BigBear.ai (BBAI): Penny Stock Potential And Investment Risks

Table of Contents

BigBear.ai (BBAI) Potential for Growth

BigBear.ai's (BBAI) core business revolves around providing advanced AI, machine learning, and data analytics solutions. Its primary focus lies in serving government agencies and defense contractors, a sector ripe with opportunity for growth and technological innovation.

Technological Advantages and Market Opportunity

BBAI boasts a range of impressive technologies, positioning it for significant market expansion. These advantages translate to considerable potential within its target sectors:

- Advanced AI capabilities for threat detection: BBAI's AI algorithms are designed to identify and analyze potential threats, providing critical insights for national security and defense applications.

- Unique data analytics solutions for government agencies: The company offers customized data analytics solutions that help government agencies make better informed decisions.

- Expanding market share in the defense sector: The increasing demand for sophisticated AI and data analytics within the defense industry presents substantial growth opportunities for BBAI.

- Cutting-edge machine learning for predictive modeling: BBAI utilizes machine learning to predict future trends and events, offering invaluable support to its clients.

Recent Developments and Positive Catalysts

Positive developments can significantly impact BBAI's stock price. Analyzing these developments is crucial for understanding the company's growth trajectory:

- Successful contract award with a major government agency: Securing large government contracts can inject significant revenue into the company and boost investor confidence.

- Strategic partnership with a technology leader: Collaborations with established technology firms can enhance BBAI's technological capabilities and market reach.

- Positive analyst reports: Favorable analyst reports and upgrades can generate positive market sentiment, leading to price appreciation.

- Expansion into new markets: Venturing into new sectors beyond defense and intelligence could diversify revenue streams and fuel growth.

Financial Performance and Valuation

Analyzing BBAI's financial statements is vital for assessing its investment viability. While past performance doesn't guarantee future success, it offers valuable insights:

- Revenue growth: Examining the company's revenue growth trajectory helps determine the sustainability of its business model.

- Profitability: Analyzing profitability metrics (e.g., net income, operating margin) reveals the company's ability to generate profits.

- Debt levels: High debt levels can indicate financial instability and increased risk.

- Valuation compared to peers: Comparing BBAI's valuation to its competitors can help determine whether it's overvalued or undervalued.

Disclaimer: Predicting future financial performance is inherently uncertain. Thorough due diligence is essential before making any investment decision.

Investment Risks Associated with BBAI

Investing in BBAI, like any penny stock, comes with significant risks. Understanding these risks is paramount to making informed investment choices.

Volatility and Price Fluctuations

Penny stocks are notorious for their volatility. BBAI's stock price is highly susceptible to:

- Market sentiment: Changes in overall market sentiment can drastically affect BBAI's stock price.

- News events: Positive or negative news, even unrelated to the company's performance, can cause significant price swings.

- Company performance: The company's financial performance directly impacts its stock price.

- Susceptibility to market manipulation: Penny stocks are sometimes vulnerable to manipulation, leading to unpredictable price movements.

Financial Risks and Uncertainty

BBAI faces inherent financial risks, including:

- High debt levels: High debt can make the company vulnerable to economic downturns and limit its ability to invest in growth opportunities.

- Uncertain revenue stream: Reliance on government contracts can create revenue uncertainty.

- Potential for losses: The company may experience losses, particularly in its early stages of growth.

- Dependence on a few key clients: Loss of major contracts could severely impact the company's performance.

Regulatory and Legal Risks

BBAI operates in a highly regulated environment, exposing it to various legal and regulatory risks:

- Government contract delays: Delays in securing or fulfilling government contracts can negatively impact revenue.

- Potential legal challenges: The company may face legal disputes related to its operations or contracts.

- Compliance issues: Failure to comply with relevant regulations can result in fines or other penalties.

- Changes in government policy: Shifts in government priorities could impact demand for BBAI’s services.

Conclusion: Weighing the Potential and Risks of BigBear.ai (BBAI)

BigBear.ai (BBAI) presents a compelling investment opportunity due to its advanced technologies and potential for growth within the defense and intelligence sectors. However, the significant volatility and inherent financial risks associated with this penny stock cannot be overlooked. While the potential rewards are substantial, so too is the potential for significant losses. Before investing in BBAI or any other penny stock, it's crucial to conduct thorough due diligence, understand your risk tolerance, and develop a well-diversified investment strategy. Remember, responsible investing involves careful consideration of both potential gains and the very real possibility of losses. Don't gamble with money you can't afford to lose. Conduct your own research and consider the potential rewards and risks before investing in BigBear.ai (BBAI) or similar penny stocks.

