Billionaires' Top Pick: The ETF Projected To Soar 110% By 2025

Table of Contents

The ETF in Focus: Unveiling the [ARKW] (ARK Innovation ETF)

The ETF we're focusing on is the ARK Innovation ETF (ARKW), managed by Cathie Wood's ARK Invest. ARKW is a actively managed ETF that invests in disruptive innovation across various sectors. It focuses on companies poised for exponential growth, making it an attractive option for investors seeking high-growth potential, albeit with higher risk.

- Inception Date: October 2014

- Assets Under Management (AUM): (Insert current AUM – this will need to be updated regularly)

- Expense Ratio: (Insert current expense ratio – this will need to be updated regularly)

ARKW's portfolio predominantly includes companies in the following sectors:

- Technology: Software, robotics, artificial intelligence, genomics, and other cutting-edge technologies.

- Healthcare: Biotechnology, genomics, and innovative medical technologies.

- Consumer Discretionary: Companies disrupting traditional industries with innovative products and services.

Billionaire Backing: Why the Influx of High-Net-Worth Investors?

The significant interest from high-net-worth individuals and institutional investors in ARKW stems from several key factors:

- Disruptive Innovation Focus: The ETF invests in companies at the forefront of technological advancements, targeting sectors with immense long-term growth potential.

- Strong Performance History: (While past performance doesn't guarantee future results, mention any periods of strong past performance, if applicable, with proper caveats.)

- Cathie Wood's Reputation: Cathie Wood, the CEO of ARK Invest, has a strong track record and is known for her bold investment strategies. (Cite any credible articles or interviews supporting this.)

While specific billionaires' holdings aren't always publicly disclosed, the substantial AUM and institutional investor interest indicate significant high-net-worth involvement. This "smart money" influx is a strong indicator of confidence in the ETF's long-term prospects.

Projected 110% Growth: Analyzing the Forecast

The 110% growth projection for ARKW by 2025 is based on several factors, although it's crucial to remember that this is just a projection, and actual results may vary significantly:

- Market Analysis: Analyst forecasts predict significant growth in the sectors ARKW invests in. (Cite credible market research reports here.)

- Technological Advancements: Continued breakthroughs in areas like artificial intelligence, genomics, and renewable energy are expected to fuel substantial growth in the companies within the ETF's portfolio.

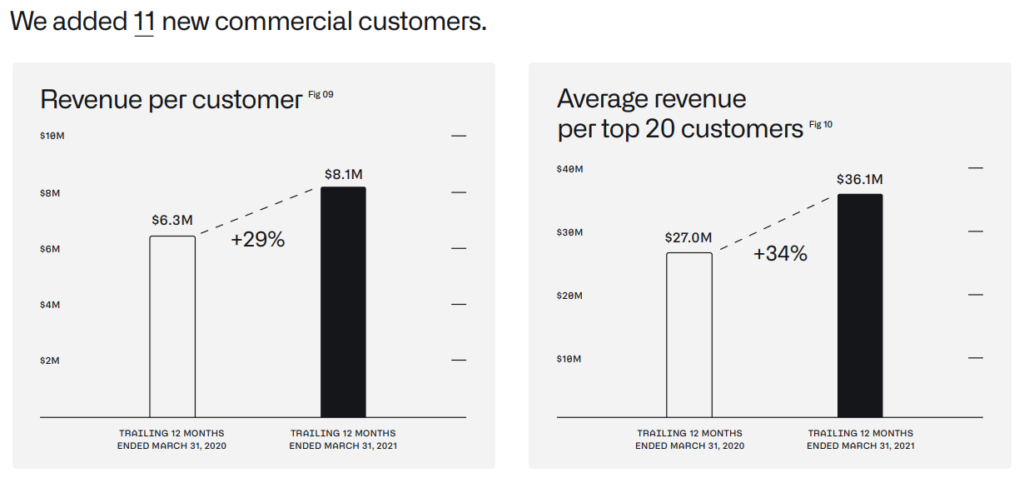

- Company Performance: ARKW's holdings are expected to show strong financial performance based on their individual growth trajectories.

Important Disclaimer: This projection should be viewed with caution. Market conditions, unforeseen events, and company-specific factors can drastically affect actual returns.

Risk Assessment: Understanding the Potential Downsides

Investing in ARKW, like any high-growth ETF, involves substantial risk:

- Market Volatility: The ETF is heavily exposed to market fluctuations, and sharp downturns can significantly impact its value.

- Sector-Specific Downturns: A downturn in the technology or healthcare sectors could disproportionately affect ARKW's performance.

- Geopolitical Factors: Global events and regulatory changes can negatively influence the companies within the ETF.

Diversification is crucial. Don't put all your eggs in one basket. ARKW should be considered only one part of a well-diversified investment portfolio.

