Apple Stock Forecast: Q2 Earnings And Beyond

Table of Contents

Q2 Earnings Analysis: Dissecting the Numbers

Analyzing Apple's Q2 earnings is crucial for any Apple stock forecast. Several key areas will determine the overall picture.

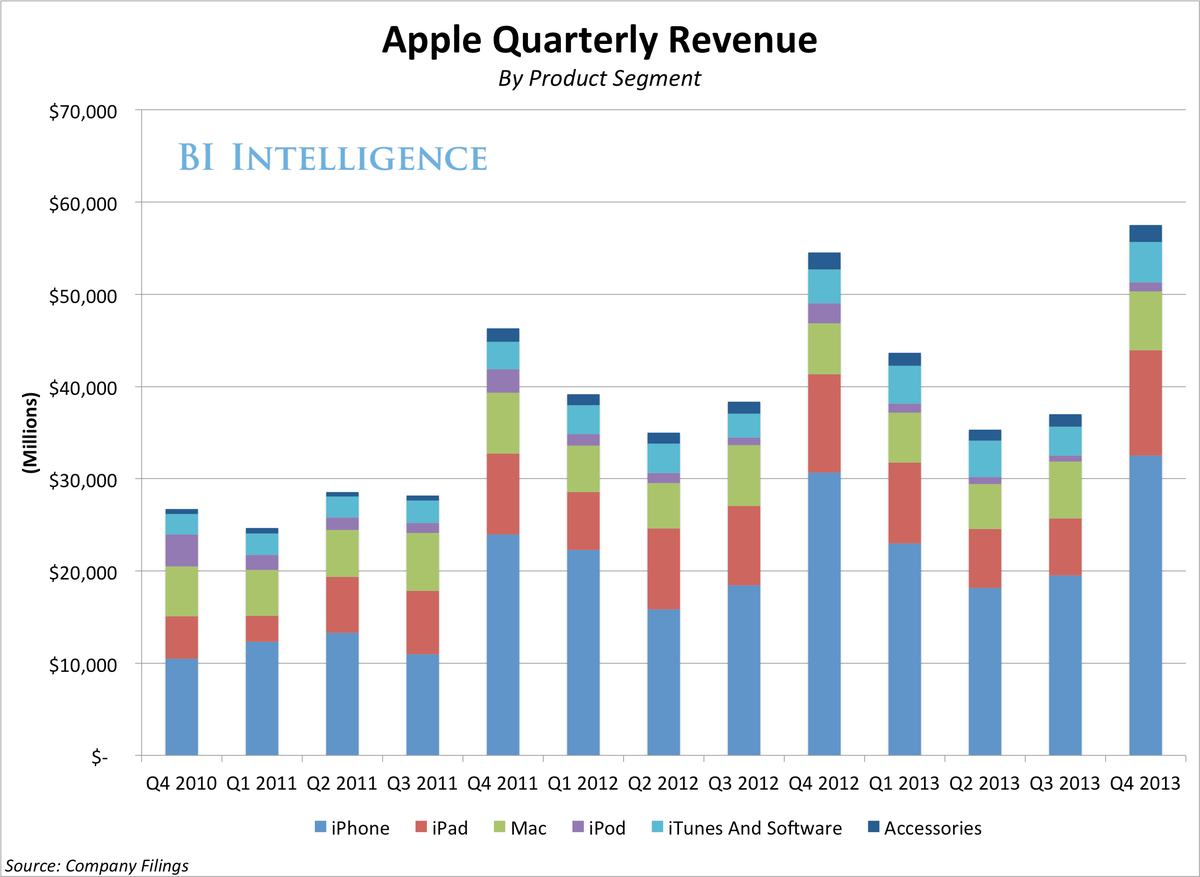

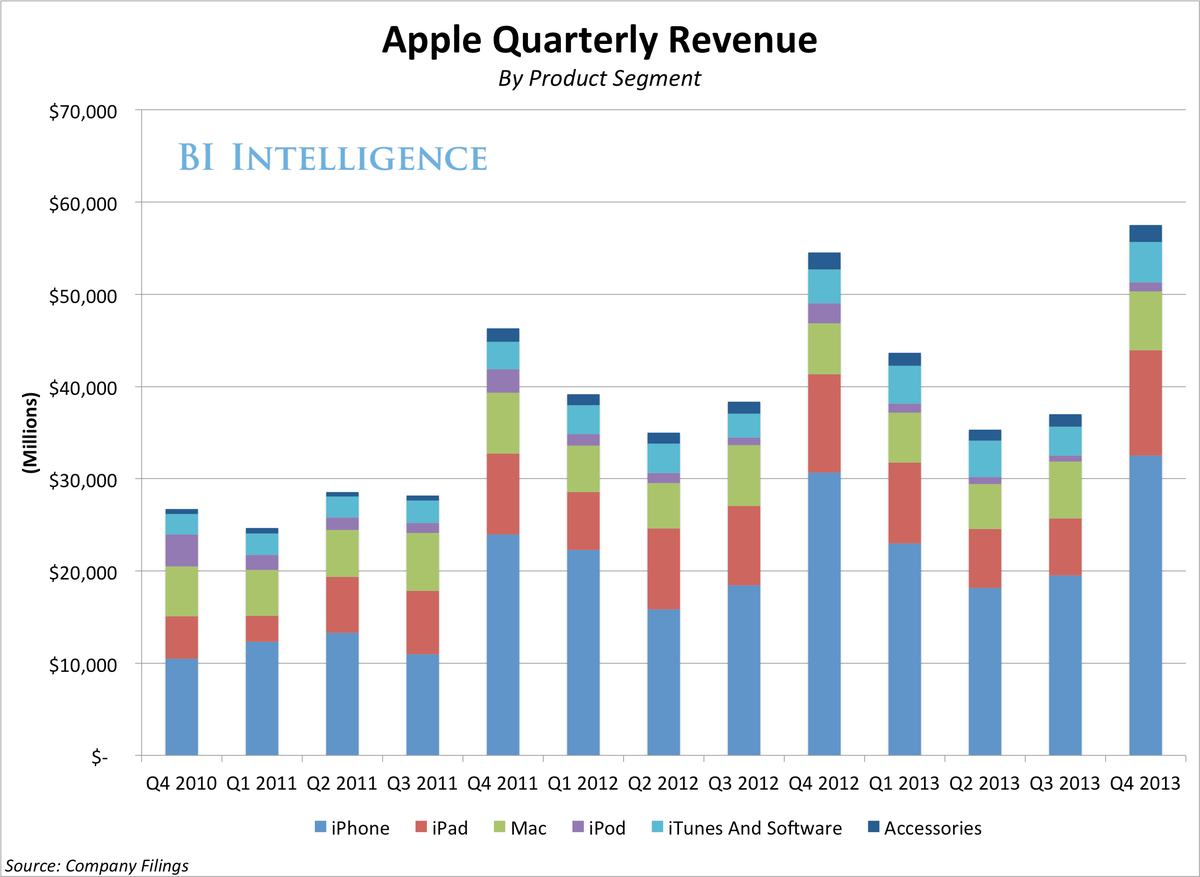

Revenue Projections and Growth

Analysts predict varying revenue figures for Apple's Q2, influenced by several factors. Let's examine these projections:

- iPhone Sales: While iPhone sales remain a significant revenue driver, growth might be moderate compared to previous years due to increased competition and potential economic slowdown. Analysts predict a range of X to Y million units sold.

- Mac Sales: The Mac segment is expected to show [positive/negative] growth, driven by [factors influencing Mac sales, e.g., new MacBook releases, market demand]. Revenue projections range from $Z to $W billion.

- Services Revenue: Apple's Services sector, including Apple Music, iCloud, and App Store, is expected to continue its strong growth trajectory. Analysts forecast a revenue increase of approximately A% to B%.

- Wearables, Home, and Accessories: This category, encompassing Apple Watch, AirPods, and other accessories, is projected to see [positive/negative] growth, influenced by [factors such as new product launches and market trends]. Revenue is expected to be in the range of $X to $Y billion.

Factors impacting overall revenue include global economic conditions, supply chain stability, and the strength of the US dollar against other currencies. A strong dollar can negatively impact international sales reported in US dollars. Comparing Q2 2024 revenue projections to Q2 2023 will reveal the year-over-year growth or decline.

Profitability and Margins

Analyzing Apple's profit margins is vital for a complete Apple stock forecast. Several aspects influence profitability:

- Component Costs: Fluctuations in the cost of components, such as chips and displays, directly impact Apple's manufacturing costs and profit margins.

- Manufacturing Efficiency: Apple's manufacturing efficiency plays a critical role in its ability to maintain or improve profit margins. Improvements in efficiency can lead to higher profitability.

- Pricing Strategies: Apple’s pricing strategies for its products significantly influence profitability. A premium pricing model allows for higher margins but can also make products less accessible to price-sensitive consumers.

- Competitor Analysis: Comparing Apple's profit margins to those of competitors like Samsung and Google reveals its relative profitability in the tech industry.

Key Metrics and Indicators

Beyond revenue and profit, several key performance indicators (KPIs) provide further insight into Apple's health:

- Active iPhone Users: The number of active iPhone users is a strong indicator of the company's customer base and future revenue potential. Increased user numbers suggest strong product adoption and loyalty.

