Australia Opposition Vows $9 Billion Budget Surplus: A Detailed Analysis

Table of Contents

The Opposition's Plan: Key Policy Proposals

The Opposition's $9 billion budget surplus promise hinges on a multifaceted plan involving significant tax reforms and substantial government spending cuts. Let's examine the key components:

Tax Cuts and Revenue Increases

The Opposition's plan to generate increased revenue relies on several key tax policy changes. These include:

- Targeted Corporate Tax Rate Reductions: The Opposition proposes lowering the corporate tax rate for small and medium-sized enterprises (SMEs), arguing this will stimulate business investment and growth, ultimately boosting tax revenue. Specific details regarding the targeted rates and eligibility criteria are yet to be fully released.

- Increased Taxation on High-Income Earners: A key element involves increasing the tax rate for high-income earners, a measure justified as a means of fairer distribution of wealth and increased revenue collection. The proposed bracket and specific rate increase are currently subject to further parliamentary debate.

- Tax Incentives for Green Technologies: The Opposition has indicated plans to incentivize investment in renewable energy and green technologies through targeted tax breaks. This aims to boost the green economy while also attracting investment and generating jobs. Detailed schemes regarding tax credits and deductions are expected to be released in the upcoming weeks.

Spending Cuts and Efficiency Measures

To achieve the projected surplus, the Opposition has outlined plans for significant cuts in government spending and improvements to efficiency across various departments. This includes:

- Review of Government Programs: The Opposition intends to conduct a thorough review of existing government programs, identifying areas where spending can be reduced without impacting essential services. This review may include consolidating overlapping programs and eliminating redundancies. Specific programs targeted for cuts have not yet been publicly detailed.

- Streamlining Bureaucracy: Improving the efficiency of government operations through technological advancements and process streamlining is central to the Opposition’s plan. They suggest that investment in digital infrastructure and modernized administrative processes will lead to considerable savings in the long term. Estimates of savings remain pending detailed costing exercises.

- Increased Focus on Infrastructure Projects with High Returns: The opposition plans to prioritize investment in infrastructure projects with high economic returns. This strategy emphasizes prioritizing areas that maximize job creation and long-term economic benefits for Australia.

Economic Growth Projections

The Opposition's $9 billion budget surplus projection is predicated on achieving a robust level of economic growth, currently estimated at X% annually for the next four years. This projection relies on a combination of factors, including the expected positive effects of the proposed tax reforms and spending cuts, the anticipated growth of key sectors such as mining and tourism, and a favorable global economic outlook. However, independent economists have raised concerns about the potential challenges to achieving this level of growth, particularly in the context of rising global inflation and interest rates.

Analysis of the Opposition's Claims: Feasibility and Credibility

The Opposition's ambitious $9 billion surplus target faces significant scrutiny regarding its feasibility and credibility. A thorough examination is necessary to evaluate the realistic chances of achieving this goal.

Independent Economic Forecasts

Independent economic institutions have yet to provide definitive forecasts that fully align with the Opposition's projections. Several prominent organizations have expressed reservations about the ambitious nature of the plan, citing potential risks and uncertainties that could hinder its success. These concerns primarily revolve around the potential impact of global economic instability and the challenges associated with implementing significant tax and spending reforms.

Historical Context and Track Record

Analyzing the Opposition's historical record in managing the Australian budget is crucial in evaluating the credibility of their current claims. Examining their previous fiscal policies, their success in achieving projected targets, and any inconsistencies between their promises and actions can offer valuable insight into the feasibility of their ambitious $9 billion surplus pledge.

Potential Risks and Unforeseen Circumstances

Several potential risks and unforeseen circumstances could significantly impact the feasibility of the $9 billion surplus. These include global economic downturns, unexpected fluctuations in commodity prices, unforeseen domestic crises, and the potential for unforeseen policy implementation challenges. A robust analysis must incorporate these variables to realistically assess the Opposition's claims.

