Analyzing The KRW/USD Exchange Rate: The Influence Of Trump's Currency Manipulation Claims

Table of Contents

Trump's Accusations and Their Context

Former President Trump repeatedly accused South Korea, along with other nations like China and Japan, of manipulating their currencies to gain an unfair trade advantage. These accusations were frequently voiced during trade disputes, often framed within the context of addressing perceived trade imbalances. He argued that these countries deliberately devalued their currencies, making their exports cheaper and thus more competitive in the global market. This, he claimed, harmed American businesses and workers.

- Specific examples: Trump frequently used Twitter and public speeches to express his concerns about South Korea's currency practices. For instance, in August 2019, he tweeted about the need to address unfair trade practices, directly mentioning currency manipulation as a key concern. [Insert links to relevant news articles and tweets].

- Trade actions: These accusations often coincided with or preceded the imposition of tariffs and trade negotiations. The threat of, or actual implementation of, tariffs frequently added to the pressure on the KRW/USD exchange rate. [Insert links to relevant trade agreements and tariff announcements].

- Economic rationale: The underlying economic rationale stemmed from the belief that a weaker currency boosts exports by making them more affordable internationally. While this is a valid economic principle, the accusation of deliberate manipulation implied an active policy of currency devaluation, a claim that is subject to debate and requires empirical evidence.

Impact on the KRW/USD Exchange Rate

Trump's statements undoubtedly contributed to volatility in the KRW/USD exchange rate. While isolating the precise impact is challenging due to the interplay of multiple factors, a clear correlation can be observed in several instances.

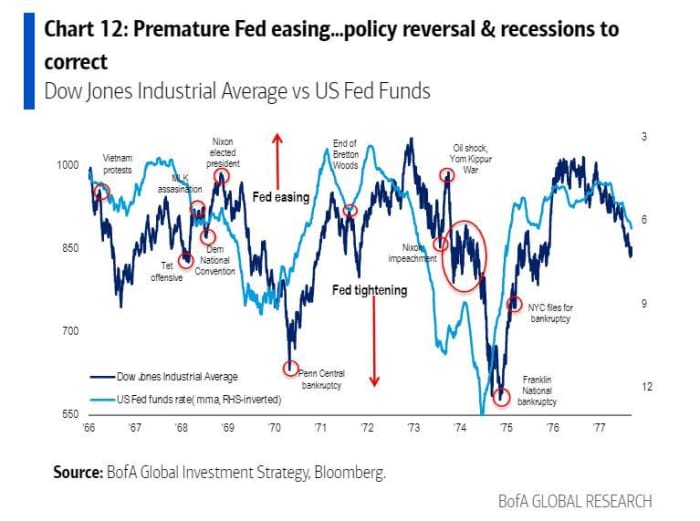

- Short-term effects: Immediately following strong statements or policy announcements from the Trump administration regarding trade and currency, the KRW often depreciated against the USD. [Insert chart showing KRW/USD fluctuations correlated with significant Trump statements/actions].

- Long-term effects: The sustained period of uncertainty surrounding US-South Korean trade relations under Trump's presidency likely contributed to a general weakening of the KRW over the long term. [Insert chart depicting the long-term trend of the KRW/USD exchange rate during the relevant period].

- Market speculation and investor sentiment: The uncertainty created by Trump's pronouncements fuelled market speculation, significantly influencing investor sentiment and impacting trading decisions. Negative sentiment often resulted in capital flight and increased demand for the USD, leading to KRW depreciation.

- Other influencing factors: It's crucial to acknowledge that global economic conditions, changes in South Korea's interest rates, and domestic political developments within South Korea also played a role in shaping the KRW/USD exchange rate during this period.

Counterarguments and Alternative Explanations

While Trump's statements demonstrably impacted market sentiment and contributed to exchange rate volatility, it's crucial to avoid oversimplifying the causal relationship. Other significant factors influenced the KRW/USD exchange rate:

- Global economic factors: Global economic downturns or shifts in global investment flows undoubtedly impacted the value of the KRW against the USD, regardless of Trump's pronouncements.

- Internal economic policies: South Korea's own monetary policies, including interest rate adjustments and other economic decisions, directly affected the value of its currency.

- Role of other major currencies: Fluctuations in major currencies like the Euro and Japanese Yen also indirectly affected the KRW/USD exchange rate.

Analyzing the Future Implications

Trump's accusations left a lasting mark on the perception of the KRW's stability and vulnerability to geopolitical pressures. While the immediate impact of his presidency is behind us, its effects continue to reverberate.

- Potential risks and opportunities: The KRW/USD exchange rate remains sensitive to global trade relations and political uncertainties. Investors need to carefully assess these risks when making investment decisions.

- Managing currency risk: Diversification of investment portfolios and employing appropriate hedging strategies are crucial for mitigating currency risks in the KRW/USD market.

- Long-term outlook: The long-term outlook for the KRW depends on various factors, including South Korea's economic performance, global economic growth, and the evolving geopolitical landscape.

Conclusion

Analyzing the influence of Trump's claims of currency manipulation on the KRW/USD exchange rate reveals a complex picture. While his statements undoubtedly contributed to volatility and negatively impacted investor sentiment, it's clear that other economic and geopolitical factors played a significant role. Understanding the KRW/USD exchange rate requires a multifaceted approach, encompassing global economic trends, domestic policies, and market sentiment. To make informed decisions about investments and business strategies related to the KRW/USD exchange rate, it’s crucial to stay informed about global economic developments, monitor relevant news sources, and utilize reliable tools for tracking exchange rate fluctuations. Resources like [Insert links to reliable financial news sources and currency tracking websites] can help you stay up-to-date on the dynamic KRW/USD exchange rate and make informed decisions in this complex market.

Featured Posts

-

12

Apr 25, 2025

12

Apr 25, 2025 -

Huge Stock Swings Navigating The New Normal For Investors

Apr 25, 2025

Huge Stock Swings Navigating The New Normal For Investors

Apr 25, 2025 -

Unexpected Nfl Draft Names Cowboys Insiders Watch List

Apr 25, 2025

Unexpected Nfl Draft Names Cowboys Insiders Watch List

Apr 25, 2025 -

Unveiling The Past Two Jewish Resistance Fighters Revealed In A Historic Wwii Photograph

Apr 25, 2025

Unveiling The Past Two Jewish Resistance Fighters Revealed In A Historic Wwii Photograph

Apr 25, 2025 -

April 24th Oil Market Report Prices Trends And Analysis

Apr 25, 2025

April 24th Oil Market Report Prices Trends And Analysis

Apr 25, 2025

Latest Posts

-

Are High Stock Market Valuations A Cause For Concern Bof A Says No

Apr 26, 2025

Are High Stock Market Valuations A Cause For Concern Bof A Says No

Apr 26, 2025 -

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025 -

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025 -

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025 -

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025

Gambling On Catastrophe The Los Angeles Wildfires And The Future Of Disaster Betting

Apr 26, 2025