Trump's 100-Day Economic Plan: Impact On Bitcoin Price

Table of Contents

Trump's Proposed Tax Cuts and Their Effect on Bitcoin Investment

Trump's proposed tax cuts, a cornerstone of his 100-day plan, could significantly influence Bitcoin investment. Lower taxes could increase disposable income for some, potentially leading to greater investment in riskier assets like Bitcoin. Conversely, if the cuts disproportionately benefit the wealthy, it might not stimulate broader investment in cryptocurrencies. The impact hinges on several factors:

-

Increased disposable income: More investment in crypto? If middle-class and working-class individuals see a substantial increase in their after-tax income, a portion might be allocated to alternative investments, including Bitcoin. This could drive up demand and price.

-

Capital gains tax implications: How will they affect Bitcoin trading? Changes to capital gains taxes directly impact the profitability of Bitcoin trading. Lower capital gains taxes could encourage more active trading and potentially inflate the price. Conversely, higher taxes could dampen enthusiasm.

-

Impact on institutional investors: Will tax cuts drive institutional adoption? Institutional investors are often swayed by tax considerations. Favorable tax policies could incentivize larger-scale investment in Bitcoin, significantly impacting its price stability and overall market capitalization.

Deregulation and its Influence on the Cryptocurrency Market

Trump's emphasis on deregulation, particularly within financial markets, could significantly alter Bitcoin's regulatory landscape. Reduced regulatory burdens might foster greater adoption and increase the price. However, a lack of clear regulatory frameworks could also lead to increased uncertainty, potentially depressing the price.

-

Reduced regulatory hurdles: Increased Bitcoin adoption? Less stringent regulations could make it easier for businesses and individuals to engage with Bitcoin, leading to increased adoption and potentially driving up demand.

-

Increased regulatory uncertainty: Negative impact on Bitcoin price? The absence of clear guidelines could create uncertainty and fear among investors, leading to capital flight and a potential decrease in Bitcoin's value.

-

Potential for new regulatory frameworks specifically targeting cryptocurrencies. The administration might introduce new legislation specifically aimed at regulating cryptocurrencies. The nature of this regulation—whether supportive or restrictive—will have a profound effect on Bitcoin's price.

Infrastructure Spending and the Indirect Impact on Bitcoin Mining

Trump's infrastructure spending plan could indirectly influence Bitcoin mining costs. Increased infrastructure spending could lead to improved energy infrastructure, potentially lowering energy costs for Bitcoin miners. Conversely, it could also lead to increased demand for energy, raising costs. The net effect on Bitcoin’s price will depend on the specifics.

-

Impact of energy price fluctuations on mining profitability. Bitcoin mining is energy-intensive. Changes in energy prices directly impact the profitability of mining, which, in turn, affects the supply of Bitcoin and ultimately, its price.

-

Potential for increased renewable energy adoption and its effect on Bitcoin mining. Investment in renewable energy sources could reduce the environmental impact of Bitcoin mining and potentially lower energy costs for miners in the long run.

-

Changes in electricity costs across different mining regions. The impact of infrastructure spending will vary across different geographic regions, affecting the competitiveness of Bitcoin mining in those locations.

