigating the complexities of current stock market valuations requires a strategic approach. BofA likely recommends a diversified strategy:

-

Diversification across asset classes (stocks, bonds, etc.): Reducing reliance on any single asset class is crucial for risk management. Diversifying across stocks, bonds, and potentially other asset classes helps mitigate potential losses from a market correction.

-

Focus on undervalued sectors or companies identified by BofA or other analysts: Identifying undervalued sectors or companies can help mitigate risks associated with overvalued markets. Thorough research and comparison with other analyst reports are essential.

-

Strategies for managing risk (stop-loss orders, hedging techniques): Employing risk management techniques such as stop-loss orders and hedging strategies can help limit potential losses in a volatile market.

-

Importance of long-term investment strategies versus short-term trading: A long-term investment horizon allows investors to ride out market fluctuations and benefit from long-term growth, reducing the impact of short-term volatility on their overall investment strategy.

The Importance of Due Diligence and Independent Analysis

It's crucial to remember that BofA's analysis is just one perspective. Investors should conduct their own thorough due diligence:

-

Reviewing multiple financial news sources and analyst reports: Gaining a comprehensive understanding requires comparing BofA’s insights with other reputable sources and perspectives.

-

Understanding your own risk tolerance and investment goals: Investment decisions should align with your individual risk tolerance and financial goals. A conservative investor might take a different approach than a more aggressive investor.

-

Seeking advice from a qualified financial advisor: Consulting a qualified financial advisor can provide personalized guidance based on your specific circumstances.

Conclusion: Should You Worry About Stock Market Valuations? Taking Action Based on BofA's Insights

BofA's analysis highlights legitimate concerns regarding current stock market valuations, particularly the high P/E ratios in certain sectors and the potential impact of interest rate hikes. However, counterarguments exist, such as strong corporate earnings growth potential and technological advancements. The key takeaway is that while BofA's insights on current stock market valuations offer valuable food for thought, ultimately the decision on how to proceed rests with you. Stay informed about market trends, conduct your own thorough research, and make sound investment choices based on your unique circumstances. Don't hesitate to seek professional financial advice regarding your stock market valuation concerns. Understanding and actively monitoring current market valuations is key to making informed investment decisions.

Featured Posts

-

Indemnizacion Por Homicidio Culposo El Caso Arrayanes Y Una Oferta De G 1 250 Millones

Apr 25, 2025

Indemnizacion Por Homicidio Culposo El Caso Arrayanes Y Una Oferta De G 1 250 Millones

Apr 25, 2025 -

Thornabys Blackbush Walk Csi On Scene Area Secured

Apr 25, 2025

Thornabys Blackbush Walk Csi On Scene Area Secured

Apr 25, 2025 -

Significant Events Of April 1945 A Historical Overview

Apr 25, 2025

Significant Events Of April 1945 A Historical Overview

Apr 25, 2025 -

Espn Mock Draft Broncos Land A Key Player

Apr 25, 2025

Espn Mock Draft Broncos Land A Key Player

Apr 25, 2025 -

Rare Rebuke Trump Condemns Putins Actions In Kyiv

Apr 25, 2025

Rare Rebuke Trump Condemns Putins Actions In Kyiv

Apr 25, 2025

Latest Posts

-

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025

Addressing Investor Concerns Bof As View On High Stock Market Valuations

Apr 26, 2025 -

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025

Bof A On Stock Market Valuations A Rationale For Investor Confidence

Apr 26, 2025 -

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025

Why Current Stock Market Valuations Are Not A Reason To Panic According To Bof A

Apr 26, 2025 -

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025

Understanding Stock Market Valuations Bof As Argument For Calm

Apr 26, 2025 -

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025

Bof A Reassures Investors Why High Stock Market Valuations Are Not A Threat

Apr 26, 2025