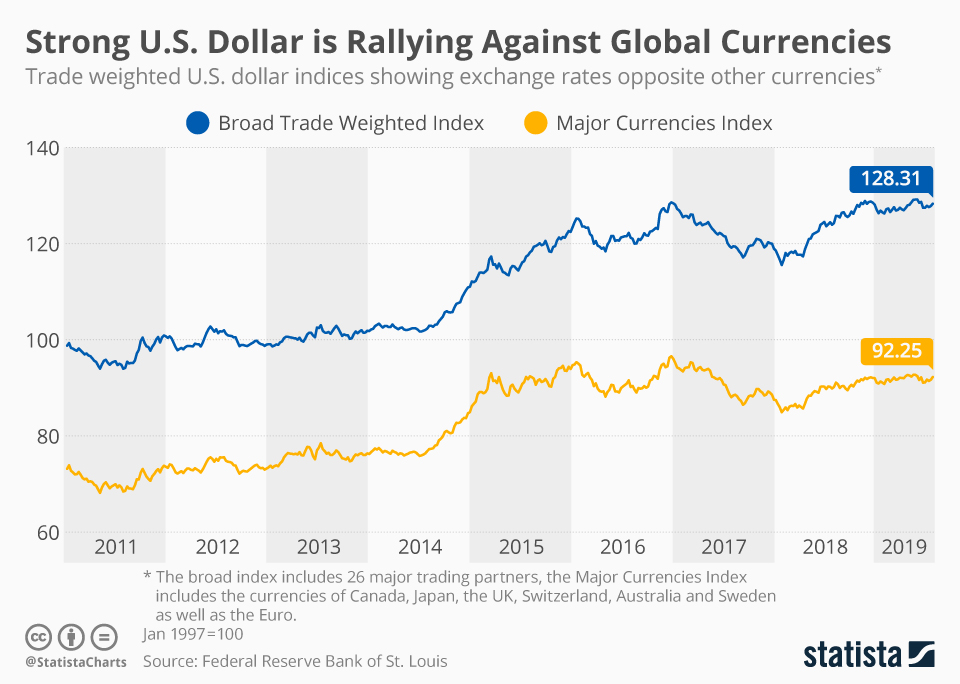

Analyzing The U.S. Dollar's Trajectory: A Post-Inauguration Economic Outlook

Table of Contents

Fiscal Policy's Impact on the US Dollar

Government fiscal policies significantly influence the US Dollar's value. Understanding the administration's approach to spending and taxation is crucial for predicting the dollar's trajectory.

Government Spending and Debt

Increased government spending can weaken the dollar, particularly if it leads to higher inflation and increased national debt.

- Increased borrowing: Funding increased spending through borrowing can drive up interest rates. While this might attract foreign investment seeking higher returns, it also increases the overall debt burden, potentially making the US Dollar less attractive.

- Inflationary pressures: Higher government spending can fuel inflation, eroding the purchasing power of the dollar and making it less competitive internationally. The resulting higher inflation weakens the dollar's value in the foreign exchange market.

- Budget analysis: A thorough analysis of the new administration's proposed budget and its impact on the national debt is crucial for understanding its potential influence on the US Dollar's exchange rate. Scrutinizing the budget deficit and the government's debt-to-GDP ratio are vital steps in this analysis.

Taxation Policies and their Effect on the Dollar

Taxation policies also play a vital role. Tax cuts, while stimulating economic growth in the short term, can widen the budget deficit, potentially weakening the dollar due to increased borrowing. Conversely, tax increases, although potentially slowing economic growth, can strengthen the dollar in the long run by reducing the deficit and enhancing investor confidence.

- Investor confidence: Tax proposals and their anticipated effect on investor confidence are key factors to consider. Uncertainty can lead to capital flight, impacting the dollar negatively. Clear and consistent fiscal policy signals are essential for maintaining a strong US Dollar.

- Corporate earnings and foreign investment: Examining the impact of tax changes on corporate earnings and foreign investment is essential. Attracting foreign direct investment (FDI) strengthens the dollar's demand. Tax policies that favor corporate profitability often lead to a stronger dollar.

Monetary Policy and the Federal Reserve's Role

The Federal Reserve (Fed), the central bank of the United States, plays a pivotal role in influencing the US Dollar through its monetary policy decisions.

Interest Rate Adjustments and the Dollar

The Fed's decisions on interest rates significantly influence the dollar's value. Higher interest rates typically attract foreign investment, strengthening the dollar, as investors seek higher returns. Lower rates, on the other hand, can weaken it.

- Interest rate trajectory: Analyzing the Federal Reserve's projected interest rate trajectory is vital for predicting dollar movements. Forward guidance from the Fed provides insight into future policy actions.

- Response to economic conditions: The Fed's response to inflationary pressures and economic growth will be critical for the dollar's movement. Balancing price stability with economic growth is a key challenge for the Fed's monetary policy.

Quantitative Easing and its Long-Term Effects

Quantitative easing (QE), a monetary policy tool involving the creation of new money to purchase assets, has long-term effects on the dollar's value and stability.

- Further QE: Examining the potential for further QE and its effects on inflation and currency valuation is crucial. QE can devalue the currency if it leads to excessive inflation.

- Unwinding QE: The implications of unwinding previous QE programs on the U.S. dollar should be explored. The gradual reduction of the Fed's balance sheet can have significant implications on the dollar’s exchange rate and market liquidity.

