India's Large-Cap Stocks Surge: Reliance's Positive Earnings Report

Table of Contents

Reliance Industries' Q2 Earnings Report: A Deep Dive

Reliance Industries' Q2 earnings report revealed a stunning performance, exceeding expectations across multiple key segments. The results showcase the company's robust growth trajectory and its ability to navigate the complexities of the current economic landscape.

- Record-breaking revenue in the petrochemicals sector: Reliance witnessed a substantial increase in revenue from its petrochemicals division, driven by strong global demand and efficient operational management. This segment alone contributed significantly to the overall positive earnings.

- Strong growth in the telecom and retail segments: Reliance Jio's continued dominance in the telecom sector, coupled with the expansion of Reliance Retail, contributed to significant revenue growth in these crucial segments. Innovative offerings and strategic partnerships fueled this expansion.

- Improved profitability compared to the previous quarter: Reliance demonstrated improved profit margins across various segments, reflecting effective cost management and operational efficiencies. This showcases the company's ability to optimize its operations for maximum profitability.

These positive results were fueled by several factors, including increased global demand for petrochemicals, the sustained success of Jio's 5G rollout, and the expansion of Reliance Retail's footprint across India. The company’s strategic investments and innovative business models have clearly paid off.

Impact on India's Large-Cap Market Indices

Reliance's strong Q2 earnings report has had a demonstrable impact on India's large-cap market indices. The positive sentiment surrounding Reliance has spilled over into other large-cap stocks, particularly those within related sectors. The Nifty 50 and Sensex, two of India's most important stock market indices, have seen a noticeable upward trend following the release of the report.

- Positive Correlation: The correlation between Reliance's performance and the movement of the Nifty 50 and Sensex is undeniable. Reliance's weight in these indices means its performance significantly influences their overall trajectory.

- Boosted Investor Sentiment: The strong earnings report has significantly boosted investor sentiment and market confidence, attracting both domestic and international investors to the Indian stock market.

- Impact on Related Sectors: The positive performance has also influenced other large-cap stocks in related sectors, like energy, telecom, and retail, further contributing to the overall market surge. This positive spillover effect highlights the interconnectedness of the Indian large-cap market.

Investor Reactions and Future Outlook for Reliance and Related Stocks

The market's reaction to Reliance's earnings report has been overwhelmingly positive. The stock price has seen a significant increase, accompanied by high trading volume and generally favorable analyst ratings.

- Stock Price Movement: Following the earnings announcement, Reliance's stock price experienced a notable surge, reflecting investor confidence in the company's future growth.

- Analyst Ratings: Financial analysts have largely upgraded their ratings for Reliance, reflecting a positive outlook on the company's long-term prospects.

- Increased Trading Volume: Trading volume for Reliance stock increased significantly after the earnings report, indicating strong investor interest and participation in the market.

The long-term implications of this positive performance are significant. Analysts predict continued growth for Reliance, driven by its diversification across various sectors and its ongoing investments in technology and infrastructure. The outlook for related stocks also appears positive, fueled by the overall market optimism.

Risks and Potential Challenges

While the outlook for Reliance and the Indian large-cap market is generally positive, it's crucial to acknowledge potential risks and challenges.

- Market Risks: Global macroeconomic factors, such as inflation and interest rate hikes, could impact investor sentiment and market performance.

- Macroeconomic Factors: Geopolitical instability and fluctuations in global commodity prices could also pose challenges to Reliance's future performance.

- Industry Headwinds: Increased competition within various sectors could impact Reliance's market share and profitability.

Conclusion: Navigating the Surge in India's Large-Cap Stocks Following Reliance's Positive Earnings

Reliance Industries' exceptionally positive Q2 earnings report has undeniably fueled a surge in India's large-cap stock market. The impact on key indices like the Nifty 50 and Sensex, coupled with the positive investor sentiment, highlights the significant influence of Reliance's performance on the broader market. While potential risks and challenges exist, the overall outlook remains optimistic. Staying informed about Reliance's performance and monitoring related market trends is crucial for investors looking to navigate this dynamic landscape. Stay updated on the latest developments in India's large-cap stocks and make informed investment decisions. [Link to relevant financial news source or investment platform].

