OPEC+ Quota Review: July Output Decision Looms

Table of Contents

H2: Current Global Oil Market Dynamics

The current global oil market is a complex interplay of supply and demand, heavily influenced by geopolitical events. Understanding these dynamics is crucial to predicting the outcome of the July OPEC+ meeting.

H3: Supply and Demand Imbalances

The balance between global oil supply and demand is precarious. Several factors are at play:

- OPEC+ Compliance: While OPEC+ has demonstrated a commitment to previous production cuts, adherence levels vary among member states. Any deviation from agreed-upon quotas can significantly impact market stability.

- Impact of Russian Oil Sanctions: Western sanctions on Russian oil have disrupted supply chains, leading to price volatility and impacting the availability of crude oil in the global market. The extent to which these sanctions continue to bite will influence the OPEC+ decision.

- Growing Asian Oil Demand: Robust economic growth in Asia, particularly in China and India, continues to drive significant increases in oil demand, putting upward pressure on prices. This surge in demand creates a counterbalance to supply disruptions.

- Global Economic Slowdown: Concerns about a global economic slowdown are tempering the demand outlook. A recession in major economies could dampen oil consumption, offsetting the impact of Asian demand growth. This uncertainty adds to the complexity of the OPEC+ decision.

H3: Geopolitical Factors

Geopolitical instability significantly influences oil prices and OPEC+ decisions. Several key factors are in play:

- The War in Ukraine: The ongoing conflict in Ukraine remains a major source of uncertainty, impacting global energy markets and creating volatility in oil prices. Disruptions to Russian oil exports remain a primary concern.

- US-China Relations: The evolving relationship between the US and China, two of the world's largest economies, plays a significant role. Any escalation in trade tensions could impact global oil demand and prices.

- Middle East Instability: Tensions in the Middle East, a major oil-producing region, always pose a risk to global supply. Any escalation of conflict or political upheaval could trigger significant price spikes. This geopolitical risk factor is always a consideration for OPEC+.

H2: Key Players and Their Interests

The OPEC+ alliance comprises a diverse group of nations with varied interests, making the decision-making process complex. Understanding the key players and their objectives is critical.

H3: Saudi Arabia's Role

Saudi Arabia, the world's largest oil exporter, plays a pivotal role in OPEC+. Its decisions significantly influence global oil prices.

- Saudi Aramco's Production Capacity: Saudi Arabia possesses significant spare production capacity, giving it considerable leverage in shaping global oil supply.

- Economic Interests: The kingdom's economic interests are deeply intertwined with oil prices. Maintaining stable and relatively high prices is crucial for its economic stability.

- Strategic Goals: Saudi Arabia’s strategic goals may include maintaining its market share and influence within OPEC+, as well as supporting global economic stability. These competing priorities inform its decision-making.

H3: Russia's Influence

Russia's role in OPEC+ is complex and significantly impacted by Western sanctions.

- Russian Oil Production: Despite sanctions, Russia continues to be a significant oil producer, although its exports have been affected. Its production levels and export capabilities are key factors.

- Impact of Sanctions: The ongoing sanctions affect Russia's ability to export and sell oil, influencing its position within the OPEC+ alliance.

- Negotiating Tactics: Russia's negotiating tactics within OPEC+ are likely to be influenced by its need to offset the impact of sanctions and maintain its oil revenue.

H3: Other OPEC+ Member States

Other significant OPEC+ member states, such as the UAE, also play a crucial role. Their production levels and priorities will influence the final decision. The diverse interests of these members can lead to internal negotiations and compromises.

H2: Potential Outcomes and Market Implications

The July OPEC+ meeting could result in several different outcomes, each carrying significant implications for global oil markets.

H3: Scenarios and Their Impacts

- Maintained Quotas: Maintaining current production quotas would likely lead to relatively stable oil prices, although the precise level will depend on other market factors.

- Increased Production: An increase in production quotas would likely put downward pressure on oil prices, potentially benefiting consumers but impacting the revenue of producing nations.

- Further Cuts: Further production cuts would likely lead to higher oil prices, potentially exacerbating inflation and impacting global economic growth.

H3: Investor Sentiment and Market Volatility

The OPEC+ decision will significantly impact investor sentiment and market volatility.

