Apple Stock Performance: Exceeding Q2 Expectations

Table of Contents

Q2 Earnings Beat Analyst Predictions

Apple's Q2 earnings report showcased impressive financial results, surpassing even the most optimistic analyst forecasts. The numbers paint a picture of sustained growth and a healthy financial position for the company. This strong performance is a testament to Apple’s effective strategies and enduring consumer demand for its products and services.

- EPS: Apple reported an earnings per share (EPS) of [Insert Actual EPS Figure], significantly exceeding the analyst consensus of [Insert Analyst Consensus EPS Figure]. This represents a [Insert Percentage] increase compared to the same period last year.

- Revenue Growth: Total revenue reached [Insert Actual Revenue Figure], marking a substantial year-over-year growth of [Insert Percentage]. This robust revenue growth is a clear indication of strong sales across Apple's product lines.

- Key Contributing Factors: The exceeding performance can be attributed to several factors, including the strong demand for the iPhone 14 series, increased adoption of Apple's services, and successful expansion in key geographic markets. A surprising uptick in [mention specific product or region if applicable] also contributed positively.

Strong iPhone Sales Drive Growth

The iPhone continues to be the cornerstone of Apple's success, with Q2 sales exceeding expectations. The latest iPhone 14 models, along with continued demand for older models, contributed significantly to this success. Apple's ability to maintain a strong presence in the competitive smartphone market is a critical driver of its overall financial health.

- iPhone Sales Breakdown: While a precise breakdown by model isn't always publicly released immediately, reports suggest [insert any available data on sales breakdown, e.g., strong sales of the iPhone 14 Pro Max].

- Market Share: Apple continues to hold a significant market share in the premium smartphone segment, demonstrating its brand loyalty and product appeal.

- Factors Influencing Demand: Innovative features, effective marketing campaigns, and a strong brand reputation all contribute to the sustained demand for iPhones.

Services Revenue Remains a Key Driver

Apple's services segment continues its impressive growth trajectory, showcasing the power of its recurring revenue streams. The App Store, iCloud, Apple Music, and other subscription services contribute significantly to the company's overall financial stability and long-term growth potential.

- Year-over-Year Growth: Services revenue experienced a substantial year-over-year growth of [Insert Percentage], solidifying its position as a vital component of Apple's business model.

- Key Contributing Services: The App Store remains a dominant force, but other services like iCloud and Apple Music are also experiencing strong growth, diversifying Apple's revenue streams.

- Subscription Model Impact: The success of Apple's subscription model ensures a predictable and reliable flow of revenue, reducing dependence on fluctuating product sales.

Impact on Apple Stock Price and Investor Sentiment

The strong Q2 earnings have had a positive impact on Apple's stock price and investor sentiment. The exceeding performance reflects well on Apple’s management and future prospects.

- Stock Price Movement: Following the earnings announcement, Apple's stock price experienced [Describe the stock price movement – e.g., a significant increase].

- Analyst Ratings: Many analysts have revised their price targets upwards, reflecting increased confidence in Apple's future performance.

- Investor Confidence: The positive results have bolstered investor confidence in Apple, strengthening its position as a leading tech stock.

- Potential Risks: While the outlook is positive, potential risks such as macroeconomic factors, competition, and supply chain disruptions could impact future performance.

Conclusion

Apple's Q2 earnings significantly exceeded expectations, demonstrating the company's robust financial health. Strong iPhone sales and the continuing success of its services segment were key drivers of this impressive performance. This positive outcome has boosted Apple's stock price and investor confidence, painting a promising picture for the future. Staying informed about future Apple stock performance is crucial for any investor interested in the tech sector. Consider researching further and exploring investment opportunities based on this strong Q2 showing. Understanding the factors influencing Apple stock performance is key to making informed investment decisions.

