Are High Stock Market Valuations A Concern? BofA Says No.

Table of Contents

BofA's Arguments Against High Valuation Concerns

BofA's optimistic stance on current market valuations rests on several key pillars. Their analysis suggests that the seemingly high valuations are justified by a confluence of factors, mitigating the immediate risk of a significant correction.

The Role of Low Interest Rates

Historically low interest rates play a significant role in supporting higher stock valuations. This is because:

- Inverse Relationship: Interest rates and stock valuations typically exhibit an inverse relationship. Lower interest rates reduce the cost of borrowing for companies, leading to increased investments and ultimately higher earnings. This makes higher price-to-earnings (P/E) ratios more justifiable, as the discount rate used in valuation models is lower.

- Quantitative Easing (QE): The impact of quantitative easing (QE) policies implemented by central banks globally has been to drastically lower interest rates, injecting liquidity into the market and driving up asset prices, including stocks.

- Time Value of Money: Low interest rates reduce the time value of money, meaning future earnings are discounted less heavily. This increases the present value of future cash flows, supporting higher valuations. Discounted cash flow (DCF) analysis, a common valuation method, is directly impacted by interest rates.

Strong Corporate Earnings and Profit Growth

Underlying the high valuations is strong corporate performance. Robust earnings and profit growth provide a solid foundation for justifying higher stock prices.

- Recent Data: Recent financial reports reveal sustained growth across numerous sectors, demonstrating the health of the corporate sector. (Note: Specific data points and sources should be inserted here for accuracy and SEO value – e.g., "According to [Source], S&P 500 earnings grew by X% in Q[Quarter] [Year].").

- Growth Sectors: Tech, healthcare, and consumer discretionary sectors, among others, have been significant drivers of this growth, fueled by technological innovation and increased consumer spending.

- Global Expansion: Global economic expansion, particularly in emerging markets, has also contributed to the increased profitability of many multinational corporations.

Long-Term Growth Prospects

BofA's optimistic outlook extends beyond the current economic climate; they see promising long-term growth prospects.

- Technological Innovation: Continuous advancements in technology are expected to drive productivity gains and create new economic opportunities, fostering further growth.

- Emerging Markets: Emerging markets represent a significant source of future growth potential, offering vast untapped opportunities for businesses.

- Sectoral Expansion: Specific sectors, such as renewable energy and sustainable technologies, are poised for significant expansion, driven by increasing demand and government initiatives.

- Uncertainties and Risks: It's crucial to acknowledge that unforeseen economic downturns, geopolitical instability, and other risks could negatively impact this growth.

Counterarguments and Potential Risks

While BofA's argument presents a compelling case, it's essential to consider potential counterarguments and risks.

Valuation Metrics and Their Limitations

Commonly used valuation metrics, such as P/E ratios, have limitations:

- Industry Specificity: Comparing P/E ratios across different industries can be misleading, as growth rates and risk profiles vary significantly.

- Sectoral Comparisons: A more robust analysis requires comparing valuations within specific sectors, accounting for industry-specific factors.

- Accounting Practices: Accounting practices can influence reported earnings, affecting the accuracy of valuation metrics.

Geopolitical and Economic Uncertainty

Several factors could undermine the optimistic outlook:

- Inflation: Persistently high inflation could erode corporate profits and negatively impact stock valuations.

- Rising Interest Rates: A reversal of current low interest rate policies could lead to higher borrowing costs for businesses, dampening investment and growth.

- Geopolitical Instability: Geopolitical events, such as wars or trade disputes, can create uncertainty and negatively impact market sentiment.

- Economic Downturns: Unexpected economic slowdowns or recessions could trigger a sharp decline in stock prices.

Market Bubbles and Corrections

Despite BofA's optimism, the possibility of a market correction remains:

- Historical Context: History shows that periods of rapid market growth are often followed by corrections.

- Potential Triggers: Unforeseen economic shocks, a sudden shift in interest rate policies, or a loss of investor confidence could trigger a correction.

