Bank Of Canada Interest Rates: Desjardins' Prediction Of Three More Cuts

Table of Contents

Desjardins' Rationale Behind the Prediction

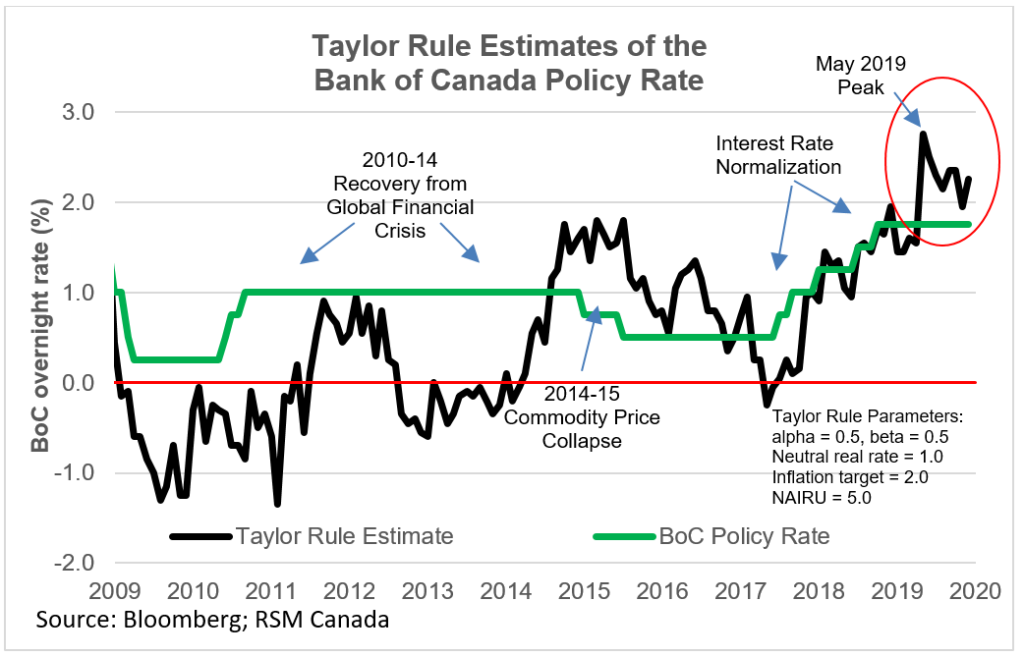

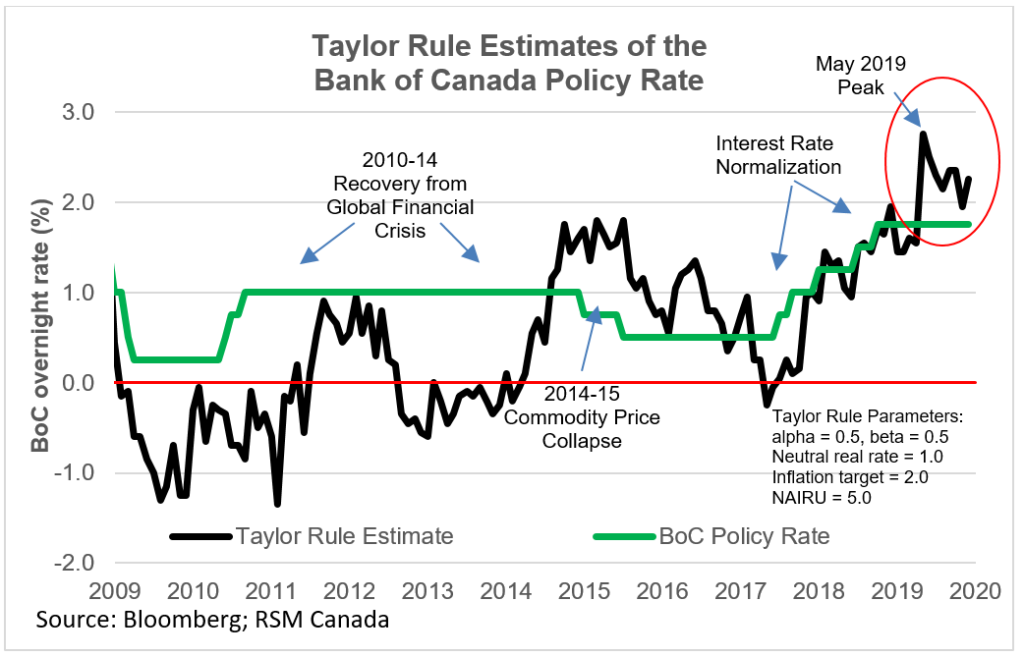

Desjardins' prediction of three further Bank of Canada interest rate cuts stems from a careful analysis of several key economic indicators. Their reasoning is rooted in a concern about the weakening Canadian economy. They point to several factors:

-

Slowing GDP Growth: Recent data suggests a slowdown in Canada's GDP growth, indicating a potential economic contraction. This is a major factor in Desjardins' prediction.

-

Persistent Inflation: While inflation is easing, it remains stubbornly high compared to the Bank of Canada's target. Desjardins believes further rate cuts are necessary to combat persistent inflation, even though this might seem counterintuitive.

-

Rising Unemployment: Although unemployment remains relatively low, there are signs of increasing job losses in certain sectors. This adds to the overall concern about the economy's health.

