Andreessen Horowitz's Omada Health Prepares For US Public Offering

Table of Contents

Omada Health's Business Model and Market Position

Omada Health operates a sophisticated virtual care platform designed to help individuals manage chronic conditions, primarily focusing on diabetes and hypertension. Their target market is the ever-growing population of individuals struggling to manage these prevalent health issues. The company offers comprehensive, personalized programs incorporating remote monitoring, coaching, and medication management. This approach differentiates Omada Health within the competitive telehealth and digital health industries.

Omada Health's competitive advantages include:

- Data-driven personalization: Their platform leverages data analytics to tailor interventions for individual needs.

- Engaging member experience: They focus on creating a supportive and motivating virtual community.

- Proven clinical outcomes: Omada Health has demonstrated significant improvements in patient health outcomes.

Their market share is steadily increasing within the booming virtual care market, driven by factors such as increasing healthcare costs and the growing adoption of remote healthcare solutions. This growth potential is substantial considering the high prevalence of chronic diseases worldwide.

- Specific programs: Omada offers programs for diabetes prevention, diabetes management, and hypertension management, among others.

- Key Performance Indicators (KPIs): Omada Health boasts impressive member engagement rates and demonstrable cost savings for healthcare systems.

- Competitive Comparison: While facing competition from other telehealth companies, Omada Health distinguishes itself through its clinically proven results and personalized approach.

Andreessen Horowitz's Role and Investment Strategy

Andreessen Horowitz's significant investment in Omada Health underscores their confidence in the company's potential and the future of virtual care. a16z's involvement is a strong indicator of the company's viability and growth prospects. This investment aligns with a16z's broader strategy of investing in innovative digital health companies poised for substantial growth. Their extensive experience in this sector makes their endorsement particularly significant.

- Investment Amount: a16z has invested a substantial amount in Omada Health across multiple funding rounds. (Specific figures would need to be sourced from public records).

- Funding Stages: a16z's investment has spanned several funding stages, reflecting their long-term commitment to the company.

- Other Healthcare Investments: a16z has a strong track record of successful investments in the healthcare and digital health spaces, including other prominent telehealth companies.

Financial Projections and IPO Expectations

Omada Health's financial performance leading up to its IPO is expected to show significant revenue growth and an increasing user base. The company's projected valuation during the public offering is highly anticipated within the investment community. Positive market sentiment suggests a strong level of investor interest. However, potential challenges and risks associated with the IPO, including market volatility and competition, need to be considered.

- Key Financial Metrics: Revenue growth, profitability margins, and user acquisition costs are key metrics investors will closely scrutinize.

- Expected IPO Pricing Range: Industry analysts will provide projected pricing ranges based on the company's financial performance and market conditions.

- Potential Risks: Competition, regulatory changes, and the overall economic climate represent potential risks to the success of the IPO.

Implications for the Telehealth and Digital Health Industries

Omada Health's IPO is poised to have a significant impact on the telehealth industry. It signifies the growing acceptance and validation of virtual care solutions as a mainstream approach to healthcare delivery. This could lead to increased investment in the sector, further accelerating the development and adoption of innovative digital health technologies.

- Increased Awareness: The IPO will generate greater awareness and understanding of the benefits of telehealth among patients and providers.

- Impact on Healthcare Costs and Access: Successful virtual care models like Omada Health's have the potential to lower healthcare costs and improve access to care, particularly for individuals in underserved areas.

- Future Trends: Omada Health's success could shape future trends in the telehealth industry, encouraging further innovation and integration of virtual care into mainstream healthcare systems.

Analyzing Andreessen Horowitz's Omada Health IPO: A Summary

The Omada Health IPO represents a significant milestone for the telehealth and digital health industries. Andreessen Horowitz's backing underscores the potential of virtual care to address the challenges of chronic disease management. The successful completion of the IPO could significantly accelerate investment and innovation in this critical sector, potentially transforming how healthcare is delivered and accessed. The potential impact on the future of virtual care and chronic disease management is profound.

To stay informed about the Omada Health IPO and its impact on the future of digital health, be sure to follow Omada Health IPO updates, research virtual care investment opportunities, and track digital health market trends.

