Bitcoin Buying Volume On Binance Tops Selling For First Time In Half A Year

Table of Contents

Binance's Dominant Role in Bitcoin Trading

Binance's influence on the cryptocurrency market, particularly Bitcoin, is undeniable. Its massive trading volume significantly impacts price discovery and overall market sentiment. Binance boasts a global reach and unparalleled liquidity, making it the preferred exchange for numerous traders worldwide. This high liquidity allows for large trades to be executed with minimal price slippage, a crucial factor for both institutional and retail investors.

- Binance's global reach and high liquidity: Binance operates across numerous jurisdictions, catering to a vast and diverse user base. This broad reach contributes to its exceptionally high trading volume.

- Its impact on Bitcoin price discovery: Due to its massive trading volume, price movements on Binance often act as a leading indicator for the overall Bitcoin market.

- Comparison to other major exchanges (Coinbase, Kraken, etc.): While Coinbase and Kraken are significant players, Binance consistently holds a dominant market share in terms of Bitcoin trading volume, making its activity a key barometer for the cryptocurrency's performance. [Insert data point comparing Binance's Bitcoin trading volume to Coinbase and Kraken if available, e.g., "In Q3 2023, Binance's Bitcoin trading volume exceeded Coinbase's by X% and Kraken's by Y%."]

Analyzing the Surge in Bitcoin Buying Volume

The recent surge in Bitcoin buying volume on Binance suggests a shift in market dynamics. Several factors could be contributing to this increased buying pressure:

- Institutional investor activity: Large institutional investors, such as hedge funds and asset management firms, may be accumulating Bitcoin, driving up demand. Increased regulatory clarity in some jurisdictions could also be contributing to this.

- Retail investor FOMO (fear of missing out): Positive price movements, fueled by news and speculation, often trigger FOMO among retail investors, leading to a surge in buying activity.

- Positive news impacting Bitcoin's price: Favorable regulatory developments, such as potential ETF approvals in major markets, can significantly boost investor confidence and drive up demand. [Cite specific positive news impacting Bitcoin's price recently].

- Technical analysis pointing to bullish trends: Certain technical indicators, such as a breakout from a long-term consolidation pattern or a positive RSI reading, might signal to traders that the price is likely to increase. [Mention specific indicators and their implications if appropriate and cite credible sources].

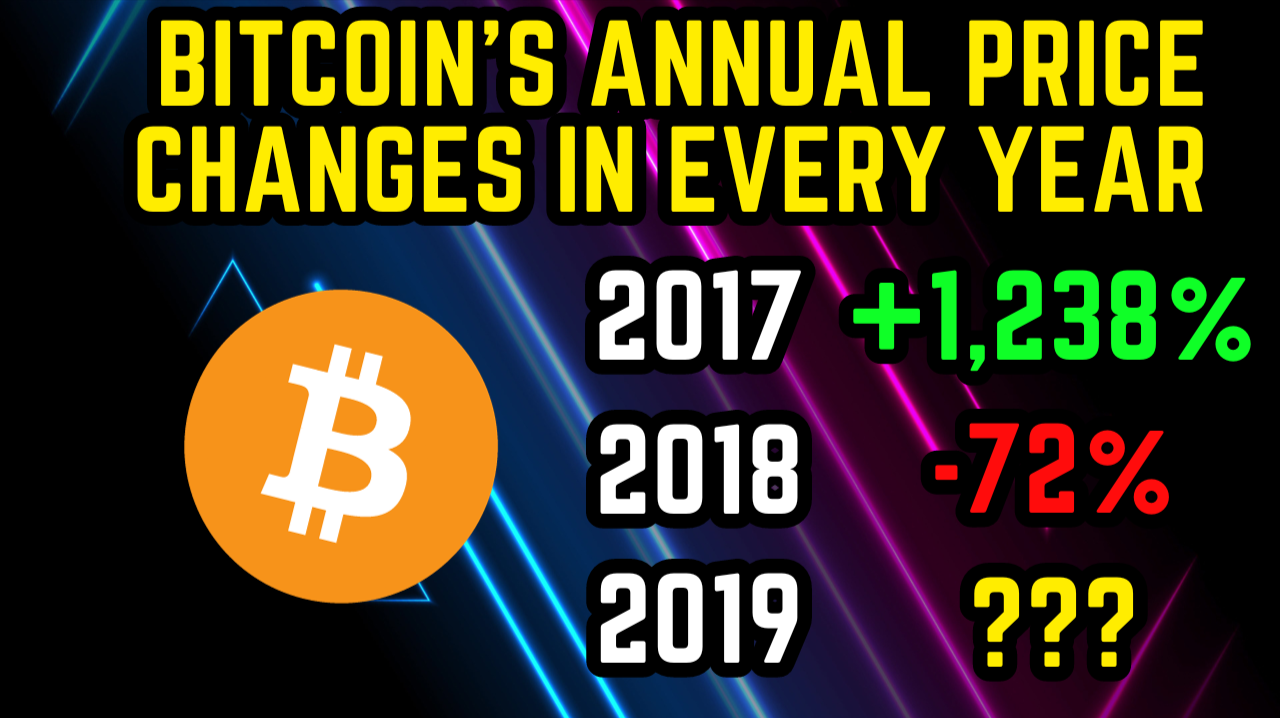

Impact on Bitcoin Price

The correlation between increased buying volume and Bitcoin price movements is typically positive. The recent surge in buying volume on Binance has indeed been accompanied by a price increase [Cite the percentage price increase].

- Short-term price predictions based on the trend: Based on the current trend, short-term price predictions suggest further upward movement, although the extent of the increase remains uncertain. [Cite predictions from reputable analysts with links to their sources].