-

Global Economic Uncertainty: The global economic outlook remains uncertain, with potential risks from geopolitical instability and global recessions. This uncertainty contributes to Desjardins' cautious forecast.

Key Economic Factors Influencing Desjardins' Forecast:

- Weakening consumer confidence

- Reduced business investment

- Potential for a housing market correction

- Pressure on the Canadian dollar

Desjardins' analysis incorporates a detailed review of current and projected inflation figures, comparing them to historical data and the Bank of Canada's inflation targets. Their forecast also considers other economic forecasts and models, providing a comprehensive assessment of the situation.

Potential Impact of Three More Interest Rate Cuts

Three more interest rate cuts would likely have a multifaceted impact on the Canadian economy and individuals:

-

Lower Borrowing Costs: This is the most immediate effect. Lower interest rates translate to reduced borrowing costs for mortgages, personal loans, and credit cards. This could stimulate consumer spending and economic activity.

- Impact on Homeowners: Existing mortgage holders might be able to refinance at lower rates, reducing their monthly payments.

- Impact on Borrowers: Individuals planning major purchases or needing loans will benefit from lower interest rates.

-

Reduced Returns on Savings: Lower interest rates mean lower returns on savings accounts, Guaranteed Investment Certificates (GICs), and other interest-bearing investments. This could impact retirees and individuals relying on savings income.

-

Potential Impact on the Canadian Dollar: Lower interest rates could weaken the Canadian dollar relative to other currencies, impacting imports and exports.

-

Impact on Businesses and Investments: Lower borrowing costs can encourage business investment and expansion. However, reduced returns on savings could also negatively impact business investment strategies.

Alternative Perspectives and Expert Opinions

It's crucial to acknowledge that Desjardins' prediction is not universally accepted. Other financial institutions and economists hold differing views. Some argue that the current inflationary pressures necessitate maintaining higher interest rates to control inflation effectively. Others believe the economy is more resilient than Desjardins' analysis suggests. This divergence in opinion highlights the inherent uncertainties involved in economic forecasting.

Contrasting Views:

- Some economists believe inflation is more persistent than Desjardins predicts and advocate for a slower pace of rate cuts or even rate hikes.

- Others focus on the potential for a deeper recession and believe that further rate cuts are crucial to avoid a significant economic downturn.

The potential risks associated with Desjardins' prediction include the possibility of fueling inflation further, or potentially exacerbating existing economic vulnerabilities.

How to Prepare for Potential Interest Rate Changes

Regardless of the exact path of interest rates, proactive financial planning is crucial. Here's what you can do:

-

Review your financial situation: Assess your current debt levels, savings, and investment portfolio. This will help you determine how potential rate changes might affect you.

-

Consider refinancing: If you have a mortgage, explore refinancing options to take advantage of potentially lower interest rates.

-

Diversify your investments: Don't put all your eggs in one basket. Diversification can help mitigate the risk associated with interest rate changes.

-

Adjust your savings plan: Consider adjusting your savings strategy based on the potential for lower returns on interest-bearing accounts. Explore alternative investment options.

Actionable Steps:

- Contact your financial institution to discuss refinancing opportunities.

- Consult a financial advisor to review your investment strategy.

- Create a budget to manage your expenses effectively.

Conclusion: Staying Informed About Bank of Canada Interest Rates

Desjardins' prediction of three more Bank of Canada interest rate cuts highlights the ongoing uncertainty in the Canadian economy. The potential impact on borrowing costs, savings returns, and the Canadian dollar is significant. While this analysis provides valuable insights, it's vital to remember that economic forecasts are subject to revision. Staying informed about future Bank of Canada interest rate changes and adapting your financial strategy accordingly is crucial. Understand how these interest rate cuts might affect you, and seek professional advice if needed.

Featured Posts

-

County Cricket Season Preview Familiar Faces And Trophy Contenders

May 23, 2025

County Cricket Season Preview Familiar Faces And Trophy Contenders

May 23, 2025 -

Interview Eric Andre Discusses Regret Over Missing Out On A Real Pain

May 23, 2025

Interview Eric Andre Discusses Regret Over Missing Out On A Real Pain

May 23, 2025 -

Bitcoin Hits All Time High Amidst Positive Us Regulatory Outlook

May 23, 2025

Bitcoin Hits All Time High Amidst Positive Us Regulatory Outlook

May 23, 2025 -

Horoscopo Completo Semana Del 1 Al 7 De Abril De 2025

May 23, 2025

Horoscopo Completo Semana Del 1 Al 7 De Abril De 2025

May 23, 2025 -

Vybz Kartels Compliance With Trinidads Imposed Regulations

May 23, 2025

Vybz Kartels Compliance With Trinidads Imposed Regulations

May 23, 2025

Latest Posts

-

Review Jonathan Groffs Powerful Performance In Just In Time

May 23, 2025

Review Jonathan Groffs Powerful Performance In Just In Time

May 23, 2025 -

Jonathan Groff Opens Up About His Experience With Asexuality

May 23, 2025

Jonathan Groff Opens Up About His Experience With Asexuality

May 23, 2025 -

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025 -

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025 -

Jonathan Groffs Just In Time Performance Channeling Bobby Darins Energy

May 23, 2025

Jonathan Groffs Just In Time Performance Channeling Bobby Darins Energy

May 23, 2025