Trump's Tariff Relief Comments Boost European Stock Markets; LVMH Shares Fall

Table of Contents

Positive Market Response to Tariff Relief Hints

Initial reactions to Trump's seemingly positive comments regarding potential tariff relief were overwhelmingly positive across European stock markets. Investors interpreted the remarks as a potential easing of trade tensions, leading to a surge in optimism. This positive market sentiment was reflected in significant gains across major indices.

- The FTSE 100 in London saw a notable increase of X%, while the CAC 40 in Paris jumped by Y%.

- The DAX in Frankfurt also experienced a substantial rise of Z%, reflecting widespread investor confidence.

- Investor sentiment shifted dramatically, with speculation rife about a potential de-escalation of the ongoing trade war.

- This optimism stemmed largely from the belief that decreased trade tensions would boost economic activity, particularly benefiting export-oriented industries and the broader consumer goods sector.

The sectors that benefited most from this positive news included consumer discretionary, particularly luxury goods and automotive manufacturing. These export-oriented industries are highly sensitive to international trade policies and stood to gain significantly from reduced tariffs.

LVMH's Contrasting Performance: A Deeper Dive

Despite the overall positive market response, LVMH, the world's largest luxury goods company, experienced a decline in its share price. This divergence from the broader market trend highlights the complexities of market reactions and the importance of analyzing company-specific factors alongside macro-economic influences.

- LVMH's significant exposure to the US market, a key consumer base for its luxury brands, likely contributed to the downturn. Previous tariff impacts may have also played a role.

- The company's dependence on US consumer spending makes it particularly vulnerable to shifts in the US economy and any lingering uncertainty about future trade relations.

- While no specific financial reports were released on the day to justify the drop, some analysts suggested that pre-existing concerns about slowing luxury goods sales might have been exacerbated by the lingering uncertainty.

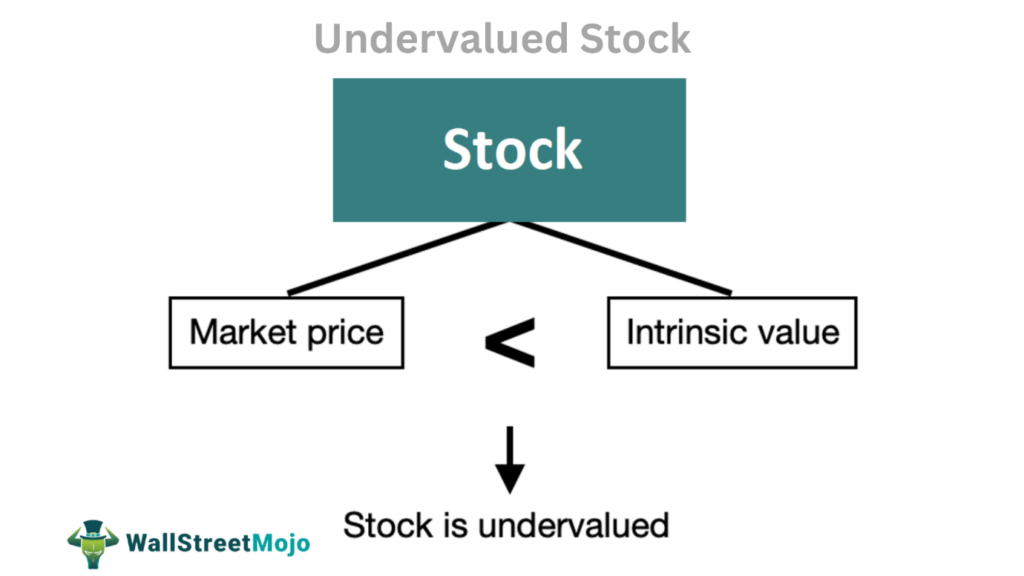

This disconnect between LVMH's performance and the overall market upturn illustrates the importance of understanding market divergence and the impact of stock-specific factors. Simply relying on broad market trends can lead to inaccurate assessments of individual stock performance.

Analyzing the Volatility and Future Implications

The sharp market fluctuations in response to Trump's comments underscore the inherent volatility of the stock market when reacting to political pronouncements. Understanding the nuances of such statements and their potential impact is crucial for investors.

- Political statements, especially those concerning international trade, can be easily misinterpreted or subject to rapid changes, leading to periods of significant market volatility.

- The unpredictability of trade negotiations and their effects on global markets necessitates a cautious approach to investment strategies.

- A long-term investment strategy, focused on fundamental analysis and diversified holdings, is often recommended to mitigate the risk associated with political uncertainty.

Several leading financial analysts have voiced caution, suggesting that the market's positive reaction may be premature and that significant uncertainty remains regarding the future direction of US trade policy. Long-term investors are urged to maintain a watchful eye on further developments.

Conclusion: Understanding the Impact of Trump's Tariff Relief Comments

In summary, Trump's comments initially boosted European stock markets, but LVMH's contrasting performance illustrates that company-specific factors can significantly impact individual stocks, even amidst broader market trends. The market's volatile response highlights the importance of careful analysis and a long-term investment strategy.

Understanding the complexities of global trade relations and their impact on investment strategies is paramount. Stay informed on the latest developments regarding Trump tariffs and their implications for European stock markets and individual stocks like LVMH. To make informed investment decisions, consider utilizing resources such as reputable financial news outlets, market analysis reports, and consulting with financial advisors. Keep abreast of the latest developments surrounding Trump tariffs and their effect on your portfolio.

Featured Posts

-

News Corps Hidden Value Why Its Undervalued And Underappreciated

May 24, 2025

News Corps Hidden Value Why Its Undervalued And Underappreciated

May 24, 2025 -

Could Kyle Walker Peters Join Crystal Palace Free Transfer Speculation

May 24, 2025

Could Kyle Walker Peters Join Crystal Palace Free Transfer Speculation

May 24, 2025 -

Hmlt Mdahmat Waset Alntaq Llshrtt Alalmanyt Dd Mshjeyn

May 24, 2025

Hmlt Mdahmat Waset Alntaq Llshrtt Alalmanyt Dd Mshjeyn

May 24, 2025 -

L Impatto Dei Dazi Sugli Abiti Made In Usa Prezzi E Tendenze

May 24, 2025

L Impatto Dei Dazi Sugli Abiti Made In Usa Prezzi E Tendenze

May 24, 2025 -

Mathieu Avanzi Le Francais Une Langue Vivante Et Accessible A Tous

May 24, 2025

Mathieu Avanzi Le Francais Une Langue Vivante Et Accessible A Tous

May 24, 2025

Latest Posts

-

Dispute Over Dylan Farrows Accusations Sean Penns Perspective

May 24, 2025

Dispute Over Dylan Farrows Accusations Sean Penns Perspective

May 24, 2025 -

Dylan Farrow And Woody Allen Sean Penn Weighs In

May 24, 2025

Dylan Farrow And Woody Allen Sean Penn Weighs In

May 24, 2025 -

Sean Penns View On The Dylan Farrow Woody Allen Case

May 24, 2025

Sean Penns View On The Dylan Farrow Woody Allen Case

May 24, 2025 -

Dylan Farrows Woody Allen Accusations Sean Penns Skepticism

May 24, 2025

Dylan Farrows Woody Allen Accusations Sean Penns Skepticism

May 24, 2025 -

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claims Against Woody Allen

May 24, 2025

Sean Penn Casts Doubt On Dylan Farrows Sexual Assault Claims Against Woody Allen

May 24, 2025