Inflation and its Influence on the US Dollar's Value

Inflation significantly impacts the US Dollar's value. Rising inflation erodes purchasing power and makes the dollar less attractive to foreign investors.

Inflation Expectations and Market Sentiment

Rising inflation erodes the purchasing power of the dollar and makes it less attractive to foreign investors, potentially weakening the currency. Conversely, low inflation can support the dollar's value.

- Inflation data: Monitoring inflation data (CPI, PPI) and assessing market expectations are crucial for understanding its influence on the dollar. Market participants react to inflation forecasts and adjust their investments accordingly.

- Supply chain disruptions: Analyzing the impact of supply chain disruptions and commodity prices on inflation is necessary. Global supply chain bottlenecks contribute to inflationary pressures, affecting the dollar's value.

The Relationship between Inflation and Interest Rates

The Federal Reserve often raises interest rates to combat inflation. This interplay between inflation and interest rates significantly impacts the dollar's trajectory.

- Correlation between inflation and interest rates: Understanding the correlation between inflation rates and the Federal Reserve's response is crucial. The Fed's actions to control inflation are often reflected in changes to its policy interest rate.

- Effectiveness of monetary policy: Analyzing the effectiveness of monetary policy in controlling inflation and its consequences for the dollar's value is important. The effectiveness of monetary policy in managing inflation has implications for the dollar's long-term stability.

Geopolitical Factors and their Impact

Geopolitical factors significantly influence the demand for the US Dollar.

Global Economic Uncertainty and the Safe-Haven Effect

During times of global uncertainty, the dollar often acts as a safe-haven currency, attracting investors seeking stability.

- Global economic developments: Monitoring global political and economic developments is crucial for understanding their impact on the dollar's value. Geopolitical risks can cause investors to seek safe havens, increasing demand for the US Dollar.

- Global economic growth: Assessing the strength of global economic growth and its influence on the dollar's demand is essential. Strong global growth can reduce the demand for the US dollar as a safe-haven currency.

International Trade Relations and the Dollar

Trade agreements and disputes can greatly influence the demand for the US dollar in international markets.

- Impact of trade policies: Analyzing the impact of trade policies on currency exchange rates is critical. Protectionist measures can lead to a decline in the dollar's value in the short-term.

- Potential for trade wars: Examining the potential for trade wars and their consequences for the U.S. dollar should be considered. Trade disputes negatively affect investor sentiment and can weaken the dollar.

Conclusion

Analyzing the U.S. dollar's trajectory post-inauguration requires a multifaceted approach that considers fiscal and monetary policies, inflation, and geopolitical events. The interplay of these factors will ultimately shape the dollar's strength and stability. While predicting the future with certainty is impossible, understanding these key influencers provides a more informed perspective on potential movements in the US Dollar exchange rate. Staying informed about these economic indicators and policy decisions is crucial for investors and businesses alike to effectively navigate the ever-changing landscape of the global currency markets. Continue to monitor the US Dollar's performance and stay updated on the latest economic news for a comprehensive understanding of its trajectory.

Featured Posts

-

Capital Summertime Ball 2025 Wembley Stadium Date Tickets And Info

Apr 29, 2025

Capital Summertime Ball 2025 Wembley Stadium Date Tickets And Info

Apr 29, 2025 -

Internal Investigation Leads To Pw C Us Partners Cutting Brokerage Ties

Apr 29, 2025

Internal Investigation Leads To Pw C Us Partners Cutting Brokerage Ties

Apr 29, 2025 -

Porsche Popularity A Global Perspective With A Focus On Australia

Apr 29, 2025

Porsche Popularity A Global Perspective With A Focus On Australia

Apr 29, 2025 -

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025

Gaza Crisis International Pressure Mounts On Israel To End Aid Blockade

Apr 29, 2025 -

Lask Dominiert Klagenfurt Mit 6 0 Und Gewinnt Die Qualifikationsgruppe

Apr 29, 2025

Lask Dominiert Klagenfurt Mit 6 0 Und Gewinnt Die Qualifikationsgruppe

Apr 29, 2025

Latest Posts

-

Amanda Owens Emotional Goodbye To Our Yorkshire Farm

Apr 30, 2025

Amanda Owens Emotional Goodbye To Our Yorkshire Farm

Apr 30, 2025 -

Where To Stream Ru Pauls Drag Race Season 17 Episode 6 A Free Guide No Cable

Apr 30, 2025

Where To Stream Ru Pauls Drag Race Season 17 Episode 6 A Free Guide No Cable

Apr 30, 2025 -

Watch Ru Pauls Drag Race Season 17 Episode 6 Online Free And Cable Free

Apr 30, 2025

Watch Ru Pauls Drag Race Season 17 Episode 6 Online Free And Cable Free

Apr 30, 2025 -

Free Streaming Options For Ru Pauls Drag Race Season 17 Episode 6 No Cable

Apr 30, 2025

Free Streaming Options For Ru Pauls Drag Race Season 17 Episode 6 No Cable

Apr 30, 2025 -

Stream Ru Pauls Drag Race Season 17 Episode 6 Free No Cable Needed

Apr 30, 2025

Stream Ru Pauls Drag Race Season 17 Episode 6 Free No Cable Needed

Apr 30, 2025