- Risk Management: Investors should implement appropriate risk management strategies, including diversification and stop-loss orders, to mitigate potential losses.

Navigating High Stock Market Valuations – A Balanced Perspective

BofA's optimistic outlook on high stock market valuations rests on low interest rates, strong corporate earnings, and promising long-term growth prospects. However, potential counterarguments include limitations in valuation metrics, geopolitical and economic uncertainty, and the ever-present risk of market corrections. While BofA offers a compelling argument, understanding the nuances of high stock market valuations is crucial for informed investment decisions. Conduct thorough research and develop a diversified strategy to navigate this complex market. Remember to consider both the optimistic outlook and the potential risks associated with high stock market valuations before making any investment decisions.

Featured Posts

-

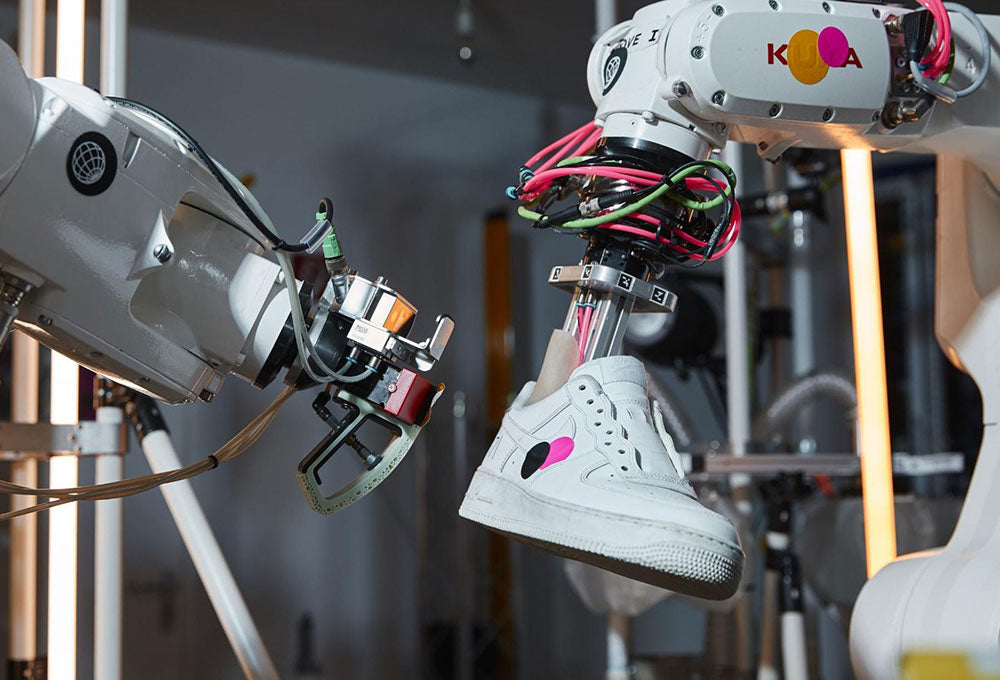

Why Nike Sneaker Production Remains A Challenge For Robots

Apr 22, 2025

Why Nike Sneaker Production Remains A Challenge For Robots

Apr 22, 2025 -

Live Stock Market Updates Dow Futures Drop Dollar Slides On Trade Worries

Apr 22, 2025

Live Stock Market Updates Dow Futures Drop Dollar Slides On Trade Worries

Apr 22, 2025 -

Deadly Russian Air Strikes On Ukraine Us Peace Efforts Face Challenges

Apr 22, 2025

Deadly Russian Air Strikes On Ukraine Us Peace Efforts Face Challenges

Apr 22, 2025 -

Review Razer Blade 16 2025 Ultra Performance Ultra Price Tag

Apr 22, 2025

Review Razer Blade 16 2025 Ultra Performance Ultra Price Tag

Apr 22, 2025 -

Navigate The Private Credit Boom 5 Dos And Don Ts For Job Seekers

Apr 22, 2025

Navigate The Private Credit Boom 5 Dos And Don Ts For Job Seekers

Apr 22, 2025