Bitcoin Hits All-Time High Amidst Positive US Regulatory Outlook

Table of Contents

The Role of Positive US Regulatory Sentiment

The evolving attitude of US regulators towards cryptocurrencies has played a pivotal role in Bitcoin's recent price surge. A more nuanced and less hostile approach is fostering increased investor confidence and fueling the Bitcoin price.

Gradual Shift in Regulatory Stance

The regulatory landscape for crypto in the US is gradually becoming clearer, offering a stark contrast to the uncertainty of previous years. This shift is evident in several key developments:

- More nuanced SEC statements: Recent statements from SEC Chair Gary Gensler, while still cautious, have shown a greater willingness to engage with the crypto industry and explore regulatory frameworks for different asset classes within the crypto space. This shift towards dialogue rather than outright condemnation is a significant positive.

- Proposed regulatory frameworks: The Biden administration and Congress are actively exploring comprehensive regulatory frameworks for digital assets, signaling a move toward establishing clear rules and guidelines instead of leaving the industry in a regulatory grey area. This clarity reduces the risk for investors.

- Increased regulatory cooperation: Increased cooperation between different US regulatory bodies (SEC, CFTC, etc.) suggests a more coordinated approach to overseeing the cryptocurrency market, leading to greater predictability and potentially reducing regulatory arbitrage.

These actions directly impact investor confidence. Clarity reduces risk aversion, encouraging investment in Bitcoin and pushing the Bitcoin price upwards.

Reduced Regulatory Uncertainty

Regulatory uncertainty has historically been a major headwind for Bitcoin's price. Periods of intense regulatory scrutiny, fear of bans, and ambiguous legal definitions have often led to significant price drops. The current positive regulatory outlook stands in stark contrast to these previous periods, instilling greater confidence in institutional and retail investors alike. This reduced uncertainty is a crucial factor contributing to the current Bitcoin all-time high.

Increased Institutional Adoption of Bitcoin

Alongside the positive regulatory shift, the growing interest from large institutional investors is another key driver behind the Bitcoin all-time high.

Growing Institutional Investments

Major financial institutions, hedge funds, and corporations are increasingly viewing Bitcoin as a valuable asset, spurred by both the positive regulatory signals and Bitcoin's perceived long-term value proposition.

- Record inflows into Bitcoin investment products: Data shows significant increases in institutional investment into Bitcoin through various vehicles, such as Grayscale Bitcoin Trust and other exchange-traded products.

- Corporate treasury holdings: Several publicly traded companies have added Bitcoin to their corporate treasury reserves, showcasing a growing belief in Bitcoin's potential as a store of value. This institutional adoption demonstrates a shift in how Bitcoin is perceived within the traditional financial world.

This increased institutional investment adds significant stability and liquidity to the Bitcoin market, contributing to its price appreciation and reducing volatility.

Bitcoin as a Hedge Against Inflation

A significant narrative driving institutional interest in Bitcoin is its perceived role as a hedge against inflation. With global inflation concerns rising, investors are seeking alternative assets that can preserve their purchasing power.

- Bitcoin's limited supply: Bitcoin's fixed supply of 21 million coins makes it a deflationary asset, contrasting with inflationary fiat currencies.

- Safe haven asset narrative: Bitcoin is increasingly viewed as a safe haven asset, similar to gold, offering a potential refuge from economic uncertainty.

This perception of Bitcoin as a hedge against inflation is a powerful catalyst driving demand and pushing the Bitcoin price to new all-time highs.

Technical Factors Contributing to Bitcoin's All-Time High

Beyond the fundamental factors, several technical indicators also contributed to Bitcoin's recent surge.

Increased Network Activity

On-chain data paints a picture of a thriving and growing Bitcoin network. Metrics like transaction volume and hash rate – a measure of the computing power securing the network – have seen significant increases, indicating growing adoption and demand.

- Rising transaction volume: Charts illustrating the daily transaction volume on the Bitcoin network show a steady upward trend.

- High hash rate: The sustained high hash rate indicates a robust and secure network, further enhancing investor confidence.

These technical indicators corroborate the narrative of increased demand and adoption, adding further weight to the upward price pressure on Bitcoin.

Positive Market Sentiment and FOMO

The positive market sentiment surrounding Bitcoin, coupled with the fear of missing out (FOMO), has significantly amplified the price surge. Positive news coverage, social media trends, and general bullish sentiment all play a role.