Featured Posts

-

Ray Epps V Fox News A Defamation Lawsuit Examining January 6th Narratives

Apr 29, 2025

Ray Epps V Fox News A Defamation Lawsuit Examining January 6th Narratives

Apr 29, 2025 -

Quinoas New Rival The Rising Star Of Superfoods

Apr 29, 2025

Quinoas New Rival The Rising Star Of Superfoods

Apr 29, 2025 -

Chinas Huawei Unveils Exclusive Ai Chip Targeting Nvidias Market Share

Apr 29, 2025

Chinas Huawei Unveils Exclusive Ai Chip Targeting Nvidias Market Share

Apr 29, 2025 -

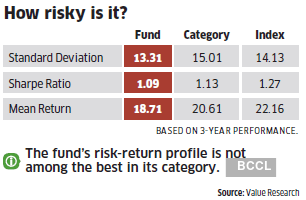

Top Performing India Fund Dsp Takes A Conservative Approach

Apr 29, 2025

Top Performing India Fund Dsp Takes A Conservative Approach

Apr 29, 2025 -

Update One Georgia Deputy Dead Another Injured Following Traffic Stop Shooting

Apr 29, 2025

Update One Georgia Deputy Dead Another Injured Following Traffic Stop Shooting

Apr 29, 2025

Latest Posts

-

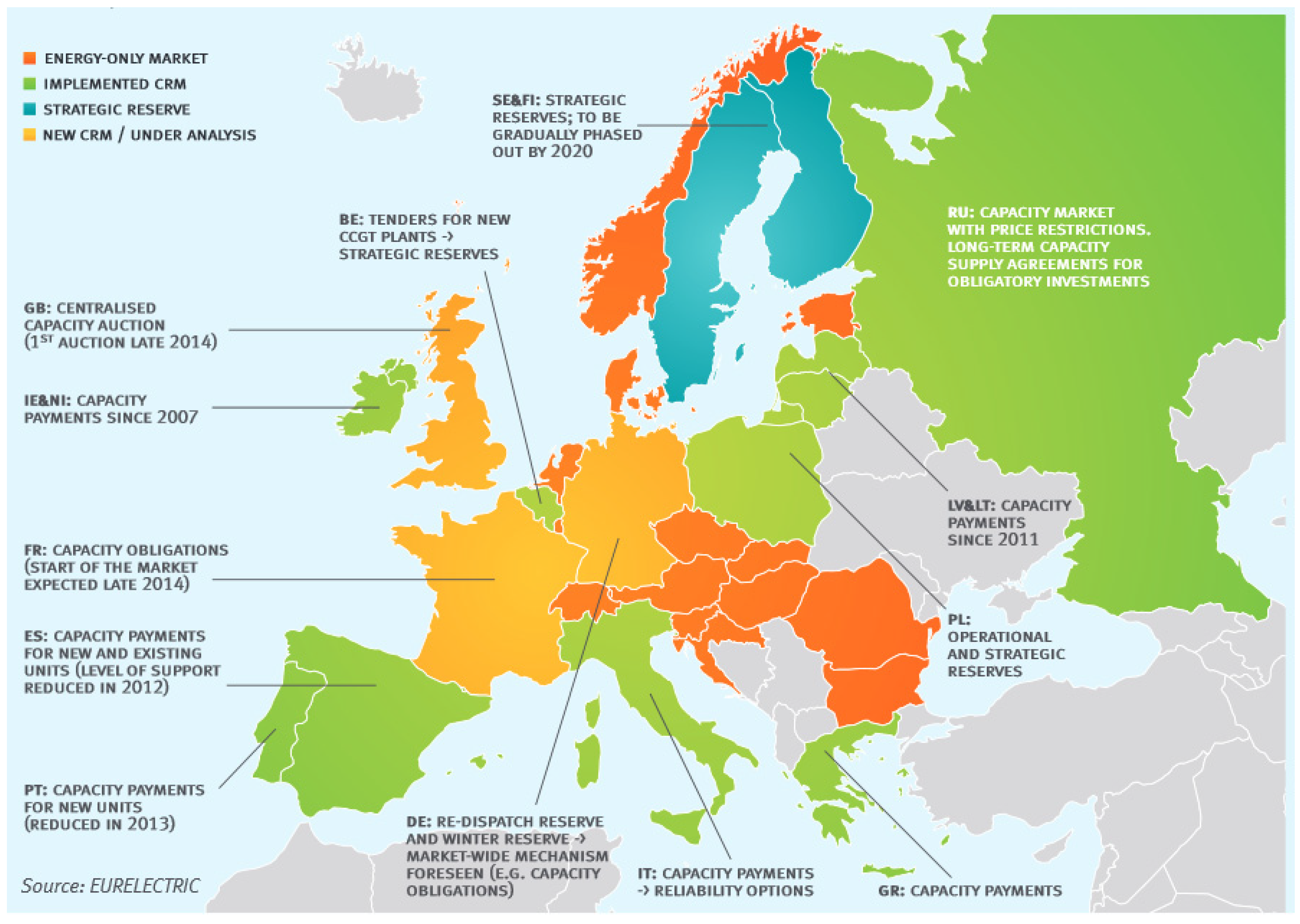

