Bitcoin Miner Surge: Understanding This Week's Increase

Table of Contents

Rising Bitcoin Price and Miner Profitability

A primary driver of the Bitcoin miner surge is the undeniable link between Bitcoin's price and the profitability of mining.

Direct Correlation Between Price and Profitability

A higher Bitcoin price directly translates to increased revenue for miners. This simple equation makes mining more lucrative and encourages greater participation.

- Increased Bitcoin price covers higher energy costs and hardware expenses, leading to higher profit margins. Miners face substantial costs, including electricity, hardware maintenance, and cooling. A rising Bitcoin price ensures these costs are easily offset, resulting in substantial profits.

- This increased profitability incentivizes both existing miners to increase their operations and new miners to join the network. Established miners may choose to add more mining hardware (ASICs) to their operations, while the potential for high returns attracts new entrants into the Bitcoin mining market.

- Analysis of the relationship between the Bitcoin price and the mining hashrate (a measure of computing power dedicated to mining) will be crucial in understanding this surge. A clear correlation between price increases and hashrate increases strongly supports the argument that price is a major catalyst for the current surge in mining activity.

Impact of Transaction Fees

Beyond the Bitcoin price itself, transaction fees play a significant role in miner profitability.

- Congestion on the network leads to increased transaction fees, which directly benefit miners. When the Bitcoin network is busy, users are willing to pay higher fees to ensure their transactions are processed quickly.

- This acts as an additional incentive, especially during periods of high network activity. This supplementary income stream further enhances the profitability of Bitcoin mining, adding another layer to the current surge.

Increased Mining Hashrate and Network Security

The Bitcoin miner surge is not just about increased profits; it has significant implications for the security and stability of the entire Bitcoin network.

Hashrate as an Indicator of Network Health

The recent surge reflects a significant increase in the Bitcoin mining hashrate – a key indicator of network health and security.

- A higher hashrate makes the network more resistant to 51% attacks, ensuring its integrity and stability. A 51% attack, where a single entity controls over half the network's computing power, poses a major threat to blockchain security. A higher hashrate makes such an attack exponentially more difficult and expensive.

- This increase demonstrates the resilience and growing adoption of Bitcoin. The expanding mining activity signifies growing confidence and participation in the Bitcoin ecosystem.

- The role of specialized mining hardware (ASICs) in contributing to the hashrate increase is undeniable. Advanced ASICs (Application-Specific Integrated Circuits) are designed solely for Bitcoin mining, offering significantly higher hashing power compared to general-purpose hardware.

Mining Difficulty Adjustment

The Bitcoin network employs a self-regulating mechanism to maintain a consistent block generation time. This is the mining difficulty adjustment.

- Explain the mechanism of difficulty adjustment and its importance in maintaining the network's stability. The difficulty adjusts automatically based on the network's hashrate. A higher hashrate increases difficulty, ensuring blocks are still generated roughly every 10 minutes. This ensures predictable transaction processing times and network stability.

- Discuss how a change in difficulty might have influenced the profitability calculations for miners. While difficulty increases with hashrate, the impact on profitability is complex. While it makes mining slightly harder, the increased competition is often outweighed by the increased Bitcoin price, keeping profitability high.

Other Contributing Factors

Beyond price and hashrate, several other factors contribute to the observed Bitcoin miner surge.

New Mining Hardware and Technological Advancements

The development and release of new, more efficient mining hardware play a crucial role.

- Discuss the role of technological advancements in improving energy efficiency and mining profitability. Newer ASICs often boast higher hashing power while consuming less energy, increasing profitability for miners.

- Mention specific examples of new hardware releases and their potential impact. The release of any new generation of ASICs with significantly improved efficiency can trigger a noticeable increase in mining activity.

Regulatory Landscape and Geopolitical Factors

External factors can also influence mining activity.

- Discuss any recent changes in regulations affecting Bitcoin mining in different regions. Government policies regarding energy consumption, taxation, and environmental impact can significantly influence where and how Bitcoin mining occurs.

- Analyze the impact of geopolitical factors on the distribution of mining activity globally. Geopolitical instability or changes in energy prices in specific regions can lead to shifts in mining operations, affecting the global hashrate.

Conclusion

The recent Bitcoin miner surge is a multifaceted phenomenon driven by several interacting factors. The rising Bitcoin price and increased miner profitability are the primary drivers, leading to a significant increase in the mining hashrate, which strengthens the network's security and stability. While new hardware and external factors play a supporting role, the core driver remains the economic incentives associated with Bitcoin mining. Understanding this Bitcoin miner surge provides invaluable insights into the dynamic nature of the Bitcoin network and its continued evolution. Stay informed on further developments in Bitcoin mining to understand the long-term implications of this recent increase. Follow us for more updates on the evolving Bitcoin mining landscape and learn more about the factors influencing the Bitcoin miner surge.

