Auto Tariff Relief Speculation Drives European Stock Market Gains; LVMH Shares Fall

Table of Contents

Auto Tariff Relief Speculation: The Catalyst for Market Gains

The European stock market's robust performance today is primarily fueled by speculation surrounding potential auto tariff relief. This follows months of tense trade negotiations between the US and the EU, characterized by significant tariffs on automobiles and auto parts.

Positive Sentiment Surrounding Potential US-EU Trade Deal

Ongoing trade tensions between the US and EU regarding auto tariffs have significantly impacted the European automotive sector. However, recent whispers of a potential breakthrough in negotiations have sparked a wave of positive sentiment among investors. Several news outlets, including the Financial Times and Bloomberg, have reported on increasing optimism regarding potential tariff reductions or even complete removal. Analysts at major investment banks are also echoing this sentiment, forecasting a positive impact on European markets.

- Increased investor confidence due to potential trade deal progress.

- Positive impact on European automakers' stock prices, leading to significant gains.

- Spillover effect on related sectors, such as steel and auto components manufacturing, further boosting market indices.

Impact on Key European Automakers

The potential for auto tariff relief has had a particularly significant impact on major European auto manufacturers. Companies like Volkswagen, BMW, and Daimler experienced substantial percentage gains in their share prices today. This reflects the immense pressure these companies have faced due to existing tariffs, impacting their profitability and competitiveness in the US market.

- Volkswagen saw a [insert percentage]% increase in its stock price.

- BMW and Daimler also experienced significant gains, with percentage increases of [insert percentage]% and [insert percentage]% respectively.

- These increases reflect increased production and sales forecasts, as well as potential for job creation within the sector. The long-term implications of tariff relief could be transformative for these businesses.

LVMH Stock Decline: A Counterpoint to the Overall Market Trend

While the broader European market celebrated the potential for auto tariff relief, luxury goods conglomerate LVMH experienced a notable decline in its share price. This stark contrast underscores the sector-specific nature of market fluctuations and the impact of diverse economic factors.

Factors Contributing to LVMH's Share Price Drop

Several factors could contribute to LVMH's underperformance. These might include concerns about slowing global luxury goods consumption, specific company-related news (e.g., a product recall or disappointing earnings report), or a general shift in investor sentiment towards the luxury sector. The contrasting performance of LVMH compared to the overall market suggests that the positive sentiment around potential auto tariff reductions is not a universal driver across all sectors.

- Specific negative news affecting LVMH (if applicable, specify the news).

- Analyst reports and potential downgrades contributing to selling pressure.

- Impact of broader macroeconomic factors, such as inflation or interest rate hikes, on luxury goods consumption.

Broader Implications for the European Stock Market

The interplay between sector-specific news (like the auto tariff relief speculation) and broader market trends highlights the inherent volatility of the European stock market.

Market Volatility and Future Outlook

Today's market activity underscores the significant impact of geopolitical and trade developments on investor sentiment. While the potential for auto tariff relief has injected optimism into certain sectors, the broader market outlook remains subject to numerous factors, including global economic conditions, inflation, and geopolitical instability. Expert opinions vary on the future trajectory of the European stock market, with some forecasting continued growth driven by economic recovery, while others caution about potential risks.

- Short-term market projections indicate continued volatility, but with potential for further gains depending on trade deal progress.

- Long-term outlook is more uncertain, dependent on a range of global economic factors.

- Investors should carefully assess both potential opportunities and risks associated with current market conditions.

Conclusion: Navigating the Impact of Auto Tariff Relief on European Markets

Today's market movement highlights the complex interplay between sector-specific factors (the potential for auto tariff relief) and broader market trends, as exemplified by the contrasting performance of the auto sector and LVMH. The surge in European stocks, primarily driven by auto tariff relief speculation, underscores the sensitivity of markets to trade developments. However, the decline in LVMH’s share price serves as a reminder of the inherent volatility and uncertainty within the stock market.

Key Takeaways: Understanding the interplay between specific sector performance and broader market trends is crucial for successful investment strategies. The volatility witnessed today emphasizes the importance of carefully analyzing various economic and geopolitical factors before making investment decisions.

Call to Action: Stay informed about the latest developments concerning auto tariff relief and its potential impact on European stocks. Regularly monitor reliable news sources and conduct thorough research to make informed investment decisions. Learn more about the impact of auto tariffs and their effect on different market sectors to enhance your investment strategy.