- Potential for a sustained price increase: If buying pressure continues, a sustained price increase is possible. However, this is dependent on a number of factors.

- Factors that could influence future price movements: Market volatility, macroeconomic factors (e.g., inflation, interest rates), and regulatory changes can all impact Bitcoin's price trajectory.

Cautious Optimism: Considering Counterarguments

While the increased buying volume on Binance is positive, it’s crucial to acknowledge potential downsides:

- Short-lived rally possibility: The surge in buying volume could be a temporary phenomenon, leading to a short-lived rally followed by a price correction.

- Whale manipulation affecting the data: Large investors ("whales") could be manipulating the market to create a false sense of bullish sentiment.

- Macroeconomic factors that could negatively impact Bitcoin’s price: Global economic downturns or tightening monetary policies could negatively affect Bitcoin's price, irrespective of trading volume on Binance.

- Importance of risk management in cryptocurrency investments: Cryptocurrency investments are inherently volatile. Risk management strategies, including diversification and stop-loss orders, are essential.

What This Means for Bitcoin Investors

The increased Bitcoin buying volume on Binance presents both opportunities and challenges for investors.

- Strategies for capitalizing on the increased buying volume: Investors might consider strategically accumulating Bitcoin, but only with careful consideration of their risk tolerance.

- Risk management strategies for navigating market volatility: Diversification across different asset classes and employing stop-loss orders are crucial risk management techniques.

- Importance of conducting thorough research before making any investment decisions: Before making any investment decisions, thorough research into Bitcoin and the cryptocurrency market is crucial.

- Different investment approaches based on risk tolerance: Investors can choose from various investment approaches based on their risk tolerance, including Dollar-Cost Averaging (DCA) or lump sum investments.

Conclusion

The increased Bitcoin buying volume on Binance, surpassing selling volume for the first time in six months, is a significant development, suggesting a potential shift towards a bullish market sentiment. While this is encouraging, it's crucial to maintain a cautious outlook. Macroeconomic factors and market volatility could still impact Bitcoin's price. Investors should conduct thorough research, implement robust risk management strategies, and stay informed about market trends. The continued monitoring of Bitcoin buying volume on Binance and other exchanges remains crucial for gaining a comprehensive understanding of the market’s direction. Therefore, continue to monitor Bitcoin buying volume on Binance to make informed investment decisions.

Featured Posts

-

Lahwr Myn Mrghy Gwsht Awr Byf Ky Qymtwn Pr Qabw Pane Myn Nakamy

May 08, 2025

Lahwr Myn Mrghy Gwsht Awr Byf Ky Qymtwn Pr Qabw Pane Myn Nakamy

May 08, 2025 -

Uber One In Kenya Your Guide To Free Deliveries And More

May 08, 2025

Uber One In Kenya Your Guide To Free Deliveries And More

May 08, 2025 -

Nathan Fillions Unforgettable 3 Minute Role In Saving Private Ryan

May 08, 2025

Nathan Fillions Unforgettable 3 Minute Role In Saving Private Ryan

May 08, 2025 -

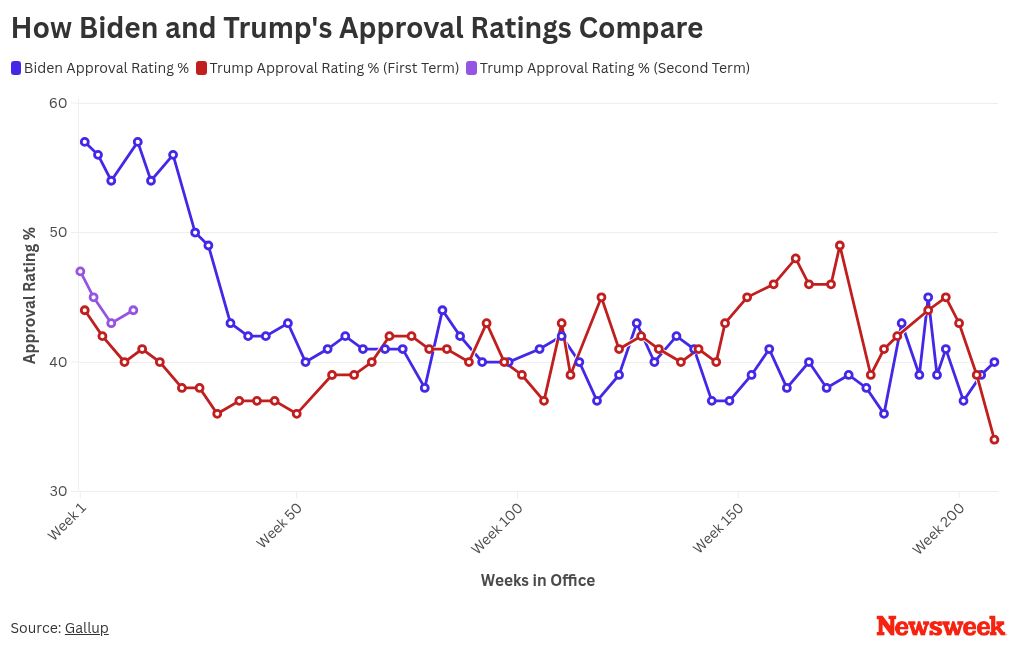

Trumps 100 Day Economic Plan Impact On Bitcoin Price

May 08, 2025

Trumps 100 Day Economic Plan Impact On Bitcoin Price

May 08, 2025 -

Ripple Xrp Major Developments Brazil Etf And Trumps Support

May 08, 2025

Ripple Xrp Major Developments Brazil Etf And Trumps Support

May 08, 2025