Featured Posts

-

Play The Best Ps 5 Pro Enhanced Exclusive Game Review

May 08, 2025

Play The Best Ps 5 Pro Enhanced Exclusive Game Review

May 08, 2025 -

Rogue Exiles A Deep Dive Into Path Of Exile 2

May 08, 2025

Rogue Exiles A Deep Dive Into Path Of Exile 2

May 08, 2025 -

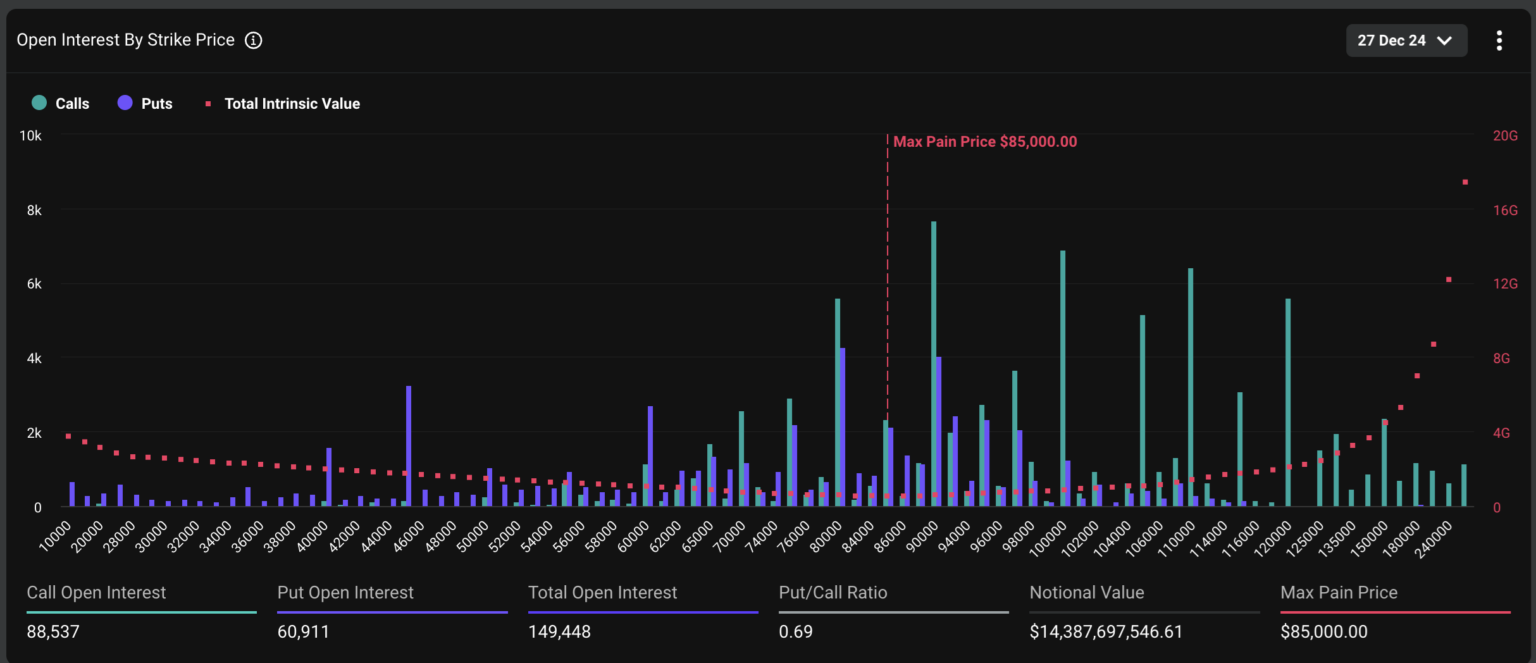

Bitcoin And Ethereum Options Billions Expiring Impact On Market Volatility

May 08, 2025

Bitcoin And Ethereum Options Billions Expiring Impact On Market Volatility

May 08, 2025 -

Stephen Kings The Long Walk Movie Cinema Con Reveals Release Date

May 08, 2025

Stephen Kings The Long Walk Movie Cinema Con Reveals Release Date

May 08, 2025 -

2025 Release Date Announced For Stephen King Adaptation Directed By The Hunger Games Director

May 08, 2025

2025 Release Date Announced For Stephen King Adaptation Directed By The Hunger Games Director

May 08, 2025