Apple Stock And Tariffs: Assessing The Risk To Buffett's Portfolio

Table of Contents

Apple's Global Supply Chain and Tariff Vulnerability

Apple's immense success is intrinsically linked to its highly efficient, yet geographically dispersed, supply chain. This very efficiency, however, makes it vulnerable to shifts in global trade policies, especially tariffs.

Manufacturing in China and the Impact of Tariffs

A significant portion of Apple's manufacturing takes place in China. Tariffs imposed on goods imported from China directly impact Apple's production costs.

- Affected Products: iPhones, iPads, MacBooks, Apple Watches, and AirPods are all susceptible to increased costs due to tariffs.

- Tariff Rates: Varying tariff rates on different components and finished goods contribute to the complexity of calculating the overall impact. Even minor percentage increases can translate into substantial costs given Apple's massive production volume.

- Increased Production Costs: Tariffs directly increase the cost of manufacturing, forcing Apple to either absorb these costs, impacting profit margins, or pass them onto consumers, potentially affecting demand.

- Manufacturing Diversification Challenges: While Apple is exploring alternative manufacturing locations to mitigate this risk (such as India and Vietnam), diversifying its supply chain is a complex and time-consuming process, fraught with logistical and infrastructural challenges.

The Ripple Effect on Component Suppliers

The impact of tariffs extends beyond finished products. Many components used in Apple devices are manufactured overseas and subject to tariffs.

- Increased Component Costs: Tariffs on these components drive up the cost of manufacturing for Apple, adding another layer to the already existing pressure on profit margins.

- Price Increases for Consumers: To maintain profitability, Apple might be forced to increase the prices of its products, potentially reducing consumer demand in a competitive market.

- Impact on Apple's Profit Margins and Competitiveness: The cumulative effect of these increased costs poses a significant threat to Apple's historically high profit margins and its ability to compete effectively with rivals.

Geopolitical Risks and Trade Tensions

The broader geopolitical landscape and escalating trade tensions between major economies significantly influence Apple's operations and stock price.

- Trade Wars and Escalation: The unpredictable nature of trade wars and the potential for further escalation creates uncertainty and risk for Apple's future planning and investment decisions.

- Supply Chain Disruptions: Geopolitical instability can lead to disruptions in Apple's already complex global supply chain, creating further uncertainty.

