Bank Of Canada's Monetary Policy: A Rosenberg Perspective

Table of Contents

Rosenberg's Critique of the Bank of Canada's Current Approach

David Rosenberg, a prominent economist and strategist, often offers a perspective that differs from mainstream consensus. His analysis is characterized by a deep dive into economic data and a focus on identifying underlying trends often overlooked by others. Let's examine his critique of the Bank of Canada's recent monetary policy decisions.

Assessment of Inflationary Pressures

Rosenberg's perspective on inflation in Canada often highlights the complexities beyond simple demand-pull explanations. He frequently emphasizes the role of supply-side bottlenecks, disruptions in global supply chains, and structural issues contributing to persistent price increases. He often argues that the Bank of Canada's forecasts, while aiming for a 2% inflation target, may understate the persistent nature of inflationary pressures.

- Supply-Side Bottlenecks: Rosenberg points to persistent supply chain disruptions and shortages as significant contributors to inflation, arguing that these are not adequately addressed by simply raising interest rates.

- Demand vs. Supply: He often distinguishes between demand-pull inflation (driven by excessive consumer spending) and cost-push inflation (driven by rising production costs). He may argue that the current inflation is more heavily weighted towards cost-push factors.

- Accuracy of Predictions: Comparing Rosenberg’s past inflation predictions with those of the Bank of Canada reveals interesting discrepancies. While both might have pointed to similar overall trends, the timing and magnitude of predicted changes may differ significantly. A thorough analysis of these historical predictions allows us to assess the accuracy and reliability of each perspective.

Analysis of Interest Rate Decisions

The Bank of Canada has recently implemented several interest rate adjustments, aiming to curb inflation. However, Rosenberg’s assessment of these decisions often focuses on their effectiveness and potential unintended consequences. He might argue that the aggressive rate hikes, while intended to cool down the economy, could trigger an unnecessary recession and exacerbate existing economic vulnerabilities.

- Rate Hike Effectiveness: Rosenberg might scrutinize the timing and magnitude of interest rate adjustments, questioning whether they are appropriately calibrated to the specific economic conditions.

- Lagged Effects: He often highlights the lagged effects of monetary policy, meaning that the full impact of rate changes is not immediately felt. This makes accurate predictions challenging and calls for a nuanced understanding of the economic mechanisms involved.

- Commentary on Past Decisions: A review of Rosenberg’s past comments on Bank of Canada rate decisions offers valuable insight into his consistent critique and his predictive capabilities. He may have pointed out potential risks that were later realized.

The Impact of Monetary Policy on Key Economic Indicators (Rosenberg's View)

Rosenberg's analysis extends beyond simple interest rate adjustments to examine their broader implications for various key economic indicators.

Impact on Employment

Rosenberg's perspective on the relationship between monetary policy and employment in Canada often highlights the trade-offs involved. While higher interest rates aim to control inflation, they can also lead to reduced investment, decreased hiring, and ultimately higher unemployment. He might analyze whether the Bank of Canada's approach adequately balances these competing objectives.

- Unemployment Rate: Rosenberg will likely analyze how the Bank of Canada's actions impact the Canadian unemployment rate, predicting potential increases based on his economic models.

- Job Market Dynamics: He often focuses on the nuances of the Canadian job market, looking beyond headline unemployment figures to assess the quality of jobs created and the potential for increased underemployment.

- Labor Market Rigidity: He may consider how structural factors within the Canadian labor market influence the responsiveness of employment to monetary policy changes.

Impact on the Canadian Dollar

Changes in interest rates influence currency exchange rates. Rosenberg’s perspective on the impact of the Bank of Canada's monetary policy on the Canadian dollar (CAD) often considers its implications for international trade. A stronger CAD can benefit consumers through lower import prices, but it may hurt Canadian exporters by making their goods more expensive for international buyers.

- CAD Exchange Rate: He will analyze the anticipated movements of the Canadian dollar based on the Bank of Canada’s actions, predicting potential appreciation or depreciation.

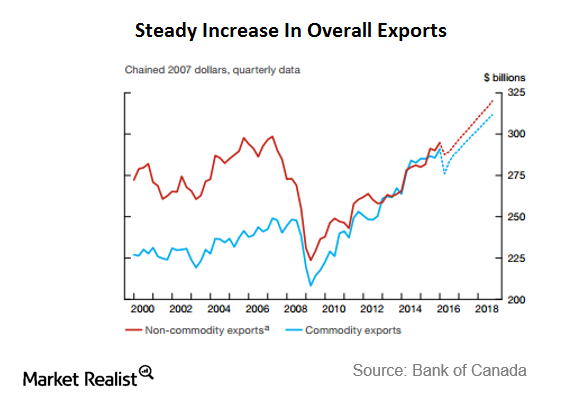

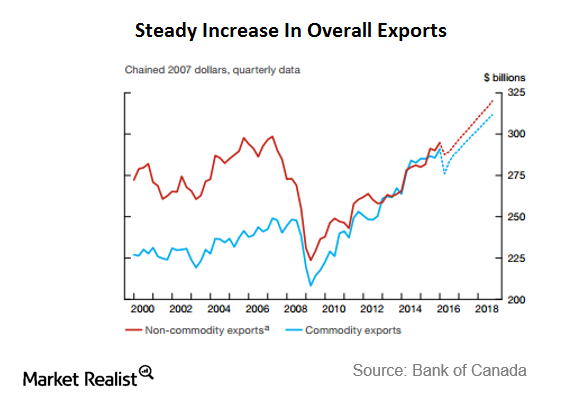

- Impact on Exports/Imports: He often assesses the effects of exchange rate fluctuations on Canada's trade balance, considering the relative impact on export-oriented and import-dependent sectors.

