BBVA's Long-Term Investment Banking Strategy: A CFO Perspective

Table of Contents

Focus on Sustainable and ESG-Driven Investments

BBVA's commitment to Environmental, Social, and Governance (ESG) factors is central to its investment banking strategy. This isn't just a trend; it's a core principle driving their investment decisions and shaping their future. The bank recognizes the growing importance of responsible investing and the increasing demand from clients for sustainable financial solutions. This commitment translates into tangible actions:

-

Increased allocation of capital to sustainable projects: BBVA is actively investing in renewable energy sources, green technologies, and other projects that contribute to a more sustainable future. This commitment is reflected in their lending practices and direct investments. They are actively seeking opportunities to finance projects that demonstrably reduce carbon emissions and promote environmental protection.

-

Development of specialized ESG advisory services for clients: BBVA offers specialized advisory services to help clients integrate ESG factors into their business strategies and investment decisions. This includes guidance on ESG reporting, risk assessment, and sustainable finance solutions. This service positions BBVA as a leader in providing comprehensive support for clients' sustainability goals.

-

Integration of ESG considerations into all investment banking decisions: ESG considerations are not an afterthought but are integral to every stage of BBVA's investment banking process, from deal structuring to risk assessment and due diligence. This holistic approach ensures that sustainability is embedded into the core of their operations.

-

Active participation in sustainable finance initiatives and industry collaborations: BBVA is actively involved in various sustainable finance initiatives and collaborates with industry peers and international organizations to promote best practices and drive innovation in the field of sustainable finance. This active participation enhances their knowledge and expertise in the field, solidifying their leadership position.

This approach aligns with growing global demand for responsible investments and attracts environmentally conscious clients. BBVA's commitment to ESG strengthens its brand reputation and long-term value, positioning them for success in a rapidly changing market.

Digital Transformation and Technological Innovation in Investment Banking

BBVA leverages technology to enhance efficiency, improve client service, and develop innovative financial products within its investment banking operations. This digital transformation is not merely about adopting new technologies; it's about fundamentally reshaping how they conduct business. Key elements of this strategy include:

-

Investment in FinTech partnerships and collaborations: BBVA actively seeks partnerships with innovative FinTech companies to access cutting-edge technologies and enhance its service offerings. These collaborations allow them to quickly adapt to evolving market trends and leverage the expertise of specialized technology providers.

-

Development of proprietary digital platforms for investment banking services: BBVA is developing its own digital platforms designed to streamline processes, improve client experience, and offer innovative investment banking solutions. These platforms are built to handle large volumes of data and provide clients with real-time access to critical information.

-

Implementation of AI and machine learning for risk management and investment analysis: BBVA is employing AI and machine learning algorithms to enhance risk management capabilities and improve investment analysis. This allows for more efficient and accurate risk assessment and more informed investment decisions.

-

Enhanced data analytics capabilities to improve decision-making and client insights: BBVA is investing heavily in advanced data analytics capabilities to gain deeper insights into market trends, client behavior, and risk factors. This data-driven approach allows for more informed strategic decisions and improved client service.

This technological focus allows BBVA to offer cutting-edge solutions and maintain a competitive edge in the market, attracting clients who value efficiency and innovation.

Strategic Partnerships and Global Expansion

BBVA’s investment banking strategy includes strategic partnerships to expand its global reach and service offerings. This expansion is a critical part of their long-term growth strategy, allowing them to diversify their revenue streams and mitigate risks. Specific initiatives include:

-

Collaborations with international financial institutions: BBVA actively collaborates with leading international financial institutions to expand its global network and access new markets. These partnerships provide access to valuable resources, expertise, and clients.

-

Expansion into new markets with high growth potential: BBVA is actively pursuing expansion into emerging markets with high growth potential in the investment banking sector. This strategic move aims to capitalize on opportunities in dynamic economies.

-

Development of specialized expertise in key industry sectors: BBVA is developing specialized expertise in key industry sectors to better serve its clients' needs. This focused approach enables them to provide more tailored and effective solutions.

-

Focus on building long-term relationships with clients worldwide: BBVA prioritizes building strong, long-term relationships with clients across the globe. This client-centric approach fosters trust and loyalty, contributing to long-term success.

This strategic approach diversifies BBVA's income streams and mitigates risks associated with reliance on a single market, enabling them to thrive in a globalized economy.

Risk Management and Regulatory Compliance within BBVA's Investment Banking Arm

Robust risk management is crucial to the success of BBVA's long-term investment banking strategy. Maintaining a strong risk management framework is not only essential for financial stability but also for building trust with investors and clients. Key aspects of this include:

-

Strict adherence to regulatory compliance standards: BBVA maintains strict adherence to all relevant regulatory compliance standards. This proactive approach minimizes legal and financial risks and ensures operational integrity.

-

Proactive identification and mitigation of financial risks: BBVA employs advanced risk assessment methodologies to proactively identify and mitigate potential financial risks. This proactive approach minimizes exposure to unforeseen events.

-

Comprehensive internal controls and auditing processes: BBVA has robust internal controls and auditing processes in place to monitor operations and ensure compliance with internal policies and regulatory requirements. These internal controls help maintain operational efficiency and minimize risks.