Impact on the Australian Economy and Voters

The success or failure of the Opposition's plan will have significant repercussions for the Australian economy and voters.

Potential Benefits of a Surplus

A $9 billion budget surplus could offer several potential benefits, including a reduction in national debt, increased government investment in crucial infrastructure projects, enhanced national credit rating, and potential future tax relief. These positive outcomes could translate into improved living standards and greater economic security for many Australians.

Potential Drawbacks and Trade-offs

However, achieving such a surplus may necessitate trade-offs that could have negative consequences. Spending cuts in vital areas like healthcare and education are possible, potentially impacting essential public services. Also, some economists warn about potential increased inequality if tax cuts disproportionately favor high-income earners.

Voter Sentiment and Election Implications

The Opposition's budget surplus pledge is likely to significantly influence voter sentiment and the upcoming election. Public opinion surveys and polling data will be crucial in assessing the extent to which this promise resonates with voters and its impact on electoral outcomes. Understanding the public's response to this significant economic policy is critical for predicting the election results.

Conclusion

The Australian Opposition's vow of a $9 billion budget surplus presents a complex picture with both potential benefits and risks. The feasibility of this ambitious promise depends on several factors, including the successful implementation of proposed tax reforms, the achievement of projected economic growth rates, and the effective management of potential risks. Independent economic analyses suggest cautious optimism, highlighting the need for a thorough and realistic assessment of the plan. Understanding the intricacies of this election promise is crucial for informed participation in the upcoming election. Conduct thorough research, engage in discussions, and make your voice heard. The future of Australia's economic policy depends on it. The success or failure of the "Australia Opposition Vows $9 Billion Budget Surplus" plan will significantly impact the nation's economic future and the electorate’s confidence in the Opposition.

Featured Posts

-

Fortnites Cowboy Bebop Collaboration Price Of Faye Valentine And Spike Spiegel Skins

May 03, 2025

Fortnites Cowboy Bebop Collaboration Price Of Faye Valentine And Spike Spiegel Skins

May 03, 2025 -

11 High School Lacrosse Players Surrender In Syracuse Hazing Case

May 03, 2025

11 High School Lacrosse Players Surrender In Syracuse Hazing Case

May 03, 2025 -

Valorant Mobile Development What We Know From The Pubg Mobile Studio

May 03, 2025

Valorant Mobile Development What We Know From The Pubg Mobile Studio

May 03, 2025 -

Alerte De Macron Risque De Militarisation De L Aide Humanitaire A Gaza Par Israel

May 03, 2025

Alerte De Macron Risque De Militarisation De L Aide Humanitaire A Gaza Par Israel