Featured Posts

-

Recenzja Porsche Cayenne Gts Coupe Plusy I Minusy

May 24, 2025

Recenzja Porsche Cayenne Gts Coupe Plusy I Minusy

May 24, 2025 -

Boosting Collaboration Bangladeshs Economic Growth Strategy In Europe

May 24, 2025

Boosting Collaboration Bangladeshs Economic Growth Strategy In Europe

May 24, 2025 -

Paris Fashion Week Amira Al Zuhairs Zimmermann Debut

May 24, 2025

Paris Fashion Week Amira Al Zuhairs Zimmermann Debut

May 24, 2025 -

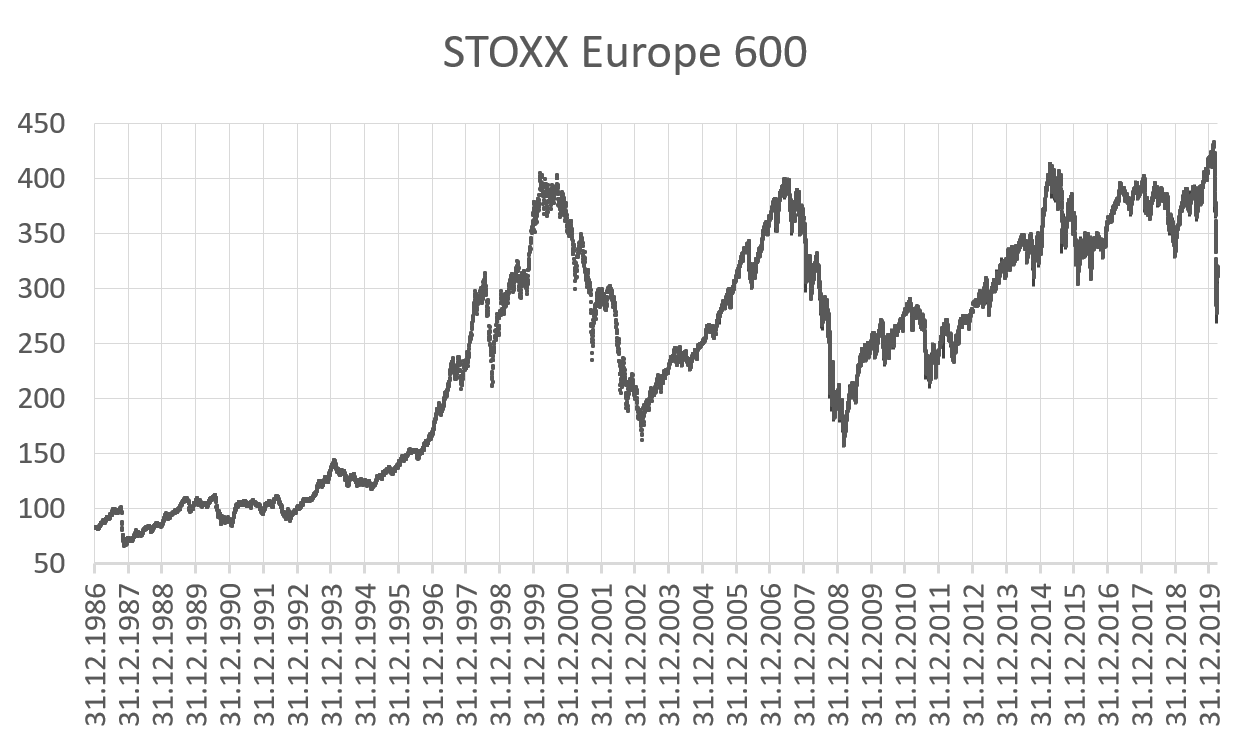

16 Nisan 2025 Avrupa Piyasalari Raporu Stoxx Europe 600 Ve Dax 40 In Duesuesue

May 24, 2025

16 Nisan 2025 Avrupa Piyasalari Raporu Stoxx Europe 600 Ve Dax 40 In Duesuesue

May 24, 2025 -

Trumps Tariff Relief Comments Boost European Stock Markets Lvmh Shares Fall

May 24, 2025

Trumps Tariff Relief Comments Boost European Stock Markets Lvmh Shares Fall

