Analyzing The Recent Increase In CoreWeave (CRWV) Stock Value

Table of Contents

Increased Demand for GPU Computing Power

The explosive growth of AI, particularly the rise of generative AI models, is fueling an unprecedented demand for GPU computing power. This isn't limited to AI; industries like machine learning, high-performance computing (HPC), gaming, and the metaverse are all heavily reliant on powerful GPUs for processing complex data and rendering high-resolution graphics. CoreWeave is strategically positioned to benefit immensely from this surge in demand. Its vast, scalable GPU infrastructure provides the processing power needed to support these demanding applications.

- Rise of generative AI models: Models like GPT-4 require immense computational resources, driving demand for GPU-powered cloud services.

- Increased adoption of machine learning in businesses: Businesses are increasingly leveraging machine learning for tasks such as predictive analytics, fraud detection, and personalized experiences, further boosting GPU demand.

- Expansion of the metaverse and gaming industries: The growth of these sectors necessitates powerful GPUs for rendering immersive virtual worlds and high-fidelity gaming experiences.

- Growth of high-performance computing research: Scientific research, particularly in fields like climate modeling and drug discovery, relies on HPC clusters powered by powerful GPUs.

Strategic Partnerships and Acquisitions

While specific details of partnerships and acquisitions may not be publicly available at this time, the potential for strategic alliances significantly impacts CoreWeave's growth trajectory. Collaborations with leading AI developers, software providers, or hardware manufacturers could provide CoreWeave with access to new markets and technologies, boosting its overall capabilities and attracting further investment. Such synergistic effects would directly impact CRWV's stock value.

- Potential Partnerships: Strategic partnerships with major cloud providers or AI software companies could expand CoreWeave's reach and customer base.

- Potential Acquisitions: Acquisitions of smaller GPU cloud providers or specialized technology firms could enhance CoreWeave’s technological capabilities and market share.

- Synergistic Effects: Combining CoreWeave's infrastructure with the expertise of other companies could lead to innovative products and services, driving revenue growth.

Strong Financial Performance and Growth Projections

CoreWeave’s recent financial performance, while not publicly detailed in its entirety, is expected to demonstrate positive trends. Analyst forecasts and growth projections play a significant role in influencing investor sentiment and CRWV stock value. Strong revenue growth, increasing profitability, and a healthy balance sheet all contribute to a positive outlook for the company's future.

- Key Financial Metrics: Investors closely monitor metrics such as year-over-year revenue growth, operating margins, and customer acquisition costs to gauge the company's financial health.

- Financial Reports: Access to CoreWeave's official financial reports (when released) is crucial for a thorough analysis of its financial performance.

- Analyst Ratings and Price Targets: Tracking analyst ratings and price targets from reputable financial institutions provides valuable insight into the market’s expectations for CoreWeave's stock price.

Competitive Landscape and Market Share

The cloud computing market is highly competitive, with major players like AWS, Google Cloud, and Azure vying for market share. CoreWeave's competitive advantage lies in its specialization in GPU computing, a niche experiencing exponential growth. Assessing CoreWeave’s market share and its potential for expansion requires analyzing its unique offerings, such as its focus on specific industries or its technological innovations.

- Key Competitors: AWS, Google Cloud, and Azure represent significant competition, offering diverse cloud services. Understanding their strengths and weaknesses in relation to CoreWeave's focus on GPU computing is essential.

- CoreWeave’s Competitive Advantages: CoreWeave needs to clearly define and communicate its unique value proposition within the crowded cloud computing market.

- Market Share Growth Factors: Analyzing factors like customer acquisition, technological innovation, and strategic partnerships will indicate CoreWeave's potential for market share growth.

Investor Sentiment and Market Conditions

Investor sentiment towards CoreWeave, the broader cloud computing sector, and the overall macroeconomic climate significantly impacts CRWV's stock price. Positive news, strong financial results, and favorable market conditions generally boost investor confidence, leading to higher stock valuations. Conversely, negative news or economic downturns can negatively affect the stock price.

- Recent News Impacting CRWV: Any significant news announcements, partnerships, or financial reports directly affect investor perceptions and stock price.

- Overall Market Trends: Broad market trends, such as interest rate changes or inflation rates, influence investor risk appetite and can impact stock valuations across sectors.

- Influential Investor Actions: Large institutional investor actions, such as significant buy or sell orders, can influence the stock price through market forces.

Conclusion: Understanding the CoreWeave (CRWV) Stock Surge and Future Outlook

The recent increase in CoreWeave (CRWV) stock value can be attributed to a confluence of factors: the escalating demand for GPU computing power driven by AI advancements, strategic partnerships (or potential for them), strong (projected) financial performance, a favorable position within the competitive cloud computing landscape, and positive investor sentiment. CoreWeave's strategic focus on GPU computing positions it well to capitalize on the continued growth of AI and related technologies. The future trajectory of CRWV stock will depend on the company's ability to execute its growth strategy, maintain its competitive advantage, and navigate the ever-evolving market conditions.

To stay updated on CoreWeave (CRWV) stock performance and the dynamic world of GPU computing, conduct further research by consulting reputable financial news sources and following the company's investor relations page for ongoing analysis of CoreWeave (CRWV) stock.