Assessing the Impact on Berkshire Hathaway's Portfolio

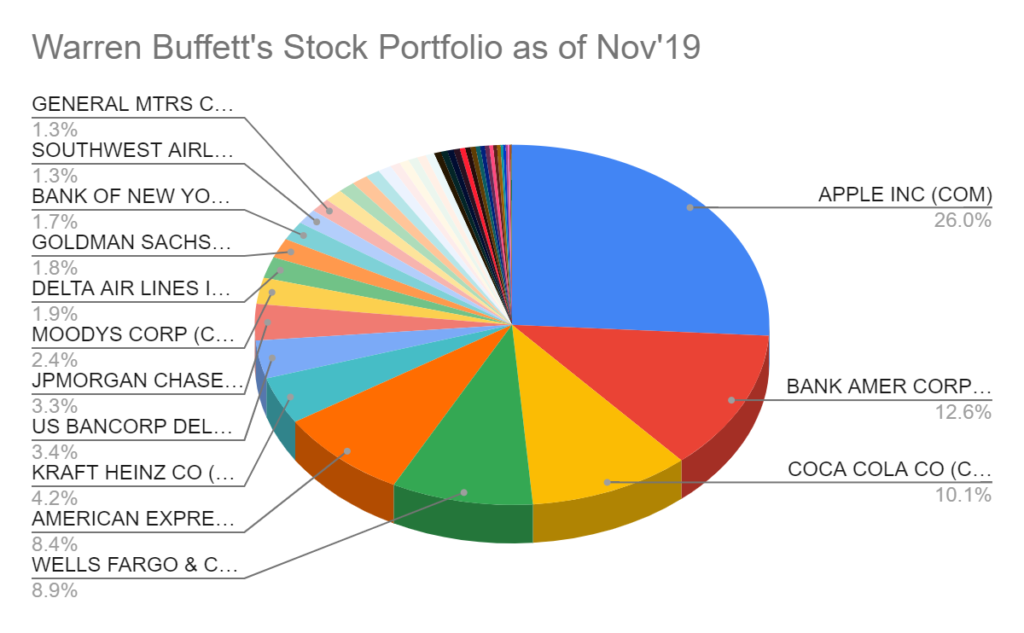

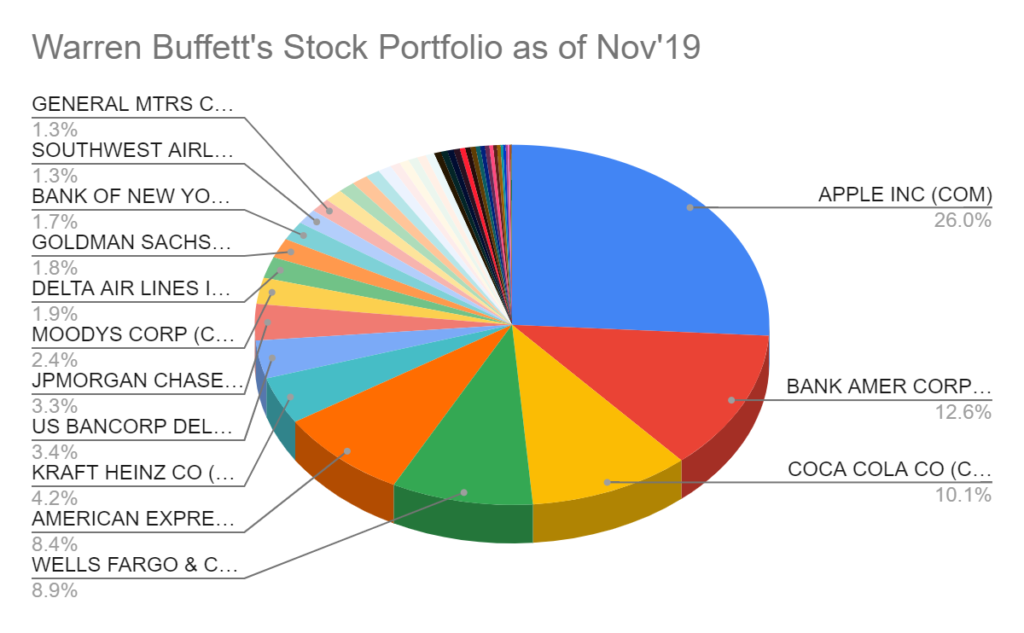

Apple represents a significant portion of Berkshire Hathaway's investment portfolio, making it a crucial factor in the overall performance of the company.

Apple's Weighting in Berkshire Hathaway's Holdings

Apple stock is a substantial holding for Berkshire Hathaway, representing a considerable percentage of its overall equity investments. A significant decline in Apple's stock price would directly and negatively impact Berkshire Hathaway's overall financial performance.

Buffett's Investment Strategy and Risk Tolerance

Warren Buffett's investment philosophy centers on long-term value investing and a preference for companies with strong fundamentals and sustainable competitive advantages. However, the tariff situation challenges his typical approach, requiring him to consider external geopolitical factors more heavily.

Diversification and Risk Mitigation

While Berkshire Hathaway boasts a highly diversified portfolio, the sheer size of its Apple investment concentrates a substantial portion of its risk within a single company heavily exposed to trade policy changes. While other significant holdings could potentially offset some losses, the scale of potential Apple losses remains a major concern.

Potential Scenarios and Future Outlook for Apple Stock

Predicting the future of Apple stock in this uncertain climate requires considering several scenarios:

Best-Case Scenario:

Apple successfully navigates the tariff challenges through diversification, cost optimization, and perhaps even negotiating favorable trade agreements. Profitability remains strong, and the stock price continues its upward trend.

Worst-Case Scenario:

Tariffs severely impact Apple's profitability and market share. Consumer demand weakens due to higher prices, and competitors gain ground. Apple's stock price experiences a significant and prolonged decline.

Most Likely Scenario:

A moderate impact is the most probable scenario. Apple will likely experience increased costs but will strive to mitigate the effects through various strategies. The stock price will likely fluctuate, reflecting the ongoing uncertainty surrounding trade policies. Close monitoring of trade negotiations and Apple's response will be critical for investors.

Conclusion: Navigating the Risks of Apple Stock and Tariffs

The impact of tariffs on Apple's stock and, consequently, Buffett's portfolio is a complex issue with significant implications. The dependence on Chinese manufacturing, the ripple effects on component suppliers, and the unpredictable nature of international trade policies all contribute to the uncertainty surrounding Apple's future performance. Monitoring trade policy developments and their effect on Apple's supply chain and financial performance is crucial for investors. Continue your research into the complexities of Apple stock and tariffs to make informed investment decisions.

