Big Machine Sells $200M Stake In Morgan Wallen's Music Catalog

Table of Contents

The Financial Details of the Morgan Wallen Catalog Sale

While the buyer remains officially unnamed, industry insiders speculate it’s a major investment firm with a proven track record in acquiring music rights. Their interest reflects a broader trend: the growing recognition of music catalogs as lucrative, stable assets with long-term earning potential. The exact percentage of the catalog sold hasn't been publicly disclosed, but sources suggest it represents a substantial portion of Wallen's recorded works. This deal sets a new benchmark for catalog valuations, especially within the country music genre. The implications are far-reaching:

- Valuation: The $200 million price tag reflects not only Wallen's current popularity but also the projected future revenue streams from his existing catalog. This valuation considers factors beyond initial album sales, encompassing streaming royalties, synchronization licensing (use of music in films, TV, and ads), and future performance royalties.

- Royalties and Future Earnings: While the specific terms of the deal remain confidential, the sale likely involves a significant transfer of future royalties to the buyer. This affects Wallen’s future earnings, albeit the extent will depend on the specifics of the contract. He likely retained some ownership and will continue to benefit from future sales.

- Market Precedent: This sale serves as a powerful precedent for future music catalog transactions. It signals a continued surge in investor interest in music rights and a potentially higher valuation for other artists' catalogs, particularly those with a comparable level of success and dedicated fanbase.

- ROI for the Buyer: For the buyer, the potential ROI hinges on sustained and increased revenue generation from Wallen's catalog. This depends on several factors, including continued streaming popularity, new licensing deals, and the overall health of the music industry.

- Financial Implications for Big Machine: For Big Machine, the sale likely provides immediate liquidity, allowing for reinvestment in other artists or projects. This strategic decision balances long-term growth with short-term financial benefits. The sale might also allow them to reduce their financial risk associated with Wallen's catalog and potentially allows the label to focus on developing new talent.

Morgan Wallen's Impact and the Value of His Catalog

Morgan Wallen's meteoric rise in the country music scene is undeniably a major factor in the $200 million valuation. His consistent chart-topping successes, coupled with an intensely loyal fanbase, have generated substantial streaming revenue and album sales.

- Chart Success and Fanbase: Wallen's numerous number-one hits and sold-out concert tours illustrate his immense popularity and market dominance. His dedicated fan base is highly engaged across multiple platforms, directly contributing to his catalog's value.

- Streaming Revenue: In the age of digital music consumption, streaming revenue plays a significant role in catalog valuation. Wallen's consistently high streaming numbers across platforms like Spotify and Apple Music significantly boost his catalog's worth.

- Social Media Influence: Wallen's adept use of social media platforms has cultivated a strong connection with his fanbase, boosting his overall brand appeal and further enhancing the value of his music. This connection translates into higher streaming numbers, increased merchandise sales and overall market influence.

- Biggest Hits: Hits like "7 Summers," "Whiskey Glasses," and "Wasted on You" have cemented Wallen's place in the country music landscape and are major contributors to his catalog’s impressive worth.

Implications for the Music Industry and Future Catalog Sales

The $200 million Morgan Wallen catalog sale is a pivotal moment for the music industry. It reinforces the growing trend of music catalog acquisitions, a trend driven by the desire for predictable, long-term revenue streams from established artists.

- Acquisition Strategies: Record labels and investment firms are increasingly employing strategies to acquire music catalogs, seeking to secure stable and predictable income streams from established artists' bodies of work. This trend signifies a significant shift in the industry's financial landscape.

- Artist Compensation: The impact on artist compensation is complex. While this sale demonstrates the immense value artists can create, it also raises questions about equitable distribution of profits across the industry value chain, especially for artists who might not have achieved Wallen's level of success.

- Future Market Trends: The deal anticipates a surge in music catalog valuations. This implies that future acquisitions might involve even higher sums, especially for artists with substantial streaming revenue and established global fanbases.

- Artist-Label Relationships: This transaction raises questions regarding the future dynamics between artists and labels. It is important to consider the implications for future artist-label negotiations and contracts given the immense financial value tied to artists' catalogs.

- Examples of other significant sales: This sale follows a trend of other high-value music catalog acquisitions like Bob Dylan’s catalog sale to Universal Music Group for a reported $300 million, demonstrating the increasing value of music intellectual property.

Big Machine Label's Strategic Decision

Big Machine's decision to sell a stake in Wallen's catalog reflects a multifaceted strategic move, likely driven by a combination of financial and broader business objectives.