- Oil Price Swings: The announcement could trigger significant price swings in the oil and gas sector, impacting both producers and consumers.

- Energy Sector Investments: The decision's impact on oil prices will influence investment decisions in the energy sector. Uncertainty can lead to caution amongst investors.

3. Conclusion

The OPEC+ quota review in July is a critical event for the global oil market. The decision, driven by a complex interplay of geopolitical factors and national interests, will shape crude oil prices and the broader energy landscape for the foreseeable future. Understanding the dynamics at play is crucial for businesses, investors, and policymakers navigating the volatile oil market. Keep checking back for updates on the OPEC+ quota review and its impact on global oil prices – the implications of this vital decision are far-reaching.

Featured Posts

-

North Koreas Infiltration Of Us Remote Jobs The Role Of American Complicity

May 29, 2025

North Koreas Infiltration Of Us Remote Jobs The Role Of American Complicity

May 29, 2025 -

Production Wraps On Lone Wolf A Conspiracy Thriller Starring Lily Gladstone And Bryan Cranston

May 29, 2025

Production Wraps On Lone Wolf A Conspiracy Thriller Starring Lily Gladstone And Bryan Cranston

May 29, 2025 -

Chainalysis Bolsters Ai Infrastructure Through Alterya Acquisition

May 29, 2025

Chainalysis Bolsters Ai Infrastructure Through Alterya Acquisition

May 29, 2025 -

Rsmya Mdafe Lyfrkwzn Yntql Lnad Jdyd

May 29, 2025

Rsmya Mdafe Lyfrkwzn Yntql Lnad Jdyd

May 29, 2025 -

Space X Falcon 9 28 Starlink Satellites Launched On Mission 28

May 29, 2025

Space X Falcon 9 28 Starlink Satellites Launched On Mission 28

May 29, 2025

Latest Posts

-

La Mejor Receta De Lasana De Calabacin Segun Pablo Ojeda Mas Vale Tarde

May 31, 2025

La Mejor Receta De Lasana De Calabacin Segun Pablo Ojeda Mas Vale Tarde

May 31, 2025 -

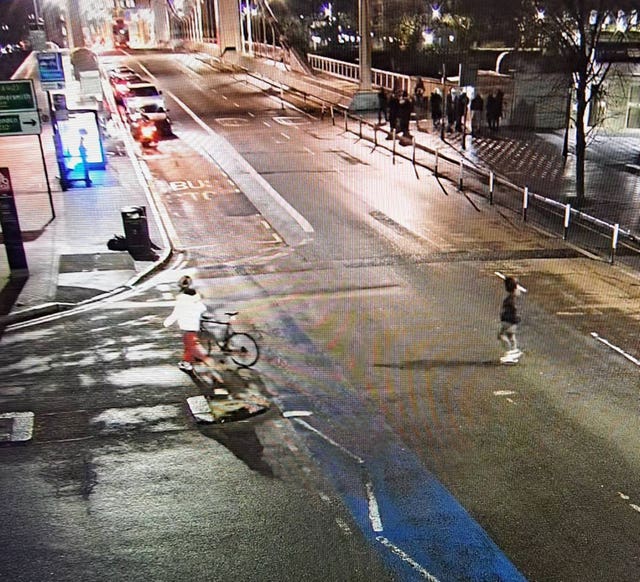

Major Search Operation For Missing Child In River Thames

May 31, 2025

Major Search Operation For Missing Child In River Thames

May 31, 2025 -

Couts De La Foire Au Jambon 2025 Une Situation Financiere Preoccupante A Bayonne

May 31, 2025

Couts De La Foire Au Jambon 2025 Une Situation Financiere Preoccupante A Bayonne

May 31, 2025 -

Receta De Lasana De Calabacin De Pablo Ojeda Facil Y Deliciosa Mas Vale Tarde

May 31, 2025

Receta De Lasana De Calabacin De Pablo Ojeda Facil Y Deliciosa Mas Vale Tarde

May 31, 2025 -

Police Appeal For Information Following Girls Fall Into River Thames

May 31, 2025

Police Appeal For Information Following Girls Fall Into River Thames

May 31, 2025