Featured Posts

-

Lancaster City Stabbing Details Emerge Following Tragic Event

May 22, 2025

Lancaster City Stabbing Details Emerge Following Tragic Event

May 22, 2025 -

The Unforgettable Vybz Kartel Concerts In Brooklyn A Sold Out Success

May 22, 2025

The Unforgettable Vybz Kartel Concerts In Brooklyn A Sold Out Success

May 22, 2025 -

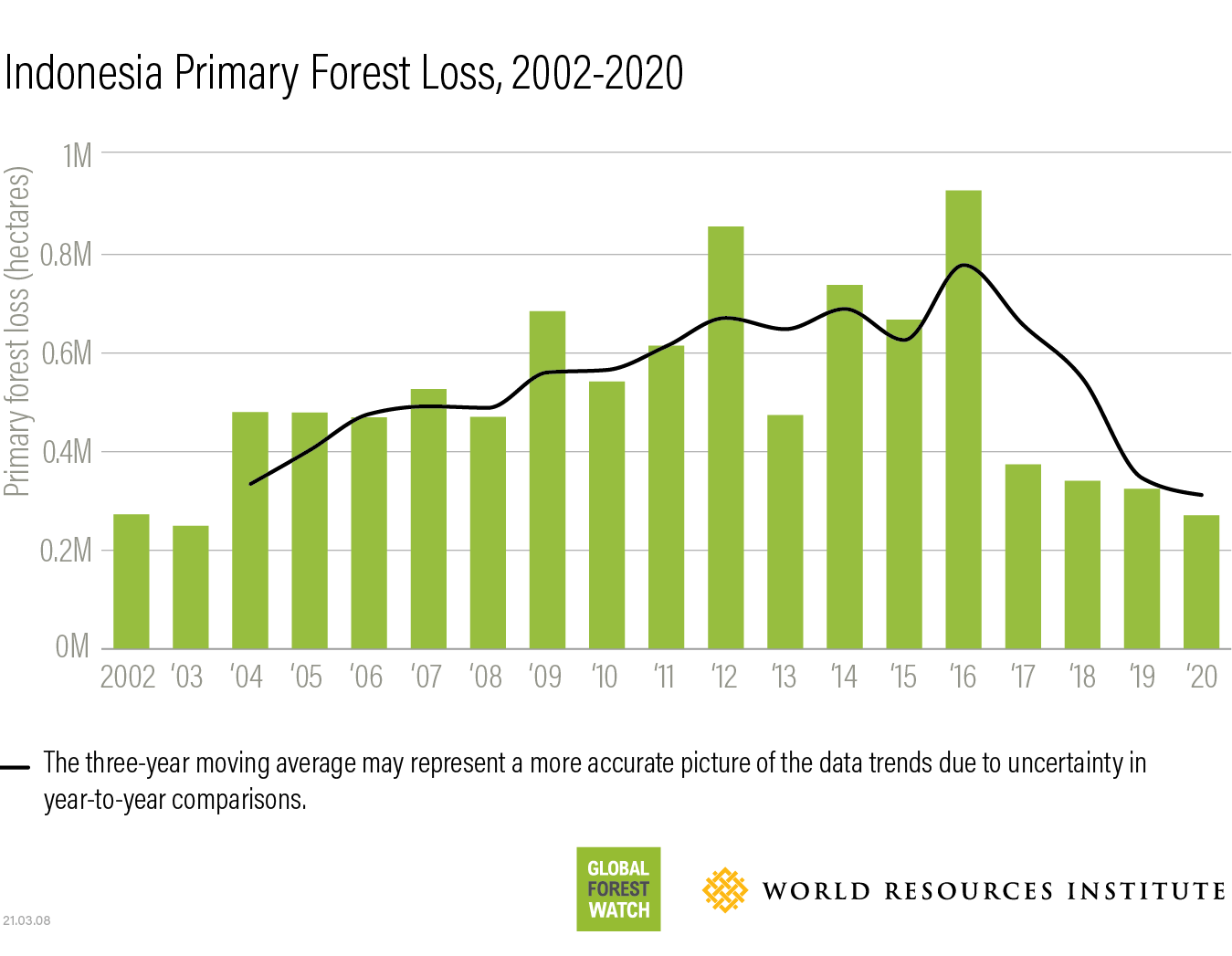

Record Breaking Global Forest Loss Wildfires And Deforestation

May 22, 2025

Record Breaking Global Forest Loss Wildfires And Deforestation

May 22, 2025 -

Vybz Kartels Exclusive Interview Life In Prison Family And Future Plans

May 22, 2025

Vybz Kartels Exclusive Interview Life In Prison Family And Future Plans

May 22, 2025 -

Ukrayina Poza Nato Analiz Potentsiynikh Zagroz Ta Politichnikh Naslidkiv

May 22, 2025

Ukrayina Poza Nato Analiz Potentsiynikh Zagroz Ta Politichnikh Naslidkiv

May 22, 2025

Latest Posts

-

Lower Gas Prices In Toledo Current Cost Per Gallon

May 22, 2025

Lower Gas Prices In Toledo Current Cost Per Gallon

May 22, 2025 -

Toledo Gas Prices Drop Per Gallon Cost Decreases

May 22, 2025

Toledo Gas Prices Drop Per Gallon Cost Decreases

May 22, 2025 -

Gas Buddy Reports On Falling Gas Prices In Virginia This Week

May 22, 2025

Gas Buddy Reports On Falling Gas Prices In Virginia This Week

May 22, 2025 -

Gas Prices Down In Virginia Gas Buddys Week Over Week Analysis

May 22, 2025

Gas Prices Down In Virginia Gas Buddys Week Over Week Analysis

May 22, 2025 -

Weekly Virginia Gas Price Report Significant Drop Reported By Gas Buddy

May 22, 2025

Weekly Virginia Gas Price Report Significant Drop Reported By Gas Buddy

May 22, 2025