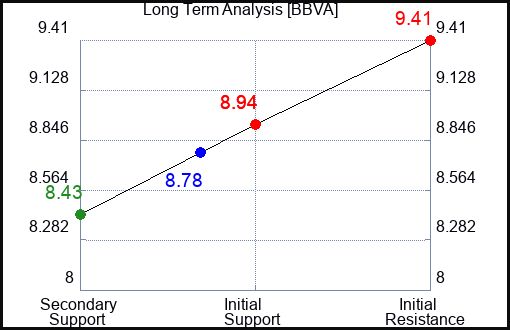

BBVA Investment Banking: A Long-Term Play For Growth

Table of Contents

BBVA's Strategic Investment Banking Focus

BBVA's investment banking arm is strategically focused on delivering comprehensive financial advisory and capital markets solutions to a diverse global client base. This focus is underpinned by a commitment to market leadership and technological advancement.

Market Leadership and Expansion

BBVA is aggressively pursuing market leadership across key sectors, demonstrating a clear understanding of emerging market trends. Their sector expertise is particularly strong in renewable energy, technology, and infrastructure, reflecting a strategic commitment to sustainable and high-growth industries.

- Successful Deals: BBVA has successfully advised on numerous high-profile mergers and acquisitions (M&A) transactions, including several landmark deals in the renewable energy sector in Spain and Latin America.

- Geographic Expansion: BBVA's investment banking operations have a significant global reach, with strong presences in key financial centers across Europe, the Americas, and Asia. This geographic diversification mitigates risk and provides access to a broader range of investment opportunities.

- Strategic Partnerships: BBVA actively cultivates strategic partnerships with leading firms in various sectors, enhancing its ability to deliver comprehensive and innovative solutions to its clients. These partnerships expand their reach and expertise.

- Market Share Data: While specific market share data is often confidential, internal reports and industry analysts consistently rank BBVA highly amongst its peers in key sectors.

Innovation and Technological Advancement

BBVA is a leader in leveraging technology to enhance its investment banking services, embracing digital transformation to streamline processes and improve efficiency.

- AI-Driven Solutions: BBVA utilizes AI-powered tools for due diligence, risk assessment, and portfolio management, enhancing accuracy and speed.

- Digital Platforms for Deal Execution: The firm has invested heavily in developing robust digital platforms that facilitate seamless deal execution and communication with clients. This improves transparency and reduces operational costs.

- Algorithmic Trading Capabilities: BBVA's sophisticated algorithmic trading capabilities provide clients with greater speed and precision in executing trades across various asset classes.

Robust Client Base and Strong Relationships

BBVA's success is built upon a foundation of strong, long-term relationships with a diverse portfolio of clients. Their dedication to exceptional client service is a key differentiator.

Diverse Client Portfolio

BBVA serves a wide array of clients across various industries, including large multinational corporations, small and medium-sized enterprises (SMEs), and institutional investors. This diversified client portfolio mitigates risk and ensures a steady stream of investment banking opportunities.

- Significant Clients: BBVA counts many Fortune 500 companies and leading global institutions among its client base. Specific client names are often kept confidential due to non-disclosure agreements.

- Long-Standing Relationships: Many of BBVA's client relationships span decades, underscoring the trust and confidence that clients place in the firm. This loyalty testifies to the quality of service provided.

- Client Testimonials: (While specific testimonials may require permission for publication, anecdotal evidence suggests high client satisfaction with BBVA's investment banking services.)

Dedicated Client Service

BBVA's investment banking teams are committed to providing personalized solutions tailored to each client's unique needs and objectives. Their dedicated advisors work closely with clients to develop strategic plans and execute complex financial transactions.

- Dedicated Advisors: Clients are assigned dedicated teams of advisors who provide ongoing support and guidance throughout the entire investment banking process.

- Personalized Service: BBVA takes a consultative approach, working closely with clients to understand their specific goals and challenges before recommending solutions.

- Successful Client Outcomes: Numerous case studies demonstrate the positive impact of BBVA's investment banking services on client businesses. These success stories highlight the value provided through their expertise and guidance.

Financial Strength and Stability

BBVA's commitment to long-term growth is underpinned by its robust financial performance, strong risk management practices, and unwavering commitment to regulatory compliance.