- Social media buzz: Positive sentiment on platforms like Twitter and Reddit fuels further buying pressure, creating a self-reinforcing cycle.

- Mainstream media attention: Increased media coverage of Bitcoin's price surge attracts new investors and amplifies the FOMO effect.

These psychological factors contribute significantly to the market's upward momentum, driving the Bitcoin price to new heights.

Conclusion

Bitcoin's recent all-time high is a result of a convergence of positive factors. A more favorable US regulatory outlook has reduced uncertainty and increased investor confidence. Increased institutional adoption, driven partly by the perception of Bitcoin as a hedge against inflation, has added significant buying pressure. Furthermore, positive technical indicators and strong market sentiment have amplified the price surge. While risks always exist in the cryptocurrency market, the current positive trajectory suggests a significant shift in how Bitcoin is perceived within both the traditional finance world and the broader public. Stay updated on the latest Bitcoin price movements and the evolving US regulatory landscape to make informed decisions. Follow us for more insights on the Bitcoin all-time high and future trends.

Featured Posts

-

Whats New On Netflix In May 2025

May 23, 2025

Whats New On Netflix In May 2025

May 23, 2025 -

Joe Jonass Hilarious Response To Couples Fight Over Him

May 23, 2025

Joe Jonass Hilarious Response To Couples Fight Over Him

May 23, 2025 -

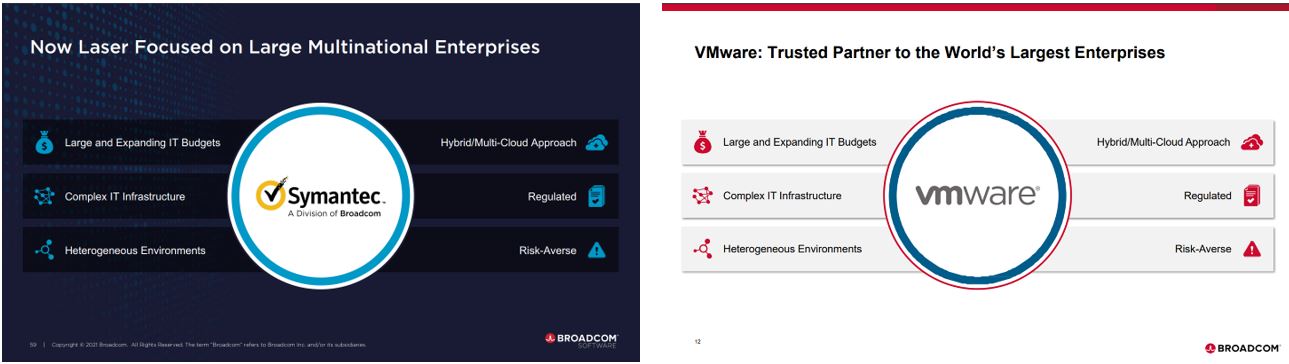

1 050 Price Surge At And T Details Broadcoms V Mware Cost Impact

May 23, 2025

1 050 Price Surge At And T Details Broadcoms V Mware Cost Impact

May 23, 2025 -

Sse Announces 3 Billion Reduction In Spending Plan

May 23, 2025

Sse Announces 3 Billion Reduction In Spending Plan

May 23, 2025 -

Erik Ten Hag Leverkusens Interest And The Implications For Manchester United

May 23, 2025

Erik Ten Hag Leverkusens Interest And The Implications For Manchester United

May 23, 2025

Latest Posts

-

Review Jonathan Groffs Powerful Performance In Just In Time

May 23, 2025

Review Jonathan Groffs Powerful Performance In Just In Time

May 23, 2025 -

Jonathan Groff Opens Up About His Experience With Asexuality

May 23, 2025

Jonathan Groff Opens Up About His Experience With Asexuality

May 23, 2025 -

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025

Jonathan Groffs Just In Time A 1965 Style Party On Stage

May 23, 2025 -

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025

Just In Time Review Jonathan Groff Shines In A Stellar Bobby Darin Musical

May 23, 2025 -

Jonathan Groffs Just In Time Performance Channeling Bobby Darins Energy

May 23, 2025

Jonathan Groffs Just In Time Performance Channeling Bobby Darins Energy

May 23, 2025