Market Sentiment and Investor Confidence

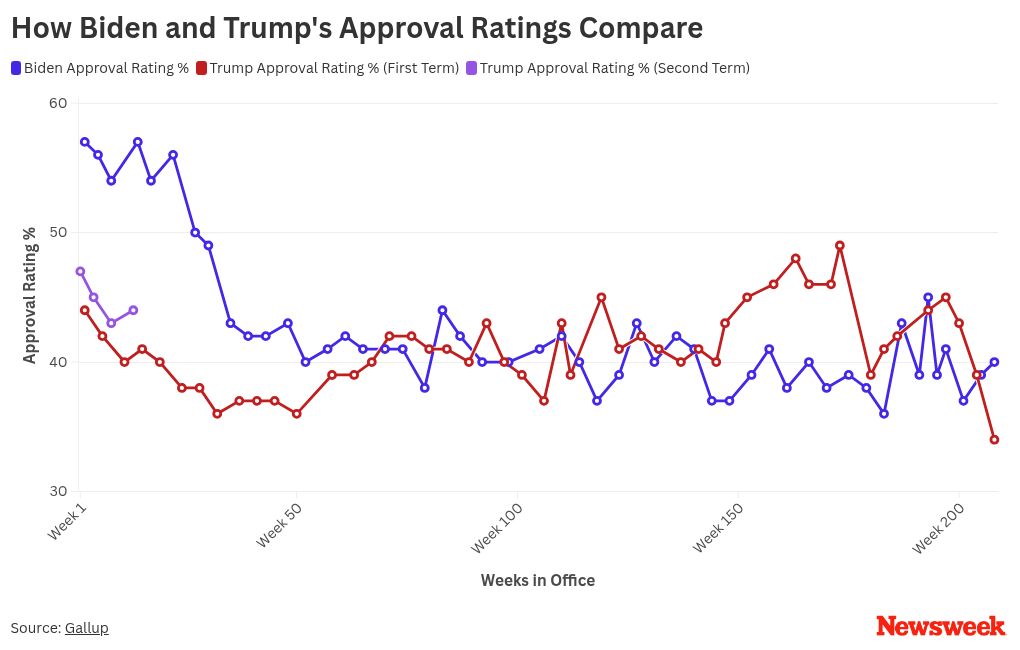

Investor confidence, significantly shaped by perceptions of Trump's economic policies, plays a crucial role in Bitcoin's price. Positive economic sentiment often translates into increased risk appetite, potentially benefiting Bitcoin. Conversely, uncertainty or negative sentiment might lead investors to seek safer assets, potentially driving down Bitcoin's price.

-

Impact of positive economic sentiment on riskier assets like Bitcoin. A booming economy often increases investor appetite for riskier assets, leading to increased investment in Bitcoin.

-

Flight to safety: Will investors move away from Bitcoin in times of uncertainty? During periods of economic uncertainty, investors often shift to safer assets like gold or government bonds, potentially decreasing demand for Bitcoin.

-

Correlation between stock market performance and Bitcoin price. Bitcoin's price is not entirely independent of traditional markets. Positive stock market performance often correlates with increased investor confidence, potentially benefitting Bitcoin.

Conclusion: Understanding the Complex Relationship Between Trump's Economic Policies and Bitcoin's Value

Trump's 100-day economic plan, encompassing tax cuts, deregulation, infrastructure spending, and its impact on overall market sentiment, presents a complex interplay of factors that can influence Bitcoin's price. While lower taxes could potentially boost investment, deregulation presents a double-edged sword, with both positive and negative implications for Bitcoin's regulatory environment. Infrastructure spending's indirect impact on energy costs for mining and the overall market sentiment driven by economic performance will further shape Bitcoin's trajectory. This relationship requires continuous monitoring and further analysis. To stay updated on the evolving impact of "Trump's 100-Day Economic Plan" and its potential future effects on the "Bitcoin price," follow our blog for regular updates.

Featured Posts

-

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025

Dwp Doubles Home Visits Thousands Of Benefit Claimants Affected

May 08, 2025 -

11 Million Eth Accumulated Analyzing The Impact On Ethereums Price

May 08, 2025

11 Million Eth Accumulated Analyzing The Impact On Ethereums Price

May 08, 2025 -

Deadly Fungi The Next Superbug Crisis

May 08, 2025

Deadly Fungi The Next Superbug Crisis

May 08, 2025 -

Check If You Re Due A Dwp Universal Credit Back Payment

May 08, 2025

Check If You Re Due A Dwp Universal Credit Back Payment

May 08, 2025 -

Ripple And Xrp Analyzing Recent Developments And The Remittix Ico

May 08, 2025

Ripple And Xrp Analyzing Recent Developments And The Remittix Ico

May 08, 2025