Solid Financial Performance

BBVA's investment banking division consistently delivers strong financial results, reflecting its market leadership and efficient operations.

- Revenue Growth: The investment banking division has shown consistent revenue growth, exceeding industry averages in recent years. (Specific financial data should be sourced from publicly available BBVA financial reports.)

- Profit Margins: BBVA's investment banking arm maintains healthy profit margins, showcasing the efficiency of its operations and its ability to generate value for shareholders.

- Return on Equity (ROE): A strong ROE demonstrates the profitability of BBVA's investment banking activities compared to its invested capital. (Again, refer to public financial reports for specific data.)

Regulatory Compliance and Risk Management

BBVA maintains the highest standards of ethical conduct and adheres strictly to all relevant regulatory requirements. A robust risk management framework ensures the safety and soundness of its operations.

- Compliance Certifications: BBVA holds numerous compliance certifications, demonstrating its commitment to adhering to the strictest industry standards.

- Internal Controls: Strong internal controls and risk mitigation strategies are implemented across all aspects of BBVA’s investment banking operations.

- Corporate Governance: BBVA's strong corporate governance framework supports its ethical conduct and risk management practices.

Conclusion

BBVA Investment Banking offers a compelling proposition for businesses seeking long-term growth and strategic financial guidance. Their strategic focus, robust client relationships, and strong financial foundation are key drivers of their success. The firm's commitment to innovation, technological advancement, and ethical conduct positions it for continued success in the dynamic global investment banking landscape. Discover how BBVA Investment Banking can help your organization achieve its long-term growth objectives. Contact us today to explore how our expertise and resources can support your financial strategies and unlock your full potential. Learn more about BBVA Investment Banking services and the long-term growth opportunities they provide.

Featured Posts

-

Convicted Cardinals Challenge A Vatican Standoff Over Papal Conclave Participation

Apr 25, 2025

Convicted Cardinals Challenge A Vatican Standoff Over Papal Conclave Participation