European Energy Market Solar Powers Impact On Electricity Prices

Apr 29, 2025

European Energy Market Solar Powers Impact On Electricity Prices

Apr 29, 2025 -

Selling Sunset Star Condemns La Landlord Price Gouging After Fires

Apr 29, 2025

Selling Sunset Star Condemns La Landlord Price Gouging After Fires

Apr 29, 2025 -

Gambling On Calamity Analyzing The Los Angeles Wildfire Betting Market

Apr 29, 2025

Gambling On Calamity Analyzing The Los Angeles Wildfire Betting Market

Apr 29, 2025 -

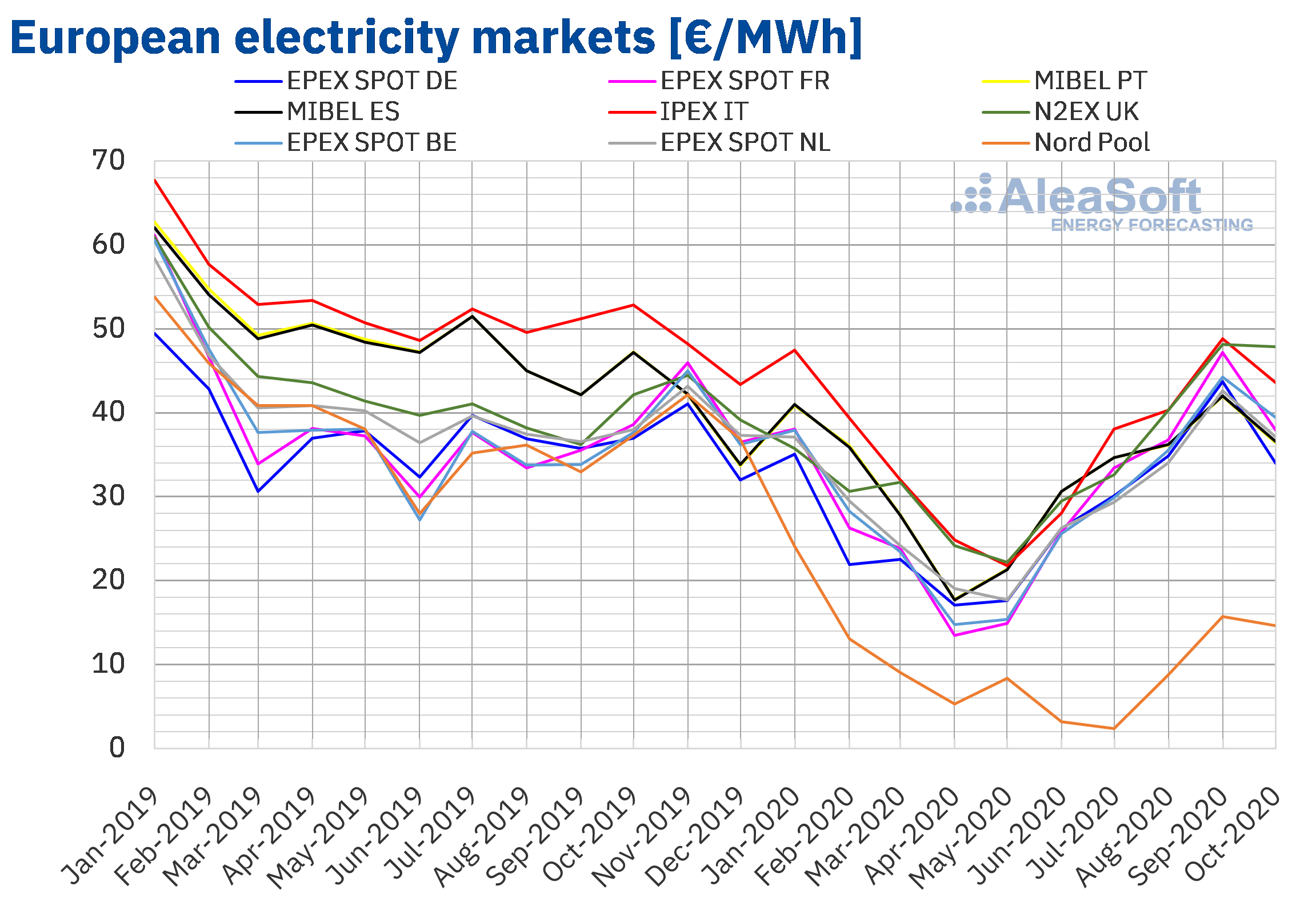

Negative European Electricity Prices A Solar Energy Success Story

Apr 29, 2025

Negative European Electricity Prices A Solar Energy Success Story

Apr 29, 2025 -

The Crucial Role Of Middle Managers In Boosting Employee Performance And Company Profitability

Apr 29, 2025

The Crucial Role Of Middle Managers In Boosting Employee Performance And Company Profitability

Apr 29, 2025