Featured Posts

-

A Seattle Park A Haven During The Initial Covid 19 Outbreak

May 24, 2025

A Seattle Park A Haven During The Initial Covid 19 Outbreak

May 24, 2025 -

Apple Stock Q2 Earnings Preview Key Levels And Potential Movement

May 24, 2025

Apple Stock Q2 Earnings Preview Key Levels And Potential Movement

May 24, 2025 -

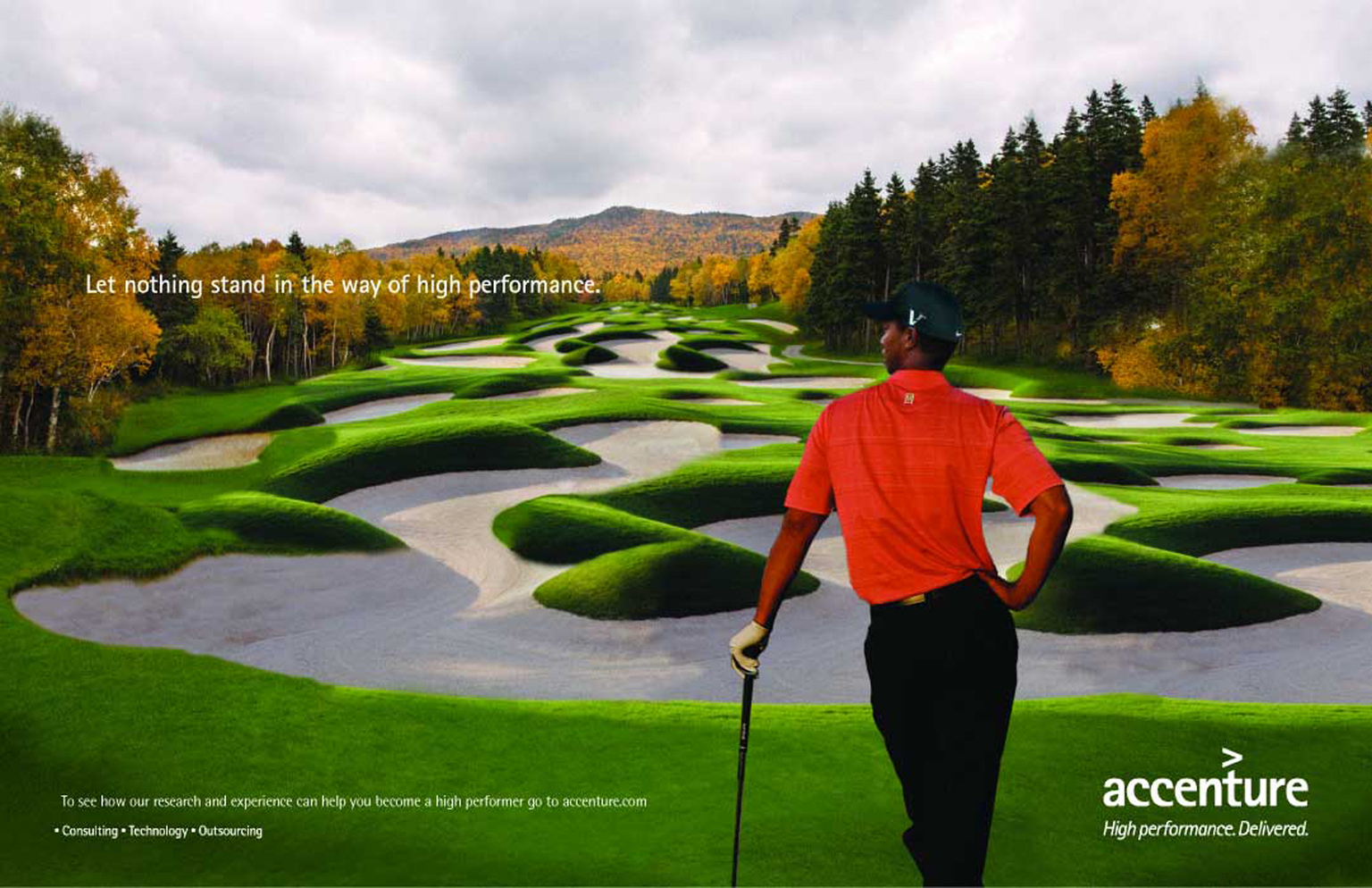

Delayed But Delivered Accenture Promotes 50 000 Staff Members

May 24, 2025

Delayed But Delivered Accenture Promotes 50 000 Staff Members

May 24, 2025 -

Bbc Radio 1 Big Weekend 2025 Sefton Park A Ticket Buyers Guide