Featured Posts

-

Judges Red Hot Start Highlights Braves Sluggish Offensive Beginning

May 11, 2025

Judges Red Hot Start Highlights Braves Sluggish Offensive Beginning

May 11, 2025 -

Boston Celtics Payton Pritchard Partners With Converse

May 11, 2025

Boston Celtics Payton Pritchard Partners With Converse

May 11, 2025 -

Ufc 315 Montreal Zahabi Vs Aldo Plus De 13 Secondes

May 11, 2025

Ufc 315 Montreal Zahabi Vs Aldo Plus De 13 Secondes

May 11, 2025 -

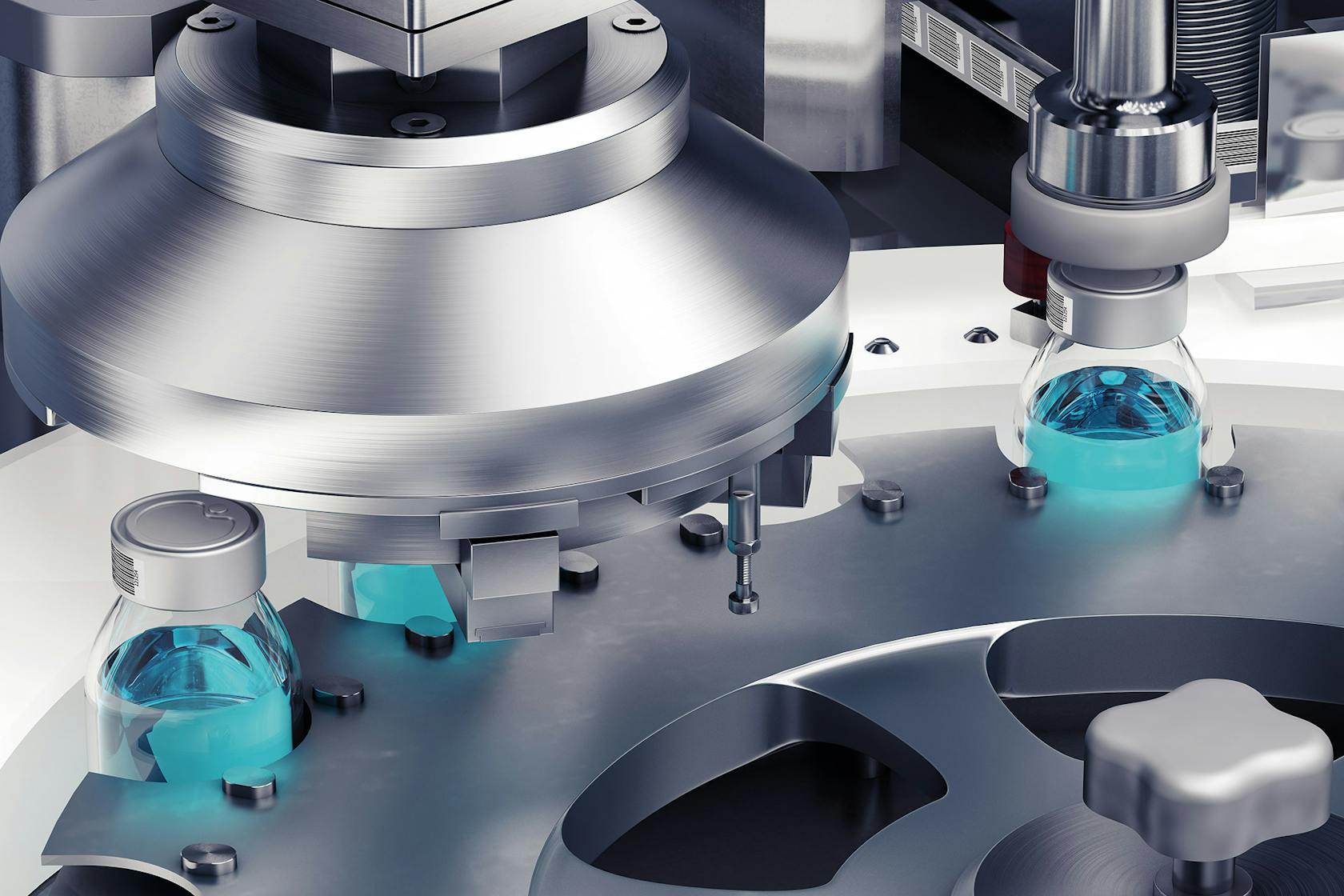

Automated Visual Inspection Of Lyophilized Vials Current Limitations And Future Directions

May 11, 2025

Automated Visual Inspection Of Lyophilized Vials Current Limitations And Future Directions

May 11, 2025 -

Sports Stadiums And Urban Renewal A Winning Combination

May 11, 2025

Sports Stadiums And Urban Renewal A Winning Combination

May 11, 2025