May 03, 2025 -

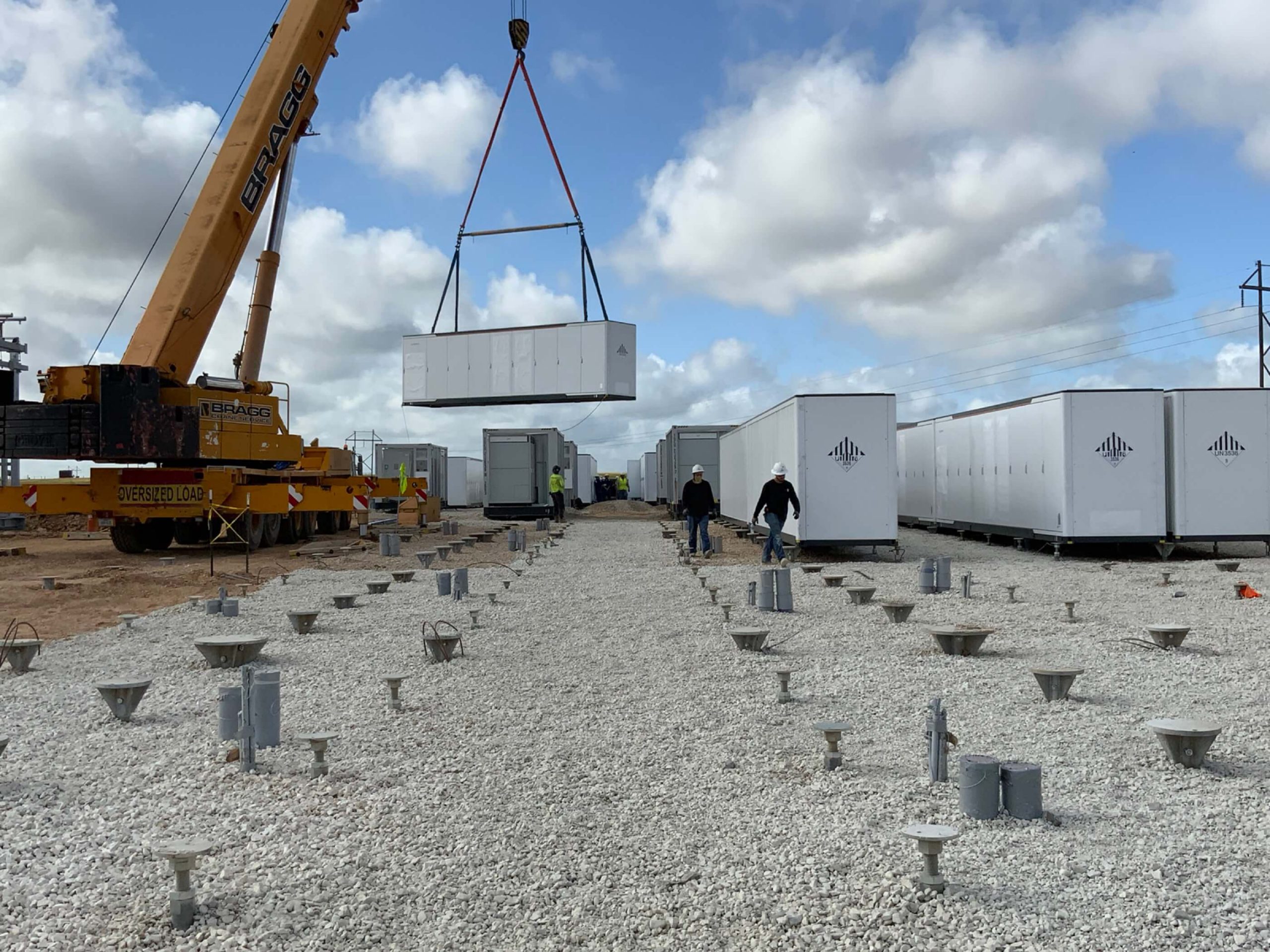

Analysis Of Financing Strategies For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025

Analysis Of Financing Strategies For A 270 M Wh Bess Project In The Belgian Merchant Market

May 03, 2025

Latest Posts

-

Arsenals Havertz A Disappointing Epl Start Souness Criticism

May 03, 2025

Arsenals Havertz A Disappointing Epl Start Souness Criticism

May 03, 2025 -

Epl Analysis Is Havertz The Right Fit For Arsenal Souness Weighs In

May 03, 2025

Epl Analysis Is Havertz The Right Fit For Arsenal Souness Weighs In

May 03, 2025 -

Havertz Fails To Impress Souness Verdict On Arsenals Epl Signing

May 03, 2025

Havertz Fails To Impress Souness Verdict On Arsenals Epl Signing

May 03, 2025 -

Epl Graeme Souness On Havertzs Arsenal Struggles Lack Of Improvement

May 03, 2025

Epl Graeme Souness On Havertzs Arsenal Struggles Lack Of Improvement

May 03, 2025 -

Souness Slams Havertz Not The Arsenal Answer Epl Performance Disappointing

May 03, 2025

Souness Slams Havertz Not The Arsenal Answer Epl Performance Disappointing

May 03, 2025