Top Performing India Fund, DSP, Takes A Conservative Approach

Table of Contents

DSP's Conservative Investment Philosophy

DSP's success isn't built on chasing short-term market trends; instead, it's rooted in a carefully crafted conservative mutual fund strategy prioritizing risk management and long-term value creation. Their investment philosophy differs significantly from more aggressive funds that often employ high portfolio turnover and speculative market timing. This philosophy is built upon several key pillars:

-

Focus on Long-Term Value Investing: DSP prioritizes identifying fundamentally strong companies with sustainable business models, focusing on long-term growth potential rather than short-term market fluctuations. This eliminates the need for constant trading and reduces transaction costs.

-

Diversification Across Sectors and Asset Classes: To mitigate risk, DSP employs a diversified portfolio strategy, spreading investments across various sectors and asset classes within the Indian market. This reduces the impact of any single sector's underperformance.

-

Emphasis on Fundamental Analysis over Market Timing: Unlike funds that rely on market predictions, DSP relies heavily on thorough fundamental analysis to assess the intrinsic value of companies. This long-term perspective minimizes exposure to market timing errors.

-

Strict Risk Assessment and Control Measures: Robust risk management is central to DSP's approach. They implement stringent controls to identify and mitigate potential risks, ensuring portfolio stability even during periods of market volatility.

-

Lower Portfolio Turnover: Compared to aggressive funds that frequently buy and sell assets, DSP maintains a lower portfolio turnover, minimizing transaction costs and tax implications, contributing to better long-term returns. This steady, patient approach is a hallmark of their conservative investment strategy.

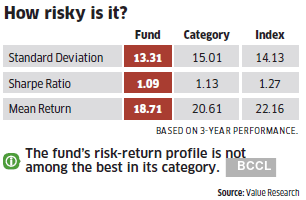

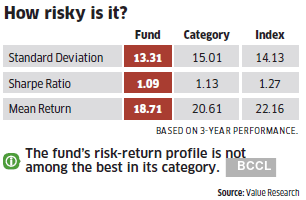

Analyzing DSP's Top Performance Despite Conservative Approach

Despite its conservative approach, the DSP India fund consistently ranks among the top-performing India funds. This counterintuitive success highlights the effectiveness of a disciplined, long-term strategy. The fund has demonstrated remarkable resilience during market downturns, often outperforming benchmarks in the long run.

-

Comparison with Competitors: Compared to funds like [Name of Competitor 1] and [Name of Competitor 2], DSP has shown more consistent returns over various market cycles, as evidenced by [Insert data/chart showing performance comparison].

-

Consistent Returns over Market Cycles: [Insert chart/graph illustrating consistent returns over bull and bear markets]. This chart clearly showcases the stability and resilience of DSP's conservative strategy.

-

Outperforming During Downturns: During periods of market downturn, such as [mention specific market corrections], DSP's conservative strategy proved advantageous, limiting losses and protecting investor capital.

-

Awards and Recognitions: DSP has received numerous awards and recognitions for its consistent performance and strong risk management practices. [Mention specific awards if available].

Suitable Investor Profile for a DSP India Fund

The DSP India fund is particularly well-suited for investors who prioritize capital preservation and long-term growth over short-term gains. The ideal investor profile includes:

-

Long-Term Investment Horizon (5+ years): A conservative approach requires patience, as substantial growth often takes time. Investors with a long-term outlook are best positioned to benefit.

-

Moderate to Low-Risk Tolerance: Investors comfortable with lower potential returns in exchange for reduced risk will find this fund suitable.

-

Prioritizing Capital Preservation: Investors focused on protecting their investment capital rather than maximizing short-term gains will appreciate DSP's strategy.

-

Seeking Portfolio Diversification: The fund’s diversification across sectors and asset classes makes it a valuable addition to a well-diversified investment portfolio.

-

Retirement Planning: The long-term growth and stability offered by DSP make it an ideal choice for retirement planning and other long-term financial goals.

Potential Drawbacks of a Conservative Approach

While DSP's conservative approach offers significant advantages, it's crucial to acknowledge potential drawbacks.

-

Lower Potential Returns: Compared to high-growth funds, a conservative approach may result in lower potential returns, especially during bull markets.

-

Missed Opportunities: Focusing on long-term value may mean missing out on significant short-term gains offered by more aggressive strategies.

-

Longer Time Horizon Required: Achieving substantial growth with a conservative approach typically requires a longer investment time horizon.

Conclusion

DSP India fund stands out as a top-performing India fund that successfully balances risk and return through a conservative investment strategy. Its consistent performance, especially during market downturns, highlights the effectiveness of this approach. While potentially offering lower returns than aggressive strategies in the short term, the long-term stability and capital preservation offered by DSP make it an ideal choice for investors with a long-term horizon and moderate to low-risk tolerance. Consider whether a DSP India fund aligns with your investment objectives and risk profile. Remember to conduct thorough research and consult with a financial advisor before making any investment decisions related to top-performing India funds like DSP. Consider the benefits of a conservative approach to managing your India fund investments.

Featured Posts

-

Ftc Probe Into Open Ai Implications For The Future Of Ai And Data Privacy

Apr 29, 2025

Ftc Probe Into Open Ai Implications For The Future Of Ai And Data Privacy

Apr 29, 2025 -

Tylor Megills Success With The Mets A Deep Dive Into His Pitching Strategy

Apr 29, 2025

Tylor Megills Success With The Mets A Deep Dive Into His Pitching Strategy

Apr 29, 2025 -

The Ev Revolutions Hidden Threat The Dysprosium Shortage

Apr 29, 2025

The Ev Revolutions Hidden Threat The Dysprosium Shortage

Apr 29, 2025 -

Choosing Between One Plus 13 R And Pixel 9a Performance Camera And Value

Apr 29, 2025

Choosing Between One Plus 13 R And Pixel 9a Performance Camera And Value

Apr 29, 2025 -

Investing In Middle Management A Strategy For Enhanced Company Performance And Employee Retention

Apr 29, 2025

Investing In Middle Management A Strategy For Enhanced Company Performance And Employee Retention

Apr 29, 2025

Latest Posts

-

Why Domestic Manufacturing In The Us Remains A Challenge

Apr 29, 2025

Why Domestic Manufacturing In The Us Remains A Challenge

Apr 29, 2025 -

The Struggle To Create All American Products A Realistic Look

Apr 29, 2025

The Struggle To Create All American Products A Realistic Look

Apr 29, 2025 -

The Challenges Of Producing All American Goods

Apr 29, 2025

The Challenges Of Producing All American Goods

Apr 29, 2025 -

Why Making An All American Product Is So Difficult

Apr 29, 2025

Why Making An All American Product Is So Difficult

Apr 29, 2025 -

Ohio Train Derailment Investigation Into Long Term Toxic Chemical Presence In Buildings

Apr 29, 2025

Ohio Train Derailment Investigation Into Long Term Toxic Chemical Presence In Buildings

Apr 29, 2025