Are Public Sector Pensions Putting A Strain On Taxpayers?

Table of Contents

The Rising Cost of Public Sector Pensions

The escalating cost of public sector pensions is a significant concern. Several factors contribute to this increase, placing a considerable burden on public finances and potentially impacting taxpayers' contributions. These include:

-

Increasing life expectancy: People are living longer, leading to longer payout periods for pension benefits and significantly increasing the overall liability. This demographic shift is a global phenomenon, impacting pension systems worldwide.

-

Generous benefit packages and early retirement options: Many public sector pension plans offer generous benefits, including early retirement options and final salary calculations, leading to higher payouts compared to private sector equivalents. This contributes to higher pension contribution rates.

-

Growth in the number of public sector employees: An expanding public sector workforce naturally increases the number of individuals entitled to public sector pensions, further increasing overall costs. This growth, coupled with generous benefits, exacerbates the financial strain.

-

Underfunding of pension schemes over time: In some cases, pension schemes haven't been adequately funded, creating unfunded liabilities that must be addressed through future government spending or increased taxation. Actuarial valuations highlighting these shortfalls are crucial for effective long-term planning.

-

The impact of economic downturns on investment returns for pension funds: Periods of economic instability can significantly impact the investment returns of pension funds, reducing their ability to meet future pension obligations. This underlines the importance of robust investment strategies and risk management within these schemes.

The combination of these factors results in escalating pension costs, demanding a closer look at the financial implications and the need for potential pension reform. These rising costs are not merely theoretical; they translate directly into the amount taxpayers contribute and the services they receive.

The Impact on Taxpayer Finances

The rising cost of public sector pensions has a direct impact on taxpayer finances. This impact manifests in several ways:

-

Increased taxation to cover pension liabilities: To meet pension obligations, governments often need to increase taxes, directly impacting the disposable income of taxpayers. This burden can be particularly acute during periods of economic hardship.

-

Reduced funding for other essential public services: The significant allocation of funds to cover pension liabilities can reduce the resources available for other essential public services such as healthcare, education, and infrastructure. This creates a trade-off between providing adequate retirement benefits and maintaining other vital public services.

-

Potential increase in government debt: If pension liabilities are not adequately funded through taxation, governments may need to borrow money, leading to an increase in government debt. This debt accumulation has long-term economic consequences, potentially impacting future generations.

-

Intergenerational equity concerns: The growing cost of public sector pensions raises concerns about intergenerational equity. Current taxpayers are bearing the cost of pensions for current and past public sector employees, potentially placing an unfair burden on future generations.

-

Comparison of public sector pension costs to those in the private sector: Comparing the cost and benefits of public sector pensions to those in the private sector reveals considerable differences, highlighting potential disparities and the need for a more balanced approach.

This analysis demonstrates the significant financial implications of public sector pensions on taxpayers. The challenge is to balance the need to provide adequate retirement benefits for public sector workers with the responsibility of ensuring fiscal sustainability and preventing excessive burdens on taxpayers.

Arguments for and Against Public Sector Pension Reform

The rising costs and potential financial strain have led to extensive debate regarding public sector pension reform. There are compelling arguments on both sides:

Arguments for reform:

- Fiscal sustainability: Reforming pension systems is crucial to ensuring the long-term fiscal sustainability of governments. Without reform, the escalating costs could jeopardize the funding of other essential public services.

- Intergenerational equity: Reforms aim to ensure a more equitable distribution of the financial burden between generations, preventing an undue burden on future taxpayers.

- Improved efficiency: Pension reform can lead to improved efficiency in the management of pension schemes, reducing administrative costs and maximizing investment returns.

Arguments against reform:

- Impact on employee morale: Proposed reforms, such as benefit reductions or increased employee contributions, can negatively impact employee morale and productivity.

- Potential legal challenges: Changes to pension plans can face legal challenges from current and future retirees, adding complexity and cost to the reform process.

