Are Los Angeles Wildfires Becoming A Gambling Commodity? An Examination Of Current Trends

Table of Contents

1. The Rise of Wildfire Insurance and Investment Strategies

Escalating wildfire risk is fundamentally reshaping the financial landscape of Los Angeles. The increasing frequency and intensity of wildfires are transforming how we think about property ownership, insurance, and investment in the region.

1.1 Increased Insurance Premiums and Difficulty in Securing Coverage:

The rising cost of wildfire insurance is a significant concern for many Los Angeles residents. Insurance premiums are skyrocketing, particularly in high-risk areas, making homeownership increasingly unaffordable for some.

- Premiums for wildfire insurance in Los Angeles have increased by an average of 25% in the past five years.

- Many insurance companies are refusing to renew policies or are refusing to offer new policies in high-risk zones, leaving homeowners scrambling to find coverage.

- This difficulty in securing affordable wildfire insurance is significantly impacting property values in fire-prone regions of Los Angeles, creating a ripple effect throughout the local economy. Finding adequate property insurance Los Angeles is becoming a major challenge.

1.2 Investment in Wildfire Mitigation and Prevention Technologies:

The escalating risk is also driving investment in wildfire mitigation and prevention technologies. Companies are actively developing and deploying new technologies aimed at reducing wildfire risk and improving response times.

- Investment in fire prevention technology, such as improved early warning systems and fire-resistant building materials, is attracting significant capital.

- Companies specializing in wildfire mitigation strategies are experiencing growth as communities and insurers seek proactive solutions.

- This investment represents a form of risk management, potentially generating profit while contributing to community safety, but raises questions regarding accessibility and equity in the implementation of these solutions.

1.3 The Role of Reinsurance Markets in Wildfire Risk Assessment:

Reinsurance markets play a crucial role in assessing and managing wildfire risk. These markets essentially insure insurance companies against catastrophic losses.

- The reinsurance market analyzes historical wildfire data and predictive models to determine risk levels, influencing the cost of insurance for homeowners.

- The use of catastrophe bonds to transfer wildfire risk is also increasing, creating another layer of financial complexity.

- Wildfire risk assessment by reinsurance companies significantly impacts insurance costs and the availability of coverage, potentially creating opportunities for speculation and influencing investment decisions.

2. The Speculative Nature of Wildfire Prediction and Forecasting

Predicting wildfire behavior remains inherently challenging, adding a layer of speculation to the financial aspects of wildfire risk.

2.1 The Limitations of Current Forecasting Models:

Despite advancements in wildfire prediction technology, accurately forecasting wildfire behavior remains a significant challenge.

- Current weather forecasting models, while improving, still struggle to accurately predict the spread and intensity of wildfires, due to variables such as wind patterns and fuel conditions.

- Inaccuracies in fire risk modeling lead to uncertainty in insurance pricing and investment decisions.

2.2 The Influence of Media Coverage and Public Perception:

Media portrayals significantly shape public perception and influence investment decisions, creating the potential for speculative bubbles.

- Sensationalized media coverage of wildfires can exacerbate public fear and lead to hasty investment decisions, potentially driving up prices for wildfire protection measures.

- The resulting public perception risk is difficult to quantify but plays a significant role in the overall financial landscape surrounding wildfires.

3. Ethical and Societal Implications of Commodifying Wildfire Risk

Treating Los Angeles wildfires solely as a gambling commodity raises serious ethical and societal concerns.

3.1 The Potential for Exploitation and Unethical Practices:

The financialization of wildfire risk creates potential for exploitation and unethical practices.

- Unfair pricing practices in wildfire insurance can disproportionately impact vulnerable communities.

- Predatory lending practices could further exacerbate financial inequalities in accessing resources.

- The need for strong regulatory frameworks and consumer protection measures is paramount to prevent such exploitation.

3.2 The Need for Responsible Risk Management and Disaster Preparedness:

Prioritizing community safety and resilience should be the primary focus, not speculation.

- Effective disaster preparedness requires comprehensive community engagement, strong government response mechanisms, and equitable resource allocation.

- A focus on community resilience is crucial in mitigating the impact of wildfires and reducing the potential for financial exploitation.

- Responsible wildfire risk management needs a shift from profit maximization to community protection.

Conclusion:

While financial aspects are inextricably linked to the escalating risk of Los Angeles wildfires, framing these events purely as a Los Angeles wildfires gambling commodity is irresponsible and potentially harmful. The need for responsible risk management, ethical investment practices, and robust regulatory frameworks is undeniable. We must prioritize community safety, equitable access to resources, and robust disaster preparedness strategies. We urge further research and discussion on the complex interplay between wildfires and investment and the ethical considerations wildfire risk presents. Let's move beyond viewing Los Angeles wildfires as a gambling commodity and focus on building a truly resilient and equitable future.

