Apple Stock Prediction: Analyst Targets $254 – Is It A Buy At $200?

Table of Contents

Analyst Predictions and Their Rationale

Several analysts have issued bullish predictions for Apple stock, with target prices ranging towards $254. These predictions are based on a variety of factors, reflecting a generally positive outlook for the company's future performance. Let's examine some key predictions and their underlying rationale:

-

Analyst A (Morgan Stanley): Target Price $260. Their rationale points to strong iPhone 15 sales projections, exceeding initial estimates, coupled with sustained growth in the Apple Services sector. This segment, encompassing Apple Music, iCloud, and the App Store, continues to demonstrate robust revenue generation and user engagement.

-

Analyst B (Goldman Sachs): Target Price $255. This prediction emphasizes the potential success of Apple's foray into augmented reality (AR) and virtual reality (VR) with the Apple Vision Pro headset. They anticipate significant market share gains in this emerging technology sector, driving substantial future revenue streams for Apple. Expansion into new markets and services is also a key factor in their positive outlook for Apple stock.

-

Analyst C (Bank of America): Target Price $245. Bank of America's prediction is underpinned by Apple's consistent market share gains across various product categories, coupled with the anticipated success of upcoming product launches. Their analysis suggests that Apple's innovative capabilities and strong brand loyalty will continue to fuel its growth trajectory. This makes Apple stock a compelling investment opportunity in their view.

Keywords: Apple stock price prediction, Apple stock analyst ratings, AAPL stock forecast, Apple stock target price

Factors Influencing Apple Stock Price

Numerous factors influence Apple's stock price, encompassing macroeconomic conditions, the company's financial performance, and competitive dynamics. Understanding these elements is crucial for accurate Apple stock prediction.

Macroeconomic factors such as interest rate hikes and inflation impact consumer spending. Higher interest rates can curb borrowing and investment, potentially slowing demand for Apple products. Conversely, inflation could impact Apple’s manufacturing and supply chain costs.

Apple’s recent financial performance has been largely positive. Strong iPhone sales continue to be a major revenue driver. However, analysts are closely watching the performance of newer product categories and the growth trajectory of Apple Services.

-

Impact of iPhone sales on overall revenue: iPhone sales remain a significant component of Apple’s total revenue, making them a key indicator of overall financial health. Fluctuations in iPhone sales directly impact Apple stock prices.

-

Growth potential of Apple's services sector (Apple Music, iCloud, App Store): The services sector offers a recurring revenue stream and high profit margins, mitigating the reliance on hardware sales alone. This segment is expected to continue to grow significantly.

-

Competition from other tech companies (Samsung, Google): Intense competition from Samsung in the smartphone market and Google in the services space presents a challenge to Apple’s continued dominance.

-

Innovation and new product launches (Apple Vision Pro, future product roadmap): Apple's ability to innovate and introduce compelling new products is vital for sustaining growth. The success of the Apple Vision Pro will be a significant factor influencing future Apple stock price movements.

Keywords: Apple financial performance, Apple revenue growth, Apple services revenue, Apple competition, Apple innovation

Risks and Potential Downsides

While the outlook for Apple stock is generally positive, several potential risks could negatively impact its performance. A prudent Apple stock investment strategy requires careful consideration of these factors.

-

Potential impact of a global recession on consumer spending: A global economic downturn could significantly reduce consumer spending on discretionary items like smartphones and other Apple products, impacting the company’s revenue and profitability.

-

Risks associated with dependence on iPhone sales: Apple's heavy reliance on iPhone sales makes it vulnerable to fluctuations in smartphone market demand. Diversification into other product categories is crucial to mitigate this risk.

-

Regulatory scrutiny and potential antitrust concerns: Increased regulatory scrutiny and potential antitrust investigations could impose significant financial and operational challenges for Apple.

-

Competition in the emerging AR/VR market: While the Apple Vision Pro offers significant potential, the AR/VR market is rapidly evolving with intense competition from established players and new entrants.

Keywords: Apple stock risk, Apple stock volatility, Apple investment risk, Apple regulatory risk

Valuation and Comparative Analysis

Assessing Apple's valuation relative to its competitors is crucial for determining whether the current price reflects its growth potential. Comparing key metrics like the Price-to-Earnings (P/E) ratio and Price/Earnings to Growth (PEG) ratio with similar companies provides valuable insights into whether Apple stock is currently overvalued or undervalued. Analyzing these factors alongside the Apple stock prediction from various analysts will assist in a more informed investment decision.

Keywords: Apple stock valuation, Apple P/E ratio, Apple stock comparison

Conclusion

This analysis reveals a mixed picture for Apple stock. While several analysts predict a significant surge in Apple stock price, reaching targets around $254, driven by strong iPhone sales, growth in services, and the potential success of new products like the Apple Vision Pro, substantial risks remain. Macroeconomic factors, intense competition, and regulatory concerns could negatively impact Apple's performance.

