BofA's Take: Why Stretched Stock Market Valuations Shouldn't Worry Investors

Table of Contents

Understanding BofA's Perspective on Current Market Valuations

BofA's recent reports haven't explicitly declared high valuations as a reason for immediate concern. Instead, their analysts tend to emphasize the interplay of various economic factors influencing the current market conditions. They often highlight the need for a nuanced approach, considering not just the price-to-earnings ratio (P/E) but also broader economic indicators and future growth potential.

The Role of Low Interest Rates

Historically low interest rates significantly impact stock market valuation and investor behavior. This impacts investment strategy decisions significantly.

- Inverse Relationship: Low interest rates make bonds less attractive, pushing investors towards higher-yielding assets like stocks. This increased demand drives up stock prices, contributing to higher valuations.

- Relative Attractiveness: When interest rates are low, the opportunity cost of investing in stocks is lower, making them a more appealing option compared to fixed-income investments.

- Quantitative Easing (QE): Central banks' QE programs inject liquidity into the market, further boosting stock prices and potentially inflating valuations. This increased liquidity fuels market activity and can lead to higher valuations, regardless of fundamentals.

The Importance of Long-Term Growth Potential

BofA's perspective likely emphasizes the importance of long-term economic growth prospects. Their analysts probably focus on the potential for future earnings growth, which can justify, to some extent, current elevated valuations.

- Growth Sectors: BofA might highlight sectors like technology, renewable energy, and healthcare as offering significant long-term growth potential. These sectors are often characterized by innovation and expansion, driving future earnings increases.

- Technological Innovation: The continued pace of technological advancements fuels productivity gains and creates new opportunities, supporting long-term earnings growth across various industries.

- Justifying High Valuations: If analysts project robust long-term earnings growth, even high current valuations can be seen as justifiable, representing the market's anticipation of future profits.

Factors Mitigating the Risk of a Market Correction

While acknowledging the elevated valuations, BofA likely points to several mitigating factors that lessen the immediate risk of a significant market correction.

Strong Corporate Earnings

Robust corporate earnings play a crucial role in supporting current stock market valuations. Many companies have demonstrated impressive resilience, even amidst global uncertainty.

- High-Performing Sectors: Strong earnings in sectors like technology and consumer staples, for example, demonstrate the underlying strength of the economy and bolster investor confidence.

- Earnings Growth vs. P/E Ratios: Earnings growth can offset high P/E ratios, making high valuations less alarming. If earnings are growing faster than stock prices, the P/E ratio will eventually decrease.

- Individual Stock Analysis: BofA likely stresses the importance of analyzing individual company performance rather than solely relying on broad market indices to assess risk. Analyzing individual stocks allows for a more granular understanding of risk.

Continued Economic Recovery

A continuing economic recovery provides a strong foundation for stock market valuations. Positive economic indicators reinforce investor confidence.

- Economic Growth Indicators: Positive GDP growth, low unemployment rates, and strong consumer confidence all suggest a healthy economic environment that supports higher stock valuations.

- Addressing Risks: BofA’s analysis likely incorporates potential risks to the recovery, such as inflation or geopolitical instability. However, their overall assessment likely still indicates sufficient strength to support market performance.

- Sustaining Investor Confidence: A positive economic outlook fosters investor confidence, sustaining higher valuations and encouraging further investment.

BofA's Recommended Investment Strategy in a High-Valuation Environment

Given the current market conditions, BofA's recommended investment strategy likely emphasizes a cautious yet opportunistic approach.

Diversification

Diversification remains crucial to managing risk in any market environment, particularly one with potentially stretched valuations.

- Asset Allocation: Diversifying across asset classes like stocks, bonds, real estate, and alternative investments helps mitigate losses from any single asset class underperforming.

- Risk Mitigation: A diversified portfolio is better equipped to weather market corrections and volatility, reducing the overall impact on investment returns.

Focus on Value and Quality

In a high-valuation environment, BofA likely recommends focusing on undervalued companies with strong fundamentals.

- Value Metrics: Investors should look at metrics like P/E ratio, debt-to-equity ratio, and return on equity to identify undervalued companies with solid financial health.

- Long-Term Investing: Investing in high-quality companies with sustainable growth potential provides a longer-term perspective, reducing the impact of short-term market fluctuations.