Featured Posts

-

Borsa Europea Attenzione Fed Banche Deboli Italgas In Luce

May 25, 2025

Borsa Europea Attenzione Fed Banche Deboli Italgas In Luce

May 25, 2025 -

Aex Rally Na Trump Uitstel Analyse Van De Stijging

May 25, 2025

Aex Rally Na Trump Uitstel Analyse Van De Stijging

May 25, 2025 -

Astonishing 90mph Refueling Police Helicopter Chase Ends In Dramatic Moment

May 25, 2025

Astonishing 90mph Refueling Police Helicopter Chase Ends In Dramatic Moment

May 25, 2025 -

The Unrealized M62 Relief Road A History Of Burys Bypassed Bypass

May 25, 2025

The Unrealized M62 Relief Road A History Of Burys Bypassed Bypass

May 25, 2025 -

Expanding Opportunities The 2nd Best Of Bangladesh In Europe Event

May 25, 2025

Expanding Opportunities The 2nd Best Of Bangladesh In Europe Event

May 25, 2025

Latest Posts

-

Malaysias Najib Razak Faces French Prosecution Over Alleged Submarine Bribery

May 25, 2025

Malaysias Najib Razak Faces French Prosecution Over Alleged Submarine Bribery

May 25, 2025 -

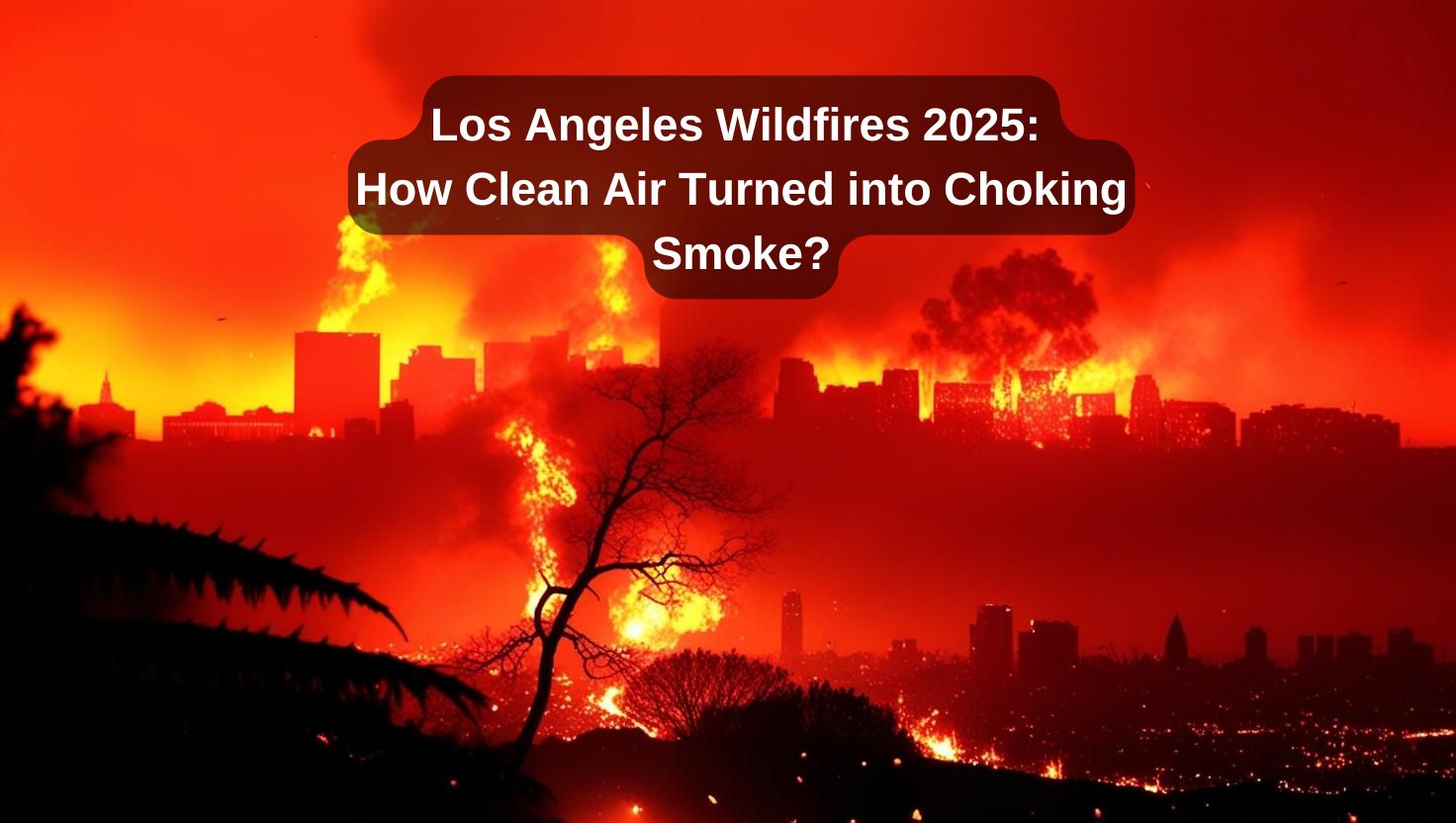

Natural Disaster Betting A Look At The Los Angeles Wildfires And Societal Implications