Apr 25, 2025 -

Pennsylvania Legal News Cozen O Connors April 17 2025 Perspective

Apr 25, 2025

Pennsylvania Legal News Cozen O Connors April 17 2025 Perspective

Apr 25, 2025 -

Harrogate Spring Flower Show 2025 Dates Tickets And What To Expect

Apr 25, 2025

Harrogate Spring Flower Show 2025 Dates Tickets And What To Expect

Apr 25, 2025 -

Cowboys Insider Reveals Unexpected Nfl Draft Prospects

Apr 25, 2025

Cowboys Insider Reveals Unexpected Nfl Draft Prospects

Apr 25, 2025 -

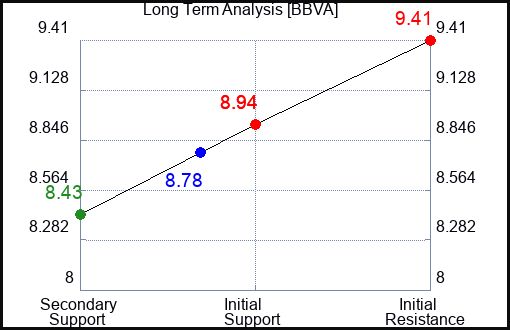

Betting On Natural Disasters The Troubling Trend Of Wildfire Wagers

Apr 25, 2025

Betting On Natural Disasters The Troubling Trend Of Wildfire Wagers

Apr 25, 2025

Latest Posts

-

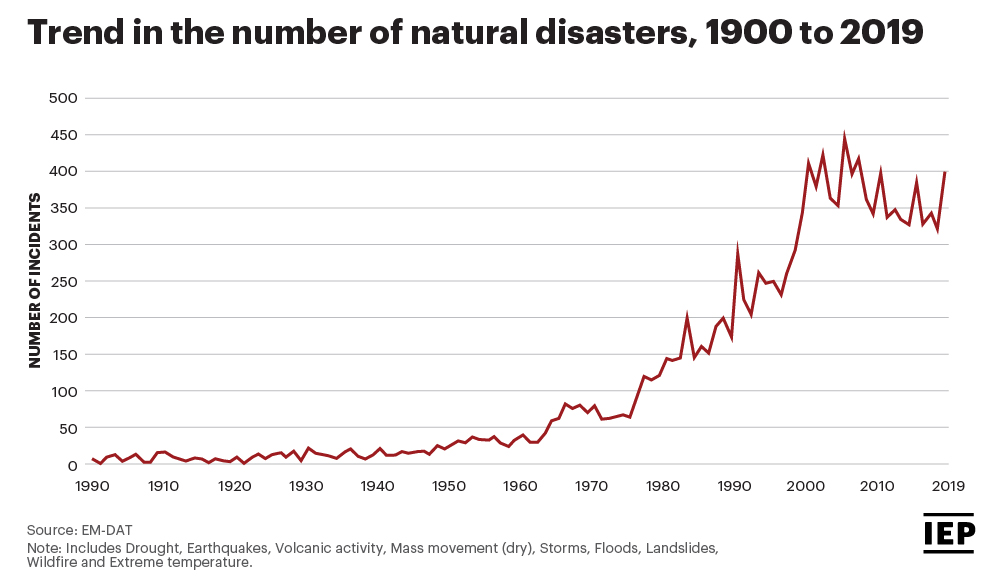

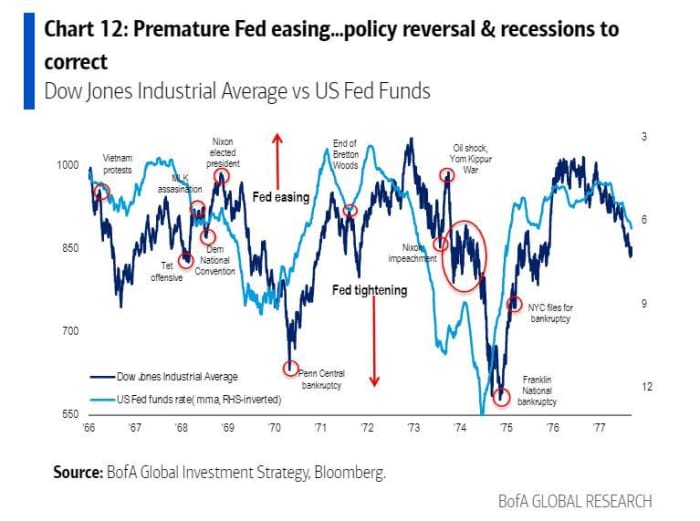

Bof As Take Why Stretched Stock Market Valuations Shouldnt Worry Investors

Apr 26, 2025

Bof As Take Why Stretched Stock Market Valuations Shouldnt Worry Investors

Apr 26, 2025 -

Are High Stock Market Valuations A Cause For Concern Bof A Says No

Apr 26, 2025

Are High Stock Market Valuations A Cause For Concern Bof A Says No

Apr 26, 2025 -

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025

The Ethics Of Betting On The Los Angeles Wildfires And Similar Events

Apr 26, 2025 -

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025

Are We Normalizing Disaster Betting The Los Angeles Wildfires Example

Apr 26, 2025 -

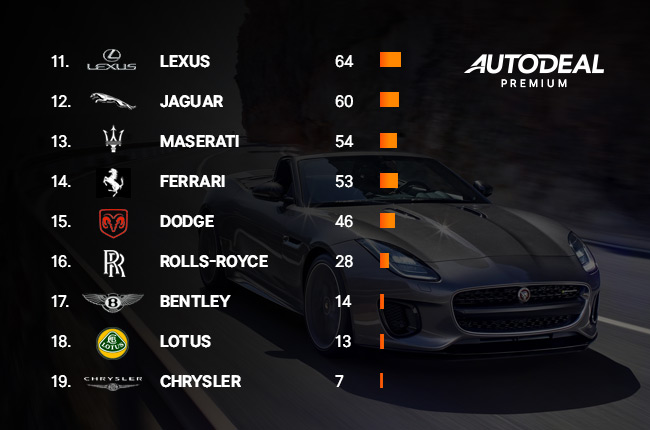

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025

The China Factor Analyzing The Difficulties Faced By Premium Car Brands

Apr 26, 2025