May 24, 2025

Bbc Radio 1 Big Weekend 2025 Sefton Park A Ticket Buyers Guide

May 24, 2025 -

Bbc Radio 1 Big Weekend Tickets Your Complete Guide

May 24, 2025

Bbc Radio 1 Big Weekend Tickets Your Complete Guide

May 24, 2025

Latest Posts

-

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025

Real Estate Fallout La Fires And The Accusation Of Landlord Price Gouging

May 24, 2025 -

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025 -

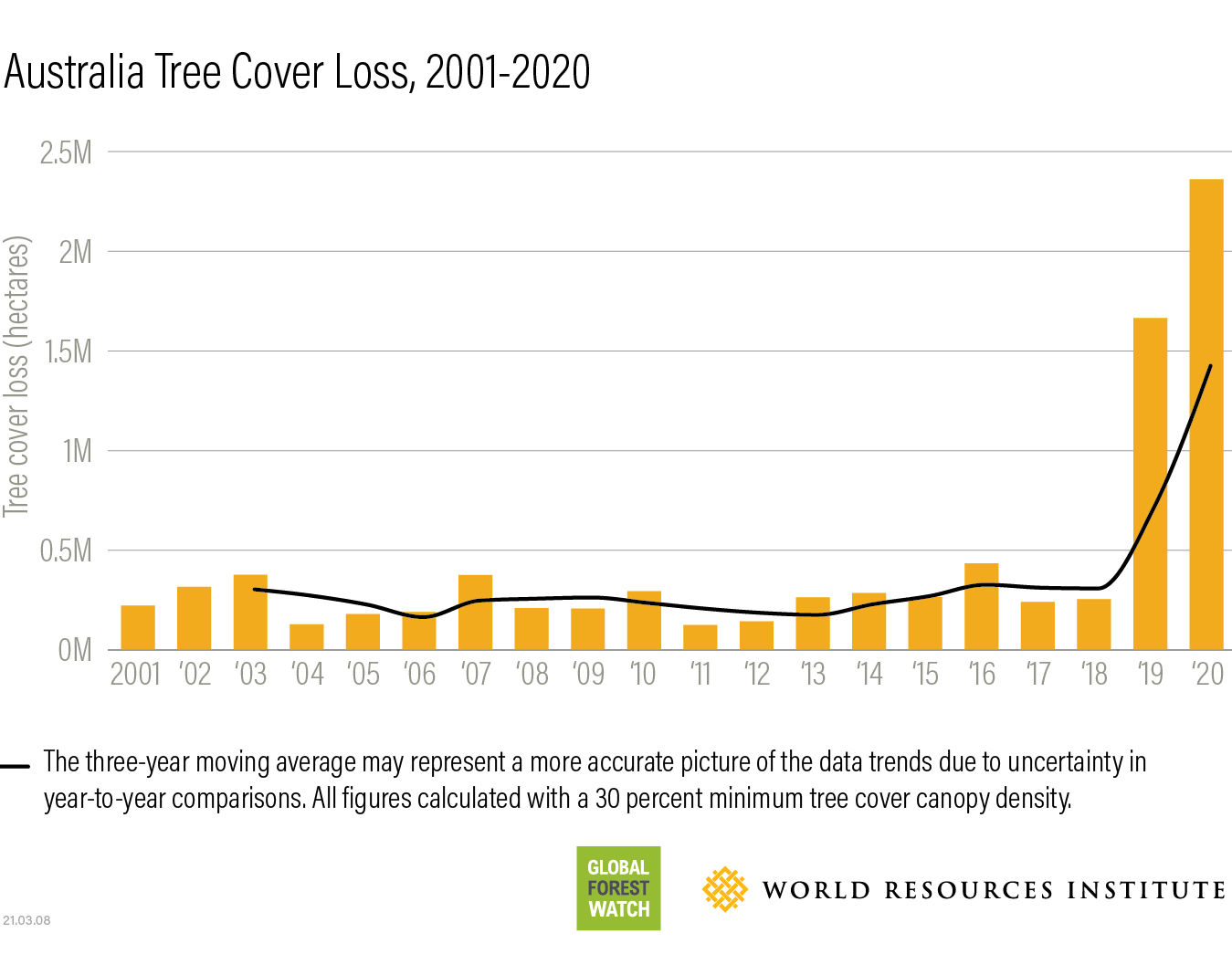

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025