Featured Posts

-

Klmat Alshykh Fysl Alhmwd Fy Dhkra Eyd Astqlal Alardn

May 29, 2025

Klmat Alshykh Fysl Alhmwd Fy Dhkra Eyd Astqlal Alardn

May 29, 2025 -

Billboards List Top Music Lawyers For 2025 And Beyond

May 29, 2025

Billboards List Top Music Lawyers For 2025 And Beyond

May 29, 2025 -

Air Force 1 Low Pink Foam Hf 2014 600 Official Release Date Announcement

May 29, 2025

Air Force 1 Low Pink Foam Hf 2014 600 Official Release Date Announcement

May 29, 2025 -

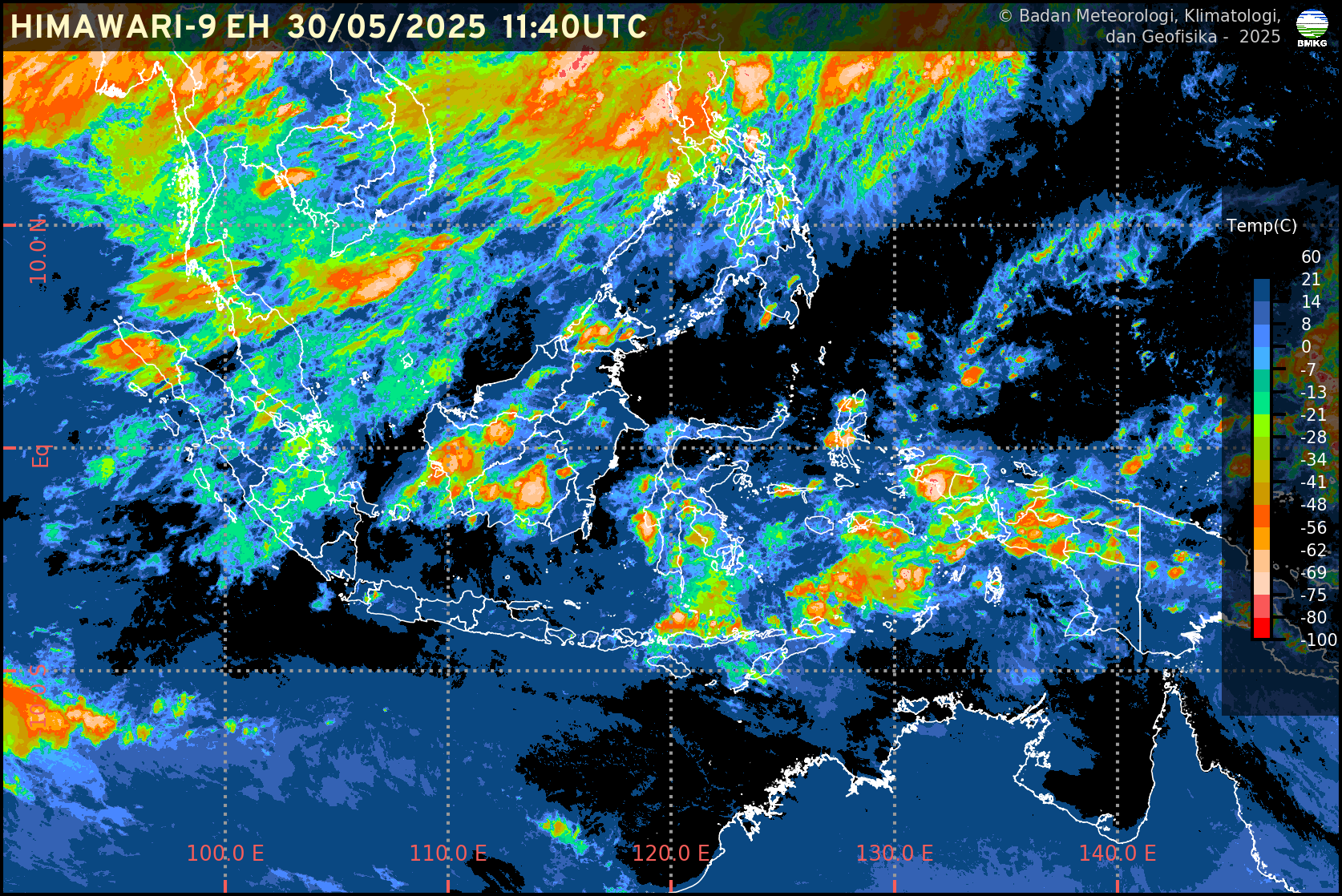

Cuaca Hari Ini And Besok Prakiraan Cuaca Sumatra Utara Medan Karo Nias Toba

May 29, 2025

Cuaca Hari Ini And Besok Prakiraan Cuaca Sumatra Utara Medan Karo Nias Toba

May 29, 2025 -

Ubisofts Commitment To A Harassment Free Assassins Creed Shadows Of London

May 29, 2025

Ubisofts Commitment To A Harassment Free Assassins Creed Shadows Of London

May 29, 2025

Latest Posts

-

The Good Life A Roadmap To A Richer More Fulfilling Life

May 31, 2025

The Good Life A Roadmap To A Richer More Fulfilling Life

May 31, 2025 -

Understanding Rosemary And Thyme From Planting To Harvesting

May 31, 2025

Understanding Rosemary And Thyme From Planting To Harvesting

May 31, 2025 -

Building The Good Life Strategies For Personal Growth And Well Being

May 31, 2025

Building The Good Life Strategies For Personal Growth And Well Being

May 31, 2025 -

What Is The Good Life Defining And Pursuing Your Ideal Lifestyle

May 31, 2025

What Is The Good Life Defining And Pursuing Your Ideal Lifestyle

May 31, 2025 -

Rosemary And Thyme Benefits Cultivation And Recipes

May 31, 2025

Rosemary And Thyme Benefits Cultivation And Recipes

May 31, 2025