- Fairness to current retirees: Reforms must be carefully designed to ensure fairness to current retirees who have made contributions based on the existing system.

Reform proposals include increasing employee contributions, reducing benefits, or transitioning from defined benefit to defined contribution plans. Each option requires careful consideration of its impact on various stakeholders and the wider economy. Finding a balance between financial stability and fair treatment of public sector employees is critical.

International Comparisons of Public Sector Pension Systems

Examining international pension systems provides valuable insights and potential solutions. Many developed countries are grappling with similar challenges, and comparing their approaches can reveal best practices. Analyzing pension systems in countries with successfully implemented reforms can offer valuable lessons and inform potential strategies for addressing the challenges faced by public sector pensions globally. By studying OECD pension indicators and other comparative analyses, policymakers can identify successful models that balance fiscal sustainability with adequate retirement benefits. This comparative approach can highlight the potential for innovative and effective reforms.

Conclusion

The financial implications of public sector pensions are complex and far-reaching. While providing adequate retirement benefits for public sector employees is essential, the escalating costs present a significant strain on taxpayer finances. Understanding the interplay between rising costs, government budgets, and the need for fiscal sustainability is crucial. The debate surrounding pension reform highlights the need for carefully considered solutions that balance the needs of public sector employees with the financial well-being of taxpayers. Public sector pension reform is not simply a financial issue; it's a question of fairness, sustainability, and the future viability of government services. Understanding the implications of public sector pensions is crucial for informed civic engagement. Learn more about the ongoing debate and advocate for sustainable pension policies that balance the needs of public employees and the financial well-being of taxpayers.

