Are Tariffs Killing The Tech IPO Boom?

Table of Contents

Increased Costs and Reduced Profitability

Tariffs, essentially taxes on imported goods, are significantly impacting the profitability of tech companies, making the prospect of an Initial Public Offering (IPO) less appealing. This is primarily due to their effect on supply chains and overall investment.

Impact on Supply Chains

Many tech products rely heavily on globally sourced components. Tariffs increase the cost of these imported parts, directly impacting manufacturing costs and ultimately, profit margins. This squeeze on profitability makes it considerably harder for tech companies to justify the expense and scrutiny associated with going public.

- Increased manufacturing costs in countries affected by tariffs: Companies face higher production costs, eating into their potential returns. This is particularly damaging for startups with already thin margins.

- Higher prices for consumers leading to reduced demand: Passing increased costs onto consumers can lead to decreased sales and reduced overall revenue, making an IPO less attractive to investors.

- Disruption of established supply chains, forcing companies to seek alternative, potentially more expensive, suppliers: The search for alternative suppliers adds complexity, delays, and further increases costs, further eroding profitability.

Impact on Investment

Reduced profitability translates directly into reduced attractiveness for investors. Securing the funding necessary to reach IPO readiness becomes a significant challenge in a climate of trade uncertainty.

- Lower valuations for tech startups due to uncertainty: Investors are less willing to pay high valuations for companies facing increased costs and reduced market certainty.

- Increased risk aversion among venture capitalists and angel investors: The volatile trade environment creates a climate of increased risk, making investors more cautious about their investments in tech startups.

- Difficulty in securing loans and credit due to increased financial uncertainty: Banks and lenders are less likely to extend credit to companies operating in unpredictable trade environments, hindering their ability to scale and prepare for an IPO.

Geopolitical Uncertainty and Investor Sentiment

The unpredictability inherent in trade wars significantly impacts investor sentiment, both domestically and internationally. This uncertainty creates a chilling effect on the tech IPO market.

Impact of Trade Wars on Global Markets

The ongoing threat of escalating tariffs and retaliatory measures creates instability in global markets. This uncertainty makes it difficult for companies to accurately forecast future revenue and profitability, crucial factors for investors considering an IPO.

- Negative impact on investor confidence and market stability: Uncertainty discourages investment, leading to market volatility and lower valuations for tech startups.

- Reduced foreign direct investment in tech startups: International investors are hesitant to commit capital to companies operating in volatile trade environments.

- Increased volatility in stock markets, making IPOs riskier: Fluctuations in the stock market due to trade tensions make IPOs a riskier proposition for both companies and investors.

Shifting Investment Landscape

Companies are reacting to the challenges posed by tariffs in various ways, leading to a significant shift in the global tech investment landscape.

- Increased mergers and acquisitions as companies seek strategic partnerships: Companies are consolidating to achieve economies of scale and mitigate the risks associated with tariffs.

- Growth of private equity funding as an alternative to public markets: Private equity provides an alternative funding source for companies that may delay or avoid an IPO due to market uncertainty.

- Relocation of manufacturing and R&D to regions with more favorable trade policies: Companies are shifting their operations to regions with more predictable and favorable trade environments.

The Long-Term Implications for Tech Innovation

The current challenges extend beyond immediate financial impact; they threaten the very engine of tech innovation.

Stifled Innovation

High costs and uncertain market conditions stifle innovation and risk-taking. This is detrimental to the development of groundbreaking technologies.

- Reduced R&D spending due to tighter budgets: Companies are forced to cut back on research and development to offset increased costs, hindering innovation.

- Fewer startups entering the market due to increased barriers to entry: The higher costs and uncertainties associated with tariffs discourage entrepreneurs from starting new ventures.

- Potential for slower technological advancements: Reduced investment in R&D and fewer startups will inevitably slow down the pace of technological progress.

Global Competitiveness

Trade wars can significantly weaken a nation's competitiveness in the global tech arena, potentially leading to the loss of market share to countries with more favorable trade policies.

- Loss of global market dominance for certain tech sectors: Companies facing higher costs due to tariffs may lose market share to competitors in countries with more favorable trade policies.

- Reduced influence in setting global tech standards: A weaker tech sector may have less influence in shaping global tech standards.

- Potential for brain drain as skilled workers migrate to more favorable environments: Talented workers may seek opportunities in countries with more stable and supportive environments for the tech industry.