- Forex Market Dynamics: He'll often explain his analysis of currency movements through the lens of global economic forces and their impact on the CAD.

Impact on Housing Market

The Canadian housing market is highly sensitive to interest rate changes. Rosenberg's views on the Bank of Canada's policy often include an assessment of its impact on housing prices and the potential for a market correction. He might examine whether the current policies are sustainable and whether they could lead to a significant downturn in the housing sector.

- Housing Price Predictions: He would likely offer predictions on the future trajectory of Canadian housing prices, considering factors like mortgage rates, borrowing costs, and consumer confidence.

- Housing Market Correction: Rosenberg might discuss the likelihood of a housing market correction, considering the potential for overvaluation and the risk of a sharp price decline.

- Regional Variations: He might also point out regional differences in the housing market's vulnerability to interest rate changes.

Alternative Approaches and Rosenberg's Recommendations

Rosenberg’s critique isn't merely negative; he often proposes alternative approaches and long-term strategies.

Potential Policy Alternatives

Rosenberg might suggest alternative monetary policy strategies, potentially advocating for a less aggressive approach to rate hikes or emphasizing the need for structural reforms to address underlying inflationary pressures. He may highlight the importance of considering the broader economic context and avoiding excessively rapid shifts in monetary policy.

Long-Term Economic Outlook

Rosenberg's long-term outlook for the Canadian economy often depends on his assessment of the Bank of Canada's policies and their potential consequences. He may express concerns about the sustainability of current growth patterns or predict potential risks like a recession based on his analysis.

Investment Strategies based on Rosenberg's Analysis

Rosenberg's economic views frequently have implications for investment strategies. His analysis may guide investors toward defensive positions or suggest opportunities in sectors less susceptible to interest rate hikes.

Conclusion: Navigating the Canadian Economic Landscape with Rosenberg's Insights on Bank of Canada Monetary Policy

David Rosenberg's perspective on the Bank of Canada's monetary policy provides a valuable counterpoint to mainstream views. His critique, focusing on the complexities of inflation, the lagged effects of interest rate changes, and the potential risks to employment and the housing market, offers crucial insights for navigating the current economic climate. Understanding diverse economic viewpoints, including Rosenberg’s contrarian approach, is essential for a comprehensive analysis of the Bank of Canada’s actions and their impact on the Canadian economy. Continue researching the Bank of Canada's monetary policy and follow David Rosenberg's commentary for further insights into the evolving economic landscape. Stay informed to make well-informed decisions in these uncertain times.

Featured Posts

-

Trumps Trade War With China Examining The Consequences Of Tariffs On The Us Economy

Apr 29, 2025

Trumps Trade War With China Examining The Consequences Of Tariffs On The Us Economy

Apr 29, 2025 -

Move Over Quinoa The Next Big Superfood Is Here

Apr 29, 2025

Move Over Quinoa The Next Big Superfood Is Here

Apr 29, 2025 -

Indias Large Cap Stocks Surge Reliances Positive Earnings Report

Apr 29, 2025

Indias Large Cap Stocks Surge Reliances Positive Earnings Report

Apr 29, 2025 -

One Plus 13 R Review Should You Buy It Or Opt For A Pixel 9a

Apr 29, 2025

One Plus 13 R Review Should You Buy It Or Opt For A Pixel 9a

Apr 29, 2025 -

A Geographic Analysis Of The Countrys Top Emerging Business Markets

Apr 29, 2025

A Geographic Analysis Of The Countrys Top Emerging Business Markets

Apr 29, 2025

Latest Posts

-

Our Yorkshire Farm Star Amanda Owens Difficult News

Apr 30, 2025

Our Yorkshire Farm Star Amanda Owens Difficult News

Apr 30, 2025 -

Amanda Owen Breaks Silence On Heartbreaking Discovery At Ravenseat

Apr 30, 2025

Amanda Owen Breaks Silence On Heartbreaking Discovery At Ravenseat

Apr 30, 2025 -

Amanda Owen Bids Farewell To Our Yorkshire Farm In Heartbreaking Scenes

Apr 30, 2025

Amanda Owen Bids Farewell To Our Yorkshire Farm In Heartbreaking Scenes

Apr 30, 2025 -

Amanda Owens Emotional Goodbye To Our Yorkshire Farm

Apr 30, 2025

Amanda Owens Emotional Goodbye To Our Yorkshire Farm

Apr 30, 2025 -

Where To Stream Ru Pauls Drag Race Season 17 Episode 6 A Free Guide No Cable

Apr 30, 2025

Where To Stream Ru Pauls Drag Race Season 17 Episode 6 A Free Guide No Cable

Apr 30, 2025