Are High Stock Market Valuations A Concern? BofA's View

Table of Contents

BofA's Current Market Assessment

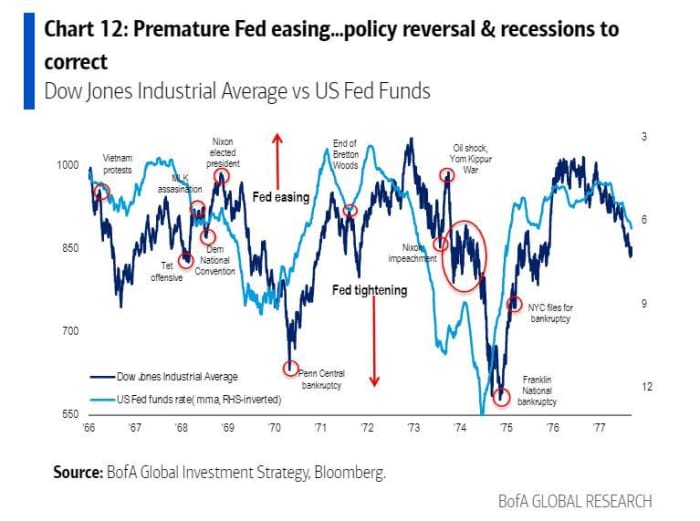

BofA's current market assessment [State BofA's overall sentiment: e.g., cautiously optimistic, moderately bearish, etc.]. While acknowledging the elevated valuation levels, BofA's recent reports, such as [mention specific report titles or dates], suggest [summarize BofA's main arguments. Are they concerned about a significant correction? Do they see opportunities within specific sectors?]. Their analysis relies heavily on key indicators to gauge market health.

- Key Valuation Indicators: BofA utilizes metrics like the Price-to-Earnings (P/E) ratio, the cyclically adjusted price-to-earnings ratio (CAPE or Shiller PE ratio), and other valuation multiples to assess market valuations across various sectors. They also consider factors like dividend yields and interest rate spreads.

- Sector-Specific Analysis: BofA often identifies specific sectors as overvalued or undervalued. For example, [mention specific sectors BofA has highlighted in recent reports, e.g., "they've flagged technology stocks as potentially overvalued while expressing more optimism about the energy sector"].

- Market Trajectory Prediction: BofA's short-term and long-term market predictions [summarize BofA's predicted market movement, e.g., "suggest a period of consolidation followed by moderate growth in the long term," or "foresee potential downside risks in the near term"].

Factors Contributing to High Stock Market Valuations

Several macroeconomic factors contribute to the current high stock market valuations.

-

Low Interest Rates: Historically low interest rates have fueled borrowing and investment, pushing up asset prices, including stocks. Lower borrowing costs make it cheaper for companies to expand and for investors to leverage their investments, driving up demand and prices.

-

Inflation and Economic Growth: While inflation erodes purchasing power, moderate economic growth can support higher corporate earnings, justifying higher stock valuations. The interplay between these two factors is a key area of BofA's analysis.

-

Investor Sentiment and Market Psychology: Positive investor sentiment and a "fear of missing out" (FOMO) can inflate asset prices beyond their intrinsic value, leading to speculative bubbles. BofA considers this psychological element in its overall assessment.

-

Technological Advancements and Disruptive Innovation: The rapid pace of technological change and the emergence of disruptive innovations can significantly impact stock valuations, particularly in growth-oriented sectors. Companies with strong growth prospects often command higher valuations, even if current earnings are modest.

-

For example, the rise of AI and other technological advancements has fueled significant investment in certain tech companies, driving up valuations even in the face of potential economic slowdown.

Risks Associated with High Stock Market Valuations

Investing in a highly valued market presents several risks.

-

Increased Risk of Correction: High valuations often precede market corrections or crashes. A sharp decline in asset prices can significantly impact investor portfolios. BofA likely addresses the probability and potential magnitude of such a correction in its analyses.