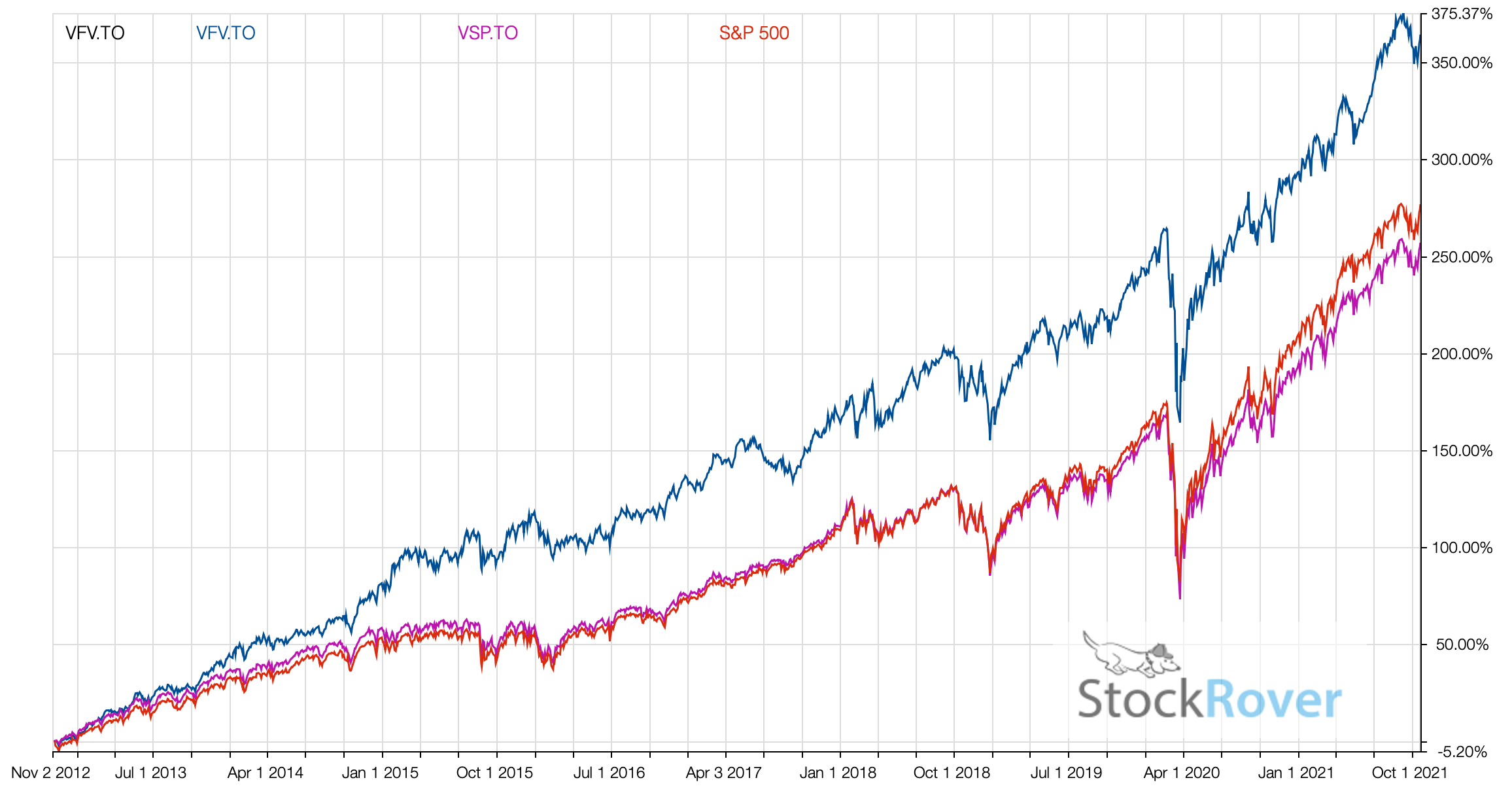

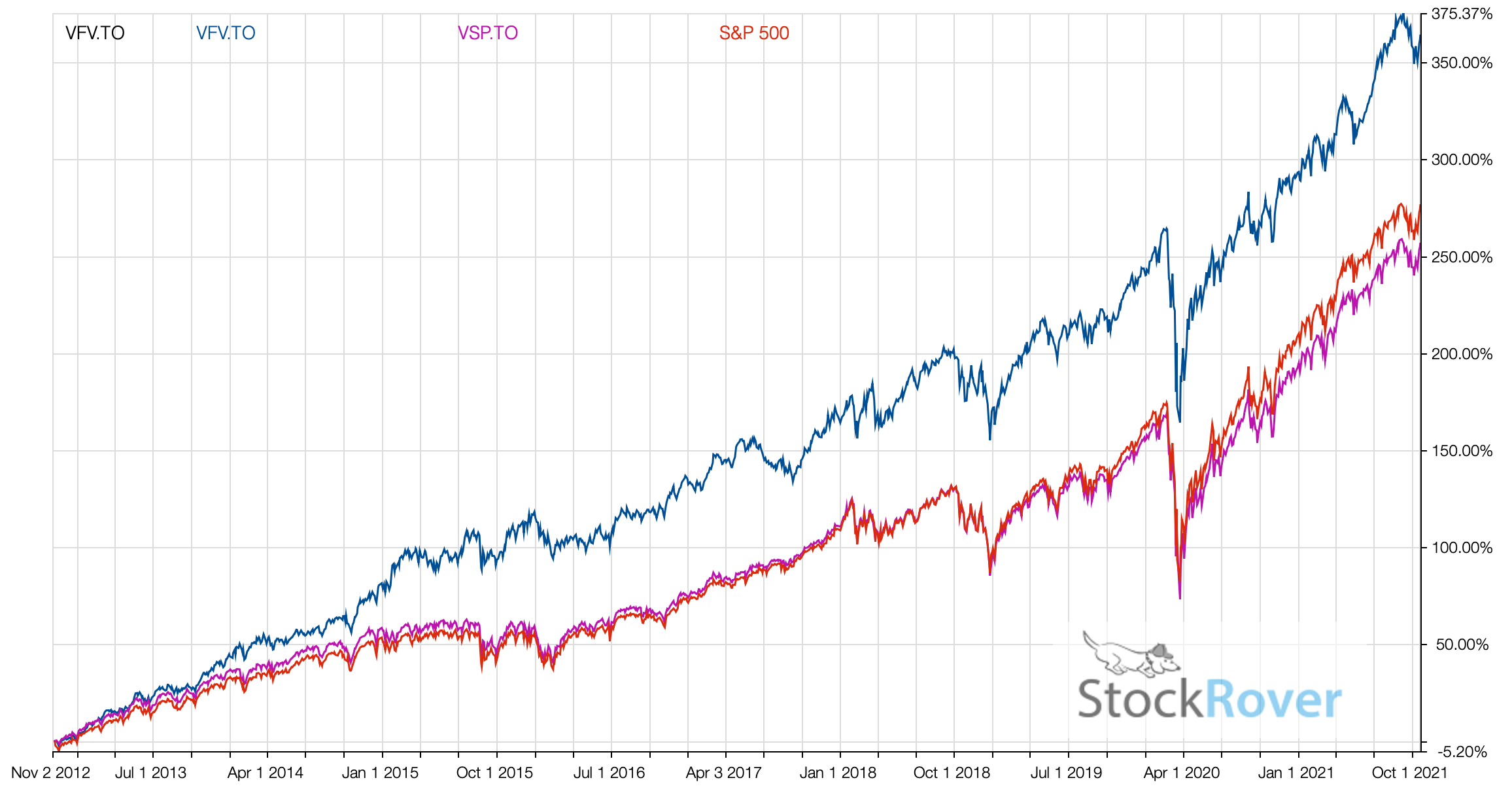

Comparing the ETF to Competitors

Compared to other growth ETFs focused on technology or innovation, ARKW often shows a higher risk-higher reward profile. While some competitors may offer broader diversification or lower expense ratios, ARKW's focus on disruptive innovation and Cathie Wood's active management strategy are key differentiators. (Compare with 1-2 direct competitors, providing specific data points for comparison where possible.)

Conclusion

ARKW, with its focus on disruptive innovation, has attracted significant attention from billionaire investors. While a projected 110% growth by 2025 is exciting, it's crucial to understand the inherent risks involved. Remember, past performance doesn't guarantee future results. This information is for educational purposes only and is not financial advice.