Ultimately, the decision of whether to buy Apple stock at its current price is a personal one. Conduct thorough research and consult with a financial advisor before making any investment decisions related to Apple stock predictions and AAPL share prices. Remember that past performance is not indicative of future results.

Featured Posts

-

Dazi Stati Uniti Prezzi Moda 2024 Guida Completa

May 24, 2025

Dazi Stati Uniti Prezzi Moda 2024 Guida Completa

May 24, 2025 -

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025

Ces Unveiled Europe A Amsterdam Un Apercu Des Innovations Technologiques

May 24, 2025 -

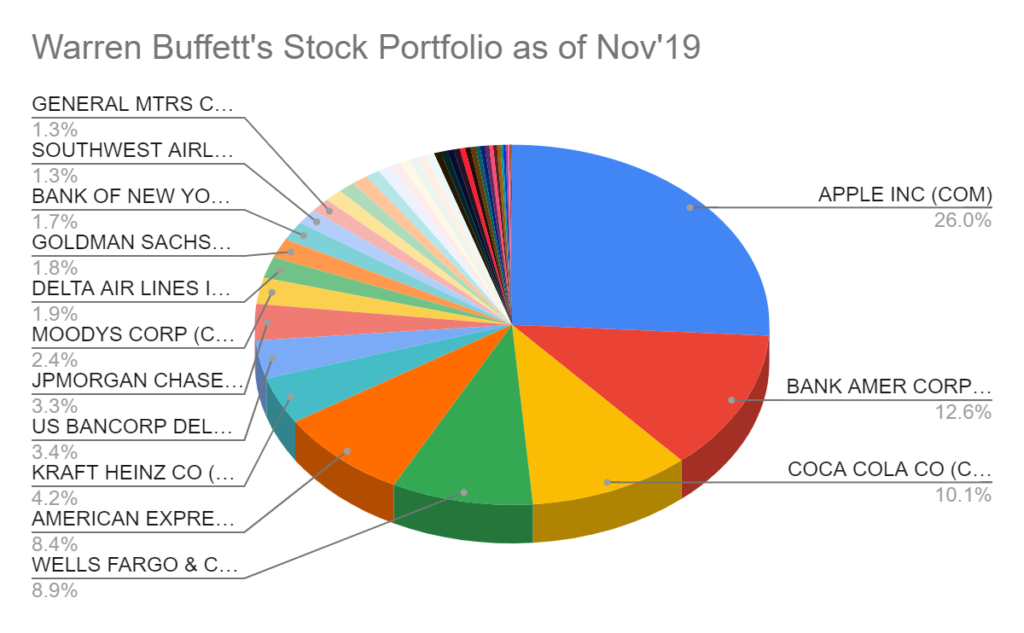

Apple Stock And Tariffs Assessing The Risk To Buffetts Portfolio

May 24, 2025

Apple Stock And Tariffs Assessing The Risk To Buffetts Portfolio

May 24, 2025 -

Investing In Amundi Msci World Ii Ucits Etf Dist Monitoring The Nav

May 24, 2025

Investing In Amundi Msci World Ii Ucits Etf Dist Monitoring The Nav

May 24, 2025 -

Imcd N V Agm All Resolutions Passed By Shareholders

May 24, 2025

Imcd N V Agm All Resolutions Passed By Shareholders

May 24, 2025

Latest Posts

-

Tutumlu Olmak Icin 3 Burctan Ilham Alin Para Tasarruf Ipuclari

May 24, 2025

Tutumlu Olmak Icin 3 Burctan Ilham Alin Para Tasarruf Ipuclari

May 24, 2025 -

Babalarin En Cok Yaktigi Erkek Burclari Guevenilir Calkantili Ve Sadik Midirlar

May 24, 2025

Babalarin En Cok Yaktigi Erkek Burclari Guevenilir Calkantili Ve Sadik Midirlar

May 24, 2025 -

En Az Harcayan 3 Burc Maddi Guevenligin Sirri

May 24, 2025

En Az Harcayan 3 Burc Maddi Guevenligin Sirri

May 24, 2025 -

Financial Strain Leads To Increased Auto Theft In Canada A Growing Concern

May 24, 2025

Financial Strain Leads To Increased Auto Theft In Canada A Growing Concern

May 24, 2025 -

Paradan Tasarruf Etmeyi Seven 3 Burc Oezellikleri Ve Ipuclari

May 24, 2025

Paradan Tasarruf Etmeyi Seven 3 Burc Oezellikleri Ve Ipuclari

May 24, 2025