-

Investment in advanced risk management technologies: BBVA invests in advanced risk management technologies to enhance its ability to identify, assess, and mitigate risks. This ensures they are equipped to manage a dynamic risk landscape.

Maintaining strong risk management practices ensures financial stability and builds trust with investors and clients, fostering long-term success and sustainability.

Conclusion:

BBVA's long-term investment banking strategy is a multifaceted approach combining sustainable investments, digital innovation, strategic partnerships, and robust risk management. By focusing on ESG principles, leveraging technology, and expanding its global presence, BBVA aims to achieve sustainable growth and solidify its position as a leading global financial institution. Understanding this BBVA Investment Banking Strategy is essential for anyone seeking to understand the future direction of the bank and the broader financial landscape. To learn more about the specifics of BBVA's strategic initiatives and financial performance, we encourage you to visit the official BBVA website and explore their investor relations resources. Stay informed on future developments in BBVA's investment banking strategy and its impact on the global financial markets.

Featured Posts

-

Blockchain Analytics Leader Chainalysis Integrates Ai Startup Alterya

Apr 25, 2025

Blockchain Analytics Leader Chainalysis Integrates Ai Startup Alterya

Apr 25, 2025 -

Former Charlottesville Weatherman Arrested On Serious Sexual Extortion Charges

Apr 25, 2025

Former Charlottesville Weatherman Arrested On Serious Sexual Extortion Charges

Apr 25, 2025 -

Broadway Star Sadie Sinks Surprise Visit To The Stranger Things Cast

Apr 25, 2025

Broadway Star Sadie Sinks Surprise Visit To The Stranger Things Cast

Apr 25, 2025 -

10 Things You Need To Know About The 2025 Los Angeles Marathon

Apr 25, 2025

10 Things You Need To Know About The 2025 Los Angeles Marathon

Apr 25, 2025 -

Sino Canadian Cooperation A Pushback Against American Bullying

Apr 25, 2025

Sino Canadian Cooperation A Pushback Against American Bullying

Apr 25, 2025

Latest Posts

-

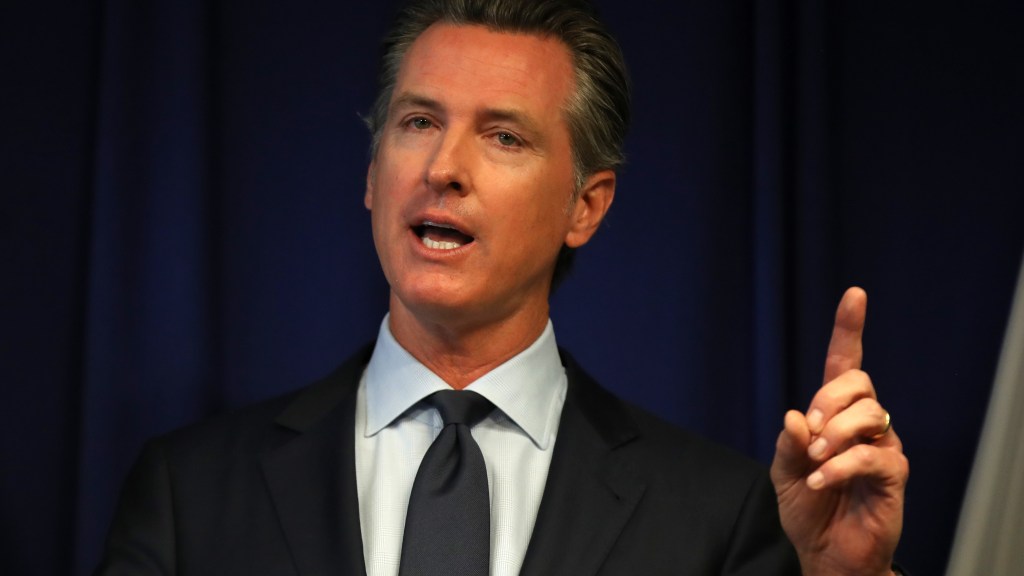

Newsoms Bannon Podcast Appearance Draws Sharp Criticism From Former Gop Representative

Apr 26, 2025

Newsoms Bannon Podcast Appearance Draws Sharp Criticism From Former Gop Representative

Apr 26, 2025 -

Is Gavin Newsom A Leftist Examining His Political Positions

Apr 26, 2025

Is Gavin Newsom A Leftist Examining His Political Positions

Apr 26, 2025 -

Former Republican Rep Condemns Newsoms Bannon Podcast Interview

Apr 26, 2025

Former Republican Rep Condemns Newsoms Bannon Podcast Interview

Apr 26, 2025 -

Gavin Newsom An Analysis Of Recent Criticisms

Apr 26, 2025

Gavin Newsom An Analysis Of Recent Criticisms

Apr 26, 2025 -

Newsoms Podcast Debut Could Charlie Kirks Interview Be A Political Disaster

Apr 26, 2025

Newsoms Podcast Debut Could Charlie Kirks Interview Be A Political Disaster

Apr 26, 2025