- Financial Incentives: The substantial sum received from the sale provides immediate liquidity for Big Machine, allowing them to invest in other promising artists, expand their operations, or potentially reduce their debt burden.

- Risk Mitigation: The sale might represent a strategy to reduce financial risk associated with the long-term performance of Wallen’s catalog. This allows the label to diversify its investments and focus on other aspects of their business.

- Future Relationship with Wallen: While a portion of the catalog was sold, the exact nature of Big Machine's continuing relationship with Wallen is still unclear. The sale doesn't necessarily mean an end to their collaboration.

- Strategic Goals: The strategic goals behind the sale include optimizing the label’s financial portfolio, providing resources for new projects, and potentially focusing on other aspects of their business.

Conclusion: Understanding the $200 Million Morgan Wallen Music Catalog Deal and its Impact

The $200 million sale of a stake in Morgan Wallen's music catalog represents a watershed moment in the music industry. It underscores the escalating value of music intellectual property and the increasing importance of music catalogs as lucrative assets. This deal has significant implications for future catalog sales, artist compensation, and the evolving relationship between artists and labels. The transaction highlights the power of streaming revenue, dedicated fanbases, and the influence of social media in driving the value of an artist's catalog. Stay informed about the latest developments in the music industry and the ongoing impact of music catalog sales by subscribing to our newsletter and following us on social media. Learn more about the evolving landscape of Morgan Wallen's music catalog and similar high-value deals.

Featured Posts

-

French Road Trip How To Avoid Traffic Jams This Weekend

May 29, 2025

French Road Trip How To Avoid Traffic Jams This Weekend

May 29, 2025 -

How To Get Morgan Wallen Tickets In 2025 A Guide To Prices And Dates

May 29, 2025

How To Get Morgan Wallen Tickets In 2025 A Guide To Prices And Dates

May 29, 2025 -

Paris Rally Le Pen Condemns Embezzlement Verdict As Politically Motivated

May 29, 2025

Paris Rally Le Pen Condemns Embezzlement Verdict As Politically Motivated

May 29, 2025 -

Opec Quota Review July Output Decision Looms

May 29, 2025

Opec Quota Review July Output Decision Looms

May 29, 2025 -

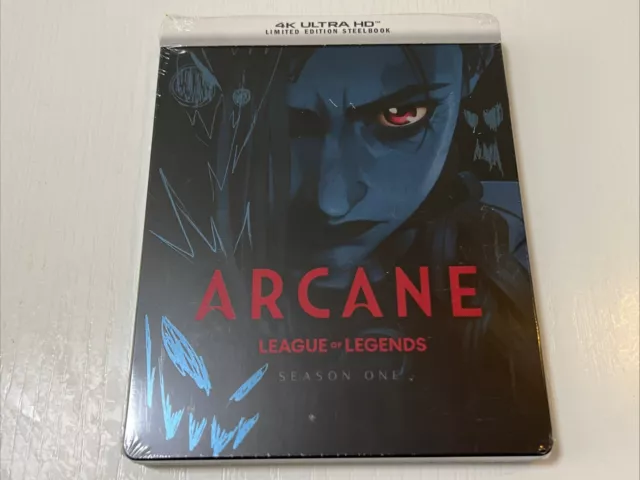

League Of Legends Arcane 4 K Blu Ray Steelbook 50 Off At Amazon

May 29, 2025

League Of Legends Arcane 4 K Blu Ray Steelbook 50 Off At Amazon

May 29, 2025

Latest Posts

-

Del Toros Pick The Best Realized World In Gaming

May 30, 2025

Del Toros Pick The Best Realized World In Gaming

May 30, 2025 -

Guillermo Del Toro Names Top Video Game World A Fully Realized Vision

May 30, 2025

Guillermo Del Toro Names Top Video Game World A Fully Realized Vision

May 30, 2025 -

Guillermo Del Toro Praises Popular Shooters World Building

May 30, 2025

Guillermo Del Toro Praises Popular Shooters World Building

May 30, 2025 -

Global Investment Opportunities In Saudi Arabia A Deutsche Bank Perspective

May 30, 2025

Global Investment Opportunities In Saudi Arabia A Deutsche Bank Perspective

May 30, 2025 -

L Ere Moderne De La Deutsche Bank Un Recit Complexe De Hauts Et De Bas

May 30, 2025

L Ere Moderne De La Deutsche Bank Un Recit Complexe De Hauts Et De Bas

May 30, 2025