May 24, 2025

Latest Posts

-

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025

Invest Smart Discover The Countrys Top Business Locations

May 24, 2025 -

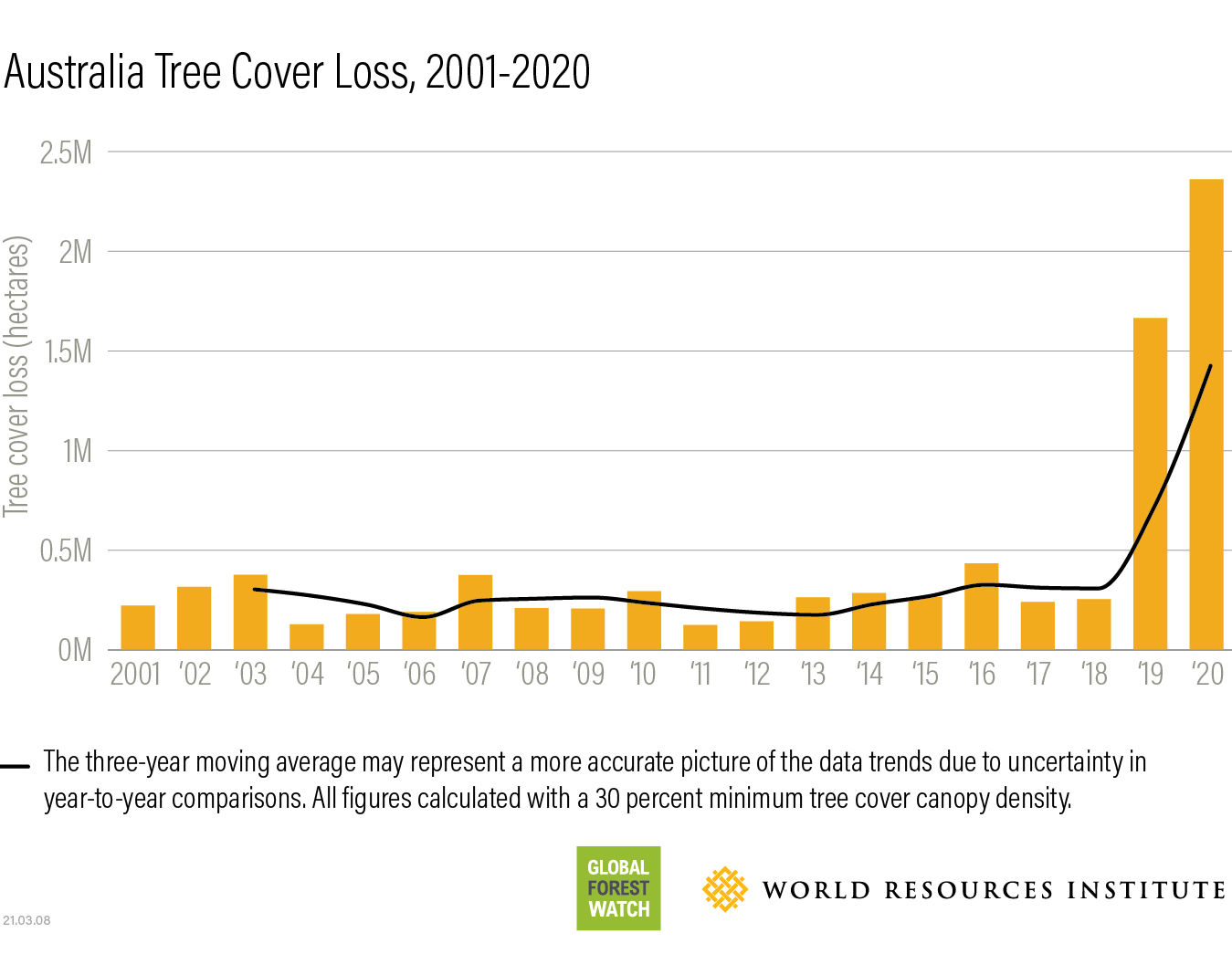

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025

The Impact Of Wildfires On Global Forest Loss A New Record Set

May 24, 2025 -

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025

Global Forest Loss Wildfires Push Destruction To Unprecedented Levels

May 24, 2025 -

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025

Record Breaking Global Forest Loss Wildfires Exacerbate The Crisis

May 24, 2025 -

Global Forest Loss Reaches Record High Wildfires Fuel The Destruction

May 24, 2025

Global Forest Loss Reaches Record High Wildfires Fuel The Destruction

May 24, 2025