Featured Posts

-

Canadas Response To Oxford Report Us Tariffs Largely Unchanged

May 21, 2025

Canadas Response To Oxford Report Us Tariffs Largely Unchanged

May 21, 2025 -

Sandylands U Tv Listings And Showtimes

May 21, 2025

Sandylands U Tv Listings And Showtimes

May 21, 2025 -

Tv Host Lorraine Kelly Squirming After David Walliams Remarks

May 21, 2025

Tv Host Lorraine Kelly Squirming After David Walliams Remarks

May 21, 2025 -

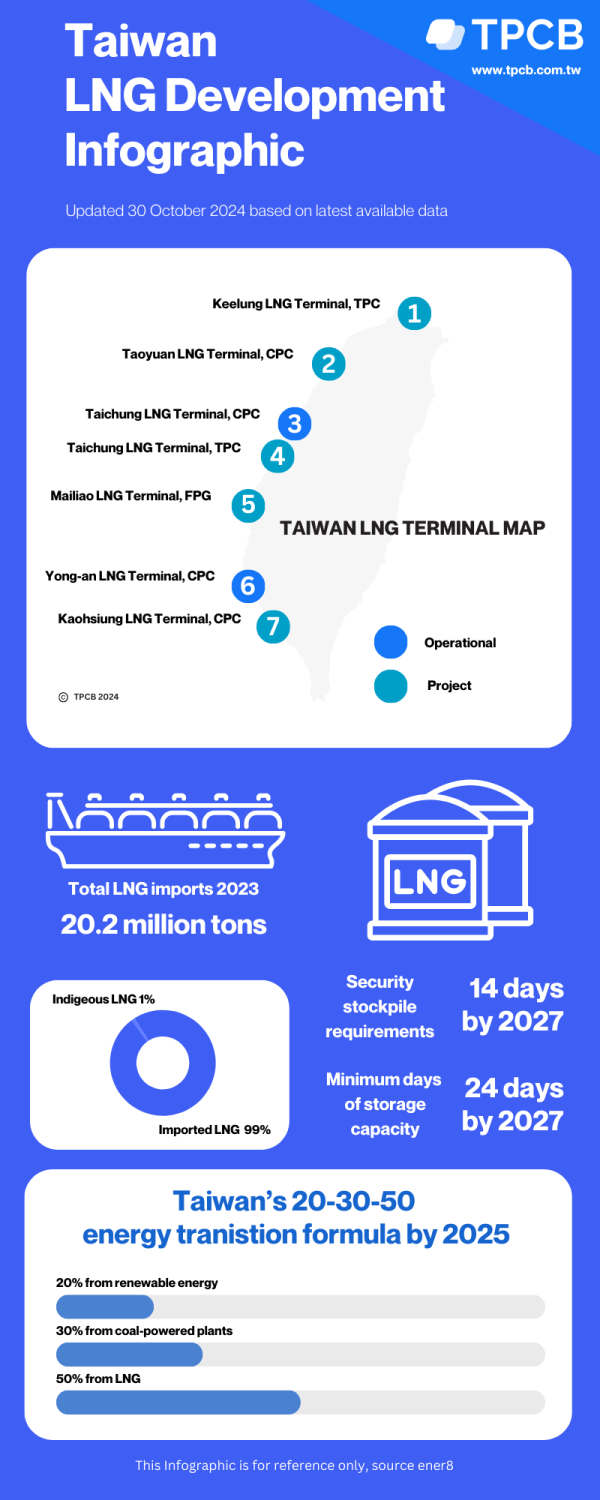

Taiwans Energy Transition Lng Takes Center Stage After Nuclear Closure

May 21, 2025

Taiwans Energy Transition Lng Takes Center Stage After Nuclear Closure

May 21, 2025 -

Effectief Verkoop Van Abn Amro Kamerbrief Certificaten Tips And Tricks

May 21, 2025

Effectief Verkoop Van Abn Amro Kamerbrief Certificaten Tips And Tricks

May 21, 2025

Latest Posts

-

The Goldbergs Behind The Scenes Look At Production And Cast

May 22, 2025

The Goldbergs Behind The Scenes Look At Production And Cast

May 22, 2025 -

From Prison To Studio Vybz Kartels Exclusive Update On Life And Music

May 22, 2025

From Prison To Studio Vybz Kartels Exclusive Update On Life And Music

May 22, 2025 -

Vybz Kartels Exclusive Interview Life In Prison Family And Future Plans

May 22, 2025

Vybz Kartels Exclusive Interview Life In Prison Family And Future Plans

May 22, 2025 -

Exclusive Vybz Kartel On Prison Freedom And New Music

May 22, 2025

Exclusive Vybz Kartel On Prison Freedom And New Music

May 22, 2025 -

Bp Executive Compensation A 31 Reduction

May 22, 2025

Bp Executive Compensation A 31 Reduction

May 22, 2025