Conclusion

BofA's perspective suggests that while stretched stock market valuations are a valid concern, they don't necessarily signal an imminent market crash. Factors like low interest rates, strong corporate earnings, and continued economic recovery mitigate the risk. The key is to adopt a long-term investment strategy that focuses on diversification and selecting high-quality, potentially undervalued companies. Don't let concerns about stretched stock market valuations deter you from building your long-term wealth. Conduct further research into BofA's reports and investment recommendations for navigating this environment effectively. Remember, a well-diversified portfolio that incorporates a long-term perspective is crucial for managing risk and achieving your investment goals.

Featured Posts

-

Pogacars Custom Colnago Speed Technology And The Pursuit Of Victory

Apr 26, 2025

Pogacars Custom Colnago Speed Technology And The Pursuit Of Victory

Apr 26, 2025 -

The American Battleground Taking On The Worlds Richest

Apr 26, 2025

The American Battleground Taking On The Worlds Richest

Apr 26, 2025 -

Ftc To Challenge Activision Blizzard Acquisition Approval

Apr 26, 2025

Ftc To Challenge Activision Blizzard Acquisition Approval

Apr 26, 2025 -

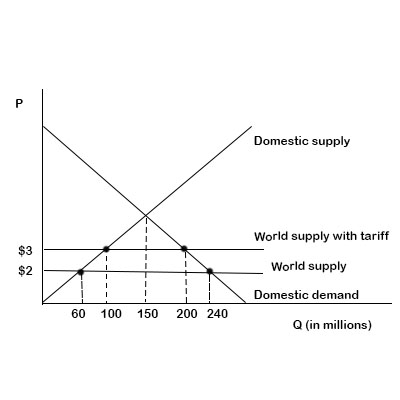

200 Million Tariff Impact Colgate Cl Announces Reduced Sales And Profits

Apr 26, 2025

200 Million Tariff Impact Colgate Cl Announces Reduced Sales And Profits

Apr 26, 2025 -

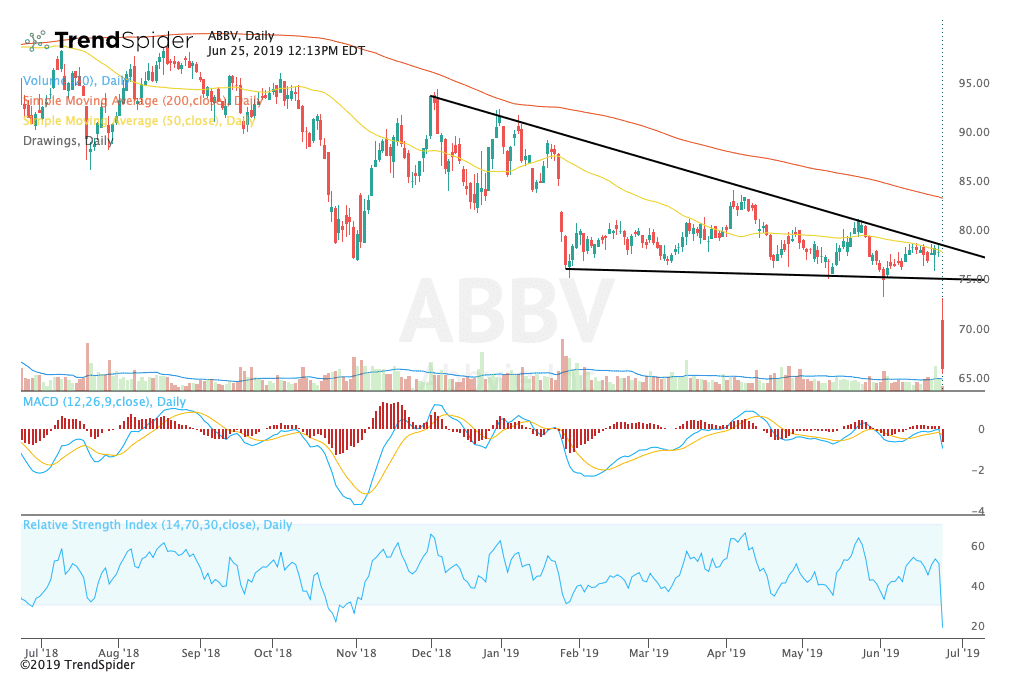

Abb Vie Abbv Stock Rises On Exceeded Sales And Revised Profit Guidance

Apr 26, 2025

Abb Vie Abbv Stock Rises On Exceeded Sales And Revised Profit Guidance

Apr 26, 2025