-

Reduced Returns: The higher the initial valuation, the lower the potential for future returns. Investors might see smaller gains or even losses if valuations revert to more historically average levels.

-

Market Bubbles and Potential Bursts: History is replete with examples of market bubbles driven by speculative excess, followed by sharp corrections. BofA carefully assesses the risk of a similar scenario playing out in the current market.

-

Geopolitical and Economic Risks: Unforeseen geopolitical events (e.g., wars, political instability) or adverse economic shocks (e.g., recessions, supply chain disruptions) can trigger significant market declines, especially in an already highly valued market.

- Examples of historical market crashes linked to high valuations include [mention specific examples, e.g., the Dot-com bubble burst of 2000, the 2008 financial crisis].

BofA's Recommendations for Investors

Based on their analysis, BofA likely provides specific recommendations for investors.

-

Investment Strategies: BofA might suggest strategies like sector rotation (shifting investments from overvalued to undervalued sectors), value investing (focusing on undervalued companies), or hedging against market risk.

-

Specific Asset Classes and Stocks: BofA might highlight specific stocks or asset classes they deem attractive or caution investors against. However, it's crucial to remember that this is general market commentary, not personalized financial advice.

-

Risk Tolerance: Recommendations should vary based on individual investor risk tolerance. BofA likely caters advice to both risk-averse and aggressive investors.

- For example, a risk-averse investor might be advised to maintain a diversified portfolio with a focus on defensive stocks and bonds, while a more aggressive investor could be encouraged to consider selectively adding exposure to growth sectors, while maintaining a cautious approach to high-valuation areas.

Conclusion: Navigating High Stock Market Valuations: A BofA-Informed Approach

In summary, BofA's perspective on high stock market valuations [reiterate BofA's main findings – are they concerned, optimistic, or somewhere in between?]. They consider various macroeconomic factors, investor sentiment, and potential risks in forming their assessment. Their recommendations often emphasize the importance of diversification, careful risk management, and a thorough understanding of individual investment goals before making decisions. Remember, this article summarizes BofA's general market analysis; it's crucial to conduct thorough independent research and consider seeking professional financial advice tailored to your specific circumstances before making any investment decisions related to high stock market valuations. Stay informed about changes in market valuations and adjust your investment strategy accordingly.

Featured Posts

-

Spring 2025 Country Music Festivals A Comprehensive Guide For Music Lovers

Apr 25, 2025

Spring 2025 Country Music Festivals A Comprehensive Guide For Music Lovers

Apr 25, 2025 -

Putin Faces Criticism From Trump After Kyiv Attacks

Apr 25, 2025

Putin Faces Criticism From Trump After Kyiv Attacks

Apr 25, 2025 -

Jets 2025 Draft Strategy Needs Assessment Draft Pick Projections And Potential Players

Apr 25, 2025

Jets 2025 Draft Strategy Needs Assessment Draft Pick Projections And Potential Players

Apr 25, 2025 -

Chinas Resilience Xis Strategy For A Lengthy Trade War With The Us

Apr 25, 2025

Chinas Resilience Xis Strategy For A Lengthy Trade War With The Us

Apr 25, 2025 -

Brian Tyree Henry And Wagner Moura Impersonate Dea Agents In Dope Thief Trailer

Apr 25, 2025

Brian Tyree Henry And Wagner Moura Impersonate Dea Agents In Dope Thief Trailer

Apr 25, 2025

Latest Posts

-

Bof As Take Why Stretched Stock Market Valuations Shouldnt Worry Investors

Apr 26, 2025

Bof As Take Why Stretched Stock Market Valuations Shouldnt Worry Investors

Apr 26, 2025 -

Are High Stock Market Valuations A Cause For Concern Bof A Says No

Apr 26, 2025

Are High Stock Market Valuations A Cause For Concern Bof A Says No

Apr 26, 2025 -

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025 -

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025 -

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025