- Services Revenue Growth: The growth rate of Apple's Services revenue demonstrates the success of its recurring revenue model and its potential for long-term growth.

- Average Selling Prices (ASPs): Tracking ASPs for iPhones and other products reveals consumer willingness to pay higher prices for premium products, impacting overall revenue and profitability.

Upcoming Product Launches and Their Impact

Anticipated product launches significantly influence any Apple stock forecast.

New Product Releases and Market Expectations

- New iPhones: The release of new iPhones typically boosts sales and revenue in the fourth quarter. Market expectations for the new models will heavily impact the Apple stock price leading up to and following the launch.

- Apple Watch Series X: New Apple Watch models are expected to contribute positively to revenue growth within the Wearables, Home, and Accessories segment.

- Potential AR/VR Headset: The highly anticipated AR/VR headset, if launched, could generate significant excitement and drive future revenue growth, though the initial impact on the stock price may depend on pricing and consumer reception.

Innovation and Future Product Roadmap

Apple's continued investment in research and development and its innovation pipeline are critical for its long-term stock performance.

- AI Integration: Apple's increasing focus on artificial intelligence across its product ecosystem suggests future growth opportunities.

- Autonomous Vehicles: Though still in early stages, Apple's rumored work on autonomous vehicle technology represents a potential long-term growth driver. However, this area carries considerable risk and uncertainty.

Macroeconomic Factors and Market Sentiment

External factors significantly impact any Apple stock forecast.

Global Economic Conditions and Their Influence

Global economic uncertainty, such as inflation, interest rate hikes, and recession risks, can significantly affect consumer spending and demand for Apple products. Economic downturns typically lead to reduced consumer spending on discretionary items like smartphones and computers. Currency fluctuations also affect Apple's international sales and profitability.

Competitor Analysis and Market Share

The competitive landscape significantly influences Apple's market share and future growth.

- Samsung: Samsung remains a major competitor, particularly in the smartphone market. Samsung's innovative products and competitive pricing pose a continuous challenge to Apple.

- Google: Google's Android operating system and its hardware offerings present another strong competitive force. Google’s dominance in search and its expansion into other areas such as smart home technology provide strong competition.

Conclusion

The Apple stock forecast for the coming months depends on multiple intertwining factors, from Q2 earnings and new product launches to broader macroeconomic conditions and competitive pressures. While the Q2 results will provide crucial immediate insights, investors should also assess Apple's long-term growth prospects fueled by ongoing innovation and its position within the global tech landscape. Carefully analyzing the key metrics and indicators discussed here is vital for making informed investment decisions concerning Apple stock. Remember to conduct thorough due diligence and consult with a financial advisor before making any investment choices related to the Apple stock forecast. Stay updated on the latest news and analysis to refine your Apple stock forecast and make sound investment choices.

Featured Posts

-

Traenen In Essen Ereignisse Rund Um Das Uniklinikum

May 25, 2025

Traenen In Essen Ereignisse Rund Um Das Uniklinikum

May 25, 2025 -

Live Updates M6 Crash Causes Significant Delays For Drivers

May 25, 2025

Live Updates M6 Crash Causes Significant Delays For Drivers

May 25, 2025 -

Pengalaman Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 25, 2025

Pengalaman Seni Dan Otomotif Porsche Indonesia Classic Art Week 2025

May 25, 2025 -

Legendas F1 Technologia Porsche Koezuti Modell

May 25, 2025

Legendas F1 Technologia Porsche Koezuti Modell

May 25, 2025 -

Are Bmw And Porsche Losing Ground In China Market Analysis And Future Outlook

May 25, 2025

Are Bmw And Porsche Losing Ground In China Market Analysis And Future Outlook

May 25, 2025

Latest Posts

-

Presidential Spending Scrutinized 100 000 Watches Marriott Parties And Official Seals

May 25, 2025

Presidential Spending Scrutinized 100 000 Watches Marriott Parties And Official Seals

May 25, 2025 -

Trumps Pressure Tactics Forcing A Republican Deal

May 25, 2025

Trumps Pressure Tactics Forcing A Republican Deal

May 25, 2025 -

The I O Io Battleground How Google And Open Ai Are Shaping The Future Of Tech

May 25, 2025

The I O Io Battleground How Google And Open Ai Are Shaping The Future Of Tech

May 25, 2025 -

Luxury And Politics An Examination Of Presidential Seals High End Watches And Exclusive Events

May 25, 2025

Luxury And Politics An Examination Of Presidential Seals High End Watches And Exclusive Events

May 25, 2025 -

Google Vs Open Ai A Deep Dive Into I O And Io Differences

May 25, 2025

Google Vs Open Ai A Deep Dive Into I O And Io Differences

May 25, 2025