Conclusion

The impact of tariffs on the tech IPO boom is undeniable. Increased costs, geopolitical uncertainty, and dampened investor sentiment are creating a challenging environment for tech startups seeking to go public. Understanding the complex interplay between trade policy and the tech industry is crucial for investors and entrepreneurs navigating these turbulent times. The future of the tech IPO market hinges on resolving trade disputes and creating a more stable and predictable global economic landscape. To stay informed on the evolving impact of tariffs on the tech sector, continue to research and analyze the effects of global trade on tech IPOs and the broader tech startup ecosystem. Understanding the implications of tariffs is essential for successful navigation of the current market conditions.

Featured Posts

-

Snow Whites 169 Million Underperformance Is The Disney Live Action Strategy Failing

May 14, 2025

Snow Whites 169 Million Underperformance Is The Disney Live Action Strategy Failing

May 14, 2025 -

Plan Your May 2025 Pokemon Go Gameplay Raids Spotlight Hours And Community Days

May 14, 2025

Plan Your May 2025 Pokemon Go Gameplay Raids Spotlight Hours And Community Days

May 14, 2025 -

Eurojackpot Voitto 40 000 Euroa Suomeen Voittopaikka Ja Numerot

May 14, 2025

Eurojackpot Voitto 40 000 Euroa Suomeen Voittopaikka Ja Numerot

May 14, 2025 -

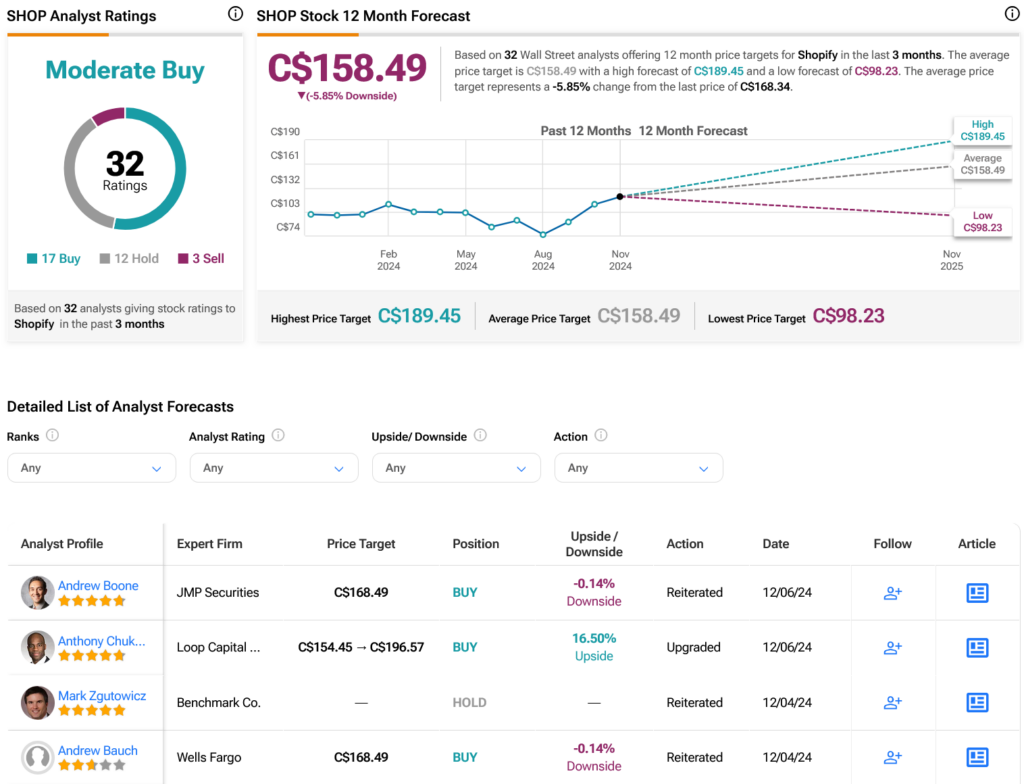

14 Shopify Stock Jump Nasdaq 100 Inclusion Impact

May 14, 2025

14 Shopify Stock Jump Nasdaq 100 Inclusion Impact

May 14, 2025 -

Maya Jamas Work Day Skincare A Face Mask Confession

May 14, 2025

Maya Jamas Work Day Skincare A Face Mask Confession

May 14, 2025