Featured Posts

-

Willie Nelsons Life A Collection Of Fast Facts

Apr 29, 2025

Willie Nelsons Life A Collection Of Fast Facts

Apr 29, 2025 -

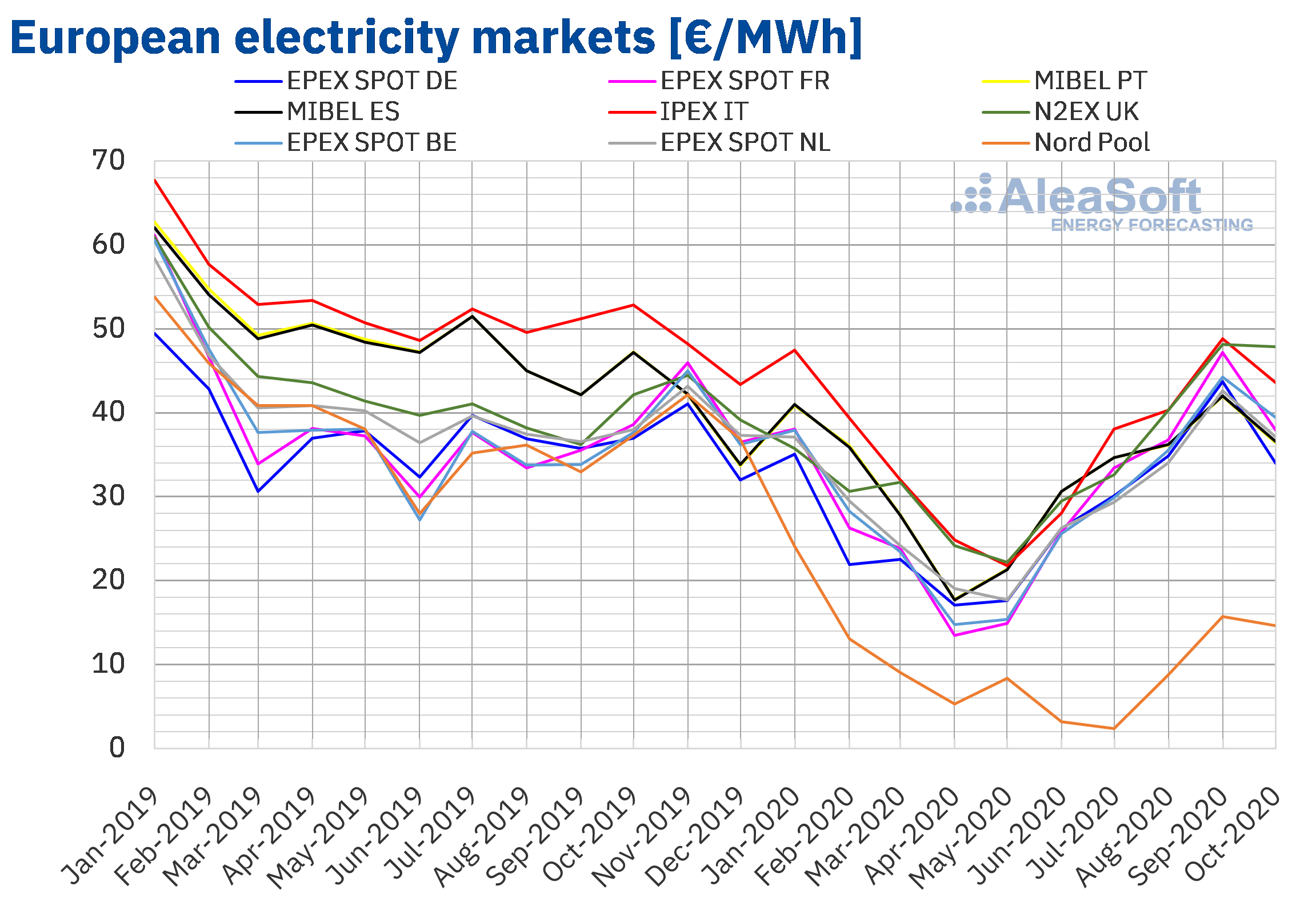

Negative European Electricity Prices A Solar Energy Success Story

Apr 29, 2025

Negative European Electricity Prices A Solar Energy Success Story

Apr 29, 2025 -

Tik Tok Adhd And The Dangers Of Self Diagnosis

Apr 29, 2025

Tik Tok Adhd And The Dangers Of Self Diagnosis

Apr 29, 2025 -

Cardinal Case Allegations Of Prosecutorial Misconduct Supported By New Revelations

Apr 29, 2025

Cardinal Case Allegations Of Prosecutorial Misconduct Supported By New Revelations

Apr 29, 2025 -

Solve The Nyt Spelling Bee February 28 2025 Puzzle Solutions

Apr 29, 2025

Solve The Nyt Spelling Bee February 28 2025 Puzzle Solutions

Apr 29, 2025

Latest Posts

-

Amanda Owen Bids Farewell To Our Yorkshire Farm In Heartbreaking Scenes

Apr 30, 2025

Amanda Owen Bids Farewell To Our Yorkshire Farm In Heartbreaking Scenes

Apr 30, 2025 -

Amanda Owens Emotional Goodbye To Our Yorkshire Farm

Apr 30, 2025

Amanda Owens Emotional Goodbye To Our Yorkshire Farm

Apr 30, 2025 -

Where To Stream Ru Pauls Drag Race Season 17 Episode 6 A Free Guide No Cable

Apr 30, 2025

Where To Stream Ru Pauls Drag Race Season 17 Episode 6 A Free Guide No Cable

Apr 30, 2025 -

Watch Ru Pauls Drag Race Season 17 Episode 6 Online Free And Cable Free

Apr 30, 2025

Watch Ru Pauls Drag Race Season 17 Episode 6 Online Free And Cable Free

Apr 30, 2025 -

Free Streaming Options For Ru Pauls Drag Race Season 17 Episode 6 No Cable

Apr 30, 2025

Free Streaming Options For Ru Pauls Drag Race Season 17 Episode 6 No Cable

Apr 30, 2025