Are you ready to explore the potential of this high-growth ETF? Conduct thorough research and consult with a financial advisor before making any investment decisions. Learn more about ARKW and its potential for significant returns. Invest wisely in the ETF projected to soar! Remember to always diversify your portfolio to manage risk.

Featured Posts

-

Fatal Collision On Elizabeth City Road Driver Hits Pedestrians

May 09, 2025

Fatal Collision On Elizabeth City Road Driver Hits Pedestrians

May 09, 2025 -

Zayavi Stivena Kinga Pro Trampa Ta Maska Pislya Yogo Povernennya V Kh

May 09, 2025

Zayavi Stivena Kinga Pro Trampa Ta Maska Pislya Yogo Povernennya V Kh

May 09, 2025 -

Palantir Stock Q1 Earnings Government And Commercial Business Trends

May 09, 2025

Palantir Stock Q1 Earnings Government And Commercial Business Trends

May 09, 2025 -

Should You Buy Palantir Stock Today Investment Pros And Cons

May 09, 2025

Should You Buy Palantir Stock Today Investment Pros And Cons

May 09, 2025 -

Oilers Win 3 2 Against Golden Knights But Vegas Still Makes Playoffs

May 09, 2025

Oilers Win 3 2 Against Golden Knights But Vegas Still Makes Playoffs

May 09, 2025