May 25, 2025

Natural Disaster Betting A Look At The Los Angeles Wildfires And Societal Implications

May 25, 2025 -

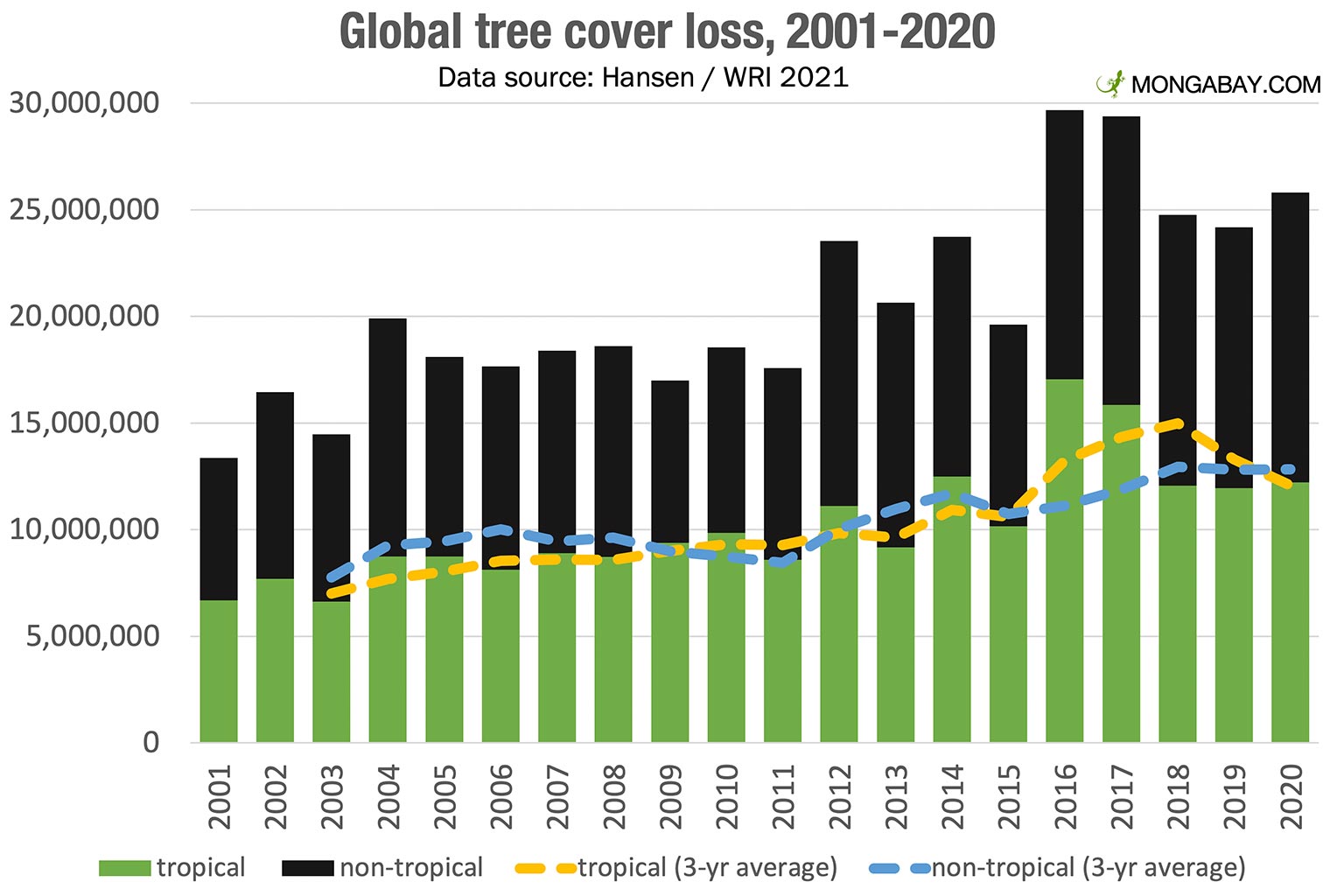

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 25, 2025

Record Breaking Forest Loss Wildfires Intensify Global Deforestation

May 25, 2025 -

2002 Submarine Bribery Case French Prosecutors Accuse Malaysias Ex Prime Minister Najib

May 25, 2025

2002 Submarine Bribery Case French Prosecutors Accuse Malaysias Ex Prime Minister Najib

May 25, 2025 -

The Rise Of Disaster Betting The Case Of The Los Angeles Wildfires

May 25, 2025

The Rise Of Disaster Betting The Case